Here is Why I’m Still Bullish on Gold Mining Stocks

Commodities / Gold and Silver Stocks 2022 May 21, 2022 - 04:48 PM GMTBy: P_Radomski_CFA

The medium-term outlook for the precious metals remains bearish, but does this mean we can’t profit on shorter-term moves? Quite the opposite!

Precious metals declined yesterday, and so did the general stock market. Is the rally already over?

When I wrote about this rally on May 12, which took place at the same time when I took profits from the short positions and entered the long ones, I mentioned that I planned to hold these long positions for a week or two. Since that was exactly a week ago, the question is: is the top already in?

In short, it probably isn’t. As always, it’s useful to check what happened in the past in similar situations to verify whether what we see is normal or some kind of an outlier that cannot be explained by something that has already happened.

Let’s start with a quote from yesterday’s analysis:

Of course, there will be some back-and-forth movement on an intraday basis, but it doesn’t change anything. Junior miners are likely to rally this week nonetheless. And perhaps not longer than that, as the next triangle-vertex-based reversal is just around the corner – on Friday/Monday.

The previous few days were the “forth” and yesterday was the “back” movement – so far, my comments remain up-to-date. However, comparing the market action with what I wrote previously isn’t what I meant by analogies to past situations. I meant this:

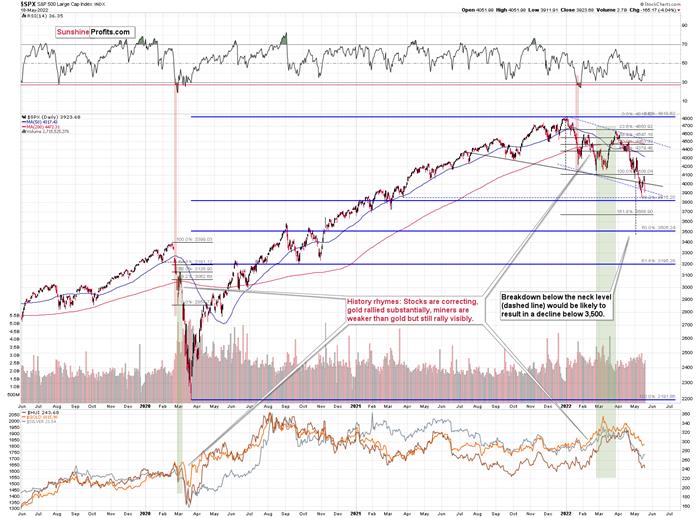

The areas marked with green rectangles are the starting moments of the previous short-term rallies. Some were bigger than others, and yet they all had one thing in common. They all included a corrective downswing after the initial post-bottom rally.

Consequently, what we saw yesterday couldn’t be more normal during a short-term rally. This means that yesterday’s decline is not bearish at all and the profits from our long positions are likely to increase in the following days.

Besides, the general stock market declined by over 4%, while the GDXJ (normally moving more than stocks) ETF – a proxy for junior mining stocks – declined by only about 2%.

If the general stock market continues to decline, junior miners could get a bearish push even if gold prices don’t decline.

However, let’s keep in mind the fact that miners tend to bottom before stocks do – in fact, we saw that in early 2020. This means that even if the S&P 500 moves to new yearly lows shortly and then bounces back up, the downside for miners could be limited, and the stocks’ rebound could trigger a profound immediate-term rally.

If stocks decline, then they have quite strong support at about 3815 – at their 38.2% Fibonacci retracement level.

Let’s keep in mind that junior miners have triangle-vertex-based reversal over the weekend, so they might form some kind of reversal on Friday or Monday.

Ideally, miners would be after a quick rally that is accompanied by huge volume on Friday. This would serve as a perfect confirmation that the top is in or at hand.

However, we can’t tell the market what it should do – we can only respond to what it does and position ourselves accordingly. Consequently, if stocks take miners lower, it could be the case that Friday or Monday will be the time when they bottom. This seems less likely to me than the previous (short-term bullish) scenario, but I’m prepared for it as well. In this case, we’ll simply… wait. Unless we see some major bearish indications, we will wait for the rally to end, perhaps sometime next week.

Again, a nearby top appears more likely than another bottom, in particular in light of what I wrote about the common post-bottom patterns in the GDXJ.

Naturally, as always, I’ll keep my subscribers informed.

Having said that, let’s take a look at the markets from a fundamental point of view.

The Chorus Continues

While investors still struggle with the notion that the Fed can’t bail them out amid soaring inflation, the S&P 500 and the NASDAQ Composite suffered another reality check on May 18. Moreover, with Fed officials continuing to spread their hawkish gospel, I warned on Apr. 6 that demand destruction does not support higher asset prices. I wrote:

Please remember that the Fed needs to slow the U.S. economy to calm inflation, and rising asset prices are mutually exclusive to this goal. Therefore, officials should keep hammering the financial markets until investors finally get the message.

Moreover, with the Fed in inflation-fighting mode and reformed doves warning that the U.S. economy “could teeter” as the drama unfolds, the reality is that there is no easy solution to the Fed’s problem. To calm inflation, it has to kill demand. And as that occurs, investors should suffer a severe crisis of confidence.

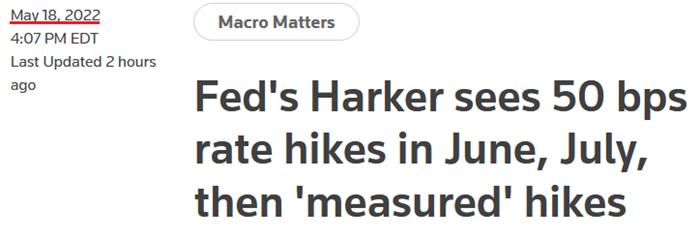

To that point, while the S&P 500 and the NASDAQ Composite plunged on May 18, Fed officials didn't soften their tones. For example, Philadelphia Fed President Patrick Harker said:

"Going forward, if there are no significant changes in the data in the coming weeks, I expect two additional 50 basis point rate hikes in June and July. After that, I anticipate a sequence of increases in the funds rate at a measured pace until we are confident that inflation is moving toward the Committee’s inflation target."

For context, "measured" rate hikes imply quarter-point increments thereafter.

Please see below:

Source: Reuters

Likewise, Chicago Fed President Charles Evans delivered a similar message on May 17. He said that by December, "we will have completed any 50 [basis point rate hikes] and have put in place at least a few 25 [basis point rate hikes]."

Moreover, "given the current strength in aggregate demand, strong demand for workers, and the supply-side improvements that I expect to be coming,” he added that “I believe a modestly restrictive stance will still be consistent with a growing economy."

Therefore, while their recent rhetoric had Fed officials “expeditiously” marching toward neutral, now the prospect of a “restrictive stance” has entered the equation. For context, a neutral rate neither stimulates nor suffocates the U.S. economy. However, when the federal funds rate rises above neutral (restrictive), the goal is to materially slow economic activity and consumer spending. As such, the medium-term liquidity drain is profoundly bearish for the S&P 500 and the PMs.

Please see below:

Source: Reuters

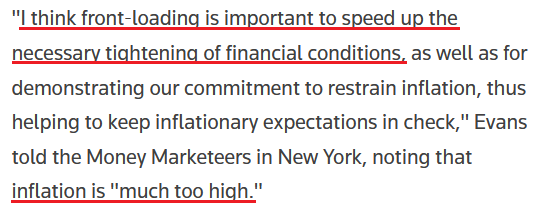

Making three of a kind, Minneapolis Fed President Neel Kashkari (a reformed dove) said on May 17 that “My colleagues and I are going to do what we need to do to bring the economy back into balance…”

“What a lot of economists are scratching their heads and wondering about is: if we really have to bring demand down to get inflation in check, is that going to put the economy into recession? And we don’t know.”

For context, Fed officials initially thought inflation was “transitory,” so don’t hold your breath waiting for that “soft landing.” However, while Kashkari is ~16 months too late to the inflation party, he acknowledged the reality on May 17:

Source: Bloomberg

As a result, while the S&P 500 and the NASDAQ Composite sell-off in their search for medium-term support, Fed officials haven’t flinched in their hawkish crusade. As such, I’ve long warned that Americans’ living standards take precedence over market multiples.

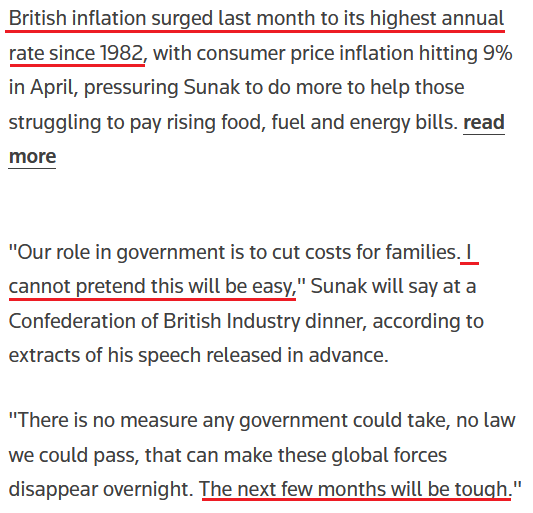

To that point, the U.K. headline Consumer Price Index (CPI) hit 9% year-over-year (YoY) on May 18. For the sake of objectivity, the results underperformed economists’ consensus estimates (the middle column below).

Source: Investing.com

However, while investors may take solace in the miss, they should focus on the fact that the U.K. output Producer Price Index (PPI) materially outperformed expectations and often leads the headline CPI. As a result, the inflation story is much more troublesome than it seems on the surface.

Please see below:

Source: Investing.com

In addition, British Finance Minister Rishi Sunak warned of a cost of living crisis on May 18, saying that “as the situation evolves our response will evolve” and “we stand ready to do more.”

Please see below:

Source: Reuters

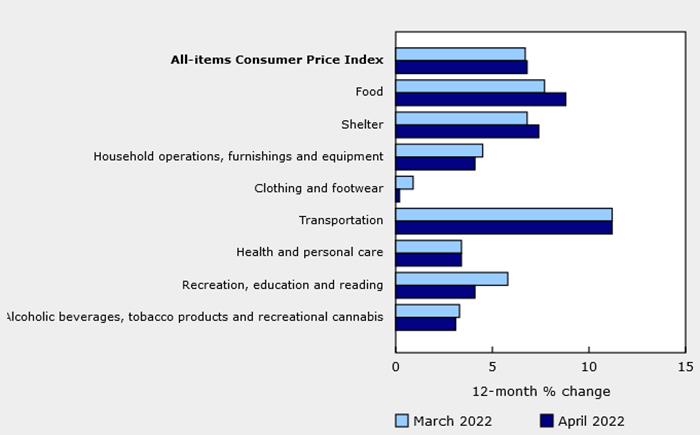

Even more revealing, I’ve noted on numerous occasions that Canada is the best comparison to the U.S. due to its geographical proximity and its reliance on the U.S. to purchase Canadian exports. Therefore, with Canadian inflation outperforming across the board on May 18, the data paints an ominous portrait of the challenges confronting North American central banks.

Please see below:

Source: Investing.com

To that point, the official report stated:

“Canadians paid 9.7% more in April for food purchased from stores compared with April 2021. This increase, which exceeded 5% for the fifth month in a row, was the largest increase since September 1981. For comparison, from 2010 to 2020, there were five months when prices for food purchased from stores increased at a rate of 5% or higher….

“Basics, such as fresh fruit (+10.0%), fresh vegetables (+8.2%) and meat (+10.1%), were all more expensive in April compared with a year earlier. Prices for starchy foods such as bread (+12.2%), pasta (+19.6%), rice (+7.4%) and cereal products (+13.9%) also increased. Additionally, a cup of coffee (+13.7%) cost more in April 2022 than in April 2021.”

Moreover, “in April, shelter costs rose 7.4% year over year, the fastest pace since June 1983, following a 6.8% increase in March.” Therefore, the data is nearly synonymous with the U.S., and I’ve been warning for months that rent inflation would prove much stickier than investors expected.

Please see below:

Source: Statistics Canada

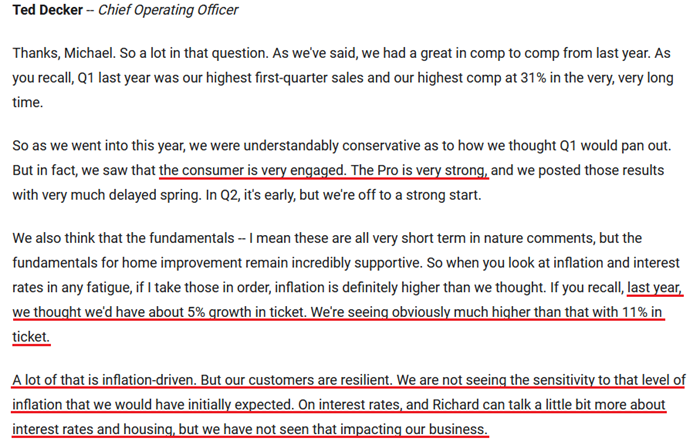

Finally, the investors awaiting a dovish pivot from the Fed assume that growth will overpower inflation. In a nutshell: the U.S. economy will sink into a deep recession in the next couple of months (some believe that we are already in one), and the Fed will resume QE. Moreover, they assume that the inflationary backdrop has left consumers destitute and that we’re a quarter away from famine.

However, I couldn’t disagree more. With Home Depot – which primarily sells discretionary items – noting that consumers are showing no signs of slowing down, I warned on May 18 that investors don’t realize that the Fed’s war with inflation would be one of attrition.

Please see below:

Source: Home Depot/The Motley Fool

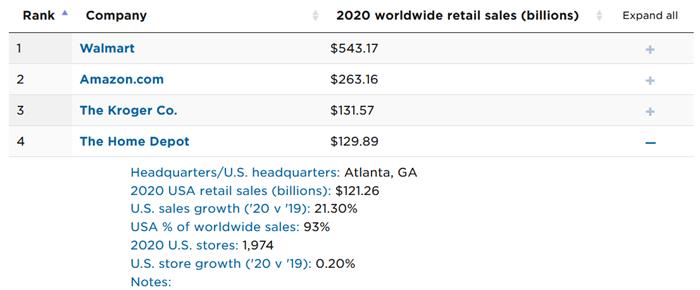

For context, the National Retail Federation (NRF) listed Home Depot as the fourth-largest retailer in the U.S. in its 2021 report. As a result, the company's performance is a reliable indicator of U.S. consumer spending.

Source: NRF

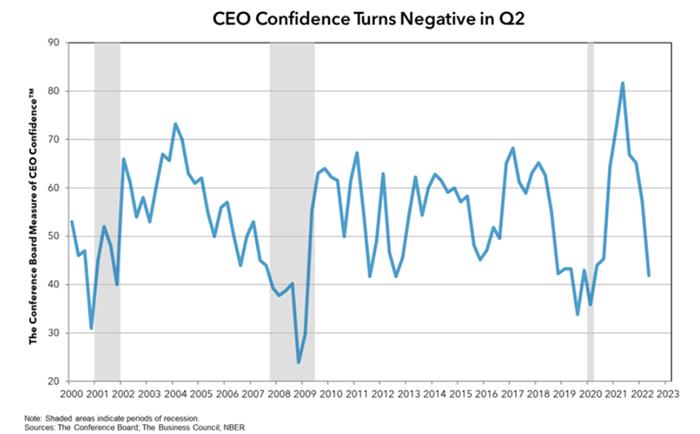

To that point, The Confidence Board released its U.S. CEO Confidence survey on May 18. The report revealed:

CEO confidence “declined for the fourth consecutive quarter in Q2 2022. The measure now stands at 42, down from 57 in Q1. The measure has fallen into negative territory and is at levels not seen since the onset of the pandemic. (A reading below 50 points reflects more negative than positive responses.)”

Please see below:

However, the devil is in the details and the details are what matter to the Fed. For example:

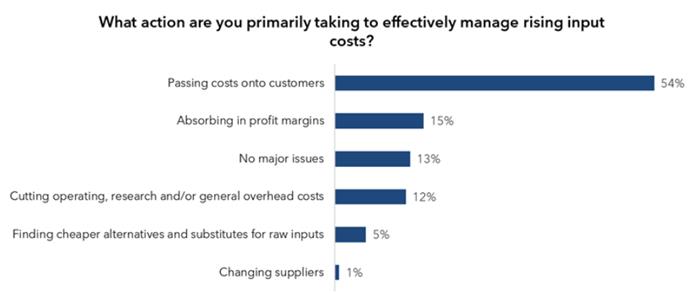

“More than half (54%) of CEOs said they were effectively managing rising input costs by passing along costs to customers, while 13% said they had no major issues with input costs.”

Source: The Confidence Board

Second:

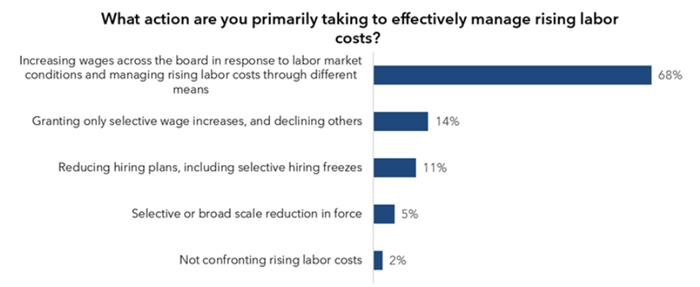

“More than two-thirds of CEOs said they are increasing wages across the board in response to labor market conditions and managing rising labor costs through different means.”

Source: The Confidence Board

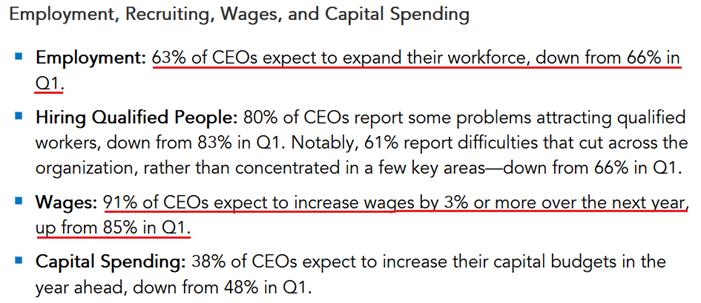

More importantly, though:

Source: The Confidence Board

Therefore, while consolidated CEO confidence has crashed to “levels not seen since the onset of the pandemic,” nearly two-thirds of CEOs plan to increase their workforce and more than nine out of 10 plan to increase wages. As a result, would major U.S. corporations be adding employees and paying them more if demand has fallen off a cliff? Of course not. Moreover, when considering the 15-point drop in consolidated CEO confidence, the three-point decline in employment expectations is largely immaterial.

The bottom line? While investors keep using the post-GFC script as their roadmap for when the Fed turns dovish, they don’t realize that 1970s/1980s-like inflation is a completely different animal. Thus, what I wrote on May 18 should prove prescient in the coming months:

While Powell keeps warning investors of what’s to come, a decade of dovish pivots has a generation of investors believing that the central bank is all talk and no action. However, with inflation at levels unseen in 40+ years, Powell is not out of ammunition, and the Fed followers should suffer profound disappointment as the drama unfolds.

In conclusion, the PMs declined on May 18, as risk-off sentiment returned to the financial markets. However, since fits and starts are always expected along the way, the GDXJ ETF should have more upside in the coming days, and profits from our long position should increase. The medium-term outlook for the mining stocks remains bearish, though.

Today's article is a small sample of what our subscribers enjoy on a daily basis. They know about both the market changes and our trading position changes exactly when they happen. Apart from the above, we've also shared with them the detailed analysis of the miners and the USD Index outlook. Check more of our free articles on our website, including this one – just drop by and have a look. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. You'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts to get a taste of all our care. Sign up for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.