AI Tech Stocks Current State, Is AMAZON a Dying Tech Giant?

Stock-Markets / Tech Stocks Jun 20, 2022 - 10:07 PM GMTBy: Nadeem_Walayat

Dear Reader

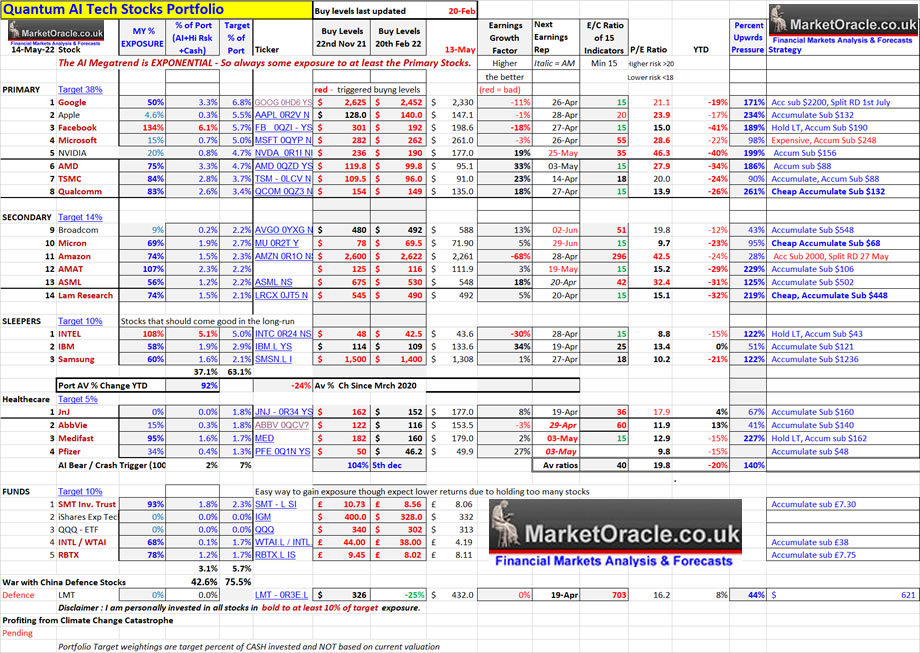

The stocks bear market continues with most AI tech stocks putting in new bear market lows during the past week, with key exceptions being Facebook and AVGO. Whilst Apple, Microsoft and Nvidia were the weakest stocks of the week, though all stocks rallied strongly Friday led by AMD which ended the week up 10% followed by Micron at +6% which are definitely two stocks to aim to accumulate during any further market weakness.

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

This analysis (AI Tech Stocks Current State, Is AMAZON a Dying Tech Giant?) was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Latest analysis include -

- The Psychology of Investing in a Stocks Bear Market

- Dow 2022 Stock Market Trend Pattern

- AI Tech Stocks Name of the Game, Climate Change Housing Market Impact and the Next Empires

- Everyone and their Grandma is Expecting a Big Stocks Bear Market Rally

Is AMAZON a DYING Tech GIANT?

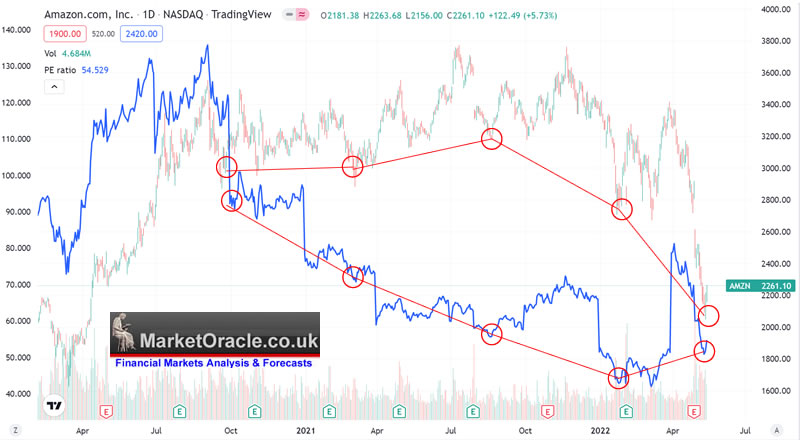

I have always been a skeptical investor in Amazon, eager to cash in profits and not get too carried away with the fantasy that Amazon is of the same caliber as the other FAANGS, much as i rejected Netflix years ago. Where I have always been puzzled by the high multiples nevertheless went along for the ride to some degree. However, at the same time have been aware that if there is one tech giant that could experience a catastrophic valuation reset then that tech giant is AMAZON, which despite the bear market delivering a deep near 50% discount on the stocks high is still trading on a high multiple of 43X earnings which is still far too high and thus I cut my maximum exposure to Amazon a couple of weeks ago including warning that the the stock price could continue to collapse all the way down to $1000 a share.

The stock is trading on a PE of 43 whilst Q1 revenues growth was just 7%, it's slowest in 2 decades with guidance for even lower growth for q2 of 4.8%, which is more akin to to a stock trading at below the S&P average of 20 at say a PE of 18. Thus Amazon is hugely overvalued by as I pointed out 2 weeks ago so anyone investing in Amazon today is banking on the lemming fund managers once more bidding the stock up to ridiculously high multiples for reasons I have never understood why.

The latest results were a disaster which as I pointed out at the time meant that despite the stock price dropping to a low of $2200 actually resulted in an INCREASE in the PE ratio Which means the stock was more expensive AFTER the earrings then BEFORE earrings when the stock was trading at above $2800 as the above chart illustrates which is NOT GOOD! Not good at all as $2200 today is the same as if Amazon were trading at $2800 on an earnings multiple basis, and if Amazon continues along this path then it could well experience several sharp quarterly earnings drops in the stock price all whilst the PE multiple stays constant at around 40.

Where is the growth going to come from?

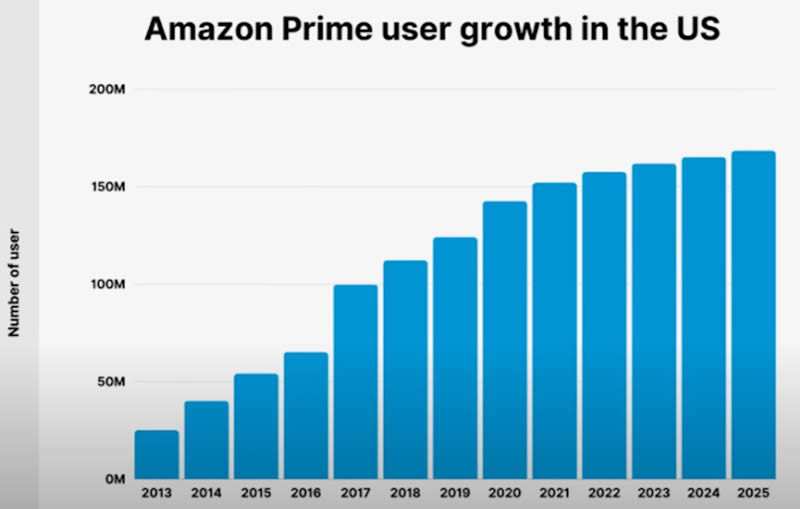

Amazon Prime appears to be in the process of topping out.

AWS - Whilst 85% of the companies revenues come from their retail business, however all of amazon profits are generated by AWS that continues to grow at a healthy rate with a Q1 profit margin of 35%.

The bottom line is that Amazon is a risky stock that can only regain it's all time highs if other investors once more ignore it's high multiples. So realistically Amazon should be moved to the high risk stocks portfolio where along with Tesla, Corsair and the Chinese tech giants should ranked at risk 3, which is where it may eventually end up advance of which I am once more dropping my max exposure by another 25%, which means my exposure jumps from 52% to 74% and so I rank the stock as a secondary at No 11 on my list with Qualcom nudging higher to become primary and thus I am further increasing my max exposure target to Qualcom.

One of the reasons why many obsesses over Amazon is because it is a retail monopoly which is probably why only a few weeks ago many clueless investors ware FOMO-ing into amazon on the basis of it's stock split announcement where in most cases when the stock price was trading at over $3000! As if the stock split would magically send the stock price soaring into the stratosphere.

I still cannot entirely fathom how can Amazon be trading on a higher PE than virtually every other primary AI tech stock apart from Nvidia? Twice that of Google, Triple that of Facebook, and nearly Quadruple that of Qualcom. So investors need to tread very carefully with Amazon where despite the price falls to date need to beware of very serous downside risk as there is a lot of dubious financial engineering going on in this corporation that can easily fool even so called sophisticated investors.

Amazon $2295 - P/E 43, EGF -68% - 76% Invested (target exposure reduced again), 1.4% of portfolio, Buy zone $2050 to $1800, My limit order is at $1852. Not much more buying for me in Amazon, target is about 1.6% of portfolio as this stock could surprise to the downside i.e. it really could even crash all the way to $1000, though with heavy support ahead at $1700. Still at the end of the day it is an AI tech stock so should eventually resolve to new all time highs even if it takes a while to get there.

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

STOCKS BEAR MARKET CURRENT STATE

Stocks put in a bottom of sorts Friday, but this is NOT THE Bottom where my existing view is to expect a Dow bottom during August at an approx level at 29,600, which is pending my next in-depth analysis. So 32,200 puts the Dow about 9% away from a probable bottom that would result in a 25% peak to trough bear market so we are about 2/3rds the way through this bear market in terms of price.

My strategy is to BUY during the DECLINES at NEW lows and then seek to sell a fraction of what I bought during corrective rallies, which has the effect of lowering my average buying price, with target sells typically for gains of 15% to 30% above where I bought, for instance a fraction of AMD buys will be sold at around $110 and $120 and similar for most stocks where what I sell is dependant upon how much I hold and where I bought.

The bottom line is that we are having a bear market rally, it would be nuts to try and ride the bear market rally by actually buying it once its underway, the best strategy is to accumulate during the sell offs and if a rally materialises to sell some of what one bought to drive average buying prices lower.

I am not even going to try and guess how high this bear market rally will go as they tend to be very volatile and short lived as we have recently seen the AMD stock price can be up 10% one day and down 10% the next! So I just take what the market giveth, if it gives a strong rally to sell into then I take that to reduce exposure a little, if it gives new bear market lows in target stocks then I buy more to continue building my positions though given the collapse in sterling that is not straightforward. For instance here is what the Google stock price looks like year to date for US investors vs UK investors. Where buying Google during late January was just as good as buying at recent lows. so the bear market experience is not quite the same for UK and US investors,

The buffoons in the government and at bank of England are hell bent on sending sterling to parity to the US dollar by fighting 10% inflation with a joke 1% interest rate! All whilst there is a growing clamber for the government to hand out even more free money to people because of the cost of living crisis without any of the fools realising that the cost of living crisis is a function of the government handing out FREE MONEY! So the more the government prints the higher inflation will go ! Thus we in the UK have no choice but to KEEP CALM and CARRY on BUYING US AI TECH STOCKS given sterling's downwards death spiral and thus we could very easily see Google and most AI tech's soon trade at STERLING NEW all time highs, as 11% in these markets equates to barely 2 or 3 days of strong upwards price action!

The bottom line is that this bear market has further to go where low multiple stocks with growing earnings offer downside protection whilst retaining upside potential of exposure to AI mega-trend and derivatives thereof.

AI stocks Portfolio Current State

Current state of my portfolio stands at 67.1% invested, AI 42.6%, high risk 24.5% with 32.9% cash on account. My objective remains to get to 85% invested during this bear market so I still have some ways to go, as a reminder in Mid January I was about 40% invested. This week via small buys I added to Apple, Microsoft, Nvidia, AMD, TSMC, Qualcom, and significantly increased exposure to AMAT that now stands at 107% of target.

Table Big Image - https://www.marketoracle.co.uk/images/2022/May/Quantum-AI-tech-stocks-14th-May-Big.jpg

Select Cheap Stocks

Qualcom - $135 - PE 13.9 - EGF +18%, 83% invested, Buy zone $132 to $123. I am seeking to buy more between $128 and $123 as I don't see much lower prices ahead for this cheap stock.

AMD -$95 - PE 27.9, EGF +33% - 75% invested. Ryzen 7000 is coming which should lift the stock price. Buy zone is $88 to $80 I am seeking to buy more at $81 and $75.

TSMC - $91 - PE 20, EGF +23%, 84% invested - Buy zone is $88 to $80. I am eager to buy more exposure with limit orders at $84 and $75.

AMAT - 112 - PE 15.2, EGF +3% - 107% invested. Sell off to $101.7 triggered my limit order at $102 and so now I am well over 100% invested. Buy zone $106 to $96. My nearest limit order is at $96.

Lam Research - 492 - P/E 15.1, EGF 5%, 74% Invested. Buy zone 448 to 386. My nearest limit order is at $408,

INTC - $43.6 - P/E 8.8, EGF -30%, 108% Invested. Intel is in a long-term trading range of $65 to $42, currently trading near the bottom of the range. Buy zone is $43 to $39.

Facebook - $199 - P/E 15, EGF -18%, 134% invested. Buying Zone is $190, to $168. Facebook continues to build a base between $230 and $186 in advance of an anticipated assault on $300 later this year.

TARGET STOCKS

GOOGLE $2330 - P/E 21.1, EGF - 11%, 50% invested. Google set a new bear market low during the week at $2200 so continues to confirm a downwards bias with the potential to nudge under $2000.Buying zone is $2220 to $1986. My nearest buy limits are at $2106 and $2006. My target is to get to about 70% invested in numero uno Google has seen little deviation from it's May opening price of $2300 which suggests rotation into Google from perhaps Amazon and Apple.In terms of upwards potential I would not be surprised to see Google trade above $2800 later this year!

Nvidia $177, PE 46.3, EGF 19%, 20% invested, Buy zone is $166 to $132. Nvidia 4000 series GPU's are due to land during Q3 and with the new more powerful cards will come higher extortionate pricing, $1000, $2000, $3000 for retail graphics card! Nvidia's stock price remains firmly in a downtrend that targets strong support between $130 and $140. Earnings report is due on 26th May that could see Nvidia move sharply lower, to even all the way to UNDER $100 a share! Currently my big buy order is at $133, but I will probably put in additional big buy order at around $100 just in case Nvidia's stock price CRASH to under $100 materialises. In the meantime I continue to accumulate small, with nearest buy order at $156 as I continue to gradually increase my exposure for the long-run for Nvidia is one of the few stocks I am willing to overpay for given that it lies at the heart of the AI mega-trend! Still we may get lucky and see a bear market panic sell off to under $100.

Apple $147.1, P/E 23.9, EGF -1%, EC 20, 4.6% invested. As expected the Apple Nut CRACKED, and with it my long standing buying level of $140 was finally achieved as the stock plunged to a low of $138, where I made by first small buy of the bear market at $139.2. Despite the bounce I remain skeptical of Apple and continue to seek to buy exposure at much lower prices i.e. I am reluctant to buy Apple above $130. Apples buy zone is $132 to $120. Where I have limit orders at $128, $120 and $116, and even at $116 I will probably be over paying.

Microsoft $261, P/E 28.6, EGF -3%, 15% Invested. Microsoft is the other nut that finally cracked and finally achieved it's long standing buying level of $262. Buying zone is $248 to $216. My nearest limit orders are at $244 and $232.

AVGO - $588. P/E 19.8, EGF +13%, 9% Invested, Buying zone is a wide $558 to $480. This stock has repeatedly found support at it's 200 day moving average ($557), a break below which could result in a sharp drop lower, earnings are due on the 2nd of June so as that date draws nearer the stock price could become more volatile. My limit orders are at $524 and $486.

MORE STOCKS

ASML $548, PE 32, EGF +18%, 56% invested - Not cheap but makes the machines that make the chips. Buying zone $502 to $452. My target is to get to about 66% invested. I have limit orders at $502 and $452.

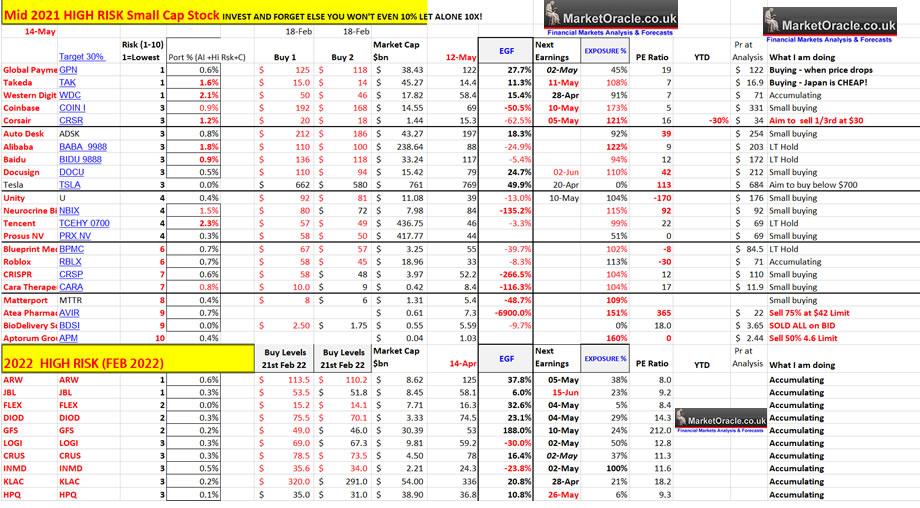

High Risk Stocks

I am continuing to accumulate into Feb 2022 high risk stocks reaching 100% of target in INMD. I also added a small amount to Roblox on its plunge to $20 and continue to build my position in GPN on sub $120 price action. 2021 High risk stocks are 19.2% of my portfolio vs 2022 high risk stocks at 2.6%.

Table Big Image - https://www.marketoracle.co.uk/images/2022/May/high-risk-stocks-15th-may.jpg

I was recently asked if I had to pick 5 of the best high risk stocks to accumulate right now which would I pick, they would be ARW, JBL, GPN, WDC and GFS, okay lets make the list 7 with FLEX and KLAC as well. Though note we only tend to get opportunities to accumulate when the news is bad, so what an investor wants is to buy on bad news hoping that the bad news turns out to be temporary.

And here's another excerpt from my full spectrum US housing market analysis that requires more work to arrive at a high probability trend forecast.

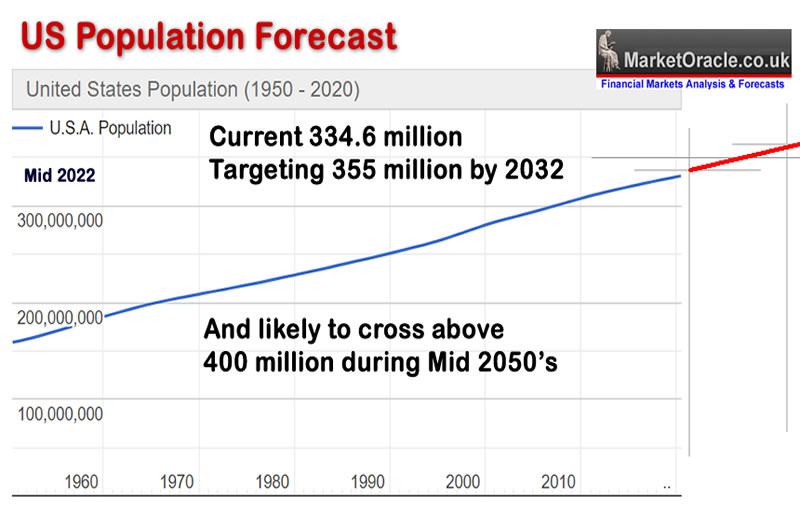

US Population Growth Forecast Implications for House Prices

One of the prerequisites for rising properties prices is an increasing population either through a high birth rate and or immigration. so whilst the right / conservatives in all nations like to bang the anti immigration drum, the fact is that nations with high immigration levels coupled with control of their borders do have a significant advantage over nations that have stagnating (most of Europe) or even falling populations (Russia, Japan) as migrants on average tend to be young vibrant and smarter than the average of any nation and thus tend to add to a nations gross domestic output and prosperity over both the medium and long-terms. Whilst nations with falling populations are usually a function of some sort of brain drain under way which was the case with the UK in the 1970s and much of the 1980's as many millions of individual Brit's fled economic stagnation to mainly Australia, Canada and the United States which is one of the reasons why Tony Blair's government opened the doors to mass migration from Eastern Europe, that and immigrants were far more likely to vote Labour.

So where does the United States stand on this important long-term house prices metric,

The current estimated population of the US is 334.6 million, against 314 million 10 years ago, which represents at 6.9% increase over the past 10 years, thus on this metric the US is definitely primed for continuing house price inflation over the next 10 years as the trend trajectory remains clear where even if the rate of population growth declines to say 6% in 10 years time that would still represent a population increase of 20 million people needing to be housed. Furthermore there is nothing to suggest that the trend trajectory will not continue for many more decades that looks set to take the US population to over 400 million by the mid 2050's.

Thus population growth continues to put significant upwards pressure on US house prices that perhaps accounts for underlying upwards pressure of 2-3% per annum thus deviations from the highs will trend to prove temporary over the long-run, even from extremes such as the 2007 mania bubble peak.

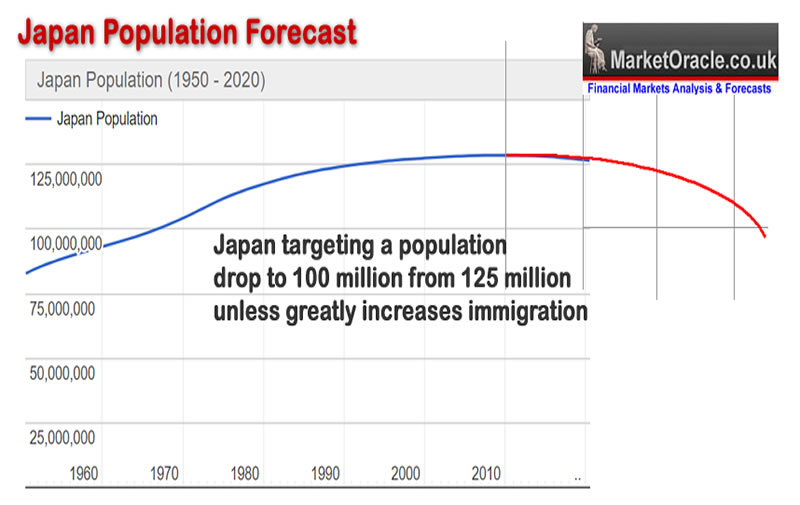

Japans Population Forecast

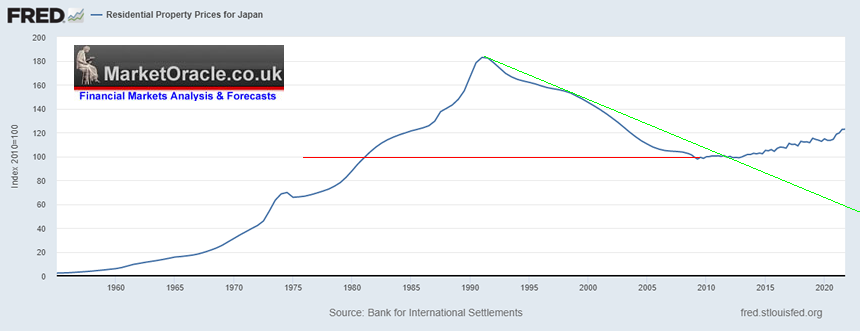

I could continue deeper into the demographic breakdown, and fertility rates but it is sufficient for this exercise to confirm that the US population continues to increase on a year on year basis now compare this against the xenophobic basket case which is Japan that has seen it's population stagnate and literally slowly go senile since the early 1990's where the stagnating population is set to roll over to target a drop from the current 125 million to below 100 million unless Japan drastically ditches it's stance on immigration and starts importing millions of workers.

Conversely the trend and prospects for future Japanese house prices inflation is dire where once the Japanese population collapse starts gathering pace will fail to even hold onto weak nominal gains in house prices.

Why Putin has KILLED Russia

This is also why Putin has effectively KILLED Russia as Russia already had a stagnating population that will now suffer the consequence of a huge brain drain of millions of Russia's best and brightest young minds escaping to a better life abroad, The irony of Putin attempting to protect Russia has in fact KILLED Russia's future! It's GAME OVER for Russia! China will likely seek to capitalise on this dying empire where any close links that Putin forms with Emperor Xi Ping will ultimately result in the loss of Russian territory to China, as several millions of Chinese slip over Russia's eastern border in an stealth invasion in the name of friendship.

The bottom line is that if a nation does not have an increasing population than it is not going to have any real terms increase in house prices in fact house prices will be continuously falling in real terms and thus most people will avoid investing in such property markets.

Terror Stable coin Terra USD IMPLODES CRASHING Crypto's

It's been a while since I last did a video warning about stable coins such USDT or rather unstable coins that are supposed to be pegged to the dollar that I have repeatedly warned are ponzi schemes backed by high risk debt instruments as that is how issuers make their money by putting your dollars to work in high risk corporate bonds, and even crypto's where everything sales along until the peg finally cracks when investors realise that their stable coin holdings are not covered by the value of the underlying assets and then it collapses in spectacular style at a far greater pace than when crypto's crash as it was last week with Terra USD or more aptly Terror USD.

So once more understand this that one is NOT investing in crypto's but rather gambling on crypto's that a greater fool will some day come along and pay more for what one paid as crypto's have zero intrinsic value.

So lets take a brief moment to remember that in the midst of the stocks bear market where invariable all of our portfolios will be down to some degree, there are those who have lost far more on both turd stocks and crypto's,who instead of learning form their mistakes go ahead and double down with several clown investors on youtube having lost many millions in turd stocks and turd coins by buying the dips towards ZERO, failing to realise that the companies they are investing in could go BUST!

Again for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My latest analysis includes -

- The Psychology of Investing in a Stocks Bear Market

- Dow 2022 Stock Market Trend Pattern

- AI Tech Stocks Name of the Game, Climate Change Housing Market Impact and the Next Empires

- Everyone and their Grandma is Expecting a Big Stocks Bear Market Rally

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

Your 72% invested analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.