Everyone and their Grandma is Expecting a Big Stocks Bear Market Rally

Stock-Markets / Stock Market 2022 Jun 23, 2022 - 08:14 PM GMTBy: Nadeem_Walayat

Everyone and their grandma has been eagerly awaiting a big bear market bounce since at least the start of May that has repeatedly failed to materialise, why? It's because everyone and their grandma has been expecting a big market rally that's why! Here's another update on the state of the AI stocks portfolio in advance of finalising my 3 YEAR US house prices trend forecast.

My bear market expectations remain for the Dow to target a trend to 29,600 due to be achieved during August / Early September for an approx 20% top to bottom bear market target.

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

This analysis (Everyone and their Grandma is Expecting a Big Stocks Bear Market Rally) was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Latest analysis include -

- The Psychology of Investing in a Stocks Bear Market

- Dow 2022 Stock Market Trend Pattern

- AI Tech Stocks Name of the Game, Climate Change Housing Market Impact and the Next Empires

7 Weeks Down

So far during May every bear market low has failed to hold where even whole day rallies soon resolved in sending the indices to new bear market lows as was the case on Friday that came after Thursdays close and pre market strength early Friday that had sowed the seeds for the long anticipated by BIG market rally to begin, which instead on Fridays open plunged to new lows soon to reverse higher before the end of the day with the Dow ending marginally higher on the day.

The S&P better illustrates the false bottom price action during Thursday which implied that the bottom was holding at an over sold state for that potential strong bear market rally which even had me fooled. Instead apparently out of the blue the market broke to a new bear market low which triggered a string of buy limit orders in target stocks including MU, TSM, Qualcom, SYNA, HPQ, AMAT, GOOG and NVIDIA, buying equivalent to about 1.5% of my portfolio.

The problem is that virtually everyone, even the clowns on CNBC have been anticipating at least a strong bear market bounce for virtually the whole of May which has repeatedly failed to materialise which implies there is a wall of potential selling building up waiting for the rally to be triggered at the indicated red resistance levels that can only now be overcome through significant buying pressure that when it happens should propel the stock market significantly higher.

However when one looks under the hood of the market as my article of 30th April illustrated (Why APPLE Could CRASH the Stock Market!) that the chances of a significant corrective rally looked bleak due to many large cap stocks having weak stock prices and that the key mega-caps Apple and Microsoft which had held the market up to that point were about to crack, which they subsequently did.

Both Apple and Microsoft have a lot further lower to go i.e. Apple will probably trade to below $120, Microsoft to below $220 and then we have a whole host of already crushed tech giants headed further lower such as Amazon, Nvidia and Tesla just to name 3! So it is going to be tough for the indices to rally given underlying weakness in many major stocks, against others such as AMD which are behaving more strongly/.

We all want the bear market to give us a respite by giving us a rally, but one has to face facts that the Apple and Microsoft nuts have cracked.So despite the stock market being very oversold and always appearing to be on the cusps of making a run higher, until we see the selling in the mega caps exhaust itself then we may not get much of any rally i.e. Apple falling to at least $120, Microsoft under $230, Nvidia under $140 and possibly as deep as under $100. Amazon perhaps to $1700 and Tesla to below $600.

The bottom line is that the e stock market IS very over sold across numerous measures and in fact has been for the whole of May hence why so many have busted the market has bottomed calls, as everyone and their grandma continues to expect, hope, even pray for a big bear market rally to sell into which IS the over whelming consensus view given that is appears very compelling across multiple metrics.

So what would another 10% drop in the market do to market participant expectations? Will they expect an even bigger bounce or come to believe the perma doom merchants that they are in for a rerun of 2000 style 90% collapse or worse and thus throw in the towel and SELL, resolving to avoid stocks forever more. Will 10% do that ? 15%? 20%? That's what it will take to hit bottom.

NASDAQ 100

Several patrons have asked for a technical take on the Nasdaq. First step is to make sure that the Nasdaq produces reliable technical signals which on a quick review resolves to a 75% probability.

The Nasdaq chart on break below 13,000 is clearly indicating it wants to go much lower than the downwards price action to date coming off the late March high as all rallies since have been very feeble which implies the Nasdaq is targeting support at 11,000 to 10,700, or about a further 10% drop from the 11,835 close where it 'should' hold for a bounce but we will only know for sure when we get there and see how the Nasdaq behaves between 11,000 and 10,700. Should support hold then it is likely that Nasdaq will target a corrective rally back to 13,000 where depending on whether it reaches or breaks above it will sow the seeds for what comes afterwards.

So pulling all the threads together it looks like the big bear market bounce that everyone is expecting won't materialise until we see the likes of Apple trade down to $120, which is about a 13% drop on the last close of $137.5 when the institutions will likely step in to accumulate for the long-run. So contrary to most investor expectations the stock market is probably more likely to head 10% lower than higher during the next week or so and I can imagine the fear that will engender in all those who have been desperately waiting for the big bounce that instead resolves into a big drop that in many cases may result in PANIC selling right at the BOTTOM which is the investing fate of most investors to FOMO Buy near the top and PANIC sell near the bottom and then decide they have suffered enough pain and so forget about the stock market for a number of years.

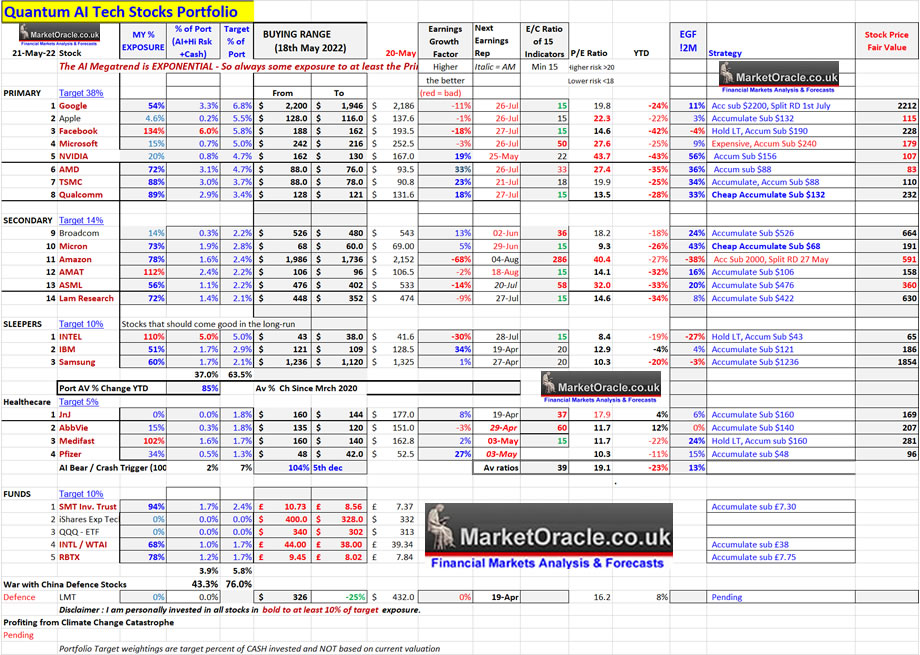

AI STOCKS PORTFOLIO - INVESTING FOR THE LONG-RUN

My portfolio currently stands at 65% invested. AI stocks 43.3%, high risk 21.9% and cash 34.8%. The table has been updated with a buying range and new columns EGF12M and Stock Price Fair value aimed towards giving a better indications of future prospects in terms of accumulating in the present. Remember the name of the game is to gain exposure to target stocks at as low multiples as possible compared to where the stock traded in the recent past as this will increase the potential reward over the long run. For instance a stock that averages earnings growth of 20% per annum, will see it's earnings and likely average stock price X6 over the next 10 years. However during that time the stock will trade to a state of being over valued and to a state of being under valued in terms of average earnings expectations, which can make the difference between for instance a X8 or X4 return over 10 years. However once invested, then the only thing to really focus upon are the periods of over valuations to seek to reduce exposure to as over valuation means future earnings are priced into the present which at best means the stock goes nowhere for several years, or at worst suffers a significant drop which is what we are now experiencing as the over valuations of 2021 evaporate.

Taking AMD as an example that reached a state of being very overvalued by November 2021, traded on a PE of 70, which was discounting approaching 2 years worth of future growth in its current stock price and thus prompted me to reduce exposure along with for most of the AI tech stocks. Whilst today AMD is trading on a PE of 27.4, less than half that of November 2021, all whilst AMD continues to command a strong expected growth rate of 36% which means if nothing changes then AMD's PE will fall to just 17 in 1 years time, whilst if one applies a conservative 20% average growth rate over the next 10 years suggests buying AMD today gives expectations for a X5 to X6 return over the next 10 years on a conservative terminal multiple of 20. Whilst buying AMD at a PE of 70 would have cost at least two whole years of growth for a return of X 4.5 to X 5.5. Now one can dream of getting AMD on a PE of under 20 but given the strong growth rate that is going to be a tough ask. Note during the whole of this exercise I have NOT MENTIONED PRICE ONCE! Which is unfortunately is what most investors obsess over. It is NOT PRICE that is important but the valuation for it is that which will determine the probable return. Which is why I am not bothered where the bottom will be all I want is exposure to good stocks at low valuations for potential returns of X5 to X6 over the next 10 years and likely more should AMD trade to an over valued state once more for me to reduce exposure into and then buy back when closer to fair value as I have been doing during this bear market. Of course one can just invest and forget. and ride out bear markets but for that to work then one really does need to INVEST AND FORGET!

The price one pays is far less important than what most investors obsess over trying to catch THE bottom, then wince when the stock price falls by 10% from where they thought the bottom was i.e. it does not matter if one bought AMD at $93.5, $83.5 or $103.5 for all that means is one bought AMD in the current PE range of a 24 to PE 30, with a cost of at worst 2 quarters worth of growth which makes for marginal difference over 10 years. The key thing is one is not going to get any potential reward unless one a) has exposure and b) REMAINs invested for the long-run. There is NO point investing in stocks if after a 20% price jump an investors starts seeking to sell that which they worked so hard to buy, that is NOT investing that is TRADING! Though of course the future is unwritten so a good company can go bad which should be reflected in quarterly earnings reports so allow one to decrease exposure to.

Remember folks the Quantum AI mega-trend stocks are literal gravy trains that are currently parked at the station for probably not much longer, so I am not wasting precious time as I get my monetary baggage on board each train every time prices deviate from their highs to new lows as whatever happens to their stock prices during 2021 will prove temporary as my implied expectation for what Google could deliver of June 2020 illustrates.

So all who are worrying about a few percent here or there or worse waiting for the bottom that they will only see in the rear view mirror will in the not too distant future be wishing they had bought into the primary AI tech stocks at current prices! Mark my words you will wish you could buy AMD for under $95! Nvidia for under $180, Google for under $2400, Qualcom for under $160! Facebook for under $220, TSMC for under $100, Micron for under $70, AMAT for under $110, Lam Research for under $500 and so on, all of which will be seen as bargain basement ultra cheap prices in the not too distant future that most investors will dream of a second chance to buy at.

So all aboard, CHOO CHOO! Else suffer the fiat currency train wreck.

Table Big Image - https://www.marketoracle.co.uk/images/2022/May/Quantum-AI-tech-stocks-20th-May.jpg

AI stocks Table explained

The fundamentals for stocks CHANGE to varying degree following each earnings report, hence volatile price action around earnings reports. So one needs to keep upto speed on both the direction of travel and changes in the companies fundamentals.

P/E Ratio - The starting point is the the P/E ratio which is calculated by dividing the share price by the sum of the last 4 reported quarterly earnings per share which is readily available, though different sites use GAAP or non GAAP EPS, my preference is for non GAAP. Higher the PE the more expensive a stock, so the simple aim is to buy stocks for as low a PE as possible, but on it's own the PE is very limited.

Buying Range - High probability range for stocks to trade within to accumulate which replaces buying levels as what one buys at what level is determined by ones existing exposure i.e. if one has no exposure then one would accumulate towards the top of the range and then scale in should prices continue to decline down towards the bottom of the range.

Earnings Growth Factor (EGF) - Gives an indication of the direction of travel of earnings where the higher the positive percentage the better. Whilst a negative EGF warns of contracting earnings which should command a LOW P/E ratio to justify accumulation. EGF is calculated by dividing share price by latest EPS X4 then divided by current P/E ratio -1 for example (2X2)=4, 100/4 = 25, Current P/E 30, thus 30/25-1 = EGF +20%.

E/C Ratio - A formulae encompassing 15 inputs such as Price to Book, Price to Sales, P/E etc to better determine which stocks are cheap or expensive in relative terms where 15 is the minimum reading.

EGF12M - Similar to the EGF, however instead of the current quarter EPS X4 I am,using my own estimated EPS for the next 12 months to arrive at the EGF12M percent, as an indication of how strongly a stocks earnings could grow over the next 12 months.

Stock Price Faire Value - Based on the current PE ratio divided by the fair value PE ./ Ratio which is usually 18 for most stocks that is adjusted by the 12M EGF. i.e. Google PE 19.8 divided by (18* EGF12M) = 20 = 1 X share price $2186 = 2212. So one wants to buy a stock for as well below the fair value as possible, whilst buying above the fair value one is over paying to some degree for exposure to a stock. Note it is not a price target but an indicator of how cheap a stock price is compared to future earnings expectations.

MY % Exposure - Is how much I have invested in a stock as percent of the target amount i.e. if my target for a stock is £10k, and I have invested £5k then the exposure is 50%.

Port % (AI +Hi Risk+Cash) - My holding in each stock as a percent of AI stocks + High Risk stocks + Cash on account. So basically my public portfolio

Target % of - Is my target percent of portfolio (AI+ High risk + Cash).

BEST BUYS

QAULCOM $131.6 - Stands out head and shoulders above the rest. P/E 13.5, EGF +18%, EC 15, EGF12M +33%, that resolves to a Fair value price of $232, with the current stock price at just $131.6 and thus remains at the top of my list to accumulate during the bear market where each new low prompts me to buy more.

MICRON $68.9 - P/E 9.3, EGF +5%, EC 15, EGF12M +43%, Fair value $191! NO it's not going to get to $191 over the next 12 months but it does suggest that there is a very high probability of Micron trading to new all time high within the next 12months, that is unless the fundamentals change to a great extent over the coming quarters.

TSMC $90.8 - P/E 19.9, EGF +23%, EC 18, EGF12M +34%, Fair value $110. Trading near 20% below fair value, TSMC is an easy stock to accumulate into the only real risk is a Chinese invasion, Another week like this and I will be 100% invested.

AVGO $543 - P/E 18.2, EGF +13%, EC 36, EGF12M +24%, Fair value $664. The AVGO stock price refuses to drop, which given fair value is $664 should not come as much surprise why. So I have had to bite the bullet and start accumulating to at least get to 20% exposure ahead of possible better opportunities yet to come perhaps in advance or on earnings day 2nd of June.

WORST BUYS

AMAZON $2151 - P/E 40.4, EGF -68%, EC 286, EGF12M -38%, Fair Value $591. I would be shocked if Amazon fell to $591! And I am sure all those who FOMOd into it will be put off from investing for life! But all of the metrics are WARNING that Amazon is very high risk that most investors have remained BLIND to all the way from it's high of $3700 down to it's recent low of $2100. Amazon is very high risk which is why I keep reducing my max exposure to the stock and if there is one stock I am eager to lighten exposure to during a bear market rally then it is Amazon.

MICROSOFT $252.5 - P/E 27.6, EGF -3%, EC 50, EGF12M 9%, Fair Value $179. Everyone is eager for a piece of Microsoft as am I but not at $252! Microsoft could easily fall to below $200, unless it posts fantastic earnings to change it's fundamentals.

ASML $533 - P/E 32, EGF -14%, EC 58, EGF12M 20%, Fair Value $360. I am eager to invest in this monopoly but it is not cheap, so I await for an earnings blood bath of sorts to enable me to accumulate much beyond my current 50% holding.in the $450 to $400 range as I doubt it will get anywhere near $360.

TARGET STOCKS

NVIDIA $167 - P/E 43.7, EGF +19%, EC22 , EGF12M +56%, Fair Value $107. Nvidia floated high as a kite above $300 during 2021 from where a drop to $200 seemed impossible to most, but the red flags were there all along warning that the stock price was headed to below $200 and could even fall as low as $140 which is what I often warned at the time, still I understand full well why many remained invested in Nvidia because it is a fantastic AI tech stock! So whilst Nvidia could fall to under $100, and even if one paid something daft like say an average of $260 a share, 3 or 4 years form now you will probably still be up 100%. So it is a safe over valued stock by virtue of it's future growth rate of +56%, the highest of all stocks. Hence why I have not waited for the price to drop anywhere near the target low before accumulating sub $200 and thus I am now 20% invested eager to get to at least 50% invested which could be achieved as early as this week when it reports earnings on the 25th.

APPLE $137.5 - P/E 22.3, EGF -1%, EC15 , EGF12M +3%, Fair Value $115. The numbers suggest that Apple could enter a trading range for several years, so whilst I will accumulate exposure to Apple at between $128 and $116. I don't think I will go much over 25% invested. I am not seeing what others see in Apple to me it's a mixed bag, not too bad but also not too good either. So just enough exposure to satisfy my thirst to have a stake as less than a year ago Apple was my 2nd largest holding after Microsoft.

AMD $93.5 - P/E 27.4, EGF 33%, EC33 , EGF12M +36%, Fair Value $83. AMD is firing on all cylinders and came tantalising close to it's fair value. If there is one stock I could get over exposed to then that stock is AMD. I am 72% invested and should I see say $80 and lower then I will probably go over well over 100% invested.

BRIEFLY

Pfizer sand Medifast look good. Healthcare sector continues to outperform.

Facebook stock price should be stable and continue base building around $200.

IBM breaks below $130, targeting $120 buying opportunity.

I don't see much further downside for Lam and AMAT

Intel continues to sleep.

Principles for Dealing with the Changing World Order (Ray Dalio)

A number of patrons mentioned Ray Dalio and his new book "Principles for Dealing with the Changing World Order" and asked for my opinion, In respect of which Ray Dalio posted a high production 40 minute youtube video of the same title.

However after watching the video I see at least 3 flaws in his rise of China to displace the US thesis.

1. Each empire that replaced the previous empire tended to be freer than the one before, which is definitely not true with China.

2. That the new expire had a rising if not an exploding population, which again not true with China which is set to see it's population fall whilst the US remains on an upwards trend trajectory for many more decades.

3. The US empire does not stand alone i.e. there is NATO and AUKUS. Whilst it is very difficult for China to create similar alliances given that China rates much higher on the Xenophobia scale so it is very difficult for the peoples of other nations to come close together to the extent they can with the US i.e. free movement of peoples and ideas between allies. That and the likely candidates of Iran, Russia and Pakistan are more likely to drag China into wars it does not want to fight than to support Chinese imperial ambitions. Which in the wake of Russia Ukraine War makes such formal alliances now even less probable.

And it does not help that China is apparently at war with it's tech sector due to CCP control freak fears, which just makes US tech giants more dominant. That's the problem with totalitarian states, they don't entirely get the big picture which is the Quantum AI Mega-trend, far more important than trying to catch up to the US in terms of the number of aircraft carriers. So when I start to see China take the lead in Quantum computers. AI and Chip fab's then one could take the the threat from China more seriously but at the moment the CCP appears to be doing it's best to crush China's tech sector. That and the United States effectively outlawing competing chinese tech firms such as Huawei due to security concerns, I am just not seeing any serious threat from China to the continuing dominance of the US Empire.

So I guess unfortunately for Ray Dalio and his thesis, this time it's going to be different, unless another empire emerges that is more liberal than the US and has a rising population. That's not to say China is going to go away anytime soon as a significant geopolitical player. it's just that it is not going to displace the US empire much as the Russian Empire (Soviet Union) trundled along for some 40 years before it collapsed, so may be the fate of the Chinese empire i.e. reach peak ambition some distance from where the US sits and then decline either slowly like the British Empire or rapidly like the Russian empire.

The West has demonstrated in Ukraine that totalitarian states are at a huge disadvantage and thus all those going on about CHINA, CHINA, CHINA need to read what I wrote many months ago, that just like the Russian military is a case of an Emperor without clothes the same is probably true of China, Where there could be a huge difference between what Xi Ping thinks his military can do than what it can actually achieve on the battlefield and where battlefields are concerned it will be infinitely harder for China to take Taiwan than Russia to take bordering Ukraine.

So if Xi ping decides to invade Taiwan the ultimate outcome could be the flying of the white sun over the blue field at the forbidden city.

Though before anyone comments, the West can also make huge military blunders such as in Iraq and Afghanistan, but totalitarian states without mechanisms to remove leaders from power before they go insane are more prone to making such huge blunders as we see Putrid's blundering army in Ukraine.

Again for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My latest analysis includes -

- The Psychology of Investing in a Stocks Bear Market

- Dow 2022 Stock Market Trend Pattern

- AI Tech Stocks Name of the Game, Climate Change Housing Market Impact and the Next Empires

- Everyone and their Grandma is Expecting a Big Stocks Bear Market Rally

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your buy the dips in AI tech stocks analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.