The Psychology of Investing in a Stocks Bear Market

InvestorEducation / Learning to Invest Jul 18, 2022 - 10:03 PM GMTBy: Nadeem_Walayat

Every bull market is followed by a bear market and every bear market is followed by a bull market, where courtesy of the electron and inflation mega-trends the general indices are on an upwards exponential trend trajectory. Thus all bear markets are living on borrowed time and thus ones focus should be on accumulating positions in good stocks i.e. those that actually generate earnings and have good prospects for continuing earnings growth that courtesy of bear market negative sentiment results in prices trading to under value stocks i.e. to under X18 earnings, where everything above X18 is carrying a premium which is why I completely sold out of many stocks last year such as Amazon and Nvidia even though they had yet to peak due to the risks of a valuation reset as I covered in my in-depth analysis of August 2021

AI Stocks Portfolio Buying and Selling Levels, Bubble Valuations 2000 vs 2021

Amazon to the MOON 2021! Then what?

YES, Apple, Amazon, Facebook, Google and Nvidia all have highly compelling reasons for why they should all continue keep going to the MOON! But so did all of the tech giants in 2000!

So in some months time we may be living in a completely different world where the likes of Microsoft, Amazon and Apple after a plunge in price have most investors who were happy to pile in at all time highs with their dollar cost averaging mantra are then too scared to either buy or sell as they watch in fear stock market armageddon take place all whilst the MSM, blogosFear and Youtubers reinforce their state of paralysis acting as echo chambers just regurgitating that which others have posted.

As for what I will be doing ? BUYING the PANIC! Even if I turn out to be early because during the mayhem most of the pieces of the puzzle will be unknown.

The thing that most fail to realise about the markets when they look at the price charts is that the fundamentals, valuations etc are SECONDARY! It's investor psychology that drives markets! Drives stock prices to FOMO to the MOON, far beyond the maths, computations, valuation metrics, reasoning, projections of how high stocks could go, literally leave reality behind as they embark on a FOMO assent to heaven with many clamouring to get on aboard the rocket ship, not wanting to hear anything that suggests to expect the opposite i.e. many patrons did not like the fact that I had started selling out of my holdings during the 2nd half of 2021 because they did not want the party to end and thus sought out views that justified the party continuing.

8th Dec 2021

Mr Nadeem

You have sent me yesterday, notice that the market would collapse – so I sold everything. Now you don’t even mention this. Surely you need to follow up on perhaps the most dramatic call in your carreer. Even if just to say sorry – I was wrong. I don’t know if to rebuy now

R...

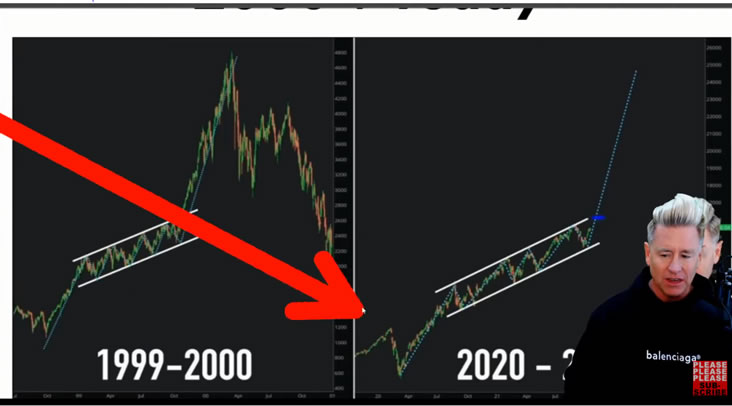

Humans are creatures of habit, they don't like change. They don't like it when a bull market changes into a bear market or even when a bear market changes into a bull market since they failed to capitalise on the price drops. Hence continue to FOMO into the early stages of a bear market convinced that the final blow off top is just around the corner that they will then sell into just as many highly popular youtubers were posting at the time because no one wants the party to actually end, so it never does as off they go on a tangent looking for patterns to confirm their bias such as the below from November 2021 illustrates.

And the same is true during bear markets, the longer a bear market goes on the more pessimistic investors become! Stocks trade far lower than anyone can imagine and the lower the go the more distant the bear market bottoms become as once more off they go clutching at straws such as what followed the 2000 dot com bubble which therefore implies this bear market is not even half way done! So extreme bullish FOMO of barely 6 months earlier has now been replaced with extreme DOOM, FEARs for another 50% CRASH or even worse hence justifies their ever solidifying view that stocks should NOT be bought just as going into the top when they sought out reasons for why they should continue buying and NOT SELL..

So the psychology of investing ensures that MOST will not buy when stocks are cheap or sell when stocks are expensive, as it is very difficult to do either so one needs to have a plan and be determined to follow it because everything looks easy with the benefit of hindsight but it is NOT at the time! Far from it, it is very difficult to SELL during the FOMO and very difficult to BUY once the BEAR has been going on for while because you WILL NEVER buy the bottom! And so no matter what one pays will be HIGHER than where the bottom will turn out to be and probably by a wide margin.

Hence in my experience one should NOT focus on the bottom but on the deviations from the HIGH coupled with that one is buying stocks at a fair valuation. For instance buying a good stock with consistent earnings growth such as Qualcom at a PE of under 15 should be a no brainier, but instead investors who were happy to FOMO into Qualcom at a PE of over 20 are now fearful to accumulate the stock when it is trading at a PE of 12.4 because the worst recession since 1981 sky is about to fall in..

YES A RECESSION IS BREWING! And so Buy the DIP has morphed into SELL THE RALLY even before the recession arrives! THIS IS THE MASS PSYCHOLOGY OF THE MARKETS and why the likes of CNBC is so dangerous! Where FOMO has given way to SELL the RALLIES as they give air time to those with a vested interest in peddling a sales pitch to their own advantage.

The bottom line is as investors we WILL NOT SELL at the TOP or BUY at the bottom, that is a fools errand in trying to do so. All we can know is when stocks are expensive and when stocks are cheap and therefore act accordingly, understanding that when stocks are very expensive ALL of the NEWS is GOOD! And when stocks are very cheap ALL of the NEWS is VERY BAD.

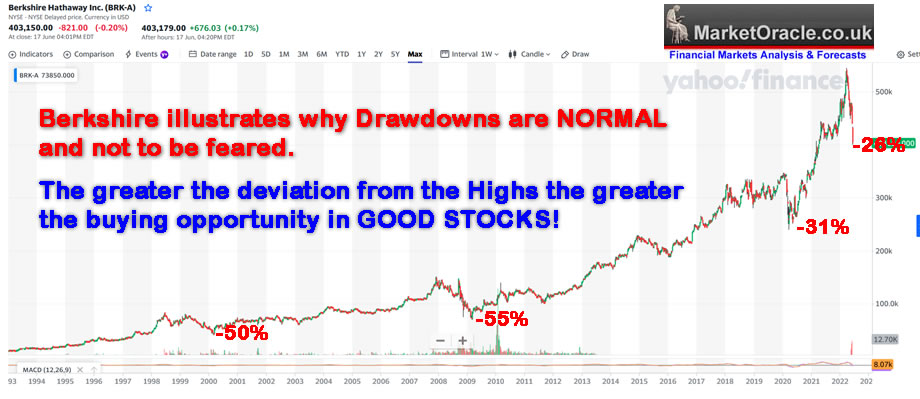

instead most obsess over draw downs without realising that draw downs are NORMAL! And are unavoidable! EVERY stock has had a draw down of 50% or more, EVERY STOCK! Even Warren Buffets Berkshire has at times fallen by 50% over the decades which sends the message that draw downs do not matter. In fact rather then being feared they are your golden opportunities to accumulate! 20% discount (Pfizer), 40% discount (Micron), even at a 50% discount (AMD). That's what draw downs are an opportunity to accumulate more of ones target stocks to distribute during the next FOMO, if one manages not to succumb to the FOMO themselves.

Stock Market Trend Pattern 2022

The rest of this extensive analysis of the state of the stocks bear market and more The Psychology of Investing in a Stocks Bear Market has first been made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Most recent analysis -

- Stock Market Rally Continues Towards Target, Why Peak Inflation is a Red Herring

- Stocks Bear Market Rally Last Gasp Before Earnings Season, US House Prices 3 Year Probability Range

- The REAL Stocks Bear Market of 2022

- The Psychology of Investing in a Stocks Bear Market

- Dow 2022 Stock Market Trend Pattern

Whilst my recent in-depth analysis is - UK House Prices Three Trend Forecast 2022 to 2025, where I pealed away every layer of the UK housing market I could think of to arrive at a high probability of trend forecast, no following of the consensus herd here! Whilst completion of my extensive analysis of the US housing market is imminent.

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

So if you want immediate access to a high probability trend forecast of UK house prices, with US and global housing markets analysis to follow soon then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 85%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

- State of the Crypto Markets

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst BUYING the panic selling falling knives.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.