What’s with all the Pretend Economists all of a Sudden?

Economics / Economic Theory Jul 20, 2022 - 07:01 PM GMTBy: Submissions

Is everyone an economist now?

Is everyone an economist now?

These days, everyone I speak with has a strong opinion on the economy.

Most are convinced things will get worse.

They think the US economy is headed off a cliff, and that inflation is here to stay.

As a result, they also want nothing to do with stocks. They’re certain that the entire market is about to collapse.

I see things differently…

- I don’t pretend to be an economist…

You see, I’m a professional trader.

Unlike many investors, I pay little attention to economic indicators like the consumer price index (CPI), gross domestic product (GDP), or the unemployment rate.

Instead, I watch the prices of stocks, bonds, commodities, and interest rates.

Each week, I easily review over a thousand different charts.

And right now, I see a ton of opportunity when I look at the market.

Today, I’ll tell you the group of stocks I’m watching most closely. These stocks are hated, cheap, and, most important, in the early stages of new uptrends.

But I should first address something.

- Inflation obviously has a major impact on the market…

It impacts how much money people can spend on everyday items. It also has a massive impact on interest rates.

But it’s not my job as a trader or investor to predict where inflation will be next month.

I’m interested in whether stocks are going to go up, down, or sideways… and what stocks to buy!

Obsessing over government economic indicators like CPI, GDP, and the unemployment rate won’t help you do this. That’s because these are lagging indicators…

They don’t tell us what’s going to happen in the future. They only tell us what’s already happened.

Folks who make investment decision based on stale economic data are going about it all wrong. It’s like driving while looking in the rearview mirror!

- Financial asset prices, on the other hand, can foretell the future…

Have you ever heard someone refer to the stock market as a “discount mechanism?”

What they mean is the stock market factors in what’s going to happen in the future.

This is why the stock market always tops out before the government admits the economy is in a recession. Stocks also bottom out well before the economy exits a recession.

Stocks can also tip you off to inflation long before you start to feel it at the gas pump and grocery store.

- Consider what happened with growth stocks last year…

Growth stocks are some of today’s fastest-growing companies.

Many of them aren’t profitable yet. Some are years away from turning a profit.

This makes them highly sensitive to inflation and higher interest rates, which often spike during periods of high inflation.

So, it shouldn’t surprise anyone to learn that the ARK Innovation ETF (ARKK), which many investors use as a benchmark for growth stocks, topped out in February 2021… 10 months before the S&P 500 topped out.

At the time, no one was really that worried about inflation.

And yet, the smart money could sniff out that inflation was coming. They sold out of growth stocks long before inflation was all over the news.

- Of course, inflation is no longer a secret…

It just hit a 40-year high of 8.6%... and everyone is feeling the wrath firsthand.

You’d think growth stocks would be struggling mightily in this environment.

But the opposite is happening.

Many growth stocks stopped falling two months ago.

The strongest ones bottomed out in March!

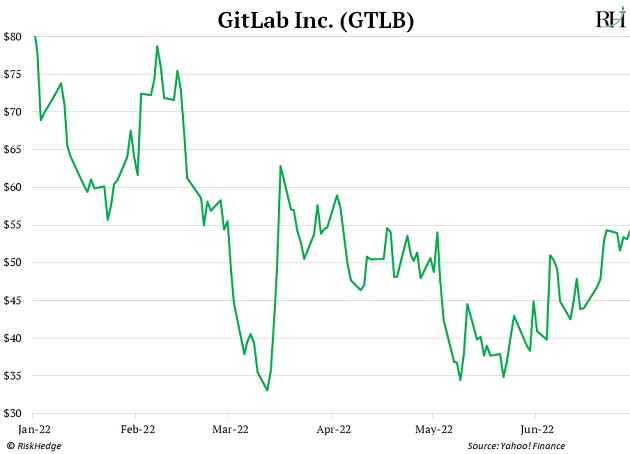

See for yourself. This chart shows the performance of GitLab (GTLB).

GitLab is a platform for open-source code collaboration. Developers use it to create, review, and deploy code faster.

You can see GTLB stopped setting new lows in March. Since May, it’s put in a series of higher highs and higher lows. In other words, it’s in the early stages of a new uptrend.

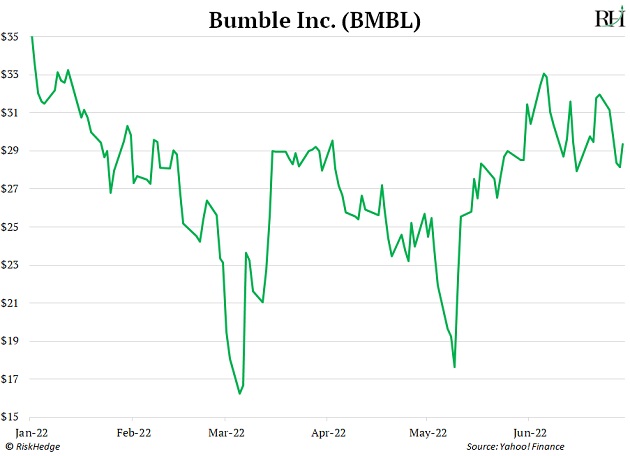

Look at Bumble (BMBL), which operates one of today’s most successful online dating apps. It also stopped falling in March.

And like GitLab, it’s since been building out a big base. This is the sort of price action we see when stocks bottom out.

The same thing is playing out in little-known growth stock Semrush Holdings (SEMR), a leading “software as a service” company.

It bottomed out in early May, and has since soared 76% off its lows. Naysayers might call that a “bear market rally.” But I believe Semrush is in the early stages of a new uptrend… one that could last many months or even years.

Many of the “sleeper growth stocks” I’m stalking are doing the same thing. Samsara (IOT), for example, has skyrocketed 37% over the past month. Informatica (INFA), another under-the-radar growth stock, has climbed around 26% since bottoming out in March. And Duolingo (DUOL) has jumped about 57% since mid-May.

This is a huge deal, especially since most investors think growth stocks will struggle due to high inflation and the slowing economy.

- Just to be clear, I don’t expect growth stocks to “V-bottom”…

They will likely remain extremely volatile.

And these market conditions will remain choppy.

But now’s a good time to do two things: For traders, I recommend putting together a watch list. As I mentioned last week, I’m watching growth stocks putting in higher highs and higher lows.

For investors with a longer time horizon, you may want to slowly start dollar-cost averaging into growth stocks. With this technique, you place a fixed dollar amount into an investment on a regular basis.

Say you plan to invest $10,000 in one stock. Instead of buying $10,000 in one go, you’d split it up into, say, four chunks of $2,500 over four months.

This way, you’re risking less money each time, and getting in at better entry points.

3 Breakthrough Stocks Set to Double Your Money in 2022\

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Justin Spittler

© 2022 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.