The REAL Stocks Bear Market of 2022

Stock-Markets / Stock Market 2022 Aug 03, 2022 - 08:29 AM GMTBy: Nadeem_Walayat

US Housing market variables are in a state of flux for we have the consequences of Quantitative Tightening with the Fed having started to sell $15 billion of Mortgage Backed securities per month, US teetering on the brink of recession given that Q1 saw -1.4% with Q2 also expected to be weak, a coin flip between +0.2 and -0.2 or worse and thus hey presto the RECESSION has ARRIVED! Brewing Financial Crisis 2.0 that I I flagged some 10 months ago where the reverse repo market of $1 trillion has now doubled to $2 trillion which implies increasing counter party risk where we wont know what the banking crime syndicate has exactly been upto in the housing market until banks start failing. Interest rate hikes of 0.75% when the Fed Chairman said 0.75% was off the table which means US rates are probably going to go a lot higher tham most can imagine today, consensus is 3.25% to 3.5%, reality could be north of 5%, so a lot of variables are in a state of flux which means instead of seeing clarity with more data I am seeing confusion!

At the end of the day the mighty Fed is clueless, what they have done and are doing is to maintain the US on the path towards a hyper inflationary crackup boom, whilst most may be salivating at the prospects of house and stock prices more than doubling in a year, when it happens the price of stocks and housing will not be at the forefront on most minds! Whilst the other central banks just play follow the Fed leader over the same monetary cliff. Which paints a complex picture for asset prices which in the final analysis has an inflationary trend trajectory pushing asset prices higher so it's a case of determining the magnitude of the ongoing chaotic panicking response to inflation which are depressing asset prices upto the point the Fed caves in or as some say pivots on inflation as the economy weakens due to rate hikes and INFLATION. Though in such a chaotic world US assets remain the place to have ones capital parked, there isn't much alternative, Chinese Yuan and Euro despite the hype are not going to replace the US Dollar, far form it, the Euro-zone remains in a death spiral. I even see this in my own portfolio that in sterling terms has the likes of IBM trading at new all time highs! Definitely safer to park ones capital in good US stocks EVEN during a bear market than in sterling! As the bear market is temporary but the loss in value of purchasing power is PERMANENT!

Going by the comments, I get most investors continue to mistakenly focus on the indices such as the S&P in terms of timing their decisions during the bear market that has seen a peak to trough draw down in the S&P of 25% with many former buy the dip talking heads now talking themselves into further deep falls in the indices and hence the emerging mantra of sell the rally.

Including access to my most recent analysis -

- Stocks Bear Market Rally End Game

- Qualcom Harbinger, AI Predicts Future Stock Prices 3 Years Ahead, China Bank Runs

- Stock Market Rally Continues Towards Target, Why Peak Inflation is a Red Herring

- Stocks Bear Market Rally Last Gasp Before Earnings Season, US House Prices 3 Year Probability Range

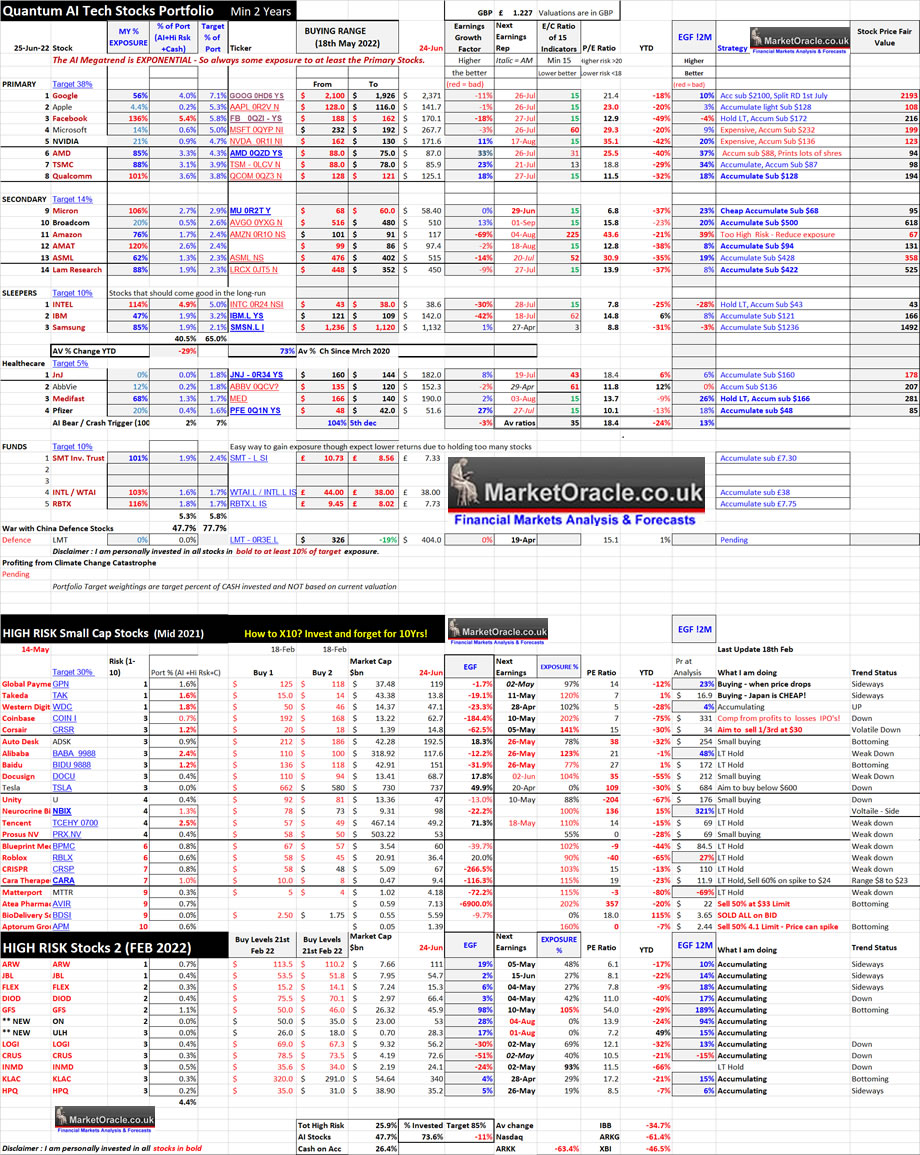

However this is what the actual reality of the stocks bear market looks like in terms of the target AI tech stocks.

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

What does this imply? We'll just as AI tech stocks have under performed the indices going into the bear market low mostly for good reasons i.e. most coming off FOMO over valuation peaks thus it is highly probable that going forward many if not most of the AI tech stocks will outperform even to the extent of some rising whilst the stock indices make new lows.

So those stocks that are NOT over valued will tend to outperform going forward, that's Micron, AMAT, Qualcom, Lam Research etc.. Whilst I suspect the overvalued will continue to take a battering, that's Nvidia, Microsoft, Amazon. Apple, ASML. With several stocks in between such as TSMC, AMD..

In fact we are already seeing early signs of such positive out performance in the higher risk target stocks such as Autodesk, and Roblox. Whilst several large cap stocks such as Google failed to make new lows during the recent sell off and thus are already showing signs of that relative strength i.e. putting in a higher bottom. There I was primed for a new low in Google so I can buy big, but it never happened! A warning sign that Google is likely to head a lot HIGHER!

The bottom line is that it is a huge mistake to make ones investing decisions on the basis of the general indices where by the time one chooses to act may find that many of their target stocks have already long since bottomed and rocketed higher and thus one will forever be waiting for that dip to buy that will NOT materialise. SO FOCUS on the INDIVIDUAL stock charts rather than the indices, else one may fund oneself posting comments such as asking me "why has Roblox tripled to $60 when the market is still making new lows, when will it fall again so I can buy?" And I expect similar comments across a spectrum such as "AMD $110, when will to fall to $82 again?"

What it's like at a bear market bottom.

This clip from March 2009 illustrates what it's like at a market bottom, that had analysts stating at Dow 6490 that the Dow was nowhere near a bottom which was at least another 20% to 25% further below.

AT THE BOTTOM

https://youtu.be/GZgMo_JuY8A?t=741

The bottom will ALWAYS BE some distance away in terms of price and time, where the rally off the bottom will always be seen as a dead cat bounce to SELL.

Where do we stand today? We'll no one, not even I think today's rally is off THE bottom! But I know enough to know that -

a, AI tech stocks have already deviated greatly from their highs so it's going to be a tough call to expect further new lows in most.

b. That many if not most will likely outperform the indices going forward. Yes a few are still expensive such as Apple, Microsoft, Nvidia and maybe AMD that carry a risk premium for further downwards price action to fair value. And then there is Amazon which whilst expensive IS DOWN 46% which offers a bottom picking cushion of sorts.

c. That bear market bottom will always be seen by virtually all as being further away in terms of time and price.

d. That the rally off the bottom will ALWAYS be seen as a bear market rally to SELL into rather than to BUY the rally as it will be taken as granted that it is just another BEAR MARKET RALLY! Whilst everyone waits for CAPITULATION to happen.

The net result is that MOST will SELL the rally off the bottom rather than buy it, that is human psychology as I covered in my last article, Investors will be relieved that they can finally cut their losses and SELL the RALLY as the dead cat bounce bear market rally mantra will persist for probably well over year AFTER the market bottoms! As most who failed to buy or worse sold are convinced that new lows remain inevitable given dire fundamentals just as was the case during 2009 and into 2010 for which investors will have plenty of media queens to turn to reinforce such views as clueless journalist regurgitate tripe of imbecilic academics all the way to NEW ALL:TIME HIGHS!

Nouriel Roubini Stock Market 20% Drop Forecast, Time to Buy?

July 2009 - Back in July as the Stealth bull market corrected, Nouriel Roubini re-appeared with another bear market call - Global Investor - Market bear Roubini sticks to dour forecasts

"Macro news, earnings news and financial shocks are going to be worse than expected and that's why I believe this is still a bear market rally," he told BNN

So one needs to get into the right mindset for which one needs a PLAN and then to FOLLOW it. My plan was pretty simple, to have a mountain of cash on account Mid Jan, and then to gradually accumulate during the bear market of 2022 as individual stocks trade to new lows with buying levels based on valuations acting as guide posts along the way. For if one bought on the basis of the indices then one would have bought Apple at over $160 instead of below $130 as I warned barely weeks ago given that the stock price was not falling along with the rest of the market early May. That's an example of what happens if one follows the indices as unfortunately many do! Of course in the long-run it won't make much difference if one bought Apple at $160, but it is a much lower draw down risk to buy at below $130 than above $160.

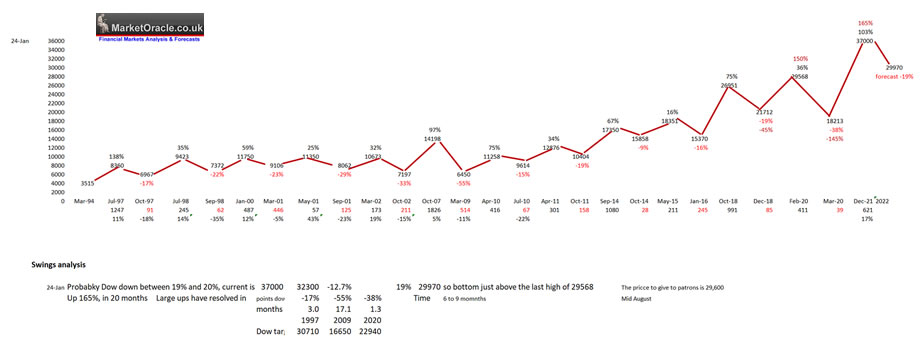

Stock Market Trend 2022

My stock market big picture remains to expect the Dow to target a trend towards 29,600 by late August / Early September. Note 29,600 is a TARGET for a low and NOT THE LOW, No one can KNOW THE LOW with any degree of confidence, all one can do is arrive at a high probability target and then look to see if the market confirms that expectation or not, so far the market is confirming it is heading towards 29,600. Some patrons are getting carried away with for instance seeking to SELL a large portion of their holdings on this rally with a view to buying back at new lows during August, is that what I am doing? NO it's not NOT! Of course everyone should make up their own minds of what to do with their own funds.

(Charts courtesy of stockcharts.com)

The 29,600 Dow target was primarily derived from bull / bear market swings analysis during late January that so far has acted as a good comfort blanket which has allowed me the time to both focus on analysis geared towards accumulating into a stocks during the bear market as well as undertaking and completing extensive analysis of the UK and US housing markets.

Big Image https://www.marketoracle.co.uk/images/2022/Jun/swings-analysis-big.jpg

Looking beyond August as I last wrote I doubt that 29,600 will be THE FINAL bottom which I expect to emerge from within a volatile bottoming trading range into the end of October as the Dow swings through 29,600 several times ahead of probably a strong rally into at least Christmas. It would be too easy to expect the stock market to put in an easy to ready higher low during October before rallying into Christmas, more probable will be chaotic price action to confuse market participants with false breaks higher and lower during October.

Where last weeks swings analysis confirmed expectations for a bear market rally that targeted 4088 that was likely to resolve in a trend to new bear market low on failure to punch through resistance due to the weight of investors desperately waiting to cut their losses.

The anticipated rally started on cue with the S&P ending Friday at 3912. up over 150 points from the last low that continues to target 4088 by early July where relative strength against the forecast trend trajectory suggests that the market may at least try to break above resistance hence the rally could continue into Mid July before likely resolving lower. Also remember that markets don't move in a straight line so there will be big down days during the trend as been the case for the duration of this bear market.

AI STOCKS PORTFOLIO CURRENT STATE

The stock market soared higher during the week so not much buying just some small nibbles earlier in the week on Qualcom and a few high risk stocks. My portfolio now stands at 73.6% invested, 47.7% AI stocks, 25.9% high risk with 26.4% cash on account as I continue to seek to accumulate at deep discounts from the highs. As a reminder my portfolio 5 months ago was about 44% invested and 56% cash, though since which I have added cash equivalent to about 15% of the original portfolio thus my buying has been far greater than the percentages suggest.

Table Big Image - https://www.marketoracle.co.uk/images/2022/Jun/AI-stocks-portfolio-24-big.jpg

In terms of the AI stocks portfolio as a whole average P/E is 18.4, EC 35, EGF -3%, EGF12M is 13%. vs the Nasdaq on a PE of 21.1, S&P 19.8, and Dow 17.9.

See last weeks article for views on individual stocks. The Psychology of Investing in a Stocks Bear Market

But briefly what's dirt cheap today?

Intel, Qualcom, META, Micron. AMAT, Lam Research, AVGO and maybe Pfizer. Though that does not mean they cannot get cheaper! Especially Intel because their capex won't start paying off until 2024, and there is a risk their brand new fab's could have teething problems, still $38 / PE 7.8 is pretty cheap!

Whilst for high risk stocks, WDC, ARW, JBL and FLEX look cheap, and GFS at $45 relative to the $60 it was trading at barely 3 weeks ago and below it's $47 IPO price, the thing about GFS is it's eye watering growth rate.

NEW High Risk Stocks

In a continuing quest to find long-term opportunities to capitalise on during the bear market. if you have not already noticed I added Universal Logistics ULH to the high risk portfolio last week, trades on a PE of 7.2, EGF 17%, EGF12M 15%, Tiny market cap of $700 mln, Risk 3, and pays a 1.5% dividend, and buys back about 1% of shares per annum. Buying levels $26 to $18.

This week I uncovered another promising stock - On Semiconductors, $53, PE 14, EGF 28%, EGF12M 94%, Market Cap $23bn, prints about 1% of shares per annum, RIsk 2. Very strong growth rate. Buying levels $50 to $35

![]()

At the time of writing I have no exposure to either of these two new high risk stocks.

This analysis The REAL Stocks Bear Market of 2022 was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.Including access to my most recent analysis -

- Stocks Bear Market Rally End Game

- Qualcom Harbinger, AI Predicts Future Stock Prices 3 Years Ahead, China Bank Runs

- Stock Market Rally Continues Towards Target, Why Peak Inflation is a Red Herring

- Stocks Bear Market Rally Last Gasp Before Earnings Season, US House Prices 3 Year Probability Range

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 90%

- Global Housing / Investing Markets - 60%

- Stock Market Trend forecast into End 2022 - 0%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trim the 'bear' market rally analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.