Recession Is Good for Gold, but a Crisis Would Be Even Better

Commodities / Gold and Silver 2022 Aug 05, 2022 - 07:07 PM GMTBy: Arkadiusz_Sieron

The US economy fell into a technical recession. As a safe-haven asset, will gold soar now?

The US economy fell into a technical recession. As a safe-haven asset, will gold soar now?

What Is Recession, Anyway?

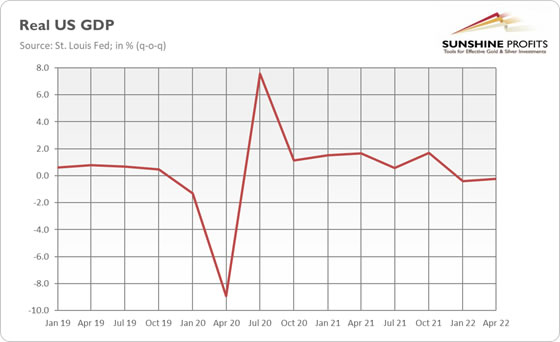

Ladies and gentlemen, please welcome the technical recession! According to the initial measure of the Bureau of Economic Analysis, real GDP dropped 0.9% in the second quarter, following a 1.6% decline in the first quarter (annualized quarterly rates). As the chart below shows, on a quarter-on-quarter basis, real GDP decreased by 0.4 and 0.2 percent, respectively. Thus, the US economy recorded two quarters of negative growth, which implies a technical recession.

However, are we really in a recession? The Fed and the White House deny that. For example, President Biden said last week: “We’re not going to be in a recession, in my view.” Similarly, Treasury Secretary Janet Yellen said that the US economy is not in a recession, instead it’s “in a period of transition in which growth is slowing”. Yeah, sure! But what else could the officials say?

There is a grain of truth in their statements. After all, with a very low unemployment rate and several economic indicators still relatively strong, the picture isn’t very gloomy. However, unemployment is a lagging indicator, so I wouldn’t seek comfort in the labor market. As well, I wouldn’t trust the officials this time, as they are the same guys who were claiming that high inflation would be only transitory.

Sure, a true recession is defined by the NBER, which determines when the US economy is in such a state as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” In this light, we are not yet in a total recession, as the scale of the decrease has been too small – so far. However, this can change when the impact of high inflation and the Fed’s interest rate hikes is fully transmitted into the economy. The monetary policy operates with a lag, so the worst is yet to come.

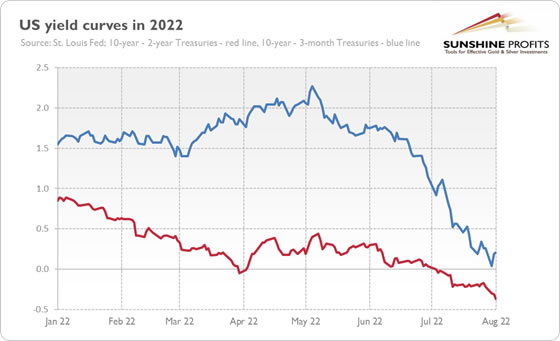

This is also what is suggested by the yield curve. The spread between 10-year and 2-year Treasury bonds (red line) has already fallen deeply into negative territory, while the spread between 10-year and 3-month Treasuries (blue line) will probably do it soon, as the chart below shows.

However, who actually cares – except the politicians – about the labels? The economy may be in a recession or not, but one thing is clear: the state of the economy is not good and it’s getting weaker. Just look at the Atlanta Fed’s projection of GDP in the third quarter. According to the GDPNow model estimate from August 1, the real GDP growth (seasonally adjusted annual rate) in the Q3 of 2022 will be 1.3%, down from the 2.1% projected on July 29. It doesn’t bode well, does it?

The same scenario was in late 2007, when economic data was already looking bad, but the pundits disagreed with statements that the US was headed into a recession. People always try to deny their problems – until they become undeniable some time later.

Implications for Gold

What does it all mean for the gold market? Well, gold – as a safe-haven asset – usually thrives during recessions. In recent weeks, the yellow metal rebounded from about $1,700 to about $1,760, as the chart below shows.

One reason for this upward move was a more dovish FOMC meeting than expected. Another driver could be renewed tensions between China and Taiwan, but gold could also start to smell recession.

To be clear, it’s too early to declare a new bull market in gold. Gold needs a full-blooded recession or an economic crisis that would trigger a lot of fear and force the Fed to ease its monetary stance. Please be prepared that gold could decline substantially before it starts its new rally. In my view, the last FOMC meeting reduced the odds of a large decline, but the sell-off at the beginning of a crisis phase is still very likely, as it was in 2008 and in 2020.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.