Gold-to-Silver Ratio Heading Lower – Setup Like 1989-03

Commodities / Gold and Silver 2022 Aug 11, 2022 - 08:03 PM GMTBy: Chris_Vermeulen

Fear is starting to become an issue. Traders are starting to realize inflation, CPI, PPI, and global currencies are reacting to the sudden policy shift by the US Fed and global central banks. This fear is showing up in the Gold-to-Silver ratio as well.

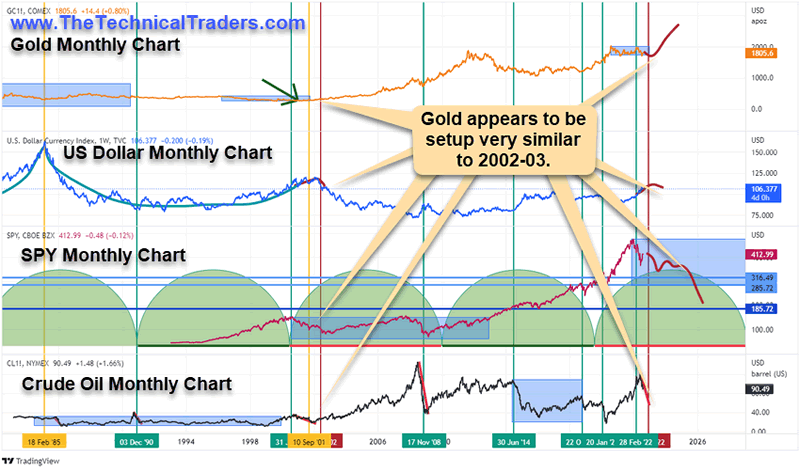

My research suggests the closest comparison to the current Gold/Silver setup may be found by looking at the early 2000~2003 US markets. Let’s investigate this setup a bit further.

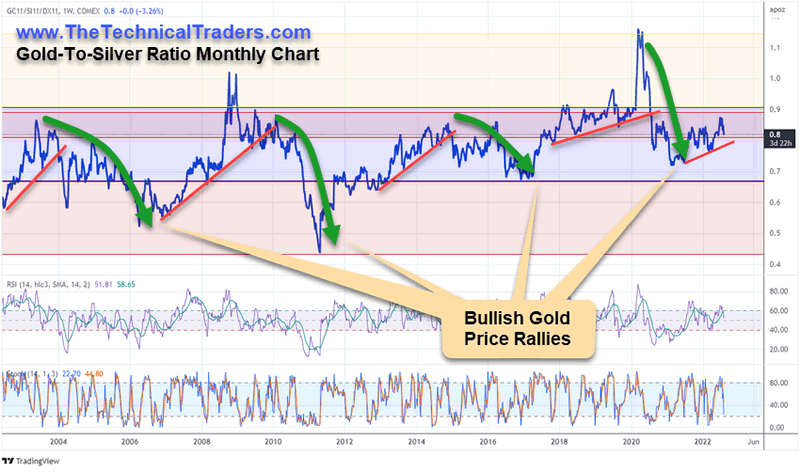

Gold-To-Silver Ratio Peaks Above 1.2 During COVID crisis

Over the past 5 years, Gold consolidated from 2017 through the COVID Virus event. This consolidation is prompting an extreme high in the Gold-to-Silver Ratio to levels above 1.2. The only other time in history when the Gold-to-Silver Ratio reached levels above 1.2 was in 1991~92. This is aligning with the fall of the Soviet Union.

This extreme peak in the Gold-to-Silver ratio marks a very weak Silver price compared to Gold. Psychologically, this represents a very real lack of fear related to global currencies/economies. The threat of extreme inflation trends.

Now, as inflation suddenly became a topic near the end of 2021, the Gold-to-Silver ratio has moved decided downward. This illustrates Silver is rallying compared to the price of Gold as fear begins to elevate across the globe. Traders, consumers, and others are moving assets into precious metals near recent price lows to hedge against uncertainty, inflation, and currency devaluation.

The Fall Of The Soviet Union Was A Global Catalyst Event – Just Like COVID

The collapse of the Soviet Union prompted a global shift in how global currencies, threats, and opportunities were perceived. It also ushered in a new wave of capitalism throughout Russia that prompted a massive credit/economic expansion phase aligned with the birth of the Internet in the early 1990s. This is why we see Gold price levels stay rather muted from 1989 through 2002-03. It was a time of very little fear when global traders chased deals, DOT COM stocks, and Real Estate instead of precious metals.

After the DOT COM bubble burst, and the 9/11 terrorist attacks rattled global financial markets, fear and precious metals suddenly came into focus again. The rally that took place after 2001 in Gold prompted a nearly 600% increase (from $260 to $1923). The biggest portion of this rally took place after the 2007-08 Global Financial Crisis.

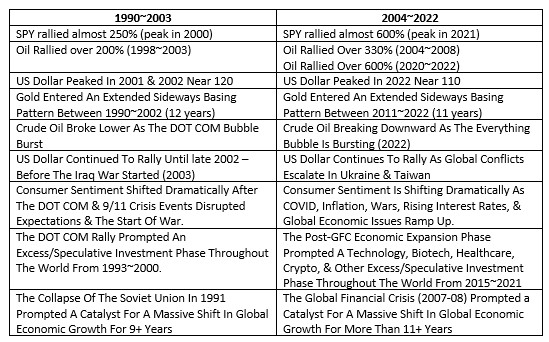

Is today any different than 2000~2002 in reality?

The similarities seem too obvious to ignore…

I believe a continued decline in Crude Oil, as well as a continued strengthening of the US Dollar, will likely take place throughout the end of 2022. In the meantime, Gold attempts to climb back toward recent highs. The catalyst for the breakout rally in Gold and Silver will likely be some extended breakdown in the US/Global financial markets and stocks or some new War/Aggression that pulls the US/EU into a conflict.

Overall, I believe global currencies will continue to recoil because of risk/devaluation factors related to inflation and disruptions within the global economy; very similar to the end of the Soviet Union in 1991.

My thinking is that Gold will attempt to hold above $1700 as a base support level while Silver attempts to hold above $19.00 as base support. Any major crisis event, war, or global financial meltdown may prompt a retest of these base support levels within the next 12+ months.

If Gold/Silver Are Repeating A 2002-03 Setup, What Can We Expect In The Future?

Then the breakout trend starts in Gold, which could happen as early as 2023 or 2024, I believe the next rally target for Gold will be somewhere above $3100. Then, we start a dedicated climb to levels above $4500 and beyond.

It is difficult to predict any date targets for this type of rally, but I’m trying to illustrate what I see related to the similarities of the 1989~2003 market conditions with what I’m seeing right now. If you were around to live through this incredibly exciting time, you may remember many of these events. I’m suggesting we may be starting to move through similar events right now and I suspect we are somewhere near August 2000 right now.

HOW CAN WE HELP YOU LEARN TO INVEST CONSERVATIVELY?

At TheTechnicalTraders.com, my team and I can do these things:

- Safely navigate the commodity and crude oil trend.

- Reduce your FOMO and manage your emotions.

- Have proven trading strategies for bull and bear markets.

- Provide quality trades for investing conservatively.

- Tell you when to take profits and exit trades.

- Save you time with our research.

- Proved above-average returns/growth over the long run.

- Have consistent growth with low volatility/risks.

- Make trading and investing safer, more profitable, and educational.

Sign up for my free trading newsletter so you don’t miss the next opportunity!

We invite you to join our group of active traders and investors to learn and profit from our three ETF Technical Trading Strategies. We can help you protect and grow your wealth in any type of market condition by clicking on the following link: www.TheTechnicalTraders.com

Have a great day!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.