Why You Should Be Leery of the Stocks Bond 60 / 40 Portfolio

Stock-Markets / Stock Market 2022 Sep 23, 2022 - 11:16 PM GMTBy: EWI

"The tidal wave of risk assumption … may be turning"

Many investors allocate a percentage of their portfolios to bonds to cushion against a drop in the stock market.

A popular allocation is a 60 / 40 mix of stocks and bonds.

However, this hasn't worked out recently. Here's a Yahoo! Finance headline (Sept. 6):

The 60/40 strategy is on pace for its worst year since 1936: BofA

The mix of 60% stocks and 40% bonds was down 19.4% from the start of the year through the end of August, according to Bank of America Global Research.

Specifically, the S&P 500 declined more than 16% through that period with long-term Treasuries sinking more than 20%. Investment grade corporate bonds were down 13%.

Investors who thought bonds would provide a degree of financial "safety" may not have been aware of Elliott Wave International's forecasts.

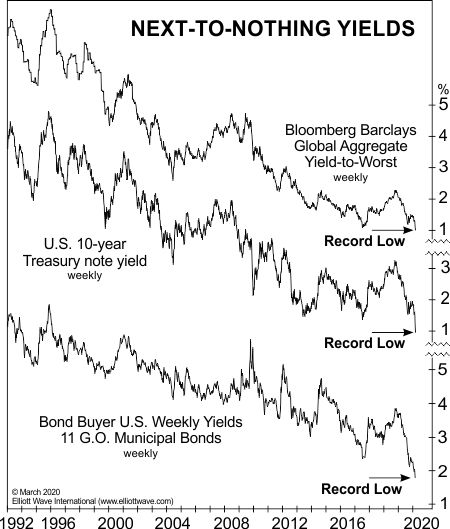

Indeed, back in March 2020, our Global Market Perspective, an Elliott Wave International monthly publication which provides analysis of 50-plus worldwide financial markets, showed this graph of yields on global bonds, 10-year U.S. Treasury notes and U.S. general obligation municipal bonds (commentary below the graph):

According to 150 years' worth of data... this is the first time that 10-year Treasury note yields have dropped below 1%. Grand Supercycle-degree tops set Grand Supercycle records. Investor ebullience is the only thing that allows for an embrace of no-yield debt. The tidal wave of risk assumption, however, may be turning.

In other words: Expect the downward trend in yields to turn upward.

Shortly after that March 2020 analysis in our Global Market Perspective published, yields began to climb (meaning bond prices began to sink).

In fact, on Sept. 13, yields on 2-year U.S. Treasuries jumped to their highest level since 2007. On the same day, the Dow Industrials registered a 3.94% decline.

Speaking of stocks, here too, our Global Market Perspective provided timely warnings. Our Dec. 2021 issue stated:

Junk [bond] yields should rise while stocks decline... The Wave Principle suggests that the era of space flight for financial assets is over. [emphasis added]

The Dow Industrials hit a top a month later.

Not every forecast based on the Wave Principle works out to a "T," however, the Elliott wave model is the best analytical method of which we know.

If you’d like to learn the details of the Wave Principle, the definitive text on the subject is Frost & Prechter’s Elliott Wave Principle: Key to Market Behavior. Here’s a quote from the book:

It is a thrilling experience to pinpoint a turn, and the Wave Principle is the only approach that can occasionally provide the opportunity to do so.

The ability to identify such junctures is remarkable enough, but the Wave Principle is the only method of analysis that also provides guidelines for forecasting. Many of these guidelines are specific and can occasionally yield stunningly precise results. If indeed markets are patterned, and if those patterns have a recognizable geometry, then regardless of the variations allowed, certain price and time relationships are likely to recur. In fact, experience shows that they do.

You may be interested in knowing that you can access the entire online version of this Wall Street classic for free once you become a member of Club EWI, the world’s largest Elliott wave educational community.

A Club EWI membership is free and opens the door to a wealth of Elliott wave resources on investing and trading.

Get started by following this link: Elliott Wave Principle: Key to Market Behavior – get instant and free access now.

This article was syndicated by Elliott Wave International and was originally published under the headline Why You Should Be Leery of the 60 / 40 Portfolio. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.