INFLATION! INFLATION! INFLATION!

Economics / Inflation Sep 25, 2022 - 10:29 PM GMTBy: Nadeem_Walayat

The big questions for the US and how our US tech stocks will fair over the coming year are -

1. Does the Federal Reserve finally understand just how dangerous inflation actually is ?

2. If it does then how is it going to subvert the inflationary policies of the White house, does not matter which clown is in office i.e. democrat or republican, BOTH have tendencies towards rampant money printing given the 4 year election cycle.

From what I have managed to glean I suspect that the Fed has finally read the inflation writing on the wall and concluded that they are forked if they do NOT at least try to bring Inflation under control, against this they will be fighting the White House all the way FOLLOWING THE Mid terms!

THOUGH Jerome Powell IS an TRANSITORY INFLATION CLOWN! Who during the whole of 2021 sat on his hands and did NOTHING to combat the raging inflation inferno that he let loose due to rampant money printing. So maybe I am giving him far too much credit to finally start to get the job done?.

Meanwhile in the UK the government is fully in charge and given that we have a Tory leadership contest to anoint the next British Prime Minister (Democracy is an illusion) which means Brit's are in in deep inflationary doo dah as the only answer the government has is to PRINT MORE MONEY! We are forked! That which I warned for years has fast become manifest during 2022, all we can do is to escape sterling into hard assets and see how the land lies once the Inflation storm finally calms. We are doomed! NO ones perfect, I still hold way too much sterling cash despite attempting to plow sterling into US stocks during the bear market, Yes US stocks WILL FAILL during a bear market, but the value of my portfolio still goes up in sterling terms, especially if one throws in a liberal sprinkling of trimming during opportune bear market rallies..

BRTS HAVE NO CHOICE, WE HAVE TO GET OUT OF STERLING! Either into domestic property or US tech stocks which has been my mantra since rampant money printing resumed in March 2020!

So sitting on the sidelines especially for Brit's is NOT an option because the value of money is now being burned at an epic rate! torched by the crooks at the Bank of England, UK Treasury and the next clown to take office in No 10.

DOOMED as the masses are finally waking up to reports that their annual energy bills are going to jump from about £800 per year not so long ago to soon approaching £6000! This is even going to hurt me as my energy bill tends to be DOUBLE the average! TWELVE THOUSAND POUNDS PER YEAR! THAT IS NUTS AND IS GOING TO BE PAINFUL! I'll be going around the house screaming to turn x,y,z off! The days of Computers GPU mining crypto in the background are long gone!

The next few years ARE GOING TO BE PAUNFUL! A case of damage limitation in the age of monetary bonfires for that is the default setting of politicians when faced with voter outrage which is to PRINT MORE MONEY!

So understand this the alternative to the bear market draw down is definite loss of purchasing power to the tune of 20% per annum!

A Fed funds rate of 2.5% to combat Inflation of 8.5% is NOT GOING TO WORK! 0.5% rate hikes are NOT GOING TO CUT IT! 0.75% all the way to 5% COULD diminish the inflation inferno to some degree that I suspect could rage well into 2023 and then there is the CLIMATE CHANGE CATASTROPHE! That this weeks Pakistan Floods act as the latest canary in the coal mine of, putting 1/3rd of the country under water,.in fact it was barely 2 weeks ago I posted a video on their Independence day that India and Pakistan need to work together else Climate change WILL KILL both nations!.The time for ***** footing about is over! Work together or die together!

What does all of this mean for stocks?

We'll whilst everyone is fixated in IS the BOTTOM IN, what it implies is that THE Bottom is likely to be followed by a volatile trading range probably well into 2023 with the risk that the Fed could further screw things up! Whilst on the flip side there is the fact that Good stocks are LEVERAGED to inflation and thus price volatility will deliver further DEEP discounts in valuation terms! which is What a long-term investor seeks! To be able to buy ones TARGET stocks when CHEAP! And I mean CHEAP in valuation terms not FAKE CHEAP as in Cathy Wood 90% NO EARNINGS COLLAPSE terms. Those stocks are not cheap, not even after a 90% price drop!

So it is going to be a bumpy ride! Especially when the latest clown in the white house answer to reducing inflation is print another $737bn and call it the Inflation Reduction act, hell lets print another $250 billion and call it the Student loan Forgiveness act so as to round it up to $1 trillion, I like round numbers, now what about next year? $1 trillion more? $2 trillion? Lets go for $2 trillion and call it the US Debt Reduction Action Plan.

This analysis is an excerpt from Jerome Powell's TRANSITORY DIP in INFLATION, AI and High Risk Stocks Updated Buying Levels that was as first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Most recent analysis includes -

- September the Stock Markets WORST Month of the Year Could Deliver a Buying Opportunity

- Jerome Powell's TRANSITORY DIP in INFLATION, AI and High Risk Stocks Updated Buying Levels

- Answering the Question - Has the Stocks Bear Market Bottomed? Saudi Black Swan

- Stock Market Bear Trap SET!

- Stocks Bear Market Rally End Game

- Qualcom Harbinger, AI Predicts Future Stock Prices 3 Years Ahead, China Bank Runs

Whilst my recent in-depth analysis is - UK House Prices Three Trend Forecast 2022 to 2025, where I pealed away every layer of the UK housing market I could think of to arrive at a high probability of trend forecast, no following of the consensus herd here! Whilst completion of my extensive analysis of the US housing market is imminent.

UK House Prices Trend Forecast 2022 to 2025

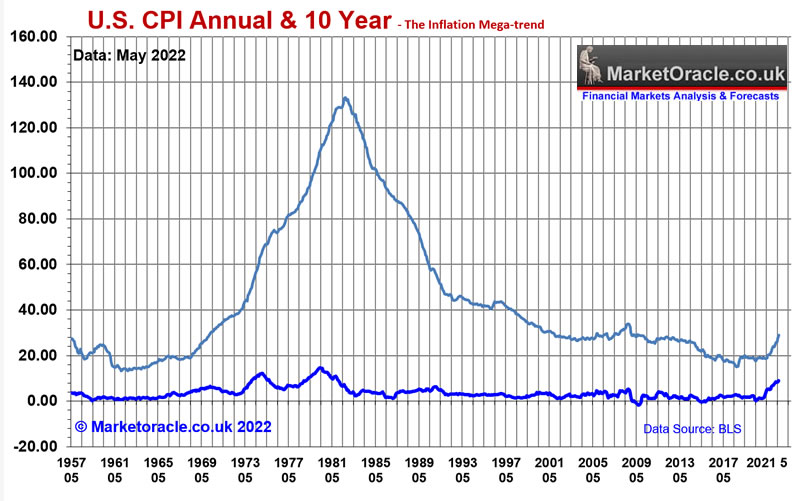

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

So if you want immediate access to a high probability trend forecast of UK house prices, with US and global housing markets analysis to follow soon then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 85%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

- State of the Crypto Markets

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your watching the British pound burn at the official rate of 9.4% per annum analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.