How to Profit During a Bear Market - Portfolio Account

Stock-Markets / Investing 2022 Sep 28, 2022 - 03:38 AM GMTBy: Nadeem_Walayat

Back in early April I opened an IKBR ISA with £20k (ISA limit) that I proceeded to quickly populate with target stocks as they traded down to new bear market lows. ISA's limit what one can do, i.e. NO SHORTING, Options and no access to most ETF's due to HMRC rules, another restriction is one cannot hold US Dollars, every buy and sell has to be converted into and out of US dollars, so ISA's are definitely geared towards longer term investors. Anyway the IKBR ISA acts as a good real world proxy for how my public portfolio should perform if one followed my analysis, where the primary goal is to accumulate during this temporary bear market to capitalise on during the subsequent bull market, my expectations from the outset were that there WILL BE DRAWDOWNS because stock prices FALL during bear markets so as to result in the buying opportunities, stocks getting cheaper during a bear market is a good thing! Cheaper in terms of their valuations for if a stock price falls and the stock gets more expensive in valuation terms then that is NOT a good thing!

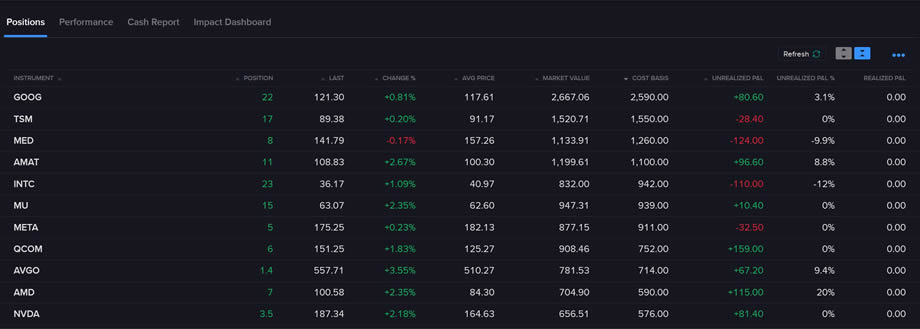

Current state of the IKBR ISA is up 12% since inception (Early April 2022) through following my analysis of buying target stocks when they trade down to NEW LOWS and then trimming lightly on the subsequent rallies, cash now comprises about 33% of this portfolio up from about 3% near the lows, as IKBR does not charge a rip off f/x fee as many brokers, for comparison FreeTrade charges 0.45%, AJ Bell 1% and Interactive Investor charge 1.5%, what are they smoking! AJ Bell recently cut their f/x fee to 0.75% but their platform is a pain in the butt to use for US stocks i.e. NO LIMIT ORDERS!

So my IKBR ISA is primed to pile back on the next dip. Max draw down was -6.5% at the Mid June low when I was fully invested, max gain was +12.55% a few days ago. It's not easy to be FLAT let alone up 12% during a bear market! And why even though I expected NEW bear market lows into Aug/Sept that did not stop me accumulating target stocks as I often voiced in my articles not to focus on the indices but rather the individual stocks for we will only see the bear market bottom proper in the rear view mirror which strongly looks to be the case today.

The portfolio largely resembles my AI stocks portfolio as my Top 11 holdings illustrate with a sprinkling of Feb 2022 high risk stocks where the most stocks trimmed during the current rally have been GFS, Qualcom, AVGO, ADSK, ASML, AMD, GPN, Amazon, Roblox, JBL, and Arrow.

So even if ones timing sucks i.e. I did not buy any of these near their LOWS, still the strategy does work! And why I tend to BE CALM AND CARRY ON BUYING QUANTUM AI TECH STOCKS AS THEY DEVIATE FROM THEIR HIGHS, whilst many investors are running around like headless chickens, reacting to nonsense market calls of SELL EVERYTHNG RIGHT AT THE MARKET BOTTOM!

This analysis is an excerpt from Answering the Question - Has the Stocks Bear Market Bottomed? Saudi Black Swan that was as first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Most recent analysis includes -

- Can the Stock Market Hold June Lows Despite Spiking Yields and Dollar Panic Buying?

- September the Stock Markets WORST Month of the Year Could Deliver a Buying Opportunity

- Jerome Powell's TRANSITORY DIP in INFLATION, AI and High Risk Stocks Updated Buying Levels

- Answering the Question - Has the Stocks Bear Market Bottomed? Saudi Black Swan

- Stock Market Bear Trap SET!

- Stocks Bear Market Rally End Game

- Qualcom Harbinger, AI Predicts Future Stock Prices 3 Years Ahead, China Bank Runs

Including access to my soon to be published extensive analysis that concludes in a detailed 1 year trens forecast into Septemenr 2023.

So if you want immediate access to a high probability trend forecast of UK house prices, with US and global housing markets analysis to follow soon then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- Stock Market Trend forecast into Sept 2023 - 90%

- US House Prices Trend Forecast - 85%

- Global Housing / Investing Markets - 60%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

- State of the Crypto Markets

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your watching the British pound burn at the official rate of 9.4% per annum analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.