Why Now 'Is a Great Time To Load up on Silver and Silver Investments

Commodities / Gold and Silver 2022 Nov 10, 2022 - 09:05 PM GMTBy: Clive_Maund

Expert Clive Maund reviews silver's 4-month and 1-year charts to tell you why he believes it is a good time to load up on this precious metal.

Silver has three irresistible attributes at this time, one is that it is very cheap historically, especially when you factor in mounting inflation in recent times. Another is that, in common with metals generally, it looks set to enter a robust bull market as the dollar breaks down into a severe bear market.

The arguments relating to why the dollar looks set to break down have been set out in the parallel Gold Market update, as have the other circumstantial factors supportive of a rising silver price, such as the upside breakouts by copper and oil, so they will not be repeated here.

The third reason is that, as a tangible asset having intrinsic value, silver will hold its value and increase in price like gold as inflation mounts in the direction of hyperinflation, and it is more practical than gold for everyday barter in situations where you have to exchange something of value to obtain what you need rather than trying to pass off piles of worthless banknotes.

So this is a good place for silver to turn higher, especially as the dollar is looking increasingly vulnerable to a breakdown.

On silver’s latest 4-month chart, we can see the large white candle that formed on Friday on strong volume and drove the Accumulation line sharply higher, which is a positive sign.

This move, which coincided with a large gain by gold and a heavy drop in the dollar, brought the price up into resistance at the upper boundary of the recent trading range.

On the 1-year silver chart, we can see how the price dropped back in the summer. The breach of the support in the US$22 area was somewhat surprising but was due to a combination of a strongly rising dollar, shown at the top of this chart, with a trend of rising rates in the U.S.

This is a great place to load up on silver and silver investments.

However, since mid-July, the price has marked out a base pattern that approximates to a Head-and-Shoulders bottom or Triple Bottom, and the duration of this pattern has allowed time for the 200-day moving average to drop down closer to the price and for downside momentum to drop out as shown by the MACD indicator, making it more likely that a rally will develop and it should be noted that if such a rally develops as a result of the dollar breaking down from its parabolic uptrend, it could be a scorcher that makes light of overhead resistance.

On the 5-year chart, we can see why the price found support in the US$18 area and has been basing there — this support arises from the considerable amount of trading that occurred in the US$17 - US$19 zone during the second half of 2019 and early in 2020.

So this is a good place for silver to turn higher, especially as the dollar is looking increasingly vulnerable to a breakdown.

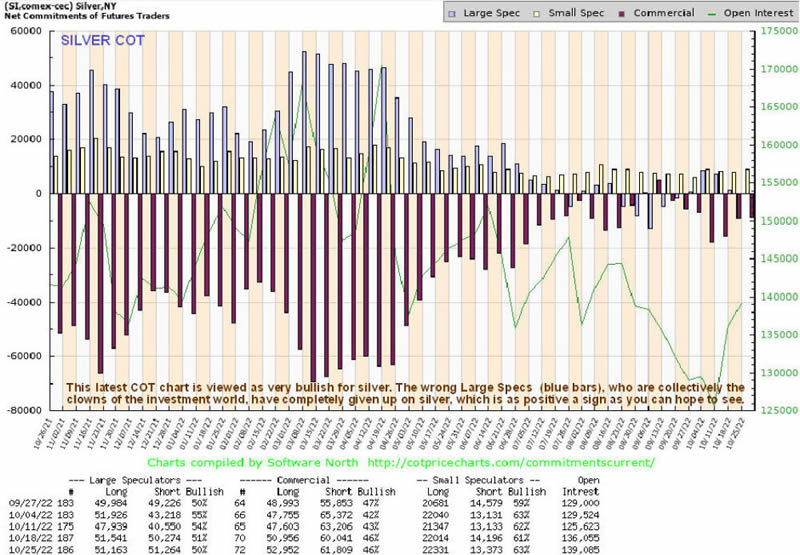

If silver is close to an optimum point to buy, then we would expect to see the dumb Large Specs having no interest in it all, and that is exactly what we see on silver’s latest COT chart, which shows the Large Specs net long positions to be virtually non-existent . . .

The conclusion is clear and simple — this is a great place to load up on silver and silver investments, many of which have been severely trampled down, as it is considered unlikely that they will remain at these depressed levels for much longer.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Disclosure: 1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure: The above repr0esents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.