Stock Market Tough Inflation Stance Still

Stock-Markets / Stock Market 2022 Dec 15, 2022 - 10:27 PM GMTBy: Monica_Kingsley

S&P 500 bulls salivated in anticipation of some low CPI recognition, but got none from the Fed. Actually, Powell reiterated the readiness to adjust the restrictive Fed funds rate level higher if justified – and household inflation expectations coupled with the still hot and tight labor market, provide him with enough work so that the expectations don‘t become unanchored. Note that the Fed is taking on a supply issue coupled with excess demand, through demand destruction.

The resulting selloff merely illustrates the degree of liquidity junkie condition markets are in, looking for cheap money. The no surprise 50bp hike yesterday and then 25bp Jan and Mar, would only get Fed funds rate to 5.00% while I see them taking it to 5.50% slowly, and keeping it there. That‘s hardly a pivot or pause – only a decelaration in rate hikes pace while the effects of tightening are gradually playing out, with housing and manufacturing more than teetering already.

With recession on the relatively immediate horizon, and fresh Treasury debt issuance and short-term debt rollover needs, good luck for the central bank executing the tightening policy the way they look to. Methinks that CPI, GDP and earnings projections need revisiting as the current estimates are too rosy, and well before Q2 2023 ends, the situation will be dramatically different as per Monday‘s extensive examination of which recession narrative is to pan out.

My big picture view continues being to look for rips to sell as S&P 500 made two brief retracements yesterday, and the ground for Santa Claus rally looks shaky. The buyers were unwilling to step in, and justifiably so. What we have left, is remaining institutional investors buying and then the unpredictable tax loss selling amid darkening economic and liquidity horizon that‘s temporarily and disproportionaltely affecting commodity and precious metals too. As inflation wouldn‘t retreat as far as projected (5-6% appears best case), look for rising stock market volatility to usher in a fresh bid in real assets, which are slated to do well during sticky inflation and economic growth trouble times.

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there, but the analyses (whether short or long format, depending on market action) over email are the bedrock.

So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open with notifications on so as not to miss a thing, and to benefit from extra intraday calls.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

Yesterday I wrote that time wasn‘t on bulls‘ side, and it‘s even more true today. Key levels are described in the caption, and I doubt another 4,040 retest is coming this week. 4,025 at best.

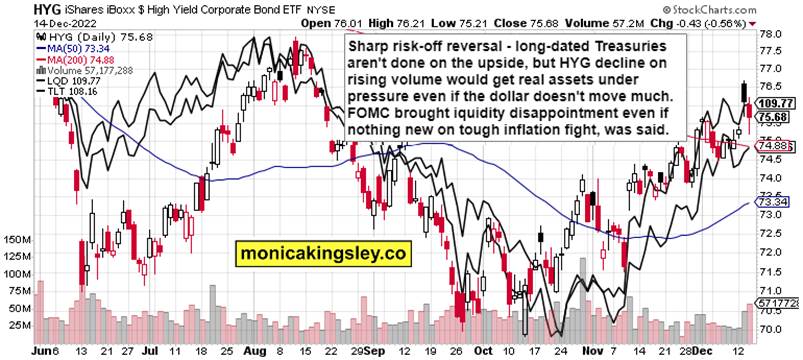

Credit Markets

No fine message as regards risk taking, Santa Claus is having issues – and the dollar decline translates to markets saying that the upcoming issues won‘t leave the States unaffected in the least. S&P 500 bears are in control, and TLT is about to rise still some more.

Thank you for having read today‘s free analysis, which is a small part of my site‘s daily premium Monica's Trading Signals covering all the markets you're used to (stocks, bonds, gold, silver, miners, oil, copper, cryptos), and of the daily premium Monica's Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates.

While at my site, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves.

Turn notifications on, and have my Twitter profile (tweets only) opened in a fresh tab so as not to miss a thing – such as extra intraday opportunities. Thanks for all your support that makes this great ride possible!

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.