HOW to INVEST - THE POWER OF TRIMMING!

InvestorEducation / Learning to Invest Feb 19, 2023 - 08:09 PM GMTBy: Nadeem_Walayat

As a reminder when I see an opportunity to buy target stocks at deep discounts then I don't tend to flinch and buy the panics, the falling knives, even if takes me to well beyond my target exposure as has been the case for many stocks during the bear market of 2022 because of what will likely follow, a rally to TRIM.

The objectives is to bank profits and free up cash for future buys, as my target is to be approx 15% in cash (current 7.2%), as with many things I take trimming for granted and assume everyone does the same to some degree i.e. the more target stocks fall the more I buy with a view to engage in trimming during a subsequently rally. If you don't trim then it is something you need to adopt as part of your investment strategy as over time it does add up! Substantially for two reasons -

1. It encourages buying the dip to a deeper extent than one otherwise would, as ones objective is for the position to oscillate around 100% invested over the long-run.

2. It releases capital during subsequent rallies to enable one to buy during the following dips any target stocks that present opportunities, and thus one always has capital at had to buy which has the psychological effect of seeing declines as buying opportunities to accumulate more rather than that a falling stock price is bad, which of course it will be perceived as being so only if one has not fired all of ones bullets or already far exceeded ones target holding, where for me the real danger level is being over 150% invested of target.

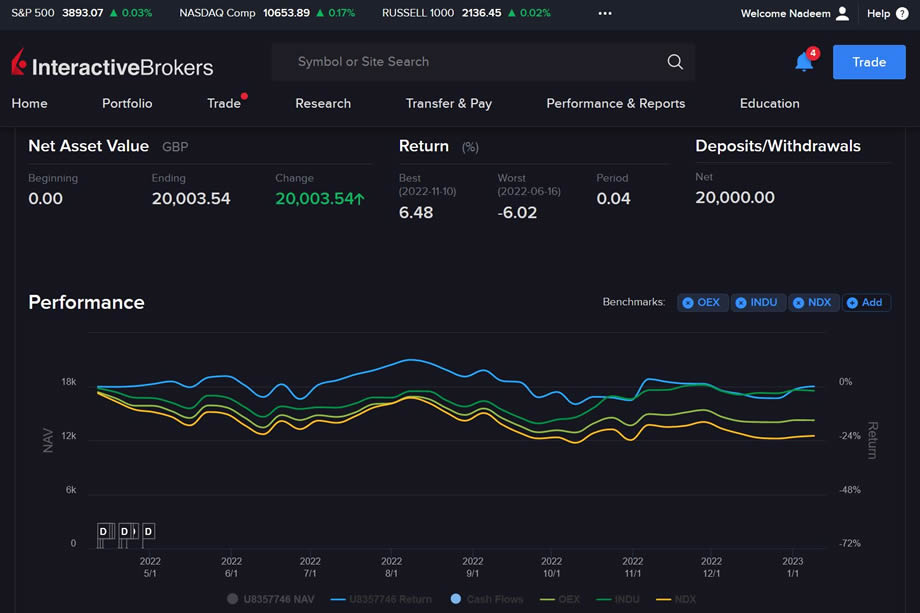

To illustrate this point I opened an ISA with IBKR early April, bunged in the maximum £20k and preceded to pile into the target stocks on my list, so given since early April the Dow is down 2%, S&P down 15%, Nasdaq down 22% one would imagine a tech heavy portfolio would be down somewhere between the S&P and the Nasdaq if not worse?

We'll the portfolio is actually FLAT since inception! Beats the Nasdaq, S&P AND DOW over the same time period. This is purely as a function of BUYING the DEEP discounts and then trimming on the rallies. The net result is that the overall portfolio stands at zero draw down which is set against any of the indices, let alone the ETF's and managed funds that only exist to line the pockets of the fund managers via their annual fees or worse as investors in the likes of ARKK are experiencing. And remember this is an ISA account so no complex trading involved such as shorting or options, just buying target stocks during the deep draw downs and then trimming on subsequent rallies, where the above portfolio currently stands at 96.5% invested, 3.5% cash, so primed for significant trimming during the current rally to rinse and repeat buying once more on the next dip. Whilst I do consider IKBR as a very good platform for trimming purposes i.e. very low commissions compared to virtually all other iSA providers, however it does have its quirks and complications which will likely be an issue for new users to get to grips with so do your own research on the pro's and cons before considering IKBR.

How to Trim?

Just as one scales into a position then one also scales out to some extent on the way up, the key difference is that one always only sells at a PROFIT. I.e. Say Google fell from 110 to 95, and I bought 10 shares each at 110, 100, and 95, then on the way up I would sell 10 at say 99, thus bank a $4 profit per share on those 10 shares, regardless of the fact that the average buying price for the 30 shares was $101.17, which on face value would seem like I sold at a loss but in reality I bought 10 shares for $95 and sold 10 for $99, and that is how I trim. free up capital to perhaps re buy Google at $95 again or lower given that one has more information than what one had when one originally bought Google at $95, the net result is no change in my portfolio i.,e. It would still show I own 30 shares however now if the platform is worth anything it 'should adjust for a lower average buying price, I though I prefer to do my own calc's in Excel.

So over time the average buying price goes down even if the stock goes nowhere, all whilst one always maintains a healthy amount of free cash on account without which one cannot buy any dips!

Another effect of actively trimming is that one is predisposed to pull the trigger and SELL a large chunk of ones portfolio in times of brewing uncertainty, as I noticed that during the second half of 2021 many patrons did not want to hear the likes of a brewing financial crisis, out of control inflation, and an impending valuation reset to at that time to a target of X20 earnings which seemed far fetched when the likes of AMD was trading on X60, Nvidia X90 etc. Clearly without any practice of actually SELLING then one is reluctant to do something that one is not practiced in this at the very least trimming and buying the dip develop experience in doing so otherwise many will find themselves reluctant to act. Which is why I sold 80% of my tech stocks portfolio BEFORE the end of 2021.

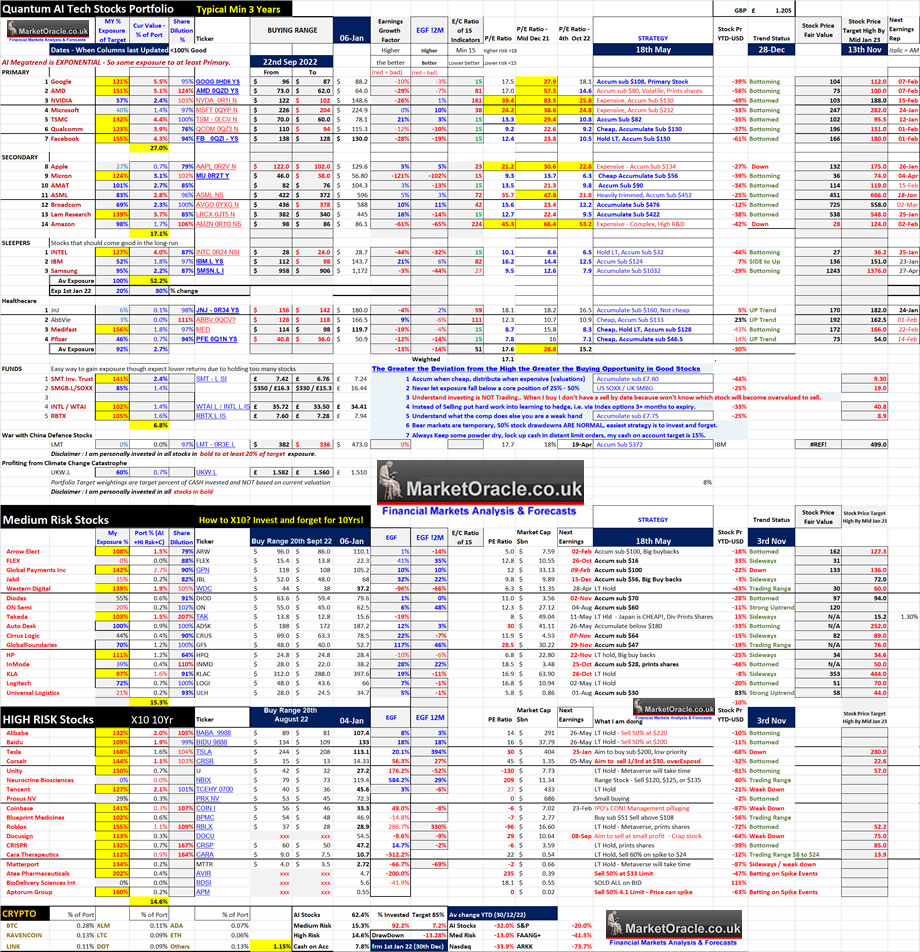

My portfolio current state 92.2% invested, 7.8% cash, my objective is to trim holdings to raise the cash percentage to at least 10% which would thus allow me to better capitalise upon any decline. I recently updated the Trend status column which indicates that most stocks have either bottomed or are bottoming. In terms of which stocks are in their buying zones - Google, AMD, META, Amazon, SMT, GPN, ADSK, CRPR. of these probably GPN, ADSK and CRSPR would perk my interest the most were I inclined to accumulate right now.

Table Big Image - https://www.marketoracle.co.uk/images/2023/Jan/AI-stocks-Big.jpg

So far only limited trimming in ASML, Micron, AVGO, KLAC, LOGI.

My current trimming ranges for most AI tech stocks are -

Google $101 to $122

AMD $78 to $110.

Nvidia $174 to $195

MSFT $261 to $292

TSMC $81.6 to $109

Qualcom $118 to $132

META $168 to $199 - Unlikely to trim any META.

Micron $57.2 to $74

AMAT $111 to $138

ASML $599 to $666

AVGO $576 to $631

LRCX $484to $533

Amazon $101 to $120

Intel $35 to $44

IBM $150 to $160

MED $155 to $192

Pfizer $53 to $57

Medium Risk Stocks

Arrow- $115 to $129

GPN - $117 to $135

HPQ $34.6 to $40

KLAC $414 to $436

Logitec $66 to $78

WDC $44 to $50

DIODE $90 to $98

ADSK $210 to $233

CRUS $85.5 to $95

GFS $67 to $78

INMODE $43 to $50

ULH $44 to $44

High Risk

CRSR $25 to $30

Tesla $156 to $196

Roblox $38 to $52

U $40 to $58

This article is an excerpt from Stock Market Gasping to Reach 4000 Ahead of Earnings Season, Dow New All Time High 2023? that was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

Immediate first access to ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 5 bucks per month which is nothing, if you can't afford 5 bucks for month then what you doing reading this article, 5 bucks is nothing, if someone did what I am doing then I would gladly pay 5 bucks for it! Signup for 1 month for a taste of the depth of analysis that cannot be beat by those charging $100+ per month! I am too cheap! I am keeping my analysis accessible to all, those willing to learn because where investing is concerned the sooner one gets going the better as portfolios compound over time, $5 month is nothing for what you get access to so at least give it a try, read the comments, see the depth of analysis, you won't be sorry because i do do my best by my patrons, go the extra mile.

And gain access to the following most recent analysis -

- Stock Market Counting Down to Pump and Dump US CPI LIE Inflation Data Release

- Stock Market Completes Phase Transition, US Real Estate Stocks - Housing Market Part1

- Stock Market Rally Slams into Q4 Earnings Season

- Stock Market Gasping to Reach 4000 Ahead of Earnings Season, Dow New All Time High 2023?

- S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

- Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION!

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023 - Part 2

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

- US House Prices Trend Forecast - 50%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 75%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trim FOMO rally buy the DIP analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.