Inflation & Commodities

Commodities / CRB Index Feb 20, 2023 - 09:14 PM GMTBy: Gary_Tanashian

The news is full of articles now discussing how food (Staples) producer prices are going to continue rising, how warehouse and distribution channels are pushing “inflation” higher, how charges to use cargo containers and transportation are all pushing “inflation” higher.

The inflationary acts were committed in 2020 and 2021. The inflation was inflicted then and is now history. What is happening now is a plethora of knock-on effects from the inflation. It’s lagging, sticky and in some cases opportunistic and greedy stuff that is not inflation but instead, the predictable after-effects of it.

What, did we expect that entities given license to mark up their profit margins (or at least try to maintain them for investors) would choose not to do so in the face of pervasive inflationary headlines? It’s an excuse to take the opportunity to PUSH costs. What economists call “cost-push inflation”. They have license to push costs, but it’s not the inflation, which happened already. That matters. Or it will matter.

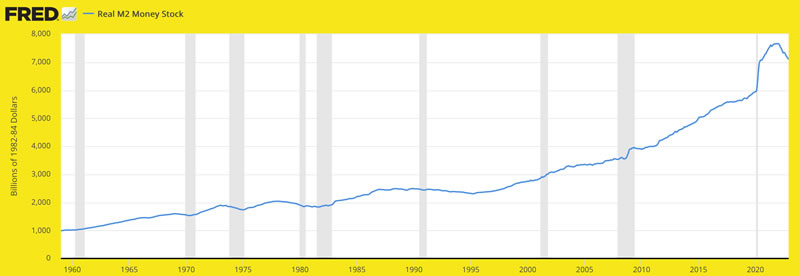

This graph deflates M2 money stock by the CPI. “Real” M2 is rolling over harder than nominal M2. To me it represents the mature stages of the inflation situation, where the Fed is trying to reel in its past actions while “sticky” prices persist. It’s also a picture of Stagflation, for however long it does persist.

Commodities and materials are the elements of consumer prices. From Oil/Gas to Wheat/Corn to Copper/Steel… commodities are the cyclical bedrock of consumer prices. But the “cost-push” is coming from services and related industries as they look backward at the inflationary effects into 2022 and promote them for all they are worth. And insofar as pricing power is the goal, they are worth a lot as long as the public believes them in its current inflationary mindset.

Yet here the CRB index still resides, trending down after making a top last spring.

Oil & Gas: Oil is back below its 50 day average and trending down. Gas is still in crash mode. Seasonal positive or not, bounce potential or not, its in a terrible bear market. Energy commodities are not currently responsible for inflation. The inflation in Energy has come and gone.

Agricultural: GKX also topped last spring, although it has stabilized of late and is technically neutral. With GKX below its now down-trending SMA 200, there is certainly no cost uproar happening in Ag commodities. Now, the supply chain and services? That’s a different matter. Cost-push license is at work.

Copper & Industrial Metals: The China story and its own depleted warehouse stocks have bolstered Dr. Copper, which maintains its intermediate-term bullish trend. The wider industrial metals patch (GYX) is somewhat weaker but not yet broken from its intermediate trend either. A lower low to the January low (437.54) would accomplish that (current index price: 451.73). Copper has been leading the cyclical relief rally that we’ve dubbed the Q4-Q1 rally. It should be watched for signs of continuation or failure.

u3o8: The uranium segment (URNM, URA) enjoyed Cameco’s results and popped but ended the week with a short-term unpleasant look on its daily charts. This is in contrast to the commodity, which ended the week with a positive look (ref. Sprott u3o8 fund SRUUF). Uranium is a wildcard and a special situation and often goes its own way within the commodity complex. Uranium price is long-term bullish coming out of a multi-year base but in consolidation.

Lithium, REE, Palladium & Platinum: Premier Li producers LTHM & ALB rammed upward on their quarterly results last week and then were unceremoniously hammered right back down, punishing anyone who would have tried to momo the results. Recall I had already taken profits on each of them, but for now they remain only on watch (ALB is the more technically constructive of the two). As a side note, the Li price has been dropping since November and is currently at support, which needs to hold at this still long-term elevated level or there would be more pain to come.

REE sees the fund REMX having broken back into its ongoing downtrend after a vigorous bounce and watch list item MP more constructive as it tries to hold its downtrending SMA 200. Still not great, but better than the fund. Palladium is firmly in its downtrend and Platinum has tanked out of its intermediate uptrend back into a technically neutral situation with a bearish bias.

Does much of the above sound like an inflation problem? Copper remains bullish on the short-term and that is a warehouse supply situation with the demand side of the equation yet to be determined. Uranium is stable and that is a long-term structural situation (as would be the likes of REE, Li and even Cu with respect to alternative energy and in the future, the after effects of war and assumed rebuilding).

<end excerpt as #745 finished up with currencies and portfolios after having covered US/Global stocks, precious metals, bonds/indicators, sentiment and the whole shootin’ match, as usual>

Excerpted from the February 19th edition of Notes From the Rabbit Hole (#745)

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed interim market updates and NFTRH+ dynamic updates and chart/trade setup ideas. You can also keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter ;@NFTRHgt.

By Gary Tanashian

© 2023 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.