Stock Market Every thing Every Where All At Once!

Stock-Markets / Stock Market 2023 Feb 26, 2023 - 12:30 AM GMTBy: Nadeem_Walayat

Virtually everyone was open jawed last week as to why the hell are stock prices soaring on BAD EARNINGS reports and yes regardless of how the headless chickens on the cartoon network (CNBC) were reacting in trying to explain the price action they were BAD EARNINGS reports as flagged by the EGF's which had zero impact on stock prices that instead of plunging soared into the stratosphere, why? It's because earnings reports are looking in the rear view mirror at what has already happened which is why one needs to be aware of current EGF and future EGF as well as current P/E relative to the high-low P/E range for each stock as shown in my AI stocks table. Our perception of time is not linear as we flit from the past (memories) into the future (forecasts, hopes and dreams) and back into the present, in a constant state of flux and so it is for all market participants which is the true nature of the markets, everything, everywhere all at once.

Which is why many get the markets so badly wrong because they get fixated on the past, by analogs of what happened in 1972, or 1982, or 1992 or 2002 and so on just as the analog breaks down, to truly understand the markets then one has to become a time traveler, flitting between the past and future through the present which is why when I hear garbage such as "I don't predict the future when I buy stocks" I shake my head as it is a load of bollox! Of course you are predicting a positive outcome for your trade i.e target price! That IS a PREDICTION! Looking into the future!

So become time travelers by understanding that the past and the future only exist in the present! It's how the impossible happens, Brexit, Trump, Russian Invasion, Bull Market.... And the reason why humans ARE time travelers is because of Language, probably the greatest evolutionary leap was to be able to look into the past and future through the use of Language, Language is TIME! Without it we are just hairless Apes, with it we are Time Lords!

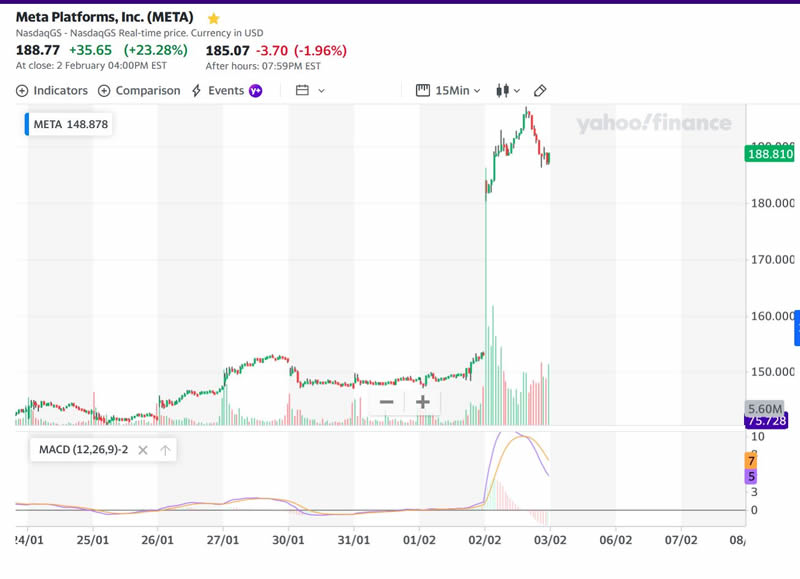

The stock market has effectively completed it's phase transition from Bear to Bull that began going into the June 2022 low, reached it's max critical point during the October sell off that marked the birth of the embryonic bull market that since has continued to set milestone after milestone with each passing month all up until the point of the weeks impossible rally that literally no one was expecting, as I have repeatedly warned was the primary risk to expectations for a correction which IS to the UPSIDE. When looking at the price charts one often forgets that the the prices are the sum of the actions and positions of all market participants who at the time of their actions had a set view on expected market price action that they are then working towards and it is subsequent price action that either reinforces or weakness that view. However systems do not operate smoothly instead have critical points which where the markets are concerned are centered around the likes of the CPI report, FOMC Rate Decision, Fed Chairman's speech and so on. And so it was the case this past week where in reality it did not matter what the Fed did 0.25% or 0.5%, or even if Jerome Powell recited Ba Ba Black Sheep have you any wool, Wednesday's Fed meeting was a criticality point that the markets were centered around, a point at which the SYSTEM TAKES ACTION. This is the true nature of reality folks, all systems are balanced at criticality points waiting to ACT, even the way you think, your brain is a collection of criticality points at which you will decide to act. With the markets it is PANIC BUYING or PANIC SELLING, This week we had PANIC BIUYING, gone out of the window were the 'constructs' that had convinced most of the view to expect new bear market lows, in steps the criticality point of the Fed meeting that prompts ACTION! And so market participants ACTED to send stocks soaring! META up an unheard of 23^% after hours following it's results.

Yes it's easy after the fact to look for reasons why META soared, but it is what it has been for the duration of the bear market, a good stock that was hated by Wall Street because they don't get the METAverse as they invested in a social media stock but instead find Zuckerberg rambling on about something few actually understand the nature of. I do use the Quest headset but not any of META's products such as Horizon world, I use it more in terms of developmental work that will probably never actually pan out into a revenue stream but what it does do is give me knowledge of what the metaverse actually is and what it is set to become, the go to place for running simulations, the Star Trek holodec! It will be as big a change as what the internet and Google Search were! Currently Google is the go to place for answers to questions, despite GPT noise. The Metaverse will be the go to place to run simulations before one acts in the real world, in fact it's already happening in many industries and there will be many flavours of the Metaverse such as Nvidia's Omniverse. In fact META has just done what it does best which is to BUY other companies and then capitalise on them, because basically META sucks at innovation but is good at spotting other companies with potential and buy them as it just did by buying a $400 million VR company.

The bottom line is META WILL trade to new all time highs and many will look back and wonder why they did not buy when the stock was trading down to UNDER $100! It is because it is not easy to buy stocks when they are dirt cheap unless one has a plan, already has a list of target stocks to buy and BUY THEM WHEN CHEAP! BUY THEM WHEN BLOOD IS POURING OUT OF ONES EYES at the draw downs they are generating! BUY THEM when MSM are SAYIING they are now DEAD stocks! As clown Cramer was saying during October, DO NOT BUY TECH STOCKS this clown was spouting as I and hopefully many patrons were catching the many falling knives during Octobers bloodbath, Clown Cramer on the CNBC Cartoon network was stating that the tech stocks were finished, META was finished at $100 per share! When it WAS the mother of all buying opps! CNBC IS the CARTOON NETWORK!

Watch the clown - https://youtu.be/ZUDoDjhuvFU?t=61

And for the life of my I do not understand why so many obsess over Bury and his tweets for if actually they followed this one trick pony then they would ALL be broke by now!

That was like S&P 300 points ago, so I guess Burry's next tweet should be "You have no idea how broke I am."

This article is an excerpt from Stock Market Completes Phase Transition, US Real Estate Stocks - Housing Market Part1 that was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

Immediate first access to ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 5 bucks per month which is nothing, if you can't afford 5 bucks for month then what you doing reading this article, 5 bucks is nothing, if someone did what I am doing then I would gladly pay 5 bucks for it! Signup for 1 month for a taste of the depth of analysis that cannot be beat by those charging $100+ per month! I am too cheap! I am keeping my analysis accessible to all, those willing to learn because where investing is concerned the sooner one gets going the better as portfolios compound over time, $5 month is nothing for what you get access to so at least give it a try, read the comments, see the depth of analysis, you won't be sorry because i do do my best by my patrons, go the extra mile.

And gain access to the following most recent analysis -

- Stock Market Counting Down to Pump and Dump US CPI LIE Inflation Data Release

- Stock Market Completes Phase Transition, US Real Estate Stocks - Housing Market Part1

- Stock Market Rally Slams into Q4 Earnings Season

- Stock Market Gasping to Reach 4000 Ahead of Earnings Season, Dow New All Time High 2023?

- S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

- Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION!

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023 - Part 2

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

- US House Prices Trend Forecast - 50%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 75%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trim FOMO rally buy the DIP analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.