Gold Sell Signal as Oversold Stock Markets Turn Bullish

Stock-Markets / Financial Markets Nov 01, 2008 - 05:09 PM GMTBy: Brian_Bloom

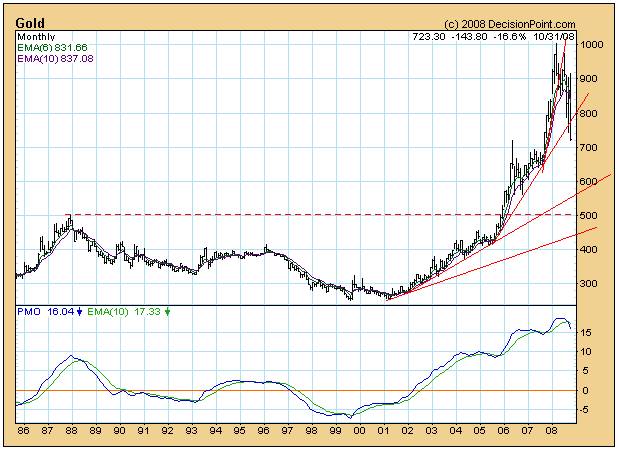

Don’t trust the Text Books - On reflection, there may be more to what is happening on the markets than meets the eye. For one thing, the gold price – the ultimate harbinger of fear in the economy – is stubbornly refusing to rise to new heights, and its oscillator has given a sell signal.

Don’t trust the Text Books - On reflection, there may be more to what is happening on the markets than meets the eye. For one thing, the gold price – the ultimate harbinger of fear in the economy – is stubbornly refusing to rise to new heights, and its oscillator has given a sell signal.

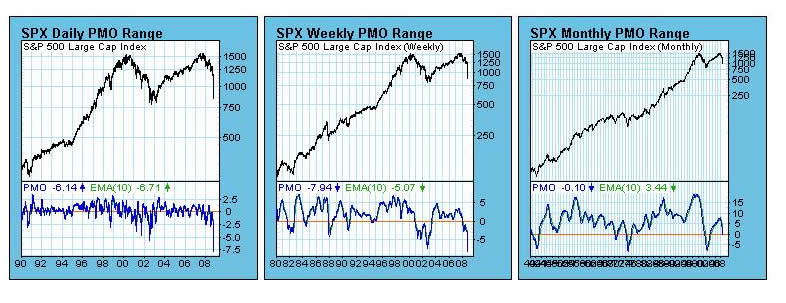

The oscillators on the short term charts of the $SPX are severely oversold and, interestingly, the oscillator on the monthly chart is approaching the zero line.

Technically (from a contrarian perspective) if the world is “universally” bearish the equity markets may still hold some surprises on the upside. Despite what Dow Theory may or may not say, a long term oscillator above the zero line is evidence of a market that has not yet entered long term bear territory. This is not theory. This is fact. (Of course it may still go into negative territory, but as of this writing it has not)

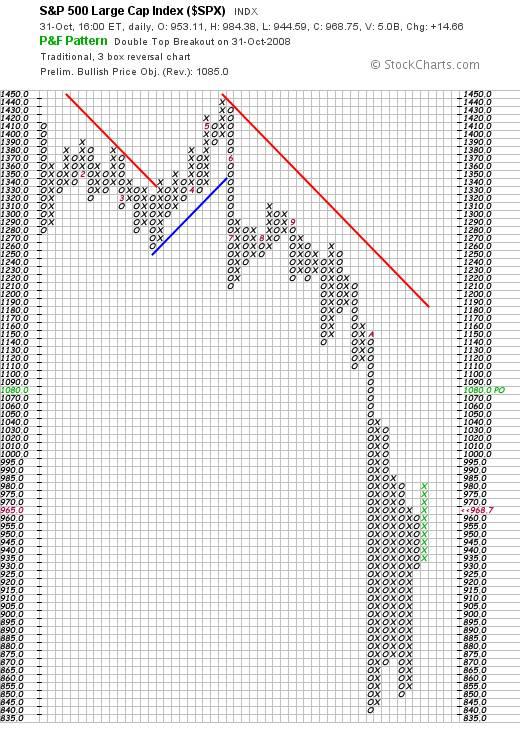

It is clear to anyone with a pulse that the banking industry is in trouble; its equity decimated – but the charts are giving buy signals, as can be seen from the P&F below. Is this just a technical bounce or could there be more to what is actually happening than meets the eye?

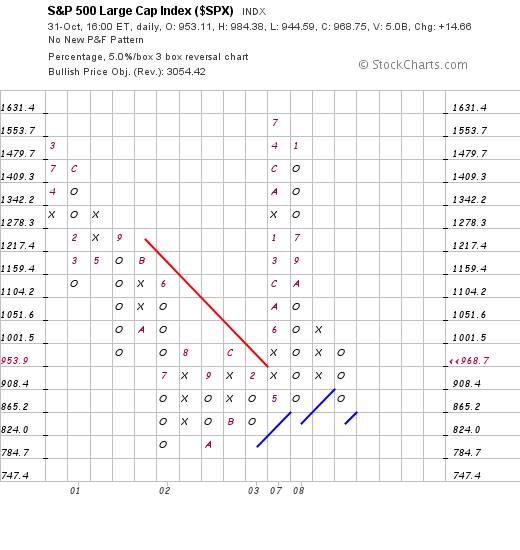

The chart below is a 5% X 3 box reversal charts which filters out all the trading noise.

What it shows is strong consolidation at around the 824-908 level. If the markets break below 824, the entire system will be at risk – because a 50% fall to around 450 will be called for.

The implications of a fall to 450 can be seen from the chart below. This will result in a downside penetration of an 80 year trend line.

The 450 target would be a conservative number. Based on the vertical downside count that will manifest, we may as well slit our wrists right now. But before you do that …..

Just look at that consolidation on the 5% X 3 box reversal chart! Ignoring the spike from 968 to 1550 and back again, there are nine blocks in the horizontal measurement at the consolidation level!

Something is happening out there which is unprecedented in my experience.

So let's get back to the insolvent banks (and the real estate industry that is clearly underwater; and the quadrillion dollar derivatives exposure which everyone now understands is a disaster waiting to happen). One thing is clear: The whole (investment) world is aware of these problems. There are no “shocks” left to be felt – other than a systemic collapse.

And yet, the markets are bouncing up. Is the entire system really about to collapse?

Here are two articles which explain the impact that the hedge funds have been having on the world markets (9000 odd of them) (Thanks Steve)

http://ragingbull.quote.com/ mboard/boards.cgi?board=JAGH& read=110912

http://www.kitco.com/ind/ GoldReport/oct272008.html

Could it be that the Fed and other Central Banks pumped money into the economy; the spare money went into the hedge funds; at the margin, the hedge funds ramped the equity and commodity markets; and then lost the money on the way down? Could we be watching a rich man's bear market – given that the Hedge Funds typically play with rich men's money? Of course, the 401k people will have been hurt along the way, but they were not speculating. They were investing – slowly and deliberately; like dripping water. Of course, there were a whole lot of baby boomers and out of workers who were playing with their charts – and that will have cost them dearly – but were there enough of them to destabilize the world economy?

9000 Hedge Funds have a lot of money under management- arguably, most of the spare cash that the Central Banks pumped into the economy. Let's make a wild assumption (unsubstantiated). Assume each fund, on average, had $250 million under management. That's $2.25 Trillion. That's around one third of the entire world's foreign exchange reserves. That is a lot of money.

Last night a friend who does business in China told me that the Chinese have raised their prices to him up to 45% in US$; and that the A$ has fallen around 30% relative to the US$.

But, if the commodity prices have tanked, and the US$ has risen, is there not now room for one of two things to happen?

- China can once again drop prices – should they so choose.

- If they choose not to, non US countries can get their manufacturing industries going again and become competitive with the Chinese. Jobs can be created outside China.

My bet is that the Chinese will choose not to cut prices. They have $1 trillion in US Dollar denominated foreign exchange reserves. They cannot afford to risk losing that by “forcing” a dollar collapse. I would bet that the tide is about to turn inside China and that life is going to become harder – but no harder than before all this started less than 30 years ago when Trick Dick Nixon opened the door to China's entry into the world markets.

And within the USA, there is Section B of HR1424 – which will clearly stimulate the US economy at domestic level (as will the collapse in the oil price). For those who are not familiar with Section B of HR1424, it contains a raft of concessions to the industries which ultimately drive the world economy – the alternative energy industries - and it seems to take away concessions from the oil and coal industries. Section B of HR1424 provides hard evidence of a shift towards a problem solving attitude on the part of our political leaders. The guys are starting to close ranks and get their act together.

The more I think about this, the more it impinges itself on my brain that the text books don't have a “canned” answer for what's happening here.

I think we may be witnessing a world economy in transition – as opposed to a world economy that is about to collapse. Based on the evidence, what seems to be about to happen is a market driven leveling of the financial playing field. The rich will get less rich, the middle class will become more relationship oriented and the entrepreneurs will roll up their sleeves. And yes, the food stamp lines will grow – but life will carry on. The sun will very likely keep rising in the mornings.

By Brian Bloom

Beyond Neanderthal is a novel with a light hearted and entertaining fictional storyline; and with carefully researched, fact based themes. In Chapter 1 (written over a year ago) the current financial turmoil is anticipated. The rest of the 430 page novel focuses on the probable causes of this turmoil and what we might do to dig ourselves out of the quagmire we now find ourselves in. The core issue is “energy”, and the story leads the reader step-by-step on one possible path which might point a way forward. Gold plays a pivotal role in our future – not as a currency, but as a commodity with unique physical characteristics that can be harnessed to humanity's benefit. Until the current market collapse, there would have been many who questioned the validity of the arguments in Beyond Neanderthal. Now the evidence is too stark to ignore. This is a book that needs to be read by large numbers of people to make a difference. It can be ordered over the internet via www.beyondneanderthal.com

Copyright © 2008 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.