Stock Market CHEAT SHEET

Stock-Markets / Stock Market 2023 May 22, 2023 - 07:44 AM GMTBy: Nadeem_Walayat

Dear Reader

It's your lucky day! You get access to my stock market brief that was made available to patrons just a few hours ago!

S&P 4192 - What if someone told you 7 months ago that TODAY the S&P would be trading at 4200 and the Dow at 33,900, how much would you value such analysis? $5 per month? https://www.patreon.com/Nadeem_Walayat

Stock market maximum confusion, are we going for 4300 or 4000? A 7 week trading range has resulted in many bull and bear busted technical signals as every indicator has only a certain probability of coming to pass, it's just that one does not expect virtually all to be uncertain at the same time! Swings, MACD, even basic trend analysis of higher high and lows, false breaks, Rising Dollar, Falling Bonds, Central banks reducing liquidity, then there are the OPTIONS MAX PAINERS fixated on the S&P being destined to be forever stuck at 4000 lodged between CALL and PUT WALLS as per expected moves.

These are the facts -

1. We are in a BULL MARKET as of Mid October 2022 (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1 )that will run for many years, which means the primary direction of travel over time is UPWARDS. Instead I get the impression that many tend to forget this fact, look at my portfolio, I am 88% invested.

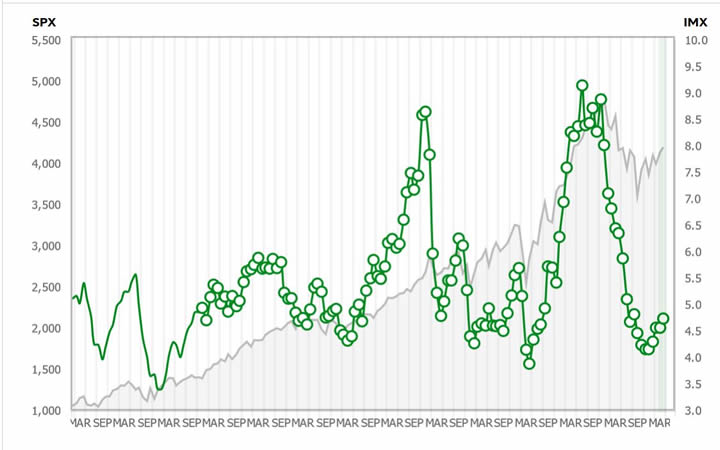

2. The retail herd AND the funny managers are sat on the sidelines with trillions parked in money market accounts having been convinced by the cartoon network that short-term t-bills are the place to be whilst watching stocks soar are now desperate for stocks to fall so they can buy as this graph by TDA illustrates that the retail crowd all but sold out of their holdings December 2022.

3. Corrections are just that CORRECTIONS, it IS a fools errand to attempt to trade the downside during a bull market as the risks are to the UPSDE!

Still the fog of what happens next is THICK and technical analysis is proving useless. it will only become obvious in hindsight which is the scam of most analists, they show you indicators of what the market did in the PAST IN HINDSIGHT! Head and shoulders garbage patterns and such like. only good in hindsight! Then we have the perma SHORTING the market fools, don't they realise that the market goes UP 85% of the time?. Instead what we need is a powerful Light house to SHINE a BEAM through the fog that is completely immune to all of the noise of not just the past 7 weeks, but 7 months! .

STOCK MARKET CHEAT SHEET

In terms of the current state of the stock marketr trend forecast the Dow by now should be trading at 33,900 vs actual last close of 33,426 thus a deviation of -1.4% against the forecast.

Whilst the S&P should be trading at 4200 vs actual of 4192 for a -0.002% deviation against trend forecast.

So forget all of the chart porn that is TA, the stock market cheat sheets are clear in that the indices are targeting their respective highs during Mid Summer 2023 i.e. S&P 4500.

What am I doing?

Trimming as the market goes up, especially in those stocks where I am over extended, current exposure is 87.3% invested, so the rate of trimming is roughly 2% for every 100 S&P points advance which suggests 6% by 4500 that will bring me down to about 82% invested, In fact many stocks have already achieved their Mid year target highs as per the AI tech stocks spread sheet -

Nvidia $313

Google $122

AMD $108

Microsoft $313

Apple $175

Broadcom $670

Lam Research $598

Amazon $122.8

FLEX $25

Diode $94.8

ON $88

KLA $432

LOGI $67.3

Whilst at the same time i am accumulating where ever opportunities arise which recently includes ABBV, PFE, QCOM and CRUS, so there are nearly always opps to buy.

AI Stocks BUYING levels have been updated! (new spreadsheet link - prev archived) - https://docs.google.com/spreadsheets/d/1-dPfmAcnptFJxJZq3h9caMLzkO0ceSA8VsO4TmU7dQo/edit?usp=sharing

I will look at updating the Medium and High risk portfolios in due course.

Nvidia $313 traded to a high of $319, ridiculously over priced, trading on a PE of 94, so whilst EGF's are strong at +8% and +58%, the stock price has long since left fundamentals of 3.9 behind now is in full FOMO mode. Earnings are on Wednesday and if any stock is going to drop hard on earnings then that stock is Nvidia, probably to below $250 and along with that one would expect an S&P correction.

Your analyst coming down with Covid 23 (probably), Vitamin D should help protect.

Nadeem Walayat

Again your not going to find analysis better than this even if you paid over $1000 per month to some Investment Bank clown outfit and this article is mere fraction of my analysis Stock Market Fundamentals, Debt Ceiling Smoke and Mirrors Circus that is first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

As my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 5 bucks per month which is nothing, if you can't afford 5 bucks for month then what you doing reading this article, 5 bucks is nothing, if someone did what I am doing then I would gladly pay 5 bucks for it! Signup for 1 month for a taste of the depth of analysis that cannot be beat by those charging $100+ per month! I am too cheap! I am keeping my analysis accessible to all, those willing to learn because where investing is concerned the sooner one gets going the better as portfolios compound over time, $5 month is nothing for what you get access to so at least give it a try, read the comments, see the depth of analysis, you won't be sorry because i do do my best by my patrons, go the extra mile.

And gain access to the following most recent analysis -

- Stock Market Fundamentals, Debt Ceiling Smoke and Mirrors Circus

- Stock Market Counting Down to Apple Earnings Trend Acceleration

- Stock Market S&P Swings Analysis Going into Earnings Season

- SVB Collapse Buying Opportunity Counting Down to Resumption of Stocks Bull Market

- Stock Market Counting Down to Pump and Dump US CPI LIE Inflation Data Release

- Stock Market Completes Phase Transition, US Real Estate Stocks - Housing Market Part1

- S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

- How to Get Rich - 85%

- US House Prices Trend Forecast - 50%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.