Stocks – Is Being Bullish Still Justified?

Stock-Markets / Stock Market 2023 Dec 22, 2023 - 10:02 PM GMTBy: Paul_Rejczak

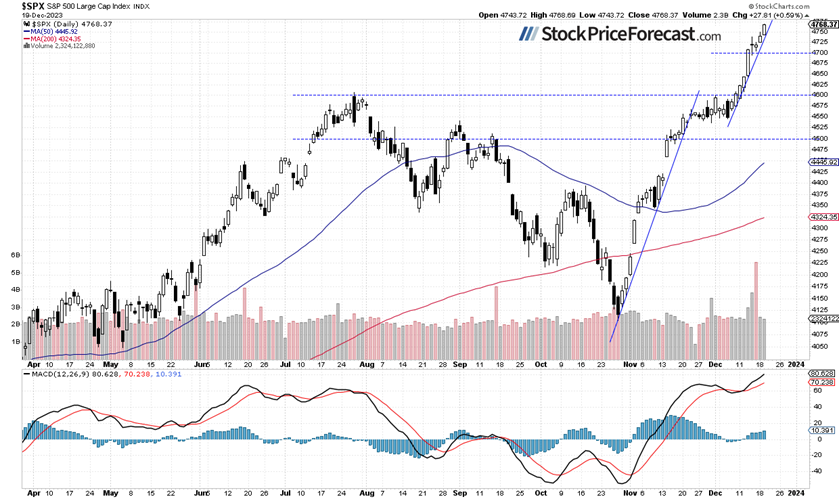

The S&P 500 index gained 0.59% on Tuesday, further extending the uptrend following last week’s release of the FOMC Statement release on Wednesday, which marked a pivot in the Fed’s monetary policy. The market went even closer to its Jan. 4 of 2022 all-time high level at 4,818.62 yesterday. Recently the S&P 500 broke above the late July local high of around 4,607 after resuming a rally from the local low of 4,103.78 on October 27.

The S&P 500 index gained 0.59% on Tuesday, further extending the uptrend following last week’s release of the FOMC Statement release on Wednesday, which marked a pivot in the Fed’s monetary policy. The market went even closer to its Jan. 4 of 2022 all-time high level at 4,818.62 yesterday. Recently the S&P 500 broke above the late July local high of around 4,607 after resuming a rally from the local low of 4,103.78 on October 27.

Stocks will likely open 0.2% lower today, so the S&P 500 index may trade sideways, but there’s still potential for it to reach the mentioned record high level, which was only 1.05% above yesterday’s closing price. The S&P 500 index continues to trade along its steep upward trend line as we can see on the daily chart:

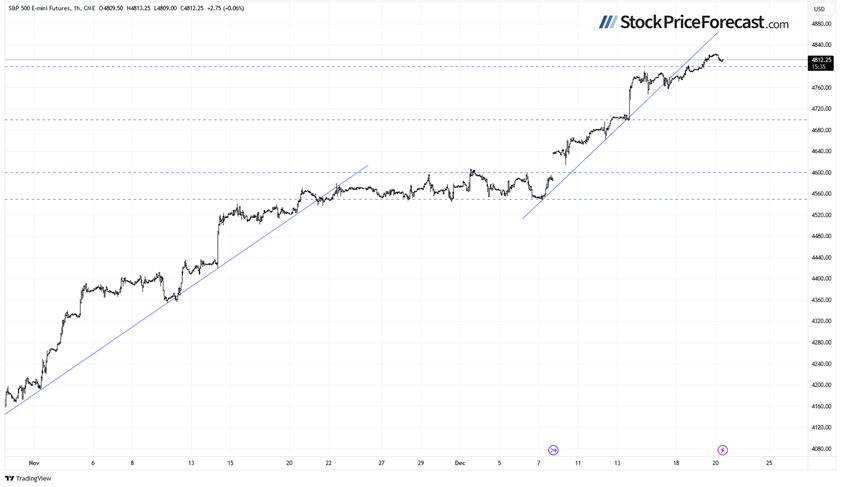

Futures Contract Remains Above 4,800

Let’s take a look at the hourly chart of the S&P 500 futures contract. It’s trading above 4,800 level ahead of the index open, but the market is basically going sideways following yesterday’s daily advance. The nearest important support level is now at 4,780-4,800, among others.

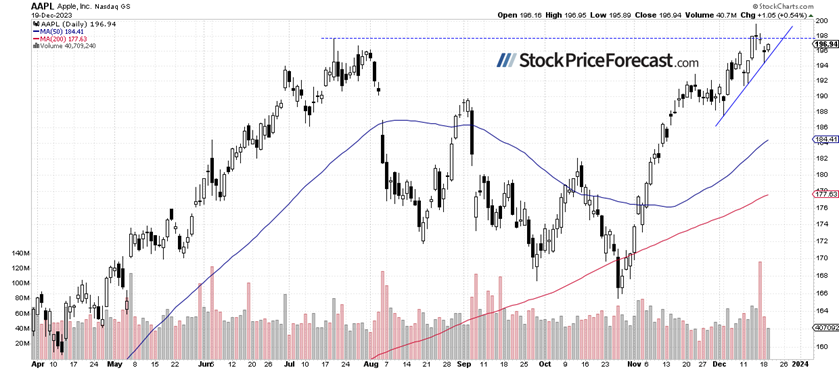

Apple Is Still at Resistance Level

Let’s move on to an individual stock. Apple is one of the most important market movers. On Monday I wrote that it “looks like a topping pattern or just some flat correction following the rally”, and indeed, the market retraced some of its recent rally before bouncing from the upward trend line. The $200 price level remains an important resistance level here.

Conclusion

Stocks are expected to retrace some of their yesterday’s advance, yet the market remains very close to its medium-term high. Will the S&P 500 reach a new record high soon? There is a chance of extending the uptrend, given the yesterday’s daily close was just 1.05% below the all-time high level.

There have been no confirmed negative signals so far, but the market may experience a downward correction at some point. The long position remains profitable and yesterday it added even more gains. Overall the index has gained 776 points or 19.4% since opening that trade at 3,992.4 on Feb. 27. In the near future, I will be looking to close that trade and shift focus to a more short-term oriented trading strategy. For now, it remains justified as stocks may further extend their uptrend.

Here’s the breakdown:

- The S&P 500 further extended its advance as it got closer to the record high level from early 2022.

- There may be a downward correction at some point.

- In my opinion, the short-term outlook is still bullish.

Like what you’ve read? Subscribe for our daily newsletter today, and you'll get 7 days of FREE access to our premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care

* * * * *

The information above represents analyses and opinions of Paul Rejczak & Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Paul Rejczak and his associates cannot guarantee the reported data's accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Rejczak is not a Registered Securities Advisor. By reading his reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Paul Rejczak, Sunshine Profits' employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.