S&P 500: What to Make of Fear Versus Greed

Stock-Markets / Stock Market 2023 Jan 21, 2024 - 07:15 PM GMTBy: EWI

This sentiment index combines seven indicators into one useful trend measure

That is -- market participants generally go from feeling deeply pessimistic all the way to feeling highly optimistic -- and then back again.

These swings in investor psychology tend to produce similar circumstances at corresponding points in the Elliott wave structure of the main stock market indexes.

Let's now consider the opposing mindsets of fear and greed and see what they reveal at this juncture in the S&P 500's price pattern.

This chart and commentary are from the January Elliott Wave Financial Forecast, a monthly publication which covers major U.S. financial markets:

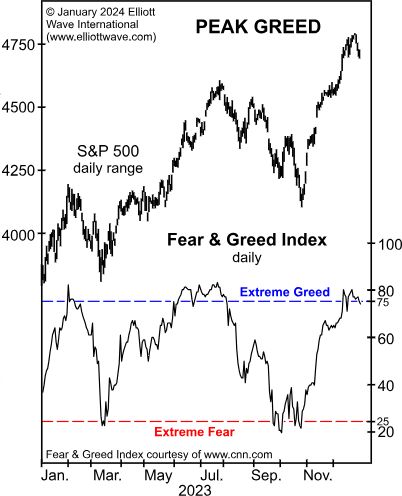

The Fear and Greed Index (CNN.com) ... combines seven different indicators into a sentiment measure. As shown, levels of Extreme Greed have occurred at or shortly before highs in the S&P 500 over the past year.

And this headline from Jan. 12 shows that even those at the top of the investment food chain are exhibiting no caution whatsoever -- nor are they encouraging others to do so (Moneywise):

'I'm more optimistic than ever': Billionaire [CEO of Major Investment Firm] says investors should be 100% in equities if they can handle it

A year or two from now the current sentiment of this CEO and other optimistic investors may turn out to have been spot on.

Presently, the S&P 500 does hover near its record high. Yet, yet you may want to check out what the Elliott wave model reveals. In our view, it's very much worth your immediate attention.

If you'd like to dig into the details of the Elliott wave model, you are encouraged to read Frost & Prechter's Wall Street classic, Elliott Wave Principle: Key to Market Behavior. Here's a quote from this "must read" book:

By knowing what Elliott rules will not allow, you can deduce that whatever remains is the proper perspective, no matter how improbable it may seem otherwise. By applying all the rules of extensions, alternation, overlapping, channeling, volume and the rest, you have a much more formidable arsenal than you might imagine at first glance. Unfortunately for many, the approach requires thought and work and rarely provides a mechanical signal. However, this kind of thinking, basically an elimination process, squeezes the best out of what Elliott has to offer and besides, it's fun! We sincerely urge you to give it a try.

Here's good news: You can read the entire online version of the book for free!

All that's required for unlimited free access is a Club EWI membership. Club EWI is the world's largest Elliott wave educational community (approximately 500,000 members) and allows you complimentary access to a wealth of resources on investing and trading from an Elliott wave perspective. Club EWI is free to join.

Get started by following this link: Elliott Wave Principle: Key to Market Behavior -- get free and instant access.

This article was syndicated by Elliott Wave International and was originally published under the headline S&P 500: What to Make of Fear Versus Greed. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.