The Roaring AI Tech Stocks 2020's

Companies / AI Jan 28, 2024 - 09:29 AM GMTBy: Nadeem_Walayat

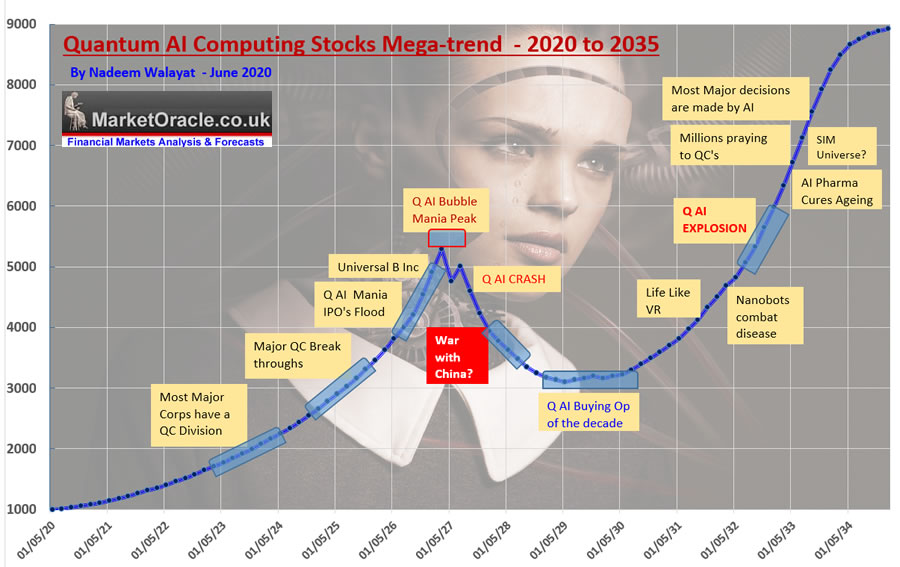

Just pause for a moment and take in the chart below that I have been iterating since June 2020, the message one should be receiving is that I expect this bull market to run for many more years, that I expected to target a return of X6 over some 7 years on where AI tech stocks stood June 2020, whilst my best guess 3.5 years ago was that we could see a major top during 2027, as long as run away valuations moderated from time to time delivering buying opps as they did during 2022 then I don't see why this should not still remain the big picture, thus the bull market that began March 2009 could continue to fulfill my original expectations for a 18 year bull market, where even the bear market that follows it will prove temporary as the bull market once more resumes during the 2030's.

12th June 2020 - Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!

Therefore the following graph illustrates my road map forecast conclusion of how I expect the AI mega-trend to play out over the next 15 years and why I will continue the mantra of buy the dips and panics all the way towards liquidating holdings during the next mania peak when valuations go out the window and when I will likely heavily short these same stocks all the way down towards the buying opportunity of the 2030's.

We are now near 4 full years into the roaring AI 2020's, whilst AI will lift all boats due to huge leaps in productivity, however obviously we want to be focused on core AI and it's primary derivatives. hence the Quantum AI tech stocks portfolio.

The greatest danger to capitalising on huge AI gains yet to come is to get side tracked into sectors such as bonds, mining, commodities and so on, that's the real danger, to DIVERSIFY AND DILUTE, which is a mistake we are ALL guilty of, including me. We are just to fidgety to stay focused on the big picture and hence dabble in stuff we know little about.

It's another one of those things that most take for granted which in reality is WRONG! i.e. TO DIVERSIFY IS WRONG!

I continue to see War with China as being inevitable that could turn a Quantum AI stocks bubble mania crash into a true multi year bear market.

Thus my primary strategy remains to buy the periodic deviations form the highs in good / fairly valued AI tech stocks as we experienced twice during 2023., in March and then again in late October, whilst several more opportunities arose randomly during the year such as AMD plunging towards $80 early May 2023, which is why you often hear me state that the S&P is a nothing burger / red herring in terms of investing in target stocks

Whilst I expect AI to continue to deliver an exponential uplift to economic activity which will continue to surprise the econofools who think in linear terms, and thus completely fail to understand what is taking place hence are stuck on the default setting of a recession is always coming! Given that the models they are using are based on decades old theories, hence why we are in the Roaring AI 20's! That most will only see with the benefit of hindsight, look back in some years time and write reams and reams of worthless economic papers about it, as if they had clue of what was transpiring at the time! I mean this is FOUR YEARS into the ROARING AI 2020's! We have had the LLM's of 2023 that will continue to explode on an exponential curve during 2024, which will be followed by Tesla's Optimus Bot's during 2025 to be followed by several competitor bot's during 2026.... The future is rushing towards us at an ever faster pace all whilst linear minds cling onto decades old comfort blankets

This decade is the WORST time in a century to be bearish on stocks! Especially AI tech stocks! Some fools on the cartoon network still call AI hype! The AI market can easily grow by 20% per annum driving earnings into AI tech stocks. Whilst 20% per year might not sound like much but through magic of compounding today's global AI market of roughly $600 billion becomes $1.5 trillion in 5 years time, and $3.7 trillion in 10 years time! And 20% is likely to turn out to be a a conservative growth rate given AI's explosive exponential nature!

This illustrates the problem with looking at past data, the pre AI era, that ship has sailed, we are living in the AI age so one needs to skew interpretation of economic data in the light of the AI prism, such as the consensus econofools view that the end of a Fed tightening cycle tends to soon be followed by a recession, which I am sure is all you are going to hear for the whole of 2024, that a recession is coming, just as was the case for 2023 and 2022! Given what I see coming to pass in terms of AI, I would not be surprised if we don't see a recession for many years!. And say even if a recession happens, if it doesn't effect target stocks earnings growth then it won't result in a drop in the stock prices, where the advantage my patrons have are the metrics I track in my portfolio that instantly show which stocks are strong and which stocks are weak in terms of their fundamental metrics that I will return to towards the end of this analysis.

This artcile is an excerpt from my in-depth analysis and concluding S&P detailed trend forecast for 2024 - S&P Stock Market Analysis, Detailed Trend Forecast Jan to Dec 2024 has first been made available to patrons who support my So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, this is your last chance to lock it in now at $5 before it rises to $7 this month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Analysis that seeks to replicate the accuracy of 2023:

S&P Stock Market Analysis, Detailed Trend Forecast Jan to Dec 2024

CONTENTS

Investing in the Stock Market is Like Boxing With Mike Tyson

Keep Calm and Carry on Buying Quantum AI Tech Stocks

Synthetic Intelligence

The Roaring AI 2020's

Stock Market 2023 Trend Forecast Review

STOCK MARKET DISCOUNTING EVENTS BIG PICTURE

Major Market lows by Calendar Month

US Exponential Budget Deficit

QE4EVER

US Stock Market Addicted to Deficit Spending

INFLATION and the Stock Market Trend

US Unemployment is a Fake Statistic

S&P Real Earnings Yield

S&P EGF EPS Growth

When WIll the Fed Pivot

Stocks and Inverted Yield Curve

The Bond Trade and Interest Rates

US Dollar Trend 2024

US Recession Already Happened in 2022!

US Presidential Election Cycle and Recessions

Margin Debt

Stock Market Breadth

Stock Market Investor Sentiment

Bitcoin S&P Pattern

SP Long-term Trend Analysis

Dow Annual Percent Change

Stock Market Volatility (VIX)

S&P SEASONAL ANALYSIS

Correlating Seasonal Swings

Presidential Election Cycle Seasonal

Best Time of Year to Invest in Stocks

Formulating a Stock Market Trend Forecast

S&P Stock Market Trend Forecast Jan to Dec 2024

Quantum AI Tech Stocks Portfolio

Primary AI Stocks

AI - Secondary Stocks

TESLA

Latest analysis - Stock Market Election Year Five Nights at Freddy's

My counter to the headless chickens following the failure of santa clause rally and the first five trading days indicator.

And gain access to my exclusive to patron's only content such as the How to Really Get Rich series.

Change the Way You THINK! How to Really Get RICH Guide 2023

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

The Investing Assets Spectrum - How to Really Get RICH

Here's what you get access to for just $5 per month -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive at least 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of my analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate access to all my analysis and trend forecasts do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it rises to $7 per month for new signup's.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your crypto's accumulating analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.