Gold Tipping Points That Investors Shouldn’t Miss

Commodities / Gold & Silver 2024 Feb 05, 2024 - 10:41 PM GMTBy: P_Radomski_CFA

The situation in gold and gold stocks is not stagnant. Something shifted. And the implications are not minor.

A Moment of Realization

In 1993, Aerosmith released the song called “Amazing”. I really enjoyed it when it came out and some of the lyrics stuck in my mind. When I was reviewing the charts to prepare today’s analysis, I recalled a part of that song. I wasn’t sure why, as it’s been sometime when I was listening to it.

But then it hit me. And as we move to the chart analysis, in particular the ones featuring the USD Index and the S&P 500 futures, you’ll see why. Here’s what I recalled:

It's amazing.

With the blink of an eye, you finally see the light.

Oh, it's amazing.

When the moment arrives that you know you'll be alright

In the song, it’s about a tipping point in life. And it seems that we reached tipping points in those two above-mentioned markets, which has implications for… Pretty much everything.

Let’s start with the key thing that happened and what didn’t happen at the same time.

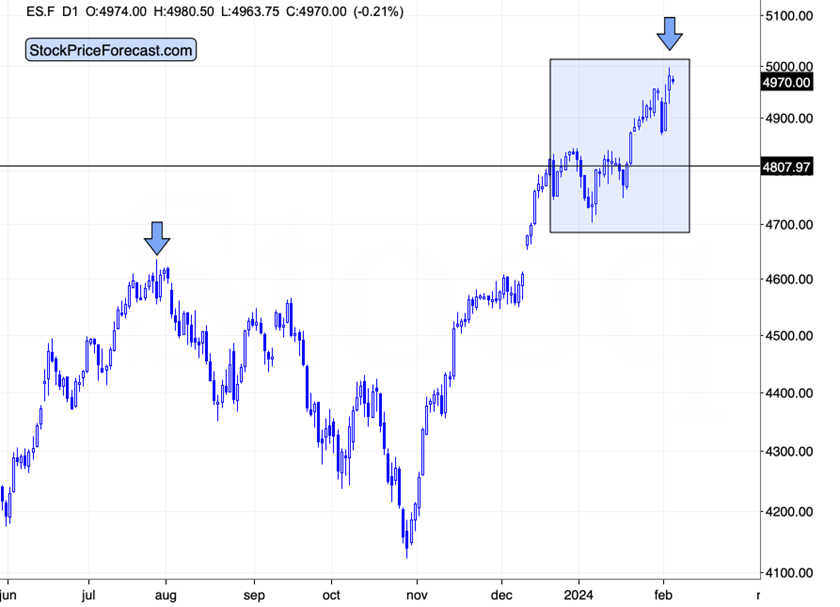

The S&P 500 Index futures approached the 5,000 level. Friday’s intraday high was 4997.75, after reaching which the futures retraced. They are slightly lower today.

I wrote on many occasions that round numbers are important from a psychological point of view, and there’s little doubt that 5,000 carries a significant weight in that regard. This level is super-important as resistance, but also as something that people can gravitate to.

“The S&P will rally to 5,000!” likely became a self-fulfilling prophecy, as people were buying all the way up to 5,000, actually causing the move that they had been foreseeing.

No fundamental trigger is necessary for that. In fact, this kind of emotional rally can happen against fundamental signs, like less dovish than expected signals from the Fed.

As the S&P 500 futures attempted to move to/above 5,000 and they moved back down, whatever was likely to happen based on the emotional upswing has probably already happened. It’s quite likely that the S&P futures’ move to 5,000 was the tipping point.

The S&P 500 Index futures were a bit higher than the index itself, which topped at 4,975.29, but that’s also very close to 5,000. This have been enough to trigger the final reversal, or it might be the case that we’ll see index’s move to 5,000 before it reverses. This would imply a move slightly above 5,000 in index futures, which could then invalidate this breakdown and both: index and futures based on it would fall – taking many other sectors with it. In particular, junior mining stocks.

If that wasn’t enough, we also saw a tipping point in the USD Index.

In my Jan. 30 analysis, I wrote the following:

The USD Index tends to reverse its course right at or close to the turn of the month. I marked the previous times when the USDX reversed close to the turn of the month with dashed, blue lines. As you can see, this simple tendency has proven to be very effective.

Tomorrow is the last day of January, so we could see the reversal today or tomorrow. Or perhaps later this week. Either way, it’s most likely coming.

If it wasn’t for the very short-term move lower that we’re seeing now, the nature of this reversal could have been bearish. After all, the USDX is after a monthly rally.

Thanks to a dip in the USDX value, this cyclical tendency could result in another powerful upleg.

Of course, this would be particularly bearish for the precious metals sector, and it would very likely make our short positions more profitable.

That’s exactly what the USD Index did, and that was another tipping point. Friday’s decisive rally took the index well above the previous intraday highs, showing that the turning point had bullish implications. And as the U.S. currency is after over two weeks of consolidation, it’s definitely ready for another big upswing. This has bearish implications for commodities (yes, Anna’s profits in crude oil increase as a result), as well as for precious metals and mining stocks.

I’m not saying that the de-dollarization will never happen, but it’s unlikely to happen anytime soon.

Indeed, the USD Index is rallying today, and gold price is declining.

Gold's Misinterpreted Signals

Many voices out there claimed that gold re-started its rally, but just taking a brief look at the position of gold’s resistance lines proves that it actually verified its breakdown.

Gold didn’t re-start its rally – it re-started its decline.

It might be difficult to notice it when looking at gold’s very recent price swings only, but gold topped in December, and it’s been forming lower highs since that time.

The most interesting part of the precious metals sectors’ performance is not visible on gold’s chart alone. We need to combine it with what gold stocks have been doing.

While gold closed last week relatively close to its recent high, the GDXJ closed close to its recent lows. And that happened even despite stock markets’ move to its all-time high!

It’s quite obvious that junior miners really can’t wait to decline here. And it’s likely that they won’t have to.

On Friday, Jan 19 (so, over 2 weeks ago), I described a new approach to profiting on lower junior mining stock prices and those two weeks were enough to show that it generated more profits than two more commonly used techniques (shorting GDXJ or buying JDST).

To clarify, I think that GDXJ is about to move lower and JDST is about to move higher, however, I think that the approach that I had featured is likely to provide bigger gains down the road.

I started today’s analysis with a quote from Amazing, and I’ll end with a different one:

Life's a journey, not a destination

So is trading. It’s not about “having an outlook” and then sticking with it no matter what.

Please remember that this likely move lower will not persist forever. We’re not only aiming to profit on it (and we’re doing so now), but we’re aiming to buy into the next long position. Just like we bought into the one that preceded our current short position. And we’ll keep our subscribers informed about both.

Naturally, the above is up-to-date at the moment when it was written. When the outlook changes, I’ll provide an update. If you’d like to read it as well as other exclusive gold and silver price analyses, I encourage you to sign up for our free gold newsletter.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.