U.S. Elections and Performance of Stocks, Dollar and Economy

Politics / Financial Markets Nov 03, 2008 - 07:20 PM GMTBy: Ashraf_Laidi

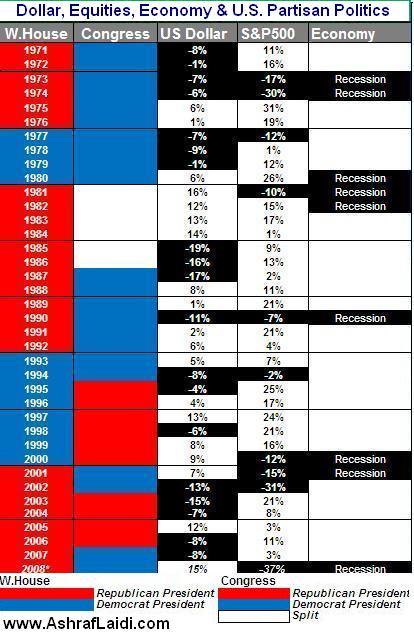

Much has been written about the relationship between the partisan power in the White House and the performance of the stock market. Considerable amount of statistical exercise was undertaken in dissecting any the correlations and causalities involving partisan control of Congress, mid-term elections, balance of power between White House and Congress, and the impact of double term presidencies. The table below shows the performance of the dollar index, S&P500 and the general state of the US economy since the dollar became freely floated in 1971.

Much has been written about the relationship between the partisan power in the White House and the performance of the stock market. Considerable amount of statistical exercise was undertaken in dissecting any the correlations and causalities involving partisan control of Congress, mid-term elections, balance of power between White House and Congress, and the impact of double term presidencies. The table below shows the performance of the dollar index, S&P500 and the general state of the US economy since the dollar became freely floated in 1971.

Here are some of the conclusions drawn from the patterns observed over the past 38 years.

Dollar Performance

Out of the 38 years analyzed, there were 19 years of negative dollar performance versus 19 years of positive performance. 7 of the 19 negative years occurred when the White House and Congress were of the same party. And in all but 2 of the 19 negative dollar years, the dollar declines occurred in series of at least 2 consecutive years. 1990 and 1998 were the only negative dollar years were the decline was preceded and followed by an increase in the currency. The 1990 dollar decline occurred due to the recession caused by the Savings & Loans Crisis and soaring oil prices resulting from Iraqs invasion of Kuwait. The subsequent Fed rate cuts dragged the dollar across the board as did flight to safety.

The 1998 dollar decline emerged from sharp unwinding of yen carry trades away from the dollar in the midst of a liquidity crisis in capital markets in the aftermath of collapse of Long Term Capital Management. Similarly, all but 1 of the 19 years of dollar gains occurred in at string of at least 2 consecutive years.

2005 was the only year during 1971-2008 delivering stand-alone rising performance, as a result of Feds interest rate hikes as well as the temporary reduction of taxes on U.S. multinationals repatriated profits. Such a pattern reflects the notion that foreign exchange rates move in trends, particularly a widely traded currency such as the dollar. As fundamental dynamics are built up and are accentuated by portfolio shifts, traders flows and speculative sentiment, the trend grows increasingly established.

The impact of U.S. presidential and mid-term elections on currency markets was especially prominent during the controversial 2000 presidential elections and the 2006 mid term elections. In November 2000, the already tumbling euro sustained a severe blow against the dollar at the announcement of a victory for President George W. Bush. The dollar rally emerged on the tax-cutting agenda by Republicans, which was a boon for the markets, especially after a series of tax hikes from former president Bill Clinton. Inaccurate media reporting of the 2000 election announcements erroneously declaring candidate Al Gore the winner prompted sharp but short-lived declines in the U.S. dollar. Republicans' full loss of power of the Senate and the House of Representatives in the 2006 mid-term elections sped up an already deepening sell-off in the US currency.

Stock Market

Out of the 10 years of negative stocks performance, 7 occurred during a Republican-controlled White House versus 3 under Democrat control. Of the 28 years of positive stock performance, 19 occurred during bi-partisan control between the White House and Congress. Regarding the relationship between the dollar and stocks, 7 out of the 10 negative years for stocks coincided with negative years for the dollar when 2008 is included.

Fundamentally, the relationship between stocks and the dollar had been prominently positive during the early 1980s and the second half of the 1990s. In the early 1980s, the Fed's staunch anti-inflation war under the command of Paul Volcker boosted interest rates towards 20%, rendering the dollar an attractive return on foreign investors funds, while stocks recovered as inflation was dampened and oil prices retreated. In the second part of the 1990s, U.S. equities attracted persistent growth in foreign capital flows while European economies were floundered in stuttering recoveries and Japan remained in a deflationary spiral.

Economy

The criteria used to determine whether the economy fell in a recession in a given year is the number of quarters showing negative GDP growth. 1973, 1974, 1980, 1981, 1982 and 2001 each showed two quarters of negative growth, regardless of whether these were consecutive quarters. Although the economic reports are increasingly pointing to a recession in 2008, at the time of writing the official body in charge of declaring U.S. recessions has not yet done so.

The National Bureau of Economic Research usually announces recessions about 2 our 3 quarters after they start. Due to this formality, 2008 is excluded from the recession count, leaving us with 8 recessions between 1971 and 2007. 1990 and 2000 were also recession years even though they had only one negative quarter. 6 of the 8 recessions occurred under a Republican Administration versus 2 occurring under the Democrats in 1980 and 2000. Regarding the sharing of power between Congress and the White House, 7 of the 8 recessions took place during a bipartisan split (1973, 1974, 1980, 1981, 1982, 1990) while 1 occurred in 1980 during dual control of the Democrats.

Dollar To Refocus on Economics

It has been widely stated that the financial markets main concern related to the election was the potential for adverse tax consequences from a Democrat-controlled White House, whereby the prevailing tax cuts will not be renewed after their 2010 expiration. Nonetheless, the risk of a Democrat victory for the market is diminished by heightened certainty that the Democrats will take control of the White House, thereby, ridding markets of the risk of the unknown. And with the US economy already mired in a recession and markets posting their biggest year-to-date decline in history, the role of politics in shoring up the economy is becoming less relevant, especially with the fiscal deficit expected to surpass the $800 billion market in 2009 regardless of politics.

The fiscal imbalance is expected to breach the 7% of GDP figure regardless of whether the Bush tax cuts are phased out, or a new stimulus packaged is announced. By mid end of Q2 2009, the dollar's main preoccuaption will revert towards the structural imbalances of the currency. And like 2005, 2008 may prove to show a lone positive year.

For more on the political and economic factors shaping the dollar over the last 38 years , see Chapter 9 "Selected Topics in Foreign Exchange" of my upcoming book "Currency Trading & Intermarket Analysis" - Wiley Trading.

By Ashraf Laidi

CMC Markets NA

AshrafLaidi.com

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.