The Fed Leads and the Market Follows? It's a Big Fat MYTH

Interest-Rates / US Interest Rates Jun 07, 2024 - 12:28 PM GMTBy: EWI

By Murray Gunn | Head of Global Research, Elliott Wave International

We help investors by analyzing what really drives the markets. Along the way, we often uncover a market myth, something most investors believe moves the markets, but really doesn't.

I want to show you one of the biggest market myths in existence. It will help you understand what the Fed can and cannot do.

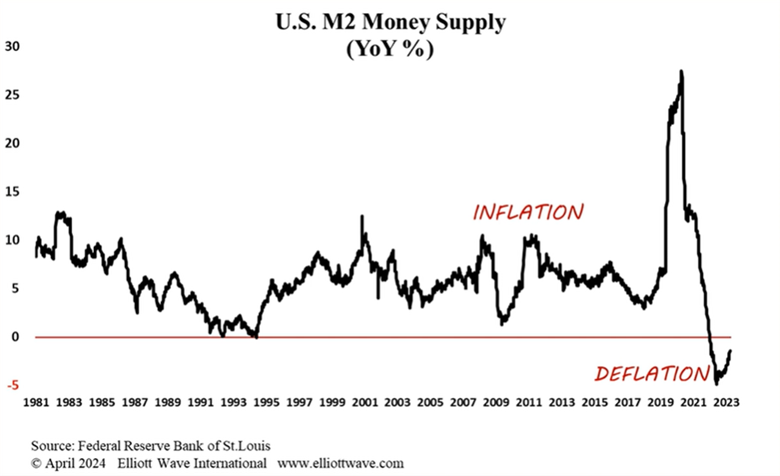

The one thing the Federal Reserve can do is control the money supply. The physical printing of dollars, or the digital creation of reserves, is in its gift. The natural state of affairs is for the money supply to grow at a rate of around 5% per annum.

Make no mistake: This is actual inflation, and is used by the Fed in an attempt to grease the wheels of economic growth.

All it really does though is devalue the purchasing power of the dollar over time. Now, after historic inflation of money in 2020 and 2021, the money supply is being purposefully deflated by the Fed.

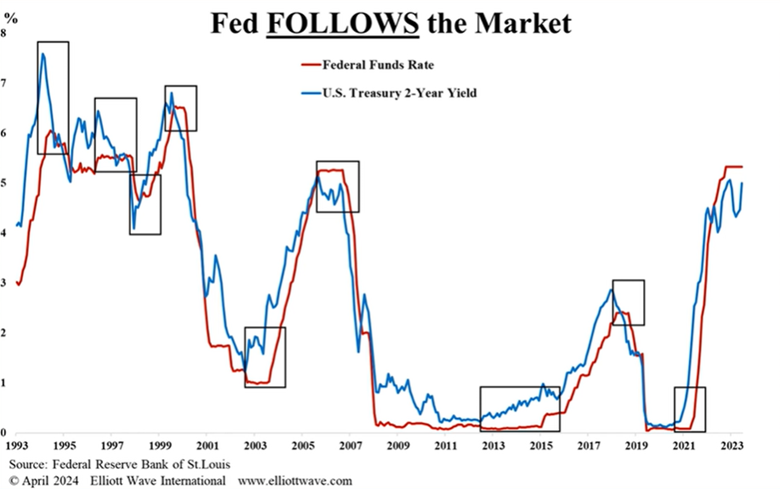

When it comes to interest rates though, the Fed is NOT in control. The Fed does not lead; it follows the market.

This chart shows the Federal Funds Rate alongside the U.S. Treasury 2-Year Yield. You can see that at major turning points, it's the 2-Year Yield that moves first, and then after awhile, the Fed changes its benchmark interest rate. This was profoundly the case in 2019 when the Fed cut rates well after the 2-Year Yield had declined. And of course in 2022, the Fed had lagged the move higher in 2-Year Yields by many, many months before it started hiking.

Conventional analysts and the financial media are obsessed with how the Fed will change interest rates, thinking that it will influence the financial markets. But to find out how the Fed will act, all they need to do is look at the short end of the bond market.

The idea that the Fed leads the market is just one of many myths that investors believe. Other myths include that corporate earnings drive stocks and that OPEC decisions determine oil prices. If you want to learn about these market fallacies and others, EWI has a free report that uncovers 13 market myths that deceive most investors.

This article was syndicated by Elliott Wave International and was originally published under the headline The Fed Leads and the Market Follows? It's a Big Fat MYTH. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.