The AI Stocks, Housing, Inflation and Bitcoin Crypto Mega-trends

Stock-Markets / Financial Markets 2024 Nov 27, 2024 - 10:58 PM GMTBy: Nadeem_Walayat

Dear Reader

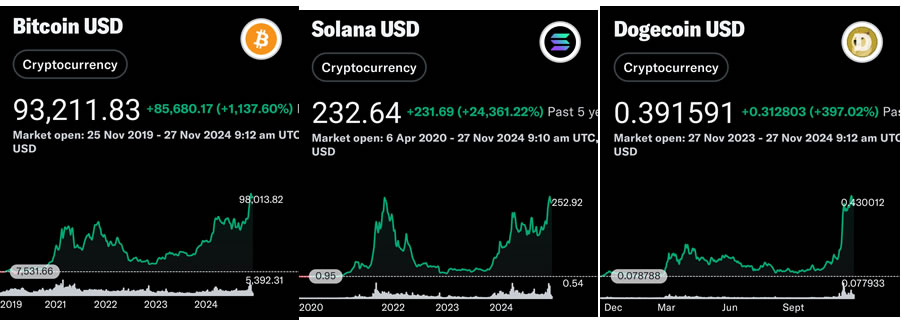

Folk keep messaging me that Bitcoins down, Solana's down, Doge is down and if they are now a good buy, I reply "dude you're a year late to the party!"

Then they get disappointed when I tell them at best they could get is a X2 from here but more likely a lot less and that I am selling rather than buying, folk want easy money, they work hard in a 9-5 and think they can get rich on crypto without doing ANY WORK! FFSK's, you earn $x salary in your 9-5 and you seek to replicate the same after a few mouse clicks?

I've been telling folk for over a year by example of what I am doing to ride the crypto gravy trains, instead they wait till towards the end to start funding accounts and buying crypto. FOMO MANIA Is building and a lot are going to lose a lot of money because they will keep buying right into the very tops just as I am selling the last of my crapcoins.

Just $7 bucks could have got you on board the Crypto Gravy Train over a year ahead of the herd.

Latest analysis - Stocks, Bitcoin and Crypto Markets Get High on Donald Trump Pump

CONTENTS

America's Angry Grandpa President

Trump War on Immigration WAR!

Trump Tariff Economic War

DONALD DEBT PUMP!

Trump Stock Market Road Map 2025

Why Apple Stock Refuses to Drop!

Nvidia Stock on a Stairway to Heaven Counting Down to Earnings

AI Stocks Portfolio Current State

Current Stocks Portfolio Buying Opps

Crypto FOMO Mania

Bitcoin Seasonal Trend

BItcoin Bull Market Target

Bitcoin Mind Game $98k to $104k Topping Zone

Bitcoin Bull Market Targets Redux

ALT COINS SEASON

SOLANA Bull Market Targets

Bitcoin & Crypto Corrections

MSTR Rocket Will Eventually Get Sucked Into the Crypto Black Hole

Exit Strategy - Leaving the Crypto Casino with Your Profits

The CURE for Diabetes!

..............

Here is part 2 of 2 of my extensive analysis - Stock Market Trend Forecast Sept 2024 to Jan 2025

Part 1 was emailed a few weeks ago - Stock Market Trend Forecast to Jan 2025

CONTENTS

The Correction Window

US Interest Rate Cut Incoming

Stock Market 2024 Road Map

Stock Market and Presidential Elections

September the Weakest Month of the Year

Stock Market Trend Forecast Sept to Jan 2025

Stocks Bull Market Big Picture

2027 Destiny with a Bear Market

The AI Mega-trend is EXPONENTIAL

Why AI WILL Kill Jobs - The Robots Are Coming

AI Means Rendering in Real Time

AI Stocks Portfolio

INFLATION MEGA-TREND Tsunami Waves Current State

GBP Bull Market Trend

US House Prices

US Housing Stocks Current State

UK House prices

Presidents are Puppets on a String

US Presidential Election 2024

Bitcoin $60k

AI Stocks Portfolio

Portfolio currently stands at 81.1% invested, 18.9% cash following recent dip buying in target stocks such as Nvidia and Micron, it will be earnings season again soon so this is a brief look at key AI tech stocks.

Portfolio Spreadsheet

https://docs.google.com/spreadsheets/d/1FICHeQvTU1pSYalH0fS1e4VYMD6Ra0T8IwVu_LCnZNQ/edit?usp=sharing

Nvidia - $119

Pre announcement EGF 42%, 69%, Dir+4%, PE Range 79%, Forward 28%

Post announcement EGF 24%, 38%, Dir-14%, PE Range 51%, Forward 25%

Nvidia is trading in the Middle of it's PE Range which is supportive of a continuing bull market at a far more measured pace, i.e. as I stated in my last article it's not going to do a x10 anytime soon at best targets X2 to $240 over the next 12 months as long as earnings continue to grow, so the strategy is to buy deviations from the high so as to maximise upside.

I added more sub $110 and will add a lot more should we see sub $100 as we remain in the stock market correction window that extends into October that should act as a drag on Nvidia's stock price. Those who buy at say $119 are still looking at a pretty good x2 potential over the next year or so. So $200 is likely to be just minor resistance along a path towards $240 based on Nvidia's earnings trend trajectory.

TESLA - $230

Robo taxi announcement on 10th Oct, earnings on 16th Oct. Metrics are weak but it's chart looks like it wants to break higher, targeting $300 and then $400+, I am 109% invested.

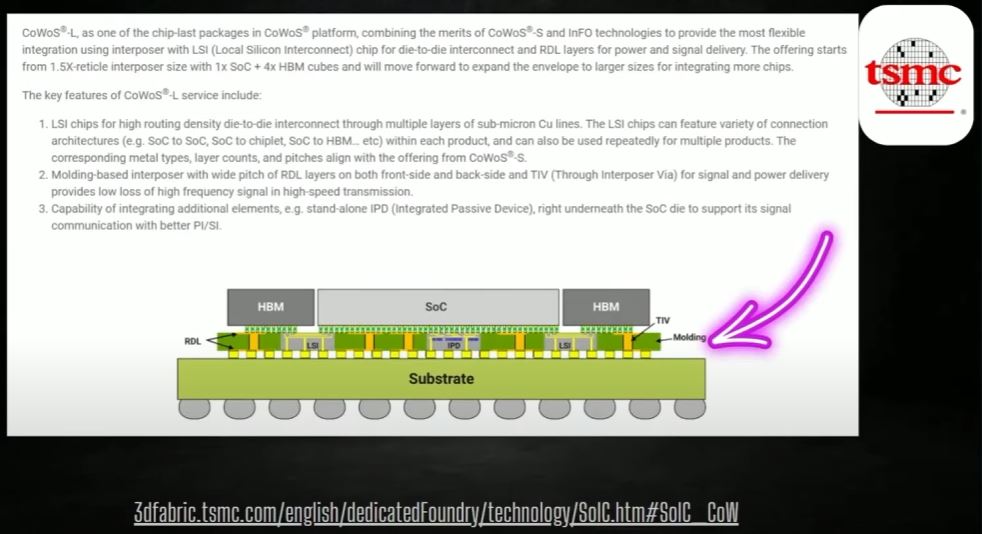

TSMC $173 - Turning LCD's into Next Gen Fab's

TSMC continues to show relative strength vs most AI tech stocks i.e. trading at 11% from it's ATH vs the likes of Nvidia at -16%, ASML -27%, LRCX -32%. For a sign that AI is far from reaching it's peak, TSMC is expanding it's advanced packaging production by 50% per annum over the next 4 years. Chip demand is accelerating not slowing down thus one needs to maintain exposure to capitalise on the mega-trend that is continuing to accelerate.

Current state of the art Chip packaging platform as used for Nvidia GPU's and HBM memory.

To give way to the next Gen chip packaging over the coming years- FOPLP, glass chips!

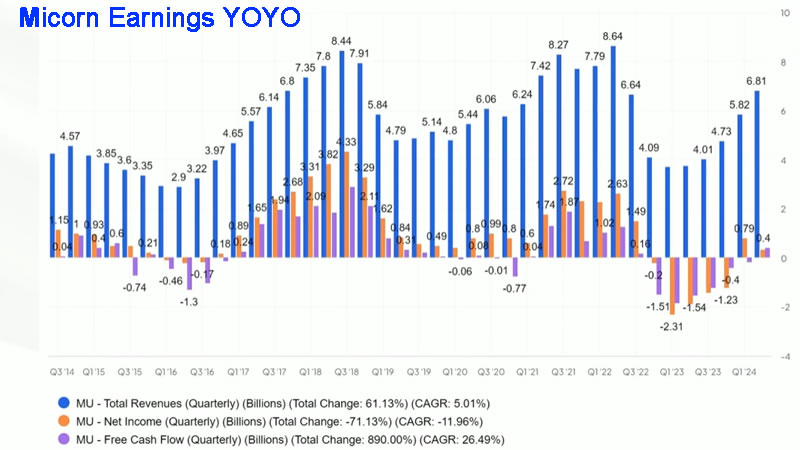

Micron $91

As you well know Micron went nuts to the upside, completely loco trading to $157 in the run upto prompting me to sell down to near 0% hard cash invested, the collapse to below $100 was inevitable which I am sure I commented of at the time hence I have re accumulated to 20% invested and eager to add more in this volatile stock. Micron reports earning in 10 days time (25th Sept). stocks like these break metrics like EGF's so gauging what they will do is more seeing what it's brethren are doing, i.e. the likes of AMD with expectations of greater volatility. At $91 Micron might seem cheap relative to it's $157 high but it could easily trade to well below $80 before the correction dust finally settles.

Micron illustrates why asking for stock picks does not work, whenever asked I can read off my list of the AI Primaries and secondaries but I also add it won't work if you don't understand what you are investing in i.e. understand when a stock is expensive and when it's cheap, where stocks such as Micron can be unforgiving in timing, so much for dollar cost averaging mantra! If you really want to make money investing then you will have to work for it.

Micron is one of the most cyclical AI tech stocks, if you take your eye off the ball it will crush you! It's a hard stock for even me to get my head around, i.e. Back in 2022 I started buying it at around $76 thinking I was getting a good deal but no it went lower and lower and lower all the way to below $50, by which time I was stuffed full of Micron.

Just look at how Microns fundamentals YOYO, what we saw with $157 was the market discounting where earnings could be over a year from now! That's what stock prices do, they discount the future which is why most investors lose money, they want to buy when the news is good and sell when the news is bad but the stock price has already moved ahead of them, which is why the news that most focus on is a nothing burger, all that MSM focus on are nothing burgers as the price has already MOVED well ahead of the event and why it nearly always does the opposite of what most were expecting it to do.

Micron earnings are being lifted higher by AI FOMO demand, so the stock price should bounce back, but even so it's going to be tough to see it climb back above $150, not unless earnings really do take off to new highs, at the moment MU has just managed to squeeze into reporting positive earnings which justifies a stock price of about $100 so you definitely don't want to pay more than $100 for Micron, which is good as right now it's trading at $91, not cheap but not expensive either. In fact I think I should refer to Micron as Micorn given that it's price behaves more like a crypto then an AI tech stock so not something that one should invest for the long-run rather recognise that it is highly cyclical where the good news is that we are in a earnings up cycle so has further upside.

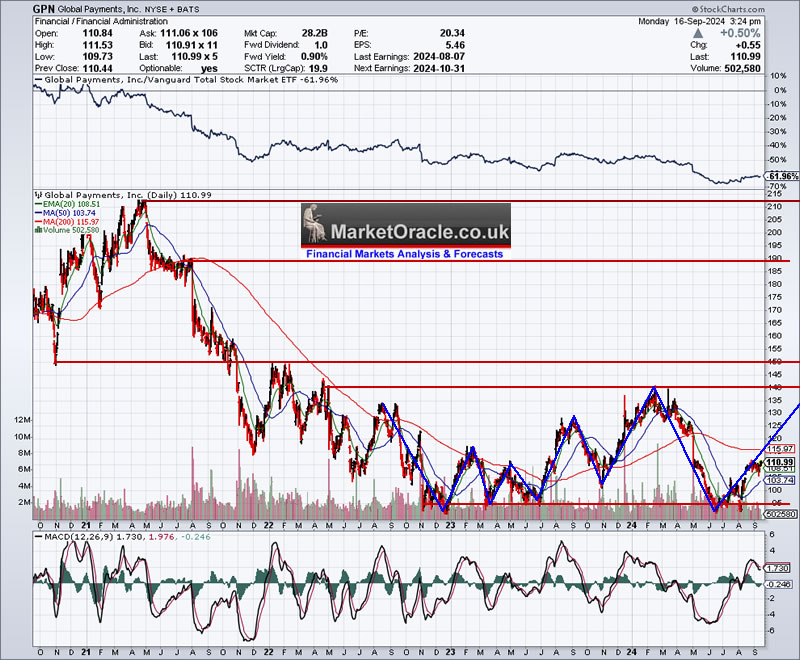

GPN - $110

Buying the dip all the way down to $91 has got me at 183% invested of target at 2.1% of my portfolio, so a quite a big position. I originally picked GPN as a buy in November 2021 at around $120 in response to patrons asking if Paypal was a good buy at the time given that it had fallen from $310 down to $180, I wrote to forget about Paypal instead look at GPN, well Paypal is trading at near 1/3rd it's then price whilst GPN has traded through $120 several times since.

(Charts courtesy of stockcharts.com)

GPN has great metrics., EGF's +11%, +14%, DIr +7%, PE range -244%. Which illustrates that a stock can have great metrics and STILL NOT GO UP in price, that's what the stock market can do, keep good stocks down and FOMO garbage! Though at $110 GPN is 21% off it's floor, put in a high of $142 in February that I trimmed into before once more buying the dip in this range trader. As long as GPN continues to maintain good metrics then it has the potential for a powerful bull run well north of $142., eventually GPN should trade to a new all time high above $220. I will trim in the run up to $142 again and I'll add more if it dips once more to sub $100 for an approx 25% spread between average buying and trimming prices that acts to further drive down the average cost per share, i.e. range trading whilst waiting for the upside breakout.

INFLATION MEGA-TREND Tsunami Waves Current State

The expectation for the whole of this decade is for economies to be buffeted by WAVES of inflation.

We had the first shock and awe wave that took everyone by surprise by just how high inflation went all whilst the Fed was sleeping at the wheel with mantras such as transitory inflation only to start acting a good 6 months too late with panic rate hikes during 2022. I flagged all of this way back in March 2020! That the rampant money printing that the governments were starting to engage in such as paying 1/3rd of British workers to stay at home was going to send inflation through the roof and that it will result in series of inflation Tsunamis where peaks will give way to deep troughs that will then give way to the next higher inflation wave for the whole of the 2020's.

You saw what the first inflation wave did to stocks 2022! The next Inflation wave will be worse than that because the fundamental economic structure has weakened, i.e. the US is running a $2+ trillion deficit during a time of near full employment and economic growth so what do you think is going to happen during the next downturn?

The current state of the Inflation Mega-trend is a trend towards an inflation trough that will start the run up to the next run away inflation peak where my best guess is that the STHF during late 2026 / early 2027, so the stock market should read the writing on the wall and have succumbed to reality by then and embarked on the great bear market of the 2020's that will see much wealth destroyed due to inflation panic that will make 2022 look like a picnic.

Bottom line is that the pandemic rampant money printing set the ball rolling on Inflation Tsunami waves during the 2020's where the next Inflation Tsunami is expected to be peak sometime during late 2027, and that 2025 is likely to see a trough in Inflation which thus suggests this bull market has at least a year to run before the warning lights start flashing red, triggering a market top that will take place long before inflation next peak.

Folk will comment but Nadeem how can inflation go up when unemployment rises and most people are getting poorer. There is only one economy, what we are seeing is the slice of the economic pie that is consumed by the machine intelligence growing whilst the slice that humanity consumes shrinking, hence prices go UP!

Governments print money = prices go up!

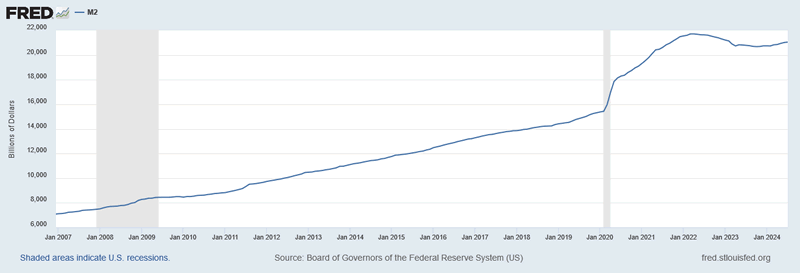

So CPI literally is a LIE! Even X2 CPLIE is less than real inflation which is going to make you poorer over the long run due to rampant money printing that is constantly debasing the currency, probably the single best measure for americans for whether one is keeping pace with currency debasement is M2 money supply.

M2 is growing at the rate of 10% per annum, so doubles approx every 10 years.

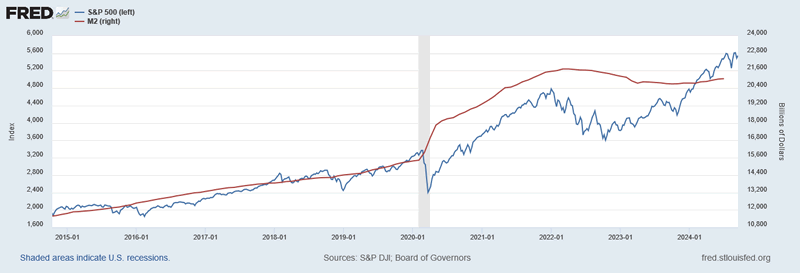

And here is what the S&P and M2 trends look like.

So all you index trackers are only just managing to keep pace with inflation, the only folk making any money are the fund managers. For actual growth one needs to take risks by invest in the primary and secondary drivers of the mega-trends with the foremost megatrend of our time being machine intelligence soon to be supplemented by Quantum AI hence long before AI became all the rage let along Quantum Computing was born my Quantum AI tech stocks portfolio that dates back to 2016.

GBP Bull Market Trend

GBP Bull market targets a trend to between $1.37 and $1.40.

Note £/$ 1.4 does not mean that is where it will top, it's what GBP is currently targeting trading to, just as in October 2022 GBP was targeting a trend to at least £/$ 1.27 during late 2023 whilst at a time folk were panicking eager for me to give them the green light to ditch sterling for dollars at parity, in response to which I stated I would need something like £/$ 1.32 to exchange sterling for dollars and that regardless of the risks of further spikes lower, sterling was dirt cheap at £/$1.1 let alone at parity.

Current $1.31 : 1.4 = +6.9%. Whilst potential downside looks limited to about 1,28, and in a worse case 1.25 barring something cuckoo coming out of Rachel Reeves October budget. Nevertheless sterling trending higher to between 1.37 and 1.40 would be an opportune time to convert excess sterling into dollars in advance of sterling's next bear market that will likely see sterling trade below parity once more, yes it could spike to as high as £/$1.50 but we will only know for sure with the benefit of hindsight.

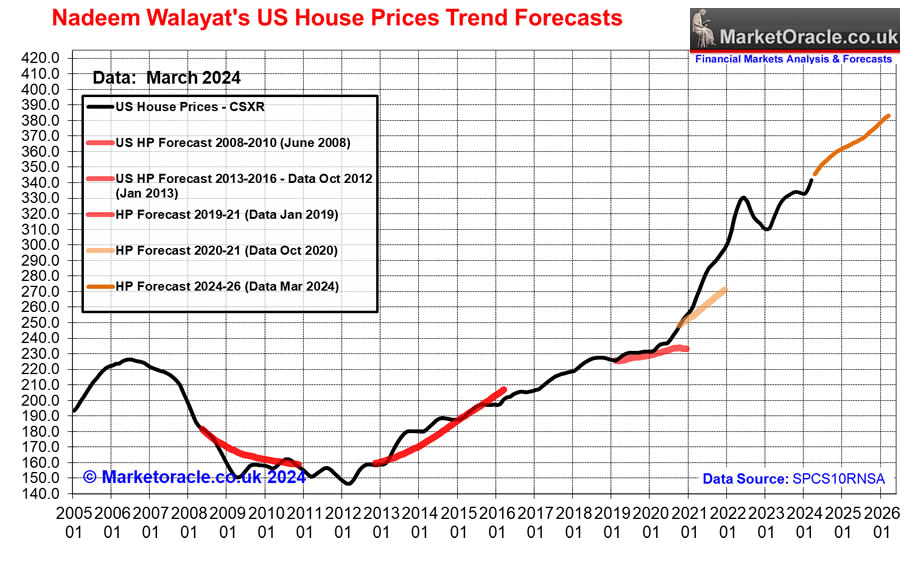

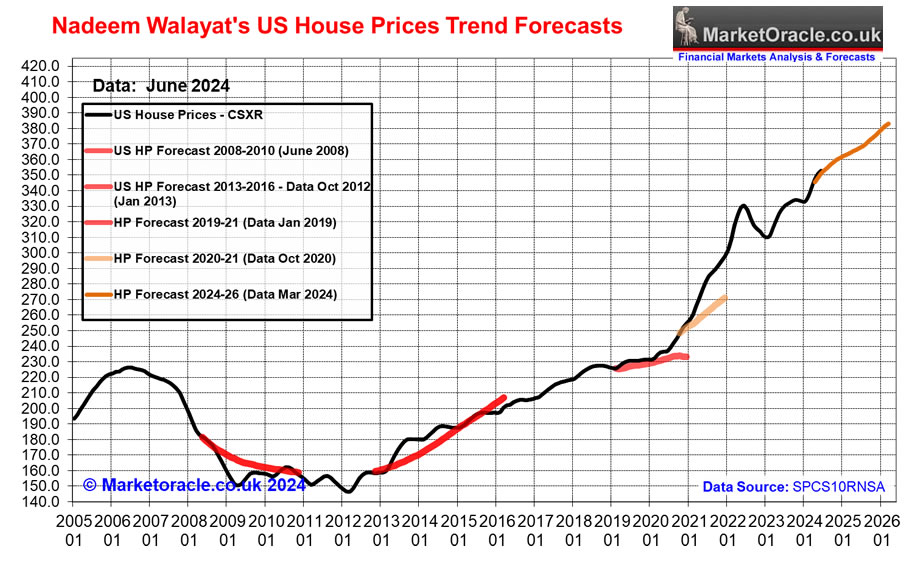

US House Prices

US House Prices new all time high (Case Shiller 10 city) galloping along at the rate of 7.4% per annum, at the start of the year MSM fools such as Forbes were printing articles warning of a CRASH. It's not rocket science - Growing population + Rampant money printing = House Price Inflation. 7.4% is a sustainable rate of HP inflation.

US Housing Market Analysis, House Prices Trend Forecast 2024 to 2026

Therefore my forecast conclusion is for the Case Shiller 10 cities Index latest data for March 2024 of 341.7 to target a 2 year rise of 12% by March 2026 data of 383.2.

I suspect US house prices will be gradually ramping up as housing market fever takes hold as 7.5% becomes 10%, 10% becomes 12.5%, 12.5% becomes 15% with folks waiting to buy having their WTF? moment and FOMO panic buy into the top. At the top we could even see something crazy like +20% annual house price inflation before the bubble finally tops, probably some time during 2027. See all trends are converging towards 2027!

US Housing Stocks Current State

t's not easy to profit from the US housing bull market via stocks. MPW looked like a safe-ish way, 10% dividend for a possible X2, 1 of 5 stocks but which delivered the most pain of the bunch. Folk tend to forget that it's a portfolio of 5 stocks, but all I hear is MPW, MPW, MPW, I mean the collective portfolio even before the most recent spikes higher was doing pretty well all things considered, RDFN delivering multiple range profits, iIPR after a wobble took off into a bull run, FORESTAR had been strong from the get go, BDEV similar, but folk have blinkered investing vision they only see the RED that is MPW. What I tend to do is sum the approx P/L of each section of the portfolio so I know where I actually stand which is at approx +30%, so if others have done similar to me then I can't see why folk should not also be up on their housing portfolios, in fact more so than me given that I measure my P/L in sterling, so in dollar terms will be a good 10% higher, and this is without taking dividend income into account.

Original housing stocks portfolio article - Feb 2023 - Stock Market Completes Phase Transition, US Real Estate Stocks - Housing Market Part1

FOR $32

Forestar a range trader with an upwards bias that traded down to its low for the year on August 5th. A case of accumulate sub $31 to distribute above $38 for a 20% spread pending a bull market proper. Metrics are strong at EGF +8%, Dir +19% and PE range fair at 88%. The stock is primed to resume it's bull run which means sub $31 opps will soon only be seen in the rear view mirror. I am 83% invested, seeking to get to 100% invested.

(Charts courtesy of stockcharts.com)

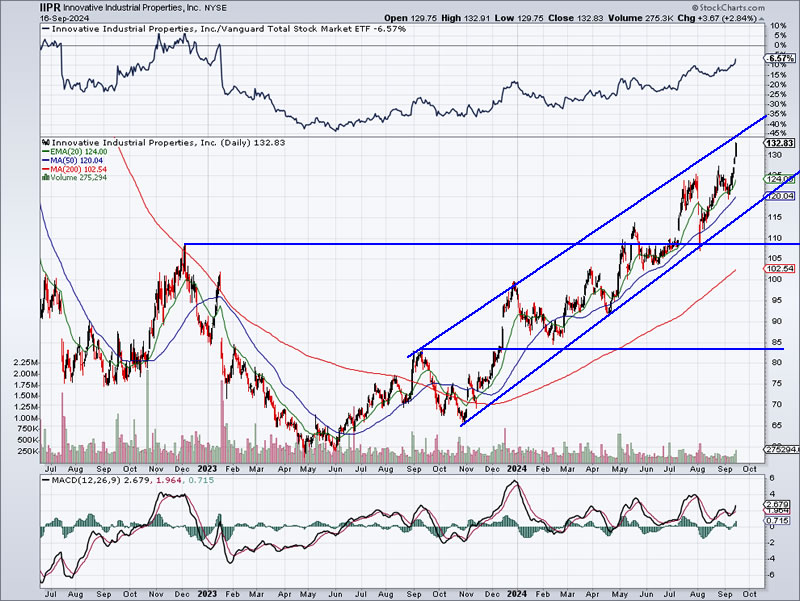

IIPR $132

Delivered what it promised and then some, one could not have asked for more from this safe low risk REIT that in many ways is similar to MPW which has 2X'd. My only regret is that did not perform worse than it has which would have given me greater opportunities to buy the dip and become over exposed as I have to to MPW and RDFN, but no IIPR has proven to be too good of a stock for that hence I stand at just 62% invested, reluctant to trim any more in case I don't get an opportunity to buy back at a lower price.

(Charts courtesy of stockcharts.com)

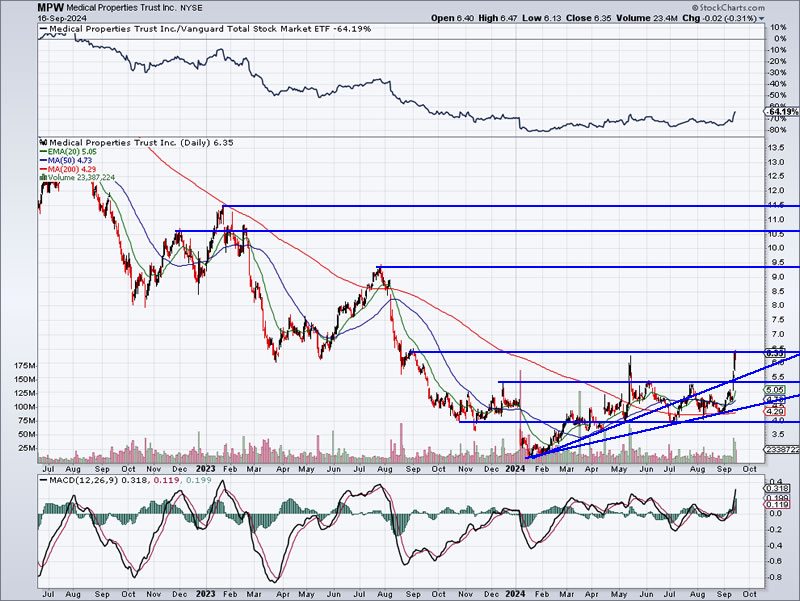

MPW $6.35

MPW is the bane of many patrons, I don't quite understand why given that it's 1 of 5 of the housing portfolio, though I too am heavily over exposed due to buying the dip that kept dipping taking me to peak exposure of 200% of target that I've trimmed a sliver off to stand at 197% invested. MPW has been buffeted by many internal woes in regards to it's tenants, medical establishments what could go wrong? Everything! Still the stock is NOT DEAD, in fact has managed to lift itself off the floor and as I commented before the current spike higher, MPW has been showing signs of having put in a base ready to enter into a bull market proper.

Following the stocks collapse to $3, MPW has been in range trade mode of between $4 and $5,5 for an approx 35% spread pending a resumption of it's bull market to target $10 and beyond. The pain would not have been so bad had they not slashed the dividend to near 1/4 of where it was 2 years ago! Still the fact that MPW rose on the recent halving of the dividend on 22nd August shows that things are turning positive for MPW well before the spike to $6.5 as the market is starting to wake up to the reality of what a rate cutting cycle means for housing market stocks such as MPW, a huge wind behind their sails as leveraged property values start to go up.

MPW was never bought for much upside potential, at best a x2 to $20, so is one I am eager to reduce exposure to during it's bull market, especially as clearly the dividend is not safe. So even though one can't win them all, it's definitely too early for the fat lady to sing for MPW as I commented at $3 bucks in response to panicking patrons wanting to throw in the towel, I never sell at a loss!

RDFN - $13.6

Redfin took off like a rocket to $14,6, the rally prompting heavy trimming bringing me down to 91% invested of target. Not so long ago I was near 200% invested on the deep recent draw down to $6.3 of barely a month ago! The plan all along has been to capitalise on RedFin's wide trading range pending a breakout higher with the first rate cut sparking speculative interest that could see Redfin x10 to $55 off of it's 2024 low. Redfin is a very volatile stock and so I am good with whatever it does, if it goes higher I will continue to trim, if it collapses back down into it's range I will once more accumulate all the way down to $6 where the only prices that matter are that which one buys at and that which one sells at. Redfin has proven to be the most profitable housing stock by virtue of it's wide trading range with many multiples more to come should the likes of $55 become manifest..

(Charts courtesy of stockcharts.com)

Overall the housing market portfolio has delivered more than what one could have expected it to deliver during a rate hiking cycle, and next will come the real reward to be reaped during the rate cutting cycle that lights a fire under the US housing market and housing stocks of which the recent spikes are just a taste of what's to come. This whole exercise also illustrates that many investors are weak hands, fail to understand what they are investing in and why, instead gravitate to short-term price action completely oblivious of the fact that it is a housing market focused mini portfolio and thus is pending the likes of rate cuts and real estate prices trending higher. DO NOT INVEST IN THAT WHICH YOU DO NOT UNDERSTAND!

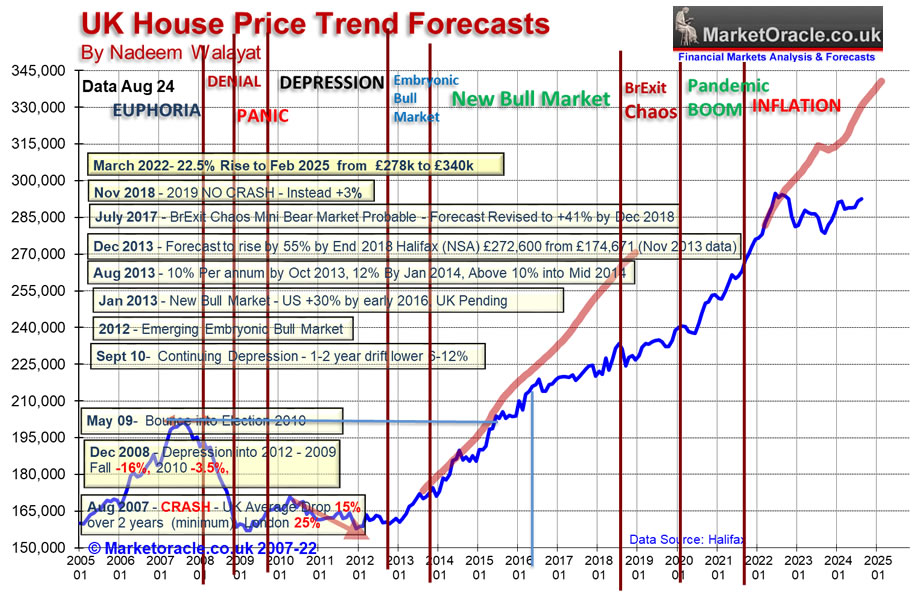

UK House Prices

UK interest rates soaring to over 5% has acted as huge drag on UK house prices since Mid 2022, and was further not helped by the chaos of the Truss catastrophe that ushered in Clown Rishi to basically do nothing for the past 18 months. Nevertheless the MSM crash is coming brigade never got their 30%+ drop in UK house prices, still UK house prices have been weak as the economy has paid the price for economic chaos that has held UK house prices back from doing what comes naturally which is to RISE as a function of money printing INFLATION and a RISING POPULATION and chronic under construction of new homes that the new Labour government promises to correct just as the Tory government had been promising for the past 15 years!. Another factor has been sterling's strength, up 31% vs it's October 2022 low against the US Dollar, so Americans will definitely find that UK property is substantially more expensive then where it was trading 2 years ago in dollar terms, so there are no bargains to be had across the pond.

Average UK house prices rose to £292,505 for latest August data as we enter into the final 6 months of my UK house prices trend forecast. With further interest rate cuts in the pipeline that should see the base rate fall below 4% by the end of 2025 which should act to accelerate the bullish trend that has been in motion for the past year, so UK house prices are within a couple of months of trading at a new all time high.

UK House Prices Trend Forecast 2022 to 2025

Presidents are Puppets on a String

Do americans really believe that Trump or Harris will make any material difference to America's trend trajectories? One of rampant money printing, and increasing spread of Imperial Military power across the globe so as to allow the US to continue to print Dollars that the rest of the world is forced to soak up by virtue of the dollar based global monetary system.

China seeks to break free of US encirclement so that they can carve out their own Empire.

Russia / Ukraine illustrates you can only know the TRUTH of a nations military capability on the battle field, as a walk in the park invasion of Ukraine by Russia has turned into a never ending nightmare for the Putin regime. No one thought that Russian military would be such utter garbage, even the backers of the Ukrainian regime held back on supply of advance weaponry on fears that they would fall into Russian hands, it's only after some time that more advanced western weaponry has flowed into Ukraine enabling the likes of Ukraine's invasion of Russia to take place.

This is the problem with all dictatorships, they lie to themselves to such an extent that they begin to believe their lies and so it will likely be with the Chinese military, what they think they are and what they actually are in combat against a battle hardened Imperial Army will be vastly different. The US has been waging war across the globe for decades so whilst on paper china may outgun the US and it's vassal states in Asia, in practice it's going to be extremely difficult for the Chinese Empire to beat the American empire even if it has nut jobs such as North Korea to call upon which itself is a smoke and mirrors nation.

As for Russia, there is no positive spin Putin can put on Ukrainian troops dug in on Russian soil, he ether uses nukes to 'win the war' or his days in power are numbered.

US Presidential Election 2024

TRUMP 2024 - "The immigrants they are eating the dogs, they are eating the cats, they are eating the pets of the people who live in Springfield" - WOOF! WOOF!

It's a good job Presidents don't have much actual power so who wins is not going to make any difference to the mega-trends i.e. Trump printed a shit load of money during his Presidency, along came Biden and printed a shit load more!

Here's the facts!

Trump - US national debt increased by $7.8 trillion.

Biden - US national debt will increase by at least $7.8 trillion.

Both were getting the US electorate high on a debt fuelled spending binges that ultimately benefit the elite.

Trump or Harris will make diddly squat difference! All you folk jumping up and down for either candidate need to understand you are being played like puppets by the one party state!

Folk need to realise that all of this rampant accelerating money printing is going to deliver bone crushing waves of inflation where the elites want the masses to focus on those who have NO POWER, the IMMIGRANTS! Don't look at the Bezos, Gates, and Musk's stuffing billions into their pockets, instead look at those desperate migrants crossing the border, they are the reason for all of your woes!

There should be a billionaire TAX! No one needs to more than $1 billion! Billionaires KILL democracies!

Who will win 2024?

I don't tend to change my forecasts, so whilst obviously the race is a lot closer post Biden, and looks set to get even closer every time Trump opens his mouth that tends to spew meaningless verbal diarrhea, I'll stick with what I concluded at the start of the year, despite it unlikely to make any practical difference to the lives of ordinary americans, Trump will win.

Bitcoin Back Above $60k

And lastly a quick look at bitcorn that remains in a correction that now extends to near 6 months that should sow the seeds for the next leg of the bull market as per trend forecast,

Bitcoin Trend forecast - Last Chance to Get on Board the Bitcoin Crypto Gravy Train - Choo Choo!

So here's my Bitcoin gift (trend forecast) that on the current price of $27k, Bitcoin will at least near X4 to $98k and likely a lot more than that, given that there will soon be a flood of Bitcoin ETF's hovering up limited supply of the NSA's, I mean Satoshi Nakamoto's crypto baby.

Bitcoin has followed through on my expectations as of $62k to target a trend down to $54k, overshooting to bottom at $52.5k, since has climbed back over $60k, the next hurdle to cross is 50% of range at $63.5k, and then break above $65k, so I am not going to count my chickens before they are hatched until those two resistance levels are crossed which would set the scene for a break above $74k and the long iterated objective of $100k+ that will likely prompt me to sell most of my crypto's by $120k for an approx X10 on the crypto I accumulated during 2023, just as most start to FOMO in on expectations of Bitcorn going to $200K and beyond..... Which it could but the reward won't be worth the risk of giving up most of ones gains as crypto bear markets can be brutal. I can hear it now at say $150k "Nadeem you made me sell too early at $115k, I've lost $35k worth of profit" Similar to Nadeem I followed your lead and sold out of Nvidia well before the 2021 $350 top, yeah well what about the 2022 dump to $100! Bitcorn will dump, I can guess by about 75% off it's final high which from $150k would imply falling to below $38k, usually when folk get greedy they give up ALL of their gains!

Is there a risk of bitcoin falling back to the $54k low once more? Of course there is as we remain in the correction window pending a breakout higher. Bitcorn price action and patron comments illustrate that folk have the wrong mindset when it comes to investing, i.e.for some reason they think they are going to be able to buy the exact bottom, for instance even though I saw bitcoin falling to $54k as highly probable, that is NOT where I was aiming to buy bitcoin during it's last dip, I began scaling in at $59k, with buy orders typically every $1lk lower all the way to $50k, so buy orders at $59k, $58k, $57k, $56k, $55k, $54k, $53k, $52k, $51k and see what gets filled. in terms of the big picture the only thing that is going to matter is that I have EXPOSURE, It's going to be the same when I sell, first trims to reduce over exposure and then large SELLs, I am not aiming to sell anywhere near the final high! All I care about is the difference between that were I buy and that where I sell, all else will be hindsight noise!

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Most Recent Analysis - Stocks, Bitcoin and Crypto Markets Get High on Donald Trump Pump

CONTENTS

America's Angry Grandpa President

Trump War on Immigration WAR!

Trump Tariff Economic War

DONALD DEBT PUMP!

Trump Stock Market Road Map 2025

Why Apple Stock Refuses to Drop!

Nvidia Stock on a Stairway to Heaven Counting Down to Earnings

AI Stocks Portfolio Current State

Current Stocks Portfolio Buying Opps

Crypto FOMO Mania

Bitcoin Seasonal Trend

BItcoin Bull Market Target

Bitcoin Mind Game $98k to $104k Topping Zone

Bitcoin Bull Market Targets Redux

ALT COINS SEASON

SOLANA Bull Market Targets

Bitcoin & Crypto Corrections

MSTR Rocket Will Eventually Get Sucked Into the Crypto Black Hole

Exit Strategy - Leaving the Crypto Casino with Your Profits

The CURE for Diabetes!

Recent analysis includes -

Bitcoin Break Out, MSTR Rocket to the Moon! AI Tech Stocks Earnings Season

Stocks, Bitcoin, Crypto's Counting Down to President Donald Pump!

Stock Market October Correction Window Into Post US Election Rip the Face Off the Bears Rally

Also access to my comprehensive 3 part How to Get Rich series -

Change the Way You THINK! How to Really Get RICH Guide

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

The Investing Assets Spectrum - How to Really Get RICH

It's simple, you pay $7 and you get FULL access to ALL of my content -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on my patreon page and I also send a short message in case the time extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules for successful investing.

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and not get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles and 3 part guide, clear concise steps that I may eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions on a daily basis.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of each analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate access to all my analysis and trend forecasts do consider becoming a Patron by supporting my work for just $7 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it next rises to $10 per month for new signup's.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your buying the dips selling the rips analyst.

By Nadeem Walayat

Copyright © 2005-2024 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.