Betting On Outliers: Yuri Milner and the Art of the Power Law

Companies / Learning to Invest Feb 08, 2025 - 10:02 PM GMTBy: Submissions

By halfway through 2024, annual global venture capital funding had reached $94 billion across 4,500 deals. Most of these investments supported companies in artificial intelligence, financial services, and healthcare.

Sebastian Mallaby’s The Power Law: Venture Capital and the Making of the New Future provides compelling case studies about investments in sectors like these. Featuring key investors like the Eureka Manifesto author Yuri Milner, this book is full of strategies that have worked for successful venture capitalists.

These strategies are essential in a world where venture capital catalyses the global economy. Without it, high-potential startups wouldn’t receive the funding and expertise they need to transform markets with their innovations. They wouldn’t grow into companies that open jobs, advance technologies, and fuel economic development.

The Power Law Principle

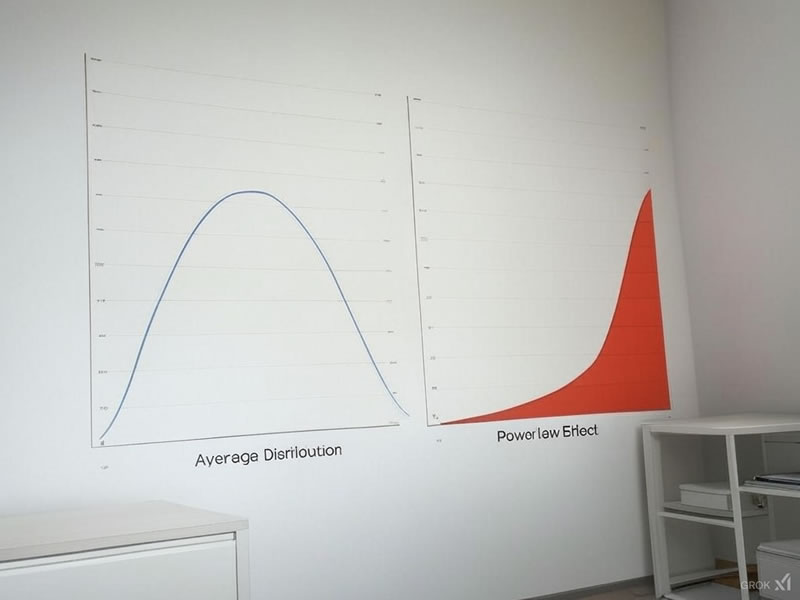

Usually, observations in a dataset cluster around an average. For example, we can identify average heights, weights, ratios, and prices. If we plot data on a graph, we will see a bell curve that determines the average, with probabilities declining as we move away from the midpoint.

However, this is not how all phenomena work, and it’s not how the power law works. Sometimes, an outlier in a dataset skews the average. Remove the outlier, and the average is very different.

In The Power Law, Mallaby gives the example of finding the average wealth of everyone in a cinema. However, if an individual like Jeff Bezos were in the cinema, the average would be much higher than if he were to leave.

An 80/20 Failure-to-Success Rate

This skewed distribution has a name: the 80/20 rule (or the Pareto principle). The idea is that 20% of the people in the cinema hold 80% of the total wealth. The 80/20 rule applies in all sorts of contexts. For example, 80% of people live in 20% of cities, and 20% of all scientific papers earn 80% of citations.

However, the numbers don’t have to be 80/20. The same principle works at a ratio of 90/10 or similar. Either way, this is how the power law works — we will find a small, powerful winner in a large pool.

This approach has brought many venture capitalists success in Silicon Valley and beyond. If a venture capitalist invests in 10 startups, 1-2 may be goldmines.

Once an investor has identified their goldmine(s), their success will continue. When they know these 1-2 startups are the ones to continue pouring resources into, their enrichment will multiply. This works the same way as a scientific paper being better known the more times it is cited.

Yuri Milner’s Famous Investment in Facebook

Yuri Milner’s unconventional approach to investing led him to his success with Facebook in 2019. Despite the Facebook’s CFO’s lukewarm initial response, Milner persevered by travelling to San Francisco to meet in person.

At the meeting, Milner presented a meticulously researched investment strategy. His detailed spreadsheet revealed Facebook’s untapped potential, drawing from international internet business trends and his experience investing in another social media platform.

Yuri Milner had also designed an offer that appealed to Facebook founder Mark Zuckerberg’s priorities. By not requesting a board seat and offering to purchase employee stock, he created an irresistible proposition.

The result of his $200 million investment for a 1.96% stake was extraordinary. Within months, Facebook’s valuation jumped to $50 billion, and Milner’s firm DST Global profited over $1.5 billion. Leveraging this success, Milner made further investments in other promising tech companies, such as Twitter (now X), WhatsApp, Alibaba, Snapchat, and JD.

Find out more about Yuri Milner.

By Sumeet Manhas

© 2025 Copyright Sumeet Manhas - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.