Stock Market Tarrified as President Dump Risks Turning Recession into Stagflationary Depression

Stock-Markets / Stock Market 2025 Apr 21, 2025 - 11:36 AM GMTBy: Nadeem_Walayat

President Dump remains determined to destroy the American economy. Yes I get it many don't like it when I say it like it is, well who else do you think just delivered a 20% drop in the S&P? Biden? was it Biden? What are folk going to say when 20% turns into 30%? Don't get me wrong Trump was always DESTINED to wreck the American economy and send stocks into a deep bear market, it's just that he's not letting anyone come up for air, so we are all drowning, trying to abandon ship as what he is doing WILL deliver Inflation, WILL deliver job losses, will deliver a recession where the risk is Inflation + recession + job losses = STAGFLATION! Which translates into a 30% market drop being a BEST CASE SCENERIO!

Tariffs, Tariffs, Tariffs, then when faced with the emerging reality of a bond market collapse the opposite of what President Stupid thought would happen what does the Tariff King do? REVERSE COURSE! Exempt 90% from tariffs that the US imports from China, leaving the 150% tariff on the remaining 10% so that President Dumbo can claim victory. Wait it gets worse the exemptions are on goods for the big tech corps who are PAYING TRUMP MONEY! So high tech is exempted, you know the stuff that Trump supposedly wants to be made in America whilst tariffs remain on the low tech or no tech such as food stuffs. Tim Cook bought the exemption for Apple for a million bucks! The Trump presidency is all about making the Trump Cabal RICH! In pursuit of which Trump is burning the US economy as folk will soon find out when the job losses start rolling in.

To Infinity and beyond latest tariffs upto 245% on Ghina.

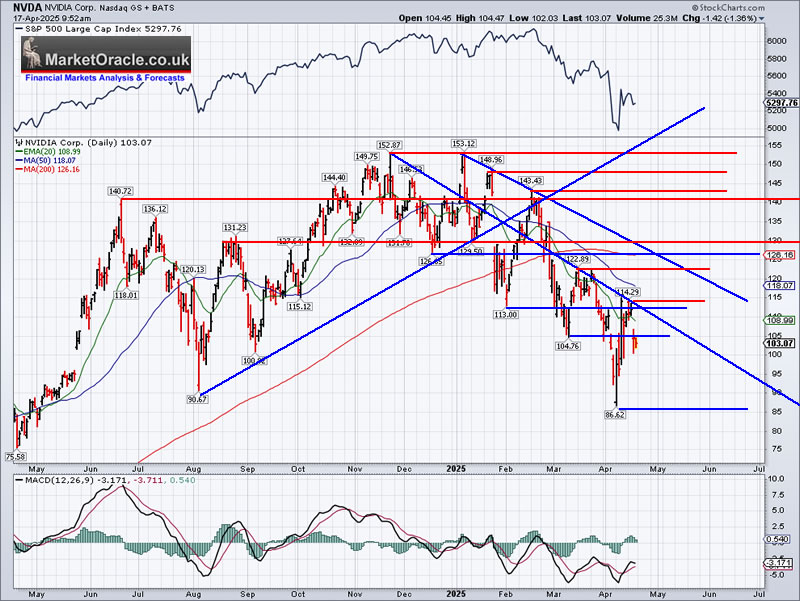

And now President Stupid has targeted our beloved Nvidia which just saw 10% of it's revenues wiped out on banning export of the H100's to China (2 year old AI tech), so it should not come as a surprise that Nvidia and the rest of the semis took a hit of typically 5%. Still it gives another opp to accumulate numero uno. where new all time highs await a higher high above $115. Alls folk need to know is that AI is not going away, AI is continuing to ACCELERATE! So the cheaper Nvidia gets in the present the better because earnings growth means eventually Nvidia will trade to a new all time high on route to over $200, until then we await bullish triggers such as a break above $115.

How can any one invest in a time of maximum uncertainty as US Tariffs policy flip flops more than a fish out of water. First there was the 10% reversal on ALL except China accompanied by messages that the world is lining up to kiss Trumps fat ass and now exemptions for this that and the other, what was the trigger? That which I have been warning of for a month! The brewing US bond market apocalypse consequences due to capital flight out of the US as we saw stocks, dollar and bonds sharply lower at the SAME TIME! That's not supposed to happen and definitely not what the US is positioned for given the $1.5 trillion budget deficit AND $9 trillion of debt needing refinancing this year! Hence we are still racing towards a US Bond Market PANIC as a consequence of all of the chaos that President Dumbo has unleashed on the global financial and economic system.

Stocks along with the dollar falling caught many by surprise because what should happen at such times is a flight to the safety of US bonds as folk kept reminding me in the comments, look Nadeem bonds are higher there is no flight of capital, like Trading Places's, wait for it wait for it, BANG! 10 Year yield spikes to 4.6%. As I have been iterating for over a month capital is flowing out of the US and into European and Japanese bonds that in 4 words is best summarised by the "Yen Carry Trade Unwind" that I warned could trigger a bond market panic event that would make the past few weeks look like a picnic given President Dumbo randomly announcing escalations in his trade war, last I heard it was 145% on China, 200%+ coming soon!.

The whole trade war escalation with China is just plain dumb as it hurts both countries but the US more than China given that it will send prices through the roof in the US whilst resulting in excess supply in China, For instance the Chinese economy is $20 trillion of which exports to the US are $500 billion of mostly electronic goods and components such as chips, laptops and iphones that the US relies on for it's supply chains that the tariffs disrupt. The advantage is to China because Trump chose to go to war against the whole world so the likes of Canada are looking to diversify away from being beholden to the US by doing trade deals with the likes of China never mind that China is the Saudi Arabia of rare earths and the panic that could trigger. Apparently Trump awaits a phone call from Xi to offer him a deal but that phone remains silent as instead China responds by halting orders of Boeing planes.

Many folks perception of global trade is completely wrong! The US NEEDS $500 billion of stuff from China to function else they would not BUY IT! Whilst China needs about $140 billion of stuff that the US produces. So who gets damaged the most during the trade war?

Bring back jobs President Dumbo says, are you going to work for dollar a day Vietnam style? Have Apple setup foxcom style slave factories where workers jump off the roof to escape?

Its simple, the US needs $500 billion worth of goods from China, cut that out then the US is short of $500 billion of stuff that if needs that it does not produce itself at an economic price. Yes sure China is a rival Empire to the US so this is part of a grand plan to box China in, in which case why the hell go to war against ALLIES such as Europe and Canada? I mean the only reason Europe has any beef with China is because the US keeps ramming it down Europe's throat!

THE US NEEDS TRADE WITH CHINA MORE THAN CHINA NEEDS TRADE WITH THE US! If china really retaliates and for instance suspends shipment of rare earths it will be Trump kissing Xi's ass and not the other way round! The way I see it China holds most of the cards, China has the factories, China has the skilled labour paid at a fraction of what US workers would want. Where are the factories? where are the skilled workers? It takes decades to build up such infrastructure and even then there will be the question of cost. In this trade war the advantage is to China.

Now having back tracked to some degree the initial reaction to should be bullish for stocks, unless President Dumbo reverses course once more! The US is fast racing towards a Bond market collapse which as I commented weeks ago required a reversal in the tariffs policy to prevent from manifesting so as to stem the tide of capital flight out of the US which given the chaos of Agent of Orange the market now demands a Moron premium to hold US assets such as stocks, dollar and bonds.

So whilst Trump ignored the plunging stock market given that it should have resulted in a flight of capital into the safety of US bonds, the only problem with theory is that the opposite HAPPANED! the US is haemorrhaging capital resulting in bond yields going higher which means HIGHER INTEREST COSTS on that $9 trillion of debt due to be refinanced this year and so Trump is being forced to announce tariffs reversals, in attempts to bring the yields lower.

What's basically happened is that the markets are now pricing in a Moron premium to hold US assets such as the dollar and bonds, US bonds are not the safe haven they once were not with the tariffs inflation freight train hurtling towards the US regardless of the dip in CPLIE for March data and maybe also for April, it doesn't matter the damage has been done, economic contraction WITH INFLATION is in the pipeline which the markets attempt to discount in the present..

The moron premium means higher yields for US bonds, all that wealth destruction in the US stock market, some $7 trillion was for NOTHING!

Trump like the North Korean dictator is incapable of acknowledging mistakes, alls he wants to hear is folk singing his praises at to his masterful management of chaos. He even spoke about the greatest stock market rally in history completely ignoring the 20% dump in US stocks that preceded it!

Alls trade barriers do is make the US LESS COMPETITIVE, WEAKEN THE US, smaller, weaker, slower. Instead the US should be seeking to race ahead of China, become bigger faster, stronger, that's how the US remains Top Dog.

The moron premium when tariffs jump from 54% to 105% and then 125% in advance of which President Dumbo turned friends into foes so they would be more susceptible to trade dialogue with China against a common foe.

This is the calm before the Inflation and Recession Storm. Dollar, Stocks and Bonds all down means the markets are pricing in STAGFLATION. This time is different because Trump constantly seeks to ESCALATE and only backs down when the SHTF!

As for our beloved AI tech stocks, supply chain disruption does not bode well for the likes of Apple and Tesla, whilst AI data centre deployment will see costs rise and slowdown in infrastructure build. The moron clearly does not understand that it takes years to relocate supply chains never mind access to rare earths that China is the Saudi Arabia of, Add rising costs and uncertainty of supply, policy and demand shocks then I don't see how corporate earnings are going to be able to keep growing.

But there is even worse to come than an inflationary recession because the Trade War could result in an actual War with China as that is where reciprocity leads, In fact I'd bet that most folk don't realise that a Trade war is an act of violence, economic violence.

12th June 2020 - Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!

The higher the tariffs the less trade with others that's both exports and imports. So buyers have less choice and worsening substitutes, americans are going to get a shock to system when they soon see empty shelves.

Stock Market Tarrified as President Dump Risks Turning Recession into a Stagflationary Depression

Contents

Trumpet of the Apocalypse

The Yen Carry Trade

Bitcoin Brief

US Exponential Budget Deficit

QE4EVER

US Interest Rates

Trade War Unintended Consequences

Trump Tax Cuts

Stock Market's Got Anxiety - Panic Attacks!

Stock Market Volatility

AI Stocks Portfolio current state

ASML - Wednesday 16th April - $673 - EGF 29% / 33%, PE Range 53% / 11%

TSMC - Thurs 17th April - $155 - EGF 21%, 43%, PE Range 62% / 26%

TSLA - Tues 22nd April - $252 - EGF -2%, 27%, PE Range 173% / 116%

IBM - Wednesday 23rd April - $239 - EGF 3%, 8%, PE Range 95% / 80%

LRCX - 23rd April - $68 - EGF 14%, 12%, PE Ranges 76% / 60%

Google $158 - EGF +5%, +19%, PE Ranges 16% / -15%.

Who wants to Live for Ever?

Canada's New National Anthem

The whole of this analysis has first been made available to patrons who support my work so for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

Recent analysis - Stocks Bull Market End Game Bear Start Strategy

CONTENTS

Money Printer Getting Ready to go Brrr

Trumponomics Breaks the US Dollar

S&P Correction Trend

Deviation Against Stock Market Trend Forecast

Recession Self Fulfilling Prophecy

Next Stocks Bear Market How Bad Could it Get?

AI Stocks Portfolio Current State

Buying the Dip

Elon's Butt Must Hurt

Stocks Bull Market End Game Strategy in Brief

PSYCHOLOGY FOR SUCCESSFUL BEAR MARKET INVESTING!

Bull / Bear Strategy To Do List

The During the last legs of the bull market

During the bear market

Road Maps and Ongoing Analysis

Post bear market

FX Impact - Sterling Bear Market Hedging

AI Tech stocks During a BEAR MARKET

Draw downs from 2021 highs to lows 2022 lows

Best and Worst Stocks to Hold During the Nest Bear Market

Agent Orange Stock Market / Financial System Doomsday Scenario

Stocks, Crypto and Housing Market Waiting for Trump to Shut His Mouth!

Contents

State of the Stocks Bull Market

It's the 1990's All Over Again!

Stock Market Deviation Against Trend Forecast

When Will US Interest Rates Next Be Cut?

Nvidia DeepSeek FEAR and PANIC

Nvidia Earnings Blast Off?

AI Megatrend

Tesla is Toast!

AI Stocks Portfolio

Bear Market Strategy

FEAR RISING PRICES

UK House Prices

US Home Builders

US House Prices Momentum

US House Prices

Bitcoin Trend Forecast

Pensions Lump Sum Take it Or Leave it?

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

More analysis -

President Chaos Delivering Tariffs Buying Opps - Earnings GOOG, AMD, QCOM, RBLX, AMZN

Trump's Squid Game America, a Year of Black Swans and Bull Market Pumps

Earnings Black Swans - MSFT, TSLA, META, AAPL, KLAC, IBM, INTC

And access to my exclusive to patron's only content such as the How to Really Get Rich 3 part series.

Change the Way You THINK! How to Really Get RICH Guide

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

The Investing Assets Spectrum - How to Really Get RICH

It's simple, you pay $7 and you get FULL access to ALL of my content -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on my patreon page and I also send a short message in case the time extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules for successful investing.

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and not get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles and 3 part guide, clear concise steps that I may eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions on a daily basis.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of each analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your buying the black swan panic events analyst.

By Nadeem Walayat

Copyright © 2005-2025 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.