Why Washington Cannot Prevent Economic Depression

Economics / Economic Depression Nov 10, 2008 - 07:56 AM GMT Martin Weiss writes: Fear of depression is sweeping the nation. Millions of Americans are consumed with anxiety, abandoning their old shop-till-they-drop habits, slashing their spending, trying desperately to pinch pennies for the coming hard times.

Martin Weiss writes: Fear of depression is sweeping the nation. Millions of Americans are consumed with anxiety, abandoning their old shop-till-they-drop habits, slashing their spending, trying desperately to pinch pennies for the coming hard times.

Thousands of bankers are snapping shut their coffers, tightening their lending standards, hunkering down in anticipation of a massive economic downturn.

Sophisticated investors also see the handwriting on the wall. They're pulling out of hedge funds, selling their mutual funds, rushing their money to the safety of Treasury bills.

Even the established media, often late to see the dangers, is beginning to speak out more loudly …

CNN Money: “The rapid deterioration of labor markets points to a sharp decline in hours worked and output in the fourth quarter. This is likely to lead to a decline in personal consumption to the tune of 5% or so for that period. Since that makes up about 70% of the economy, the stage has already been set for real GDP to shrink at a more than 4% rate in the fourth quarter.”

New York Times: “As dozens of countries slip deeper into financial distress, a new threat may be gathering force within the American economy — the prospect that goods will pile up waiting for buyers and prices will fall, suffocating fresh investment and worsening joblessness for months or even years. The word for this is deflation, or declining prices, a term that gives economists chills. Deflation accompanied the Depression of the 1930s. Persistently falling prices also were at the heart of Japan's so-called lost decade after the catastrophic collapse of its real estate bubble at the end of the 1980s.”

The Wall Street Journal , USA Today , and hundreds of other newspapers around the world are all asking essentially the same question: Are we sinking into a depression? How bad will it be?

The answer, they say with unanimity, lies with Washington. That's why General Motors has suddenly switched PR tactics, now admitting it will run out of the cash it needs to stay in business. It wants a Washington handout.

That's why dozens of major cities and states are saying the same thing. They want their share of the federal money too.

In this Washington-worship environment, you may even see Wall Street brokers drop their traditional embellishment of the news and begin stressing the negative — all for the sake of pressing the case for “bigger and better” federal bailouts.

The dire reality: Washington is not God. It cannot save the world. It cannot prevent the next depression.

Hard to believe? Here's the proof:

Proof #1

The Debt Crisis, the Primary Catalyst

of the Economy's Decline, Is Far Too Big

for the U.S. Government to Control

The facts:

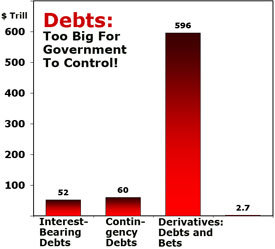

1. Based on the Federal Reserve's Flow of Funds report, there are now $52 trillion in interest-bearing debts in the U.S.

2. Based on estimates provided by the U.S. Government Accountability Office and other sources, it's safe to assume that there are also at least $60 trillion in contingency debts and obligations now starting to kick in — for Social Security, Medicare and other pensions.

3. Separately, the Bank of International Settlements reports that the total value of debts and bets placed worldwide (derivatives) is $596 trillion, or more than a half quadrillion !

In contrast, even after the most reckless outpouring of government bailouts in recent months, the total rescue money announced in the U.S. so far is $2.7 trillion — a huge, unwieldy amount, but still minuscule in comparison to the massive debt build-up.

|

The numbers are not directly comparable, but just to get a sense of the magnitude of the problem, compare the size of the debts and bets outstanding (the first three bars in the chart) with the size of the $2.7 trillion in bailout commitments thus far (barely visible in the chart).

Still, most people insist,

“If only Washington can avoid the mistakes it made in the 1930s … if only Washington can preemptively nip this crisis in the bud … if only Washington can be our lender and spender of last resort … Great Depression II will never come to pass.”

What they don't see is the fact that the debt build-up in the U.S. today is far greater than it was on the eve of Great Depression I. Indeed, in the chart below, Claus Vogt, the editor of Sicheres Geld (the German edition of our Safe Money Report) shows how …

Prior to the 1930s, the total debt in the U.S. was between 150% and 160% of GDP. Now it's close to 350% of GDP.

Moreover, he reminds us that this chart does not even include derivatives, which barely existed in the 1930s but which are now sinking banks deeply into the red.

Clearly the government bailouts are too little, too late to end this crisis. At the same time …

Proof #2

The Cost of the Bailouts Is Too Much,

Too Soon for Those Who Must Finance It

With the economy already falling, Washington cannot — and will not — fund the bailouts with higher taxes. Nor will it do it by making major cuts in government expenditures. Instead, at this phase of the crisis, the government will try to finance its folly largely by borrowing the money.

And now it has started: Just last week, the U.S. Treasury department announced that it is borrowing $550 billion dollars in the fourth quarter, more than the entire deficit of fiscal year 2008.

Also last week, Goldman Sachs estimated that the upcoming borrowing needs of the U.S. Treasury will be a shocking $2 trillion — to finance the bailouts, to finance the existing deficit and to refund debts coming due. That's four times the size of the entire deficit.

This means you can expect an avalanche of new Treasury bond supplies, crowding out private borrowers and putting severe upward pressure on interest rates. And, needless to say, higher interest rates cannot end the debt crisis; they can only make it worse.

Proof #3

You Can Bring a Horse to Water

But You Cannot Make It Drink.

My father told me this story about President Herbert Hoover shortly after the Crash of ‘29 …

Hoover was worried about the sinking U.S. economy. So he called the leaders of major U.S. corporations down to Washington — auto executives from Detroit, steel executives from Pittsburgh, banking executives from New York.

And he said:

“Gentlemen, when you go back home to your factories and your offices, here's what I want you to do. I want you to keep all your workers. Don't lay any off! I want you to keep your factories going. Don't shut any down! I want you to invest more, spend more, even borrow more if you have to. Just don't do any cutting. So we can keep this economy going.”

Instead, the executives went back to their factories and offices and said to their associates:

“If the president himself had to call us down to Washington to lecture us on how to run our business, then this economy must be in even worse shape than we thought it was.”

They promptly proceeded to do precisely the opposite of what Hoover had asked: They laid off workers by the thousands. They shut down factories. They slashed spending to the bone.

And today, we're beginning to see precisely the same phenomenon:

Washington is prodding consumers to borrow more, spend more, and save less. But consumers are doing precisely the opposite, as we just saw from the October collapse in retail sales.

Washington is prodding bankers to dish out more mortgage money, give people continuing access to credit cards, even lend money to sinking businesses. But the bankers are also doing precisely the opposite, as we just saw in a recent Fed's survey of bank loan officers.

Why the reluctance to borrow and lend? Because most borrowers and lenders are finally beginning to recognize what really went wrong in the United States: Too much debt, not enough savings. They also recognize what they have to do about it: Try to cut back.

In response, Washington bureaucrats are rushing out, waving their arms frantically in the air, and shouting: “No! Don't do that! We want you to lend and borrow more — so we can keep this economy going.”

But their pleas fall on deaf ears: No matter what the government says, it is the natural survival instinct of billions of people and businesses around the world that will determine the outcome: Depression and deflation.

Proof #4

Powerful Vicious Cycles

of Debts and Deflation

You ask: We've had these debts for many years, haven't we? So why are they suddenly such a huge disaster now?

The answer: Yes, debt alone is usually tolerable. It can persist and pile up for years. And as long as borrowers have the income — or as long as they can borrow from Peter to pay Paul — they can continue making payments, and life goes on.

Deflation alone is also not so bad. It can help make homes more affordable, a college education more achievable, a tank of gas easier to fill.

It's when debts and deflation come together that a depression is inevitable. That's what happened in the 1930s; and, in a somewhat different way, that's what's happening today.

We are witnessing powerful vicious cycles in which deflation brings down debts and debts help accelerate the deflation.

For example …

- In the U.S. housing market, widespread mortgage delinquencies and foreclosures precipitate massive selling of real estate; massive real estate selling causes severe price declines; and the price declines, in turn, cause more delinquencies and foreclosures.

- On Wall Street, corporate bankruptcies — and the fear of more to come — precipitate the liquidation of common stocks, corporate bonds and virtually every kind of asset; the selling drives markets lower; and falling markets, in turn, cause more corporate bankruptcies.

- Consumers, small and medium-sized businesses, city and state governments, hospitals and schools, even entire countries are caught up in a similar downward spiral; slashing their spending, laying off workers, dumping assets, losing revenues, and slashing their spending still more.

In every sector of the economy and every corner of the globe, debt defaults are causing deflation; and deflation is causing debt defaults. No government can stop this powerful vicious cycle. It has to play itself out.

Next, you ask: Why can't the U.S. government simply create more inflation? Why can't it do what the government of Germany did after World War I? Or what the government of Zimbabwe is doing right now? In other words, why can't it just print all the money it needs to buy up all the debts?

That takes me to the fifth and final reason the government cannot end the debt crisis, cannot stop the vicious cycle of debt default and deflation, cannot prevent a depression.

Proof #5

The Ultimate Power of Markets

Let's say I am Uncle Sam; I represent the U.S. government. And let's say you represent the investors of the world, especially investors in U.S. government bonds.

I issue the bonds to borrow money. You buy the bonds to loan me money, to finance the U.S. government.

Now let me ask one fundamental question: Who is really in control of this situation? You or me?

The answer is obvious: I do not control you. I cannot tell you what to buy or how much. You are the one in control of that decision.

You have great power — power that the creditors of Germany did not have after World War I and the creditors of Zimbabwe do not have today. You have the power of the market — a market for the government securities you own.

In fact, in order to run my government, I cannot even dream of raising the money I need without you or without that market.

I need you . I need you to hold the U.S. bonds you've already bought. Plus, I need you to buy more new bonds to finance all my new spending and deficits. You are my lender, my creditor, my benefactor. I must keep you happy. I cannot afford to do anything that will make you angry.

In fact, by allowing the evolution of this vast market for government securities, I have effectively transferred the ultimate power to make final, critical decisions from me — the government — to you, the investors in government securities. And …

The power of the market is stronger than any politician or government bureaucrat. It is more powerful than any law. It is even more powerful than the gold standard.

In order to raise money for the government, I must retain your confidence, your trust. To do that, I cannot run the printing presses or destroy your money. Instead, I have to let the deflation and depression run its course.

Bottom line: It's preposterous to believe that Washington can save every failing individual, company, country and government on this planet.

It's naive to believe that government gimmicks or trick — manipulating the currency, writing new laws, changing the banking structure — will be a match for billions of consumers in revolt, millions of investors desperate to sell and thousands of banks pulling in their horns.

The government cannot repeal the law of gravity or stop investors from dumping their assets.

It cannot turn back the clock or reverse decades of financial sins.

It cannot win the battle against depression.

It cannot stop the Dow or S&P from losing half their value from current levels, if not more.

It cannot stop the collapse in real estate, commodities, and corporate bonds.

So act promptly now to liquidate or hedge your holdings, build cash and make sure the cash is safe.

For specific instructions, see Weiss Research's Emergency Q&A Conference . And after watching this 1-hour commercial-free video, check your email inbox for our follow-up guide. Then, be sure to review it carefully for our step-by-step recommendations on precisely how to find safety in an unsafe world.

Good luck and God bless!

Martin

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.