Economic Forecast, Peering into a Debt Ridden Future

Interest-Rates / US Interest Rates Nov 19, 2008 - 06:21 PM GMTBy: Mick_Phoenix

Welcome to the weekly report. This week we look at some longer term indicators that will help identify when a turning point in the economy has arrived and why you should cancel Christmas, or at least go back to its traditional meaning, forgoing the pointless consumerism that surrounds it.

Welcome to the weekly report. This week we look at some longer term indicators that will help identify when a turning point in the economy has arrived and why you should cancel Christmas, or at least go back to its traditional meaning, forgoing the pointless consumerism that surrounds it.

Before we start, you may have wondered (or not) why the weekly report wasn't around. I have spent the past 3 weeks laying out the groundwork for an attempt to peer into the longer term future. Subscribers have seen all 3 articles, culminating in the new scenario. I have released the first 2 articles to the public, the final part will also be released but not for awhile yet.

Whilst this may be viewed as harsh I believe subscribers deserve some added value for their money. I must admit, it was hard to leave the original scenario behind, it had served me (and others) well over the past 5+ years but as events have finally played out, it became obvious it was time to look ahead.

As someone who looks at the larger picture it becomes apparent that certain events happen in recessions and expansions and these events can be monitored to signal a change in economic conditions. However most people ignore these signals or dismiss them as "lagging". Whilst that may be true for those conditions that result after a primary change has taken place, some indicators of economic conditions are more responsive. The trick is to find such indicators that are in the public domain and that show a repeating pattern when economic conditions repeat.

By keeping an eye on amongst other things changes in forex, yield curves, the ISM surveys, Senior Loan Officer Opinion Survey on Bank Lending Practices from the Fed and commercial paper rates then a "heads up" warning can be received about changes in macro-economic conditions. Some readers might well say (with some justification) why don't the Central Banks watch for the same signals? I believe they do but the staffs have an overly optimistic view on the ability of economies to avoid downturns or recessions. This over-optimism leads to decisions being delayed and actions not taken even when evidence of a change is apparent. It is a failure that is all too human but leads to greater risk taking in the hope of a change happening that would forestall having to make hard choices. Not unlike a trader that is unwilling to cut a losing position, hoping for a change in trend.

That makes the work of humble writers like me more difficult. Many of the so-called bear commentators have warned for some time that the imbalances in credit and derivative markets would end badly, the difficult bit has been to work out what the Central Banks and Governments would or would not do as the imbalances became too big to ignore. With hindsight it is now apparent that the response to the tightening of credit, the disappearance of asset backed commercial paper facilities and the increase in LIBOR back in the summer of 2007 were insufficient. Yet at the time the invention of the first US Fed "facilities" to enhance discount window and repo market operations took many by surprise and allowed markets to believe the problems were contained and a fix was in place. Whilst the initial drip feed of assets from the Fed balance sheet into the banks restored some confidence and allowed markets to rally all that really happened was the eventual melt down was delayed. Yet some indicators showed that such actions were indeed ineffectual.

So let's have a look at those indicators that warned conditions had changed and were not misled by any false confidence.

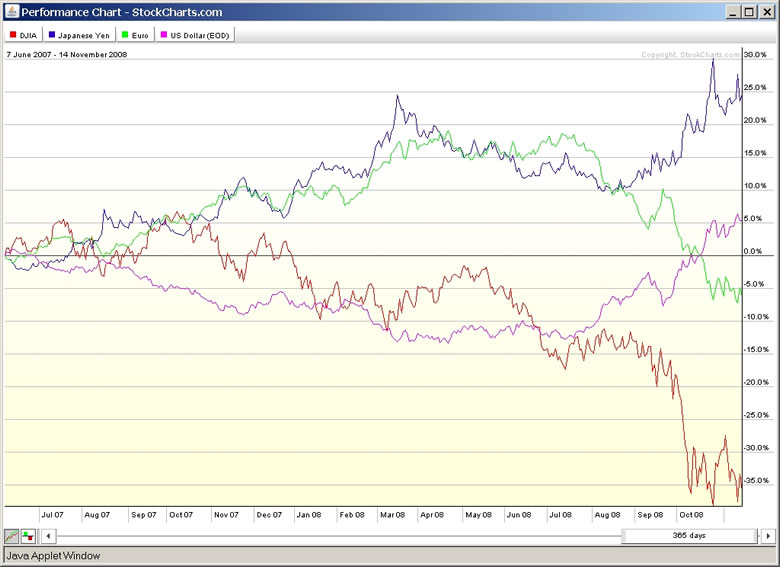

Chart courtesy of www.StockCharts.com

The Yen didn't lie, it gained strength as the carry trade unwound and when compared to the Dow it outdid any chart based indicator. Since August the Yen has established a clear and steepening uptrend and until that uptrend is broken I see no signs of a new carry trade being implemented. I am watching the triangle that has formed since October very closely. Interestingly the dollar/euro carry trade has also unwound since July, explaining how the dollar has remained resilient despite all the bad news. If Eurozone rates continue to fall then the carry will continue to unwind.

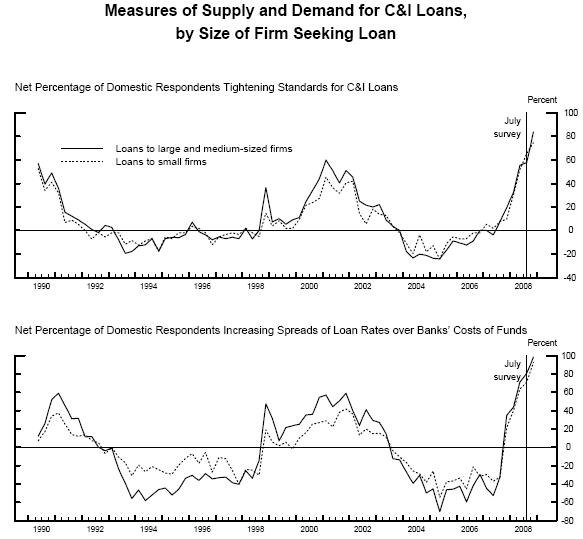

Banks always play the game the same way, tightening standards and increasing spreads when risk is high, loosening when risk is low, according to their models:

October 2008 Senior Loan Officer Opinion Survey on Bank Lending Practices.

Probably amongst the most revealing charts you will see. As banks tighten and increase spreads to offset risk of default economic conditions follow. Notice the extreme conditions we are currently living with and remember these charts show "tightening" and "increasing spreads". What that means is that these charts could fall from the current peaks because they had stopped tightening and increasing spreads, it would not necessarily mean that conditions are getting looser, any fall would probably reflect that banks had stabilised their positions. It is the move above and below the neutral line at zero that would reflect looser lending conditions. It is also clear that some banks were aware that trouble was brewing well before the summer of '07. I do not see a short or shallow recession in our future and neither do the banks, rather conditions are extreme and will remain so for some years.

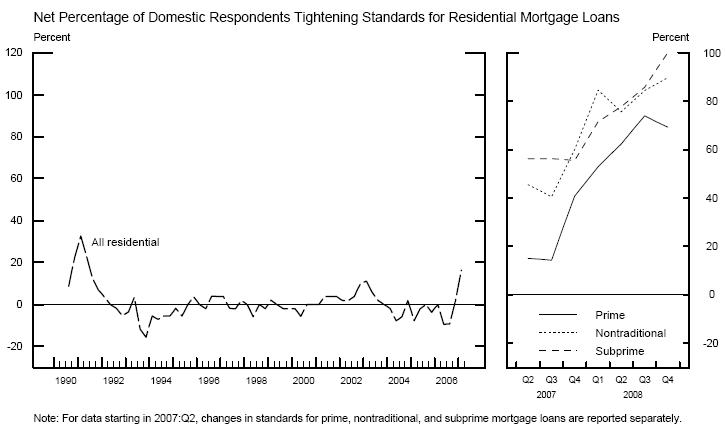

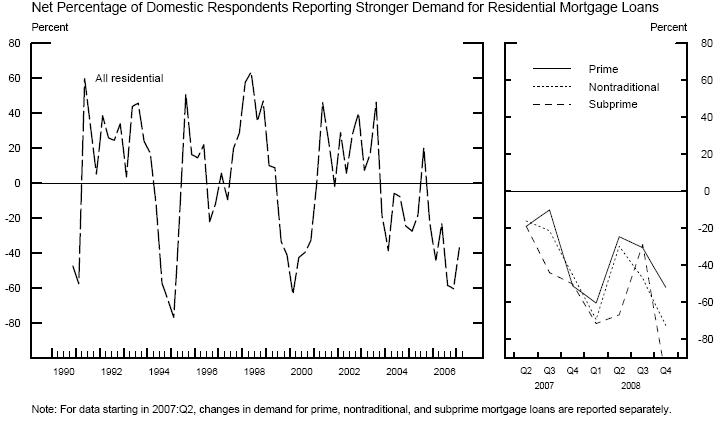

Conditions for mortgages are no better as we see from the Loan Officer Opinion Survey:

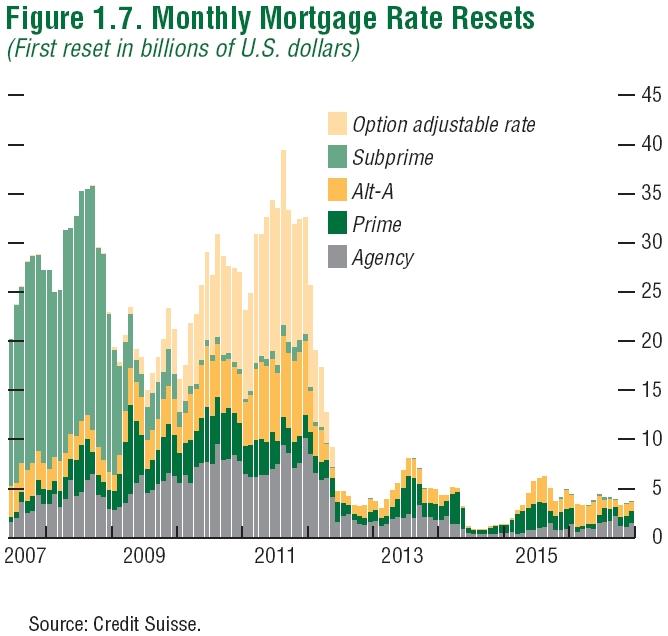

Again we see the mortgage market at extremes across the board which makes the following chart even more important:

Do not be fooled by the lack of sub-prime green, it's still there hidden behind the Alt-A. Overall total resets are about to increase into '09, fall back in mid '09 and then move much higher into Q1 '12. Without a functioning mortgage market, what we have seen since the summer of '07 to present may seem mild in comparison. The following chart is a little old now (I originally saw it in early '07):

Anyone telling me that the worst is over is trying to sell something!

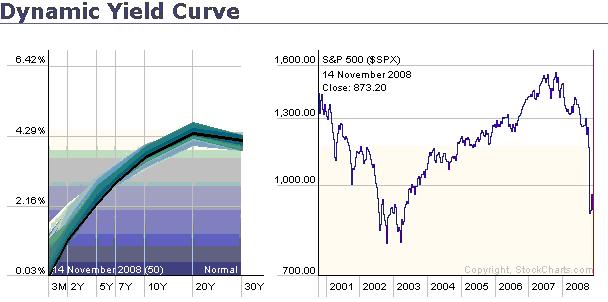

Finally we look at the yield curve:

Courtesy of www.stockcharts.com

Click on the link above and press animate. Any future economist, analyst or writer who says the yield curve doesn't work like it did in the past should be regarded with deep suspicion.

Should you cancel Christmas, is this the deluded ranting of an over-stimulated bear?

It truly depends on your circumstances. If you are in debt, struggling to pay a mortgage and decide that you are going to have one last splurge with your lower limit credit card, be ready for a knock on the door in the spring from a Collection Agency.

The situation now feels dire yet it may well be about to get much worse. Anyone calling for a shallow recession and a move back to the "good old days" is to my mind not looking at the new landscape we live in.

I would rather forego the pointless giving of presents if it means that more debt is incurred or a reduction in savings results. Your family would rather have a roof over their heads than a 42 inch plasma screen in '09.

Maybe it is time for a new fireside chat to be introduced into the homes of America. A chat that is not reliant on the word of the government but one where the family gathers around (turn the TV off!) and tells the truth to each other. Talk about the real meaning of giving and caring, not the display of swapping presents but through the protection of those you hold close. Agree to look after each other, cut spending, start saving and most importantly do not ignore what is coming. Prepare yourselves, have a realistic plan and ignore the consumerist brainwashing that will be directed at you.

This time next year those you hold close may be very grateful they didn't receive an expensive present this Christmas.

By Mick Phoenix

www.caletters.com

An Occasional Letter in association with Livecharts.co.uk

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.