U.S. Economy Reflation Challenge and LIBOR Deceptive Manipulation

Interest-Rates / Credit Crisis 2008 Nov 19, 2008 - 07:07 PM GMTBy: Jim_Willie_CB

A major challenge looms large on the immediate horizon. The US Economy must be reflated in order to avoid collapse. Debts have become a crippling factor. Liquidation of speculative trades coincides with economic retreat, and hedge funds are under attack by their creditors (largely Wall Street firms) while major companies shed workers by the tens of thousands. When asked about economic prospects, a standard answer lately of mine has been to observe important signals not of recession but of potential disintegration.

A major challenge looms large on the immediate horizon. The US Economy must be reflated in order to avoid collapse. Debts have become a crippling factor. Liquidation of speculative trades coincides with economic retreat, and hedge funds are under attack by their creditors (largely Wall Street firms) while major companies shed workers by the tens of thousands. When asked about economic prospects, a standard answer lately of mine has been to observe important signals not of recession but of potential disintegration.

Almost all of the economic data, almost all of the Fed regional reports, almost all of the consumer sentiment indexes, almost all of the jobs data, almost all of the housing foreclosure data, is negative. The most dangerous and disgusting aspect of the current rescue initiatives is that almost all Dept Treasury and US Fed actions are not revealed via any disclosure at all, nothing. Despite demands for transparency, nothing is shared on detail. Corruption and fraud usually thrive in such an environment.

Many clownish elite economists seem to miss the point, when they overlook how bank insolvency is much more the issue than liquidity. Big banks not only have doubts as to their own solvency, but they dislike the credit standing of many of their borrowers. So the challenge will be to reflate the economy even as desired, to proceed with money flowing into its credit centers, and to exploit how current loans can be paid back with cheaper future money. Gold will thrive in this environment, since a climax of a disaster, or a climax of produced price inflation will benefit gold enormously. Both scenarios are very favorable to gold and silver prices. Besides, a default at the COMEX for both gold and silver seem highly likely, with cracks forming in December, and outright highly publicized defaults suffered in 1Q2008.

LENDERS NOT LENDING

Put aside for now the fact that the big TARP bailout is not to be used to place vast sums of money into the banking system to neutralize the deeply impaired asset backed bonds. Paulson has a better use for the first $125 billion tranche of Congressional funds from the Troubled Assets Relief Program. He enabled executive bonuses for the big banks that make up the Federal Reserve banking system, by purchasing their preferred stock. Almost 90% of doled money to banks equalled the magnitude of executive bonuses, how bizarre! Was that his plan? In fact, the Fed bank system has been privileged, while their competitors have been denied. Most of the $125B went precisely to the Fed member banks, the elite, as others were denied. THIS IS THE VAST CONSOLIDATION MENTIONED IN MY PAST WORK. The crisis is being used to eliminate competitors in a coordinated planned manner, in direct alignment with the Fascist Business Model (along with lack of transparency). Efficiency is not the goal, but preservation of power. Imagine being a troubled bank not in the system, under solvency strain. Your elite competitors put your bank in the dust from official channels. The consolidation continues unabated.

The US Fed itself has been working on countless swap programs, thereby relieving much of the soured bonds, taking them off the market, relegating them to special ‘Garbage Cans' under management. The TARP money, so Paulson claims, would be better devoted to the bank system by stock purchases, since 12:1 leverage could be employed on bank assets. Well, nice story, Hank, but executive bonuses usurped over 85% of the new funds, to reward Wall Street firms for a fine year, one certainly to go down in the annals. Paulson has given instructions to big firms participating in the TARP fraud to acquire smaller banks, NOT TO LEND, and thus assist the Federal Deposit Insurance Corp. It insures bank deposits. See for instance the PNCbank buyout of National City, well discussed.

By acquisitions, bigger banks have essentially spread their insolvency to the system at large, much like a cancer. When heavy trims are called for, and new planting is urgently needed, but no new trees will be grown in this ass-backward environment. Failed financial fiascos continue as zombies with huge capital appetites. Nowhere have funds been set aside for lending. A strangulation process is underway, so deep that one must ask if it is intentional. The Elite seem to be killing the economy and absconding with federal funds before the administration ends.

Lenders are not lending much. Why should they? They are unsure of their own bank assets, since no transparency yet exists on exotic lunatic bonds like certain mortgage bonds and many CDO bonds derived from mortgages. If a bank knows little about its actual solvency, then it will hesitate to lend. The facilities to provide funds for banks to lend are themselves still clogged and interrupted, despite what one might hear about short-term lending signals having improved. The US Fed has stepped in also to help clear funds for both the asset backed commercial paper arena and the money market funds arena. The clogs and blockages are everywhere.

Furthermore, lenders do not often encounter worthwhile borrowers. The calculated risks seem not so full of promise. Workers are losing jobs in record numbers, even while assets for borrowers are losing measured value. Worse still, new sources of bank loss are soon to hit, like credit cards, car loans, and commercial mortgages. Commercial mortgage AAA-rated bond spreads have doubled in just the last two or three weeks! No asset backed bonds were sold in October, tied to credit cards! Both ability to pay back is poor and posted collateral is poor on new loan issuance. Lenders just say no, sometimes even to people with good credit history.

THE SPIGOTS ARE SOON TO OPEN, OR AUTHORITIES WILL ATTEMPT SOON TO OPEN SUCH SPIGOTS, WHICH WILL PROVIDE A FLOOD OF MONEY TO LEND. IT MIGHT OCCUR WITH STRICT ORDERS TO LEND, WITH THE USGOVT AS THE LENDER BACKSTOP. This would be great for gold, but ruinous for the US Dollar.

DESTINATION OF NEW MONEY

Just where has all the new money gone in the last several months of bailouts, rescues, backstops, nationalizations, blank checks, and more? Plenty of money has been created, of course of the counterfeit official variety off the printing press. My reference here is to the US Congressional funds made available that are sure to fall flat in Treasury auctions in associated funding. Last week's auction, for instance, stunk on ice, a real dud, fell on its face, and a harsh warning to USGovt and US Fed officials who hope for foreigners to step forward and save our bacon with continued purchases of USTreasury Bonds. THEY WILL NOT!!!

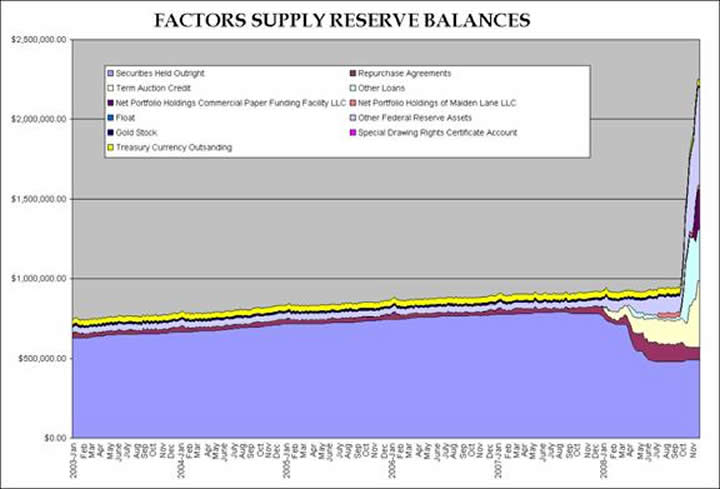

Actually, the ugly truth is that the US Fed has actively been REMOVING money from the system in order to fund its swap facilities. See the chart below, which is somewhat mind boggling. Balances have tripled in less than one year. The image of Weimar Factor seems to come alive . The US Fed has actually drained vast amounts of money from the mainstream US Economy and its banking system in order to create USTreasurys in sufficient volume to offer them to big banks in swaps of soured and impaired mortgage bonds. Here is a fact. In October alone, the volume of Cash Management Bills sold into the bond market by the US Fed totaled $515 billion, with another $70 odd billion in the first week of November. That constitutes a massive drain. The US Fed is actually trying to fund the banks, but to drain the economy, in order not to trigger price inflation. INSTEAD, THEY ARE LIKELY TO SEE ECONOMIC RECESSION ACCELERATE DOWNWARD, OR WORSE. My biggest concern is of economic disintegration. When evidence confirms, the spigot will be turned on in a desperate attempt.

Where is new money going? It is pumping up bank stocks, replacing dead bonds on bank balance sheets with USTreasurys, along with backstopping Fannie Mae and AIG haemorrhages under official aegis. It is replenishing JPMorgan in pre-dawn agreements before bankruptcy judges to the tune of $138 billion under highly suspicious circumcisions. JPMorgan must carve out its layers so it can continue funding the gold suppression and USTreasury propping, if not their own massive unreported credit derivative losses. They enjoy a pass on proper accounting, due to national security nonsense. Their credit derivative monster book grew during the late 1990 decade, when the sham Strong Dollar Policy was in vogue under Robert Rubin direction. Everything the guy touches turns to ruin, but he will pick the next Treasury Secretary.

Gee guys! Not only was the giant diversion of funds to help bank stocks executed at doubled the share prices, well documented by other analysts, but the initiative has failed to help the bank stock index . See below. The BKX index is scratching out new lows, perhaps a reflection of the further abuse of TARP funds. Look for a target on the BKX of 30 or lower. Bank executives have paid themselves bonuses, after they drove their businesses into the graveyard with horrible bond investments and sidetracked private equity deals. My personal conjecture is that a huge amount of that infamous TARP money has been quietly transferred over to the Plunge Protection Team, for stock market index intervention and management. Too many denials and ridicule have come to the contrary. Where denials abound, lies are told, confirmed later.

NATURE OF USDOLLAR RALLY

The most common question to cross my desk is why the US Dollar. is rallying so strongly, given a severe stock decline and really bad economic news. Surely, the answer must go in direct contradiction to any targeted investment in the US Economy, or to property purchases. Some money, according to one source in Atlanta, seeks safe haven in US$ denomination, like among Russian investors. He made reference to wealthy individuals. The sums total the tens of billion$, maybe a little more, from that region. Their financial markets are in disarray. Even some European investors might seek the safety of the US$ as the euro currency continues to correct downward. Middle East money might seek safety also, as some disorder has entered their markets. So perhaps safe haven might be the objective for as much as a couple $100 billion or more. On the other side, a different source from Toronto tells of numerous multi-billion$ exits of money and investments from the US$-based system. Money is being repatriated as an implosion is expected, or at least a palpable risk is perceived in the United States during continued financial turmoil.

Contrast such numbers with other sources moving in the opposite direction. Up to half the hedge funds are under assault with many liquidations. Hundreds, if not a few thousand, will ultimately fail and die. Once there were 9000 hedge funds with over $1.6 trillion in managed investments. Big numbers are involved, and price changes in numerous commodities have been noted, from copper to crude oil. When their standard spread trades are closed out, enormous sums of money are demanded to buy back USTreasury Bonds that serve as anchor typically in such trades. With $1600 billion under management, spanning from New York City to London and elsewhere, and so much liquidation in big markets, my guess is that several $100 billion are involved into the beleaguered US Dollar.

Also, we hear of tens of trillion$ in Credit Default Swap redemption payout's being made. To be sure, they are handled on a net basis. The swap contract payout's pertained to Lehman Brothers, Fannie Mae, and other giant firms. Truly enormous numbers are involved. Confirmation of speculative trade and CDSwap contract closeouts comes from the installed US Dollar. Swap Facility, designed to meet that demand. The US Fed is trying to flood the world with US Dollars. They have two major motives, one openly understood, one privately hidden.

They are enabling the orderly payout of CDSwap contracts. They are supplying USTBonds in proper volume to cover the many spread trades that are retired. However, the US Fed also is attempting ensure the globe is in synch with a reflation initiative, and continued endorsement of the US Dollar. as global reserve currency. In order to satisfy contracts, USTBonds are thus “ACCEPTED” as valid legal tender, if you will. That preserves the US$ as global reserve currency. When reflation is attempted, all participants lose together, as the USTBonds might lose some value when long-term interest rates rise again.

The safe haven argument has its place, but is grossly overstated in my estimation. Look at ratios in magnitude and the closed spec trades and CDSwap payout's They seem to vastly overwhelm the safety seek to any US$ haven.

MANIPULATED MEASURES

Evidence has begun to enter the picture that the LIBOR rate is being manipulated, and being pulled down artificially. It is too crucial to be permitted to remain high. The London Interbank Offered Rate is used worldwide to calculate the interest rate on hundreds of billion$ in corporate loans, mortgages, spread trades, countless other loan products, and credit derivatives too. It is a wholesale borrowing rate determined by 16 major banks, published by the British Bankers Assn on a daily basis. The banking system has a vested interest in keeping the LIBOR rate low, and thus to falsify it, in a manner parallel to the Consumer Price Index kept low. A high LIBOR rate means banks lack funds to lend, or distrust each other from either past loans turning bad or new loans having poor prospects. Banks are now apparently making fake LIBOR quotes on the grounds that they wish not to be regarded as a credit risk, from which other banks would then demand a premium in reaction, and their image sure to suffer as well. Their bank stock and bond valuable would also fall. Lies help lift value. LIBOR rates are used to set adjustable rate mortgages across many nations.

Here is where the deception, shenanigans, and chicanery enter the LIBOR picture. Some of the money granted (gifted by Congress via Czar Paulson) to the big US banks in the last few weeks was lent to London banks, in particular by JPMorgan and Citigroup. This is NOT free-flowing lending at work. Money moved with a purpose. London banks are given political cover to say they have money to lend, did not borrow at their firm, but could have, and the rate would have been lower. Thus they submit via the honour system a lowball rate for LIBOR calculation, that has little bearing on reality. Details are shown in the November Hat Trick Letter, already posted.

The 3-month LIBOR chart tells a story. It came down from over 4.8% to 2.25% from brute force and manipulation, and has stabilized near the lower figure. The fact that 30-year fixed mortgage rates are still stuck at or near 6.0% is testimony that LIBOR is not a true reflection of market reality. LIBOR rates have come way down, but ARMortgage rates have not much. Such mortgage rates are still higher than a year ago, despite all the exceptional efforts by the US Fed and empty talk of federal loan assistance.

This chart shows the ratio of this short-term LIBOR versus the 3-month US TBill yield, now the commonly used spread trade viewed to reveal government guaranteed bonds versus commercially available borrowed funds. This correctly exhibits the strain to private sector lending, out of step with the government guaranteed bonds. A longstanding ratio range between 1.5x and 2.0x range on yields has been shattered. It now stands at way above 10x, even 15x. Banks distrust each other, and with good reason. Thus the private sector is not benefiting from lower official rates, as EXTREME DISTRESS continues. Banks still hide their crippled assets from their balance sheets, and lie on their earnings statements. The economies are not sharing the benefit of cheaper borrowing costs. Banks, however, struggle to realize the benefit of lower official short-term rates, if they reside outside the den of corruption closely located to the USGovt. Inside that den, banks make money by swapping to the US Fed itself.

COMPETITION FOR CAPITAL

One should expect expert economists to object to the devotion of money to failed enterprises, whether big banks or major firms like AIG, or to a major icon industrial giant like General Motors. Instead, they parrot on and on like politicians. Do economists have to preserve votes from the public? The competition for capital will become an important topic of debate before long. Precious funds are already being wasted on failed Wall Street firms, and on undeserved executive bonuses. Deaths for companies are being decided, not by the marketplace, but by a czar. Where will money come from to fund vast wind farms, or new gasoline refineries, or the infrastructure projects once promoted? Where will money come from to fund hybrid vehicle ownership? Too much money is now chasing failure so that jobs are preserved. Too much money is now redeeming failed financial vehicles, giving their elite owners a second chance. Too much money is now supplying labor unions that have essentially strangled their car maker parent firms. Sure, many labor union agreements were made in full faith, in an era when price inflation was properly recognized. Now labor unions are starting to exert a serious pinch, after years of passing bargaining agreement concessions into retiree benefits. The labor wage for the Detroit 3 car makers is still an order of magnitude higher than other industrial labor wages, like double. But that is changing.

The greater point is that the USGovt and US Fed are together organizing and channeling vast sums of money into unproductive centers of the US Economy, where failure abounds. Nowhere will money be available for new ideas, when 30% of car loan and home loan applicants are denied even with good credit. The US Economy is about to suffer major seizures, since success and competence are no longer rewarded. Instead, connection to power and sprawling size are rewarded. US economists are predictably silent, since they are predictably incompetent, compromised, and too closely associated with the elite think tanks. Job loss will accelerate in coming months. Two stories that struck me were 53k job layoffs planned by Citigroup, and 20% of the Sun Microsystems workforce to be laid off. General Motors continues to cut jobs and close plants. The supply chain, including distribution lines inside the country and overseas to the country, is another story altogether. Lack of short-term credit is a major problem, as letters of credit for shippers are often unwanted. My position on economic forecast is still much more tilted toward possible disintegration than just a garden variety recession.

GOLD WINS WITH EITHER OUTCOME

Scenario A: The US Economy suffers a strong recession. Many distribution lines are interrupted. Job losses continue into the millions. Many retail chains close down. These are already in progress. So imagine for the scenario that they all worsen. Commodity and material prices stabilize, and maybe rise. A big myth is out there, that claims commodity prices are down since the basic demand is down from a recession. That is only partly true. Prices are down predominantly since the US Dollar. has artificially enjoyed a prop from the financial markets, on liquidity of speculation and redemption of credit derivatives. As those processes slow, the US Dollar. will seek its proper value. That is much less, like 30% lower to start. Prices will then rise for things like food and gasoline and utility bills. Under this scenario, where the US Economy suffers mightily, even becomes something of a wasteland, the US Dollar. might be replaced. Under this destruction scenario, with or without that replacement (forced in shame), gold will be a refuge of stored value, as industry falters and debt collapses further.

Scenario B: The vast Reflation Initiative succeeds. Somewhere the maestros and wizards succeed in engineering a revival of price inflation, as is their newfound goal. The destruction of the US Economy is averted, except that hidden is the detrimental effect of price inflation. Wages might rise a little, but not enough. Asset prices like in the stock market improve, but not enough to keep pace with inflation. Corporations avert bankruptcy, but their profit margins are still damaged. The ultimate hedge against the systemic price inflation will be gold. This trend will continue, even as credit derivative accidents occur from higher rates, discussed in the upcoming Hat Trick Letter report. Massive price inflation will be the plan, the goal, the intention. INFLATE OR DIE will become the mantra on a global scale. The rise in the gold price, the longstanding time-honored inflation hedge, will be tolerated, as a system ill.

My forecast is that the US Dollar. will be replaced anyway, especially given the current meetings by major USTBond creditors. The G20 Meeting last weekend was an orchestrated sideshow. It opened Pandora's Box however, as Germans in attendance have made firm formal rational demands. The movement is afoot to force profound change. A difficult, if not impossible, task comes for foreign bankers. They must separate themselves from the US Dollar. and USTreasury, its tradable vehicle. If they do not, then their economic and financial systems will be dragged down with the United States. The US Fed executed on a gambit in recent weeks. They distributed hundreds of billion$ to foreign central banks. The hidden objective is to force foreigners to engage the great Reflation Initiative when the trigger is pulled, when the corner is turned, when the signal is given. Foreigners so far have taken that bait, but they might have an exit plan, if they are working closely with those who seem in charge: the Germans, Russians, Chinese, and Arabs.

Foreigners will soon realize that it is in the best interest of their nations to use their vast FOREX and USTBond reserves, to bring down their domestic currencies in exchange rate. They must enter the race of being among the initial group to use their USTBonds, to use their US Agency Mortgage Bonds, or suffer huge loss later. China has announced usage of US$-based bonds in a stimulus plan of gigantic proportions, the smart choice. Right now, the USTreasury Bill principal value is artificially high. Right now, the US Dollar. valuation is artificially high. THUS RECENT TREASURY AUCTIONS HAVE BEEN DISMAL FROM OVERPRICING. Foreigners can only expect their USTBond holdings to fall in value from here. The recent moves by the Saudis, the Iranians, and other nations to expand their gold holdings is another trend certain to gain ground.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

“Your analysis is of outstanding quality, the best I have read. In particular, as a person on the spot, I can confirm the accuracy of your bleak assessment of our prospects in the UK .” (JanB in England )

“I just subscribed to your services and must say that your insights are so eye-opening that it is like having a window to the future. I never thought that they would in so much detail encompassing the entire world. With all that is going on, I still wonder how you are so in touch with it all.” (ChrisB in Australia )

“The latest Hat Trick letter is great work. I am still reading and absorbing, but this is just great analytical work. Truly inspired. I would say you produce a very sophisticated, detailed product that is the best of the bunch. Truly. You help keep me very focused on current events and help me keep my eyes on the distant horizon.” (RichardB in Texas )

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-*****-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces' approach into an awesome intellectual tool.” - (RobertN in Texas )

“Your reports scare the hell out of me every month, probably more so over time, since so many of your predictions have turned out to be very accurate. I am afraid you might be right that by the end of 2008, we are in a pretty severe situation, with civil unrest and severe financial stress on Main Street .” - (GeorgeC in Minnesota )

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.