Credit Crisis Persists as Bond Spreads Widen

Interest-Rates / Credit Crisis 2008 Nov 23, 2008 - 04:33 PM GMT Reuters: Financials need at least $1 trillion - analyst

Reuters: Financials need at least $1 trillion - analyst

“The US financial system still needs at least $1 trillion to $1.2 trillion of tangible common equity to restore confidence and improve liquidity in the credit markets, Friedman Billings Ramsey analyst Paul Miller said.

“Eight financial companies - Citigroup, Morgan Stanley, Goldman Sachs Group, Wells Fargo, JPMorgan Chase, AIG, Bank of America Corp and GE Financial - are in greatest need of capital, he said.

“‘Debt or TARP capital is not true capital. Long-term debt financing is not the solution. Only injections of true tangible common equity will solve the current crisis,' he said.

“Currently, the US financial system has $37 trillion of debt outstanding, he noted.

“Combined, these eight companies have roughly $12.2 trillion of assets and only $406 billion of tangible common capital, or just 3.4%, the analyst said.

“Miller said these institutions need somewhere between $1 trillion and $1.2 trillion of capital to put their balance sheets back on solid ground and begin to extend credit again, given their dependence on short-term funding and the illiquid nature of their asset bases.”

Source: Reuters , November 20, 2008.

Mr Mortgage: The great mortgage modification pump

“Reworking loans to make ‘payments affordable' without permanently reducing principal balances is the worst possible thing that can be done because it ensures the housing and foreclosure crisis will be with us for a long time. If these programs are widely accepted, housing is a dead asset class indefinitely …

“This style of modification does not sit well with owners of mortgage securities either, which make up the bulk of distressed mortgages. This is because deferred interest, 40-year terms and interest only teaser periods, greatly reduces the cash flows and lengthens the duration of the security.”

Source: Mr Mortgage , November 19, 2008.

Credit Suisse: More fiscal action needed to ease crisis

“The US, Europe and Japan are in significant recession, says Giles Keating, Head of Global Research at Credit Suisse. He explains how the financial crisis is evolving and why capital injections are needed.”

Source: Credit Suisse , November 12, 2008.

The Wall Street Journal: Discussing the Great Depression

“Dorothy Womble and William Hague survived the Great Depression. They share their stories of living during that time as children.”

Source: The Wall Street Journal , November 14, 2008.

Reuters: Fed's Hoening - Fed has done “as much as it can”

“Kansas City Federal Reserve President Thomas Hoenig said on Monday the US central bank has done what it can to buffer the economy through a downturn, and a painful process of readjustment is likely ahead.

“‘The Fed has done about as much as it can do,' he said in an interview on PBS's Nightly Business Report. Interest rates are already extremely low, he noted, according to a transcript of the program.

“‘We might put it out there, but banks are not able to, given their own capital constraints, able to lend as aggressively,' he added.

“Hoenig said he was surprised at how quickly economic activity has slowed, but that a sharp reversal of consumption was clearly a key development.

“‘The consumer factor was a major part of the strong slowdown and the actual entering into the recession,' he said.

“‘Part of it is working through the deleveraging,' he said. ‘I don't know of any painless way to rebalance your economy, you have to go through this adjustment, and we will get through it, but it's not going to be without consequence,' he added.”

Source: Mark Felsenthal, Reuters , November 17, 2008.

Bloomberg: NABE's Varvares says US recession to extend into 2009

“Chris Varvares, president of Macroeconomic Advisers LLC and president of the National Association for Business Economics, talks with Bloomberg about the results of NABE's survey of business economists.”

Source: Timothy R. Homan, Bloomberg , November 17, 2008.

Bloomberg: Nouriel Roubini - “I fear the worst is yet to come”

Source: Bloomberg , November 20, 2008.

Clusterstock: Roubini - How are we screwed? Let us count the ways

“Nouriel Roubini weighs in with another treatise of doom, this time focused on consumer spending. He lists 20 reasons consumer spending is headed to hell in a handbasket, taking the economy down with it. We're short on Prozac, so we'll summarize only a handful here, and we'll let Nouriel take it away:

“Today's news about October retail sales (-2.8% relative to the previous month and now down in real terms for five months in a row) confirm what this forum has been arguing for a while, i.e. that the US has entered its most severe consumer-led recession in decades. At this rate of free fall in consumption real GDP growth could be a whopping 5% negative or even worse in Q4 of 2008. And this is not a temporary phenomenon as almost all of the fundamentals driving consumption are heading south on a persistent and structural basis …”

Source: Henry Blodget, Clusterstock , November 15, 2008.

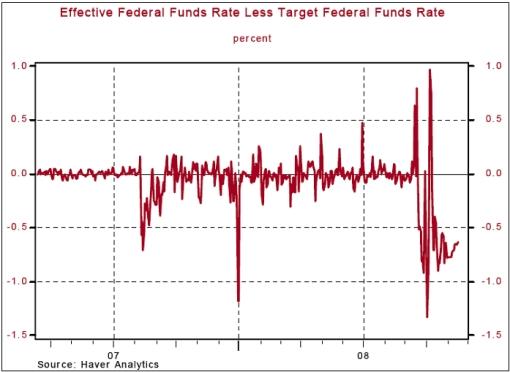

Asha Bangalore (Northern Trust): What is the Fed's next move?

“The minutes of the October 28 to 29 FOMC meeting were published this afternoon [Wednesday]. The main thrust of these minutes is that economic growth is the topmost concern. The minutes noted that ‘members also saw the substantial downside risks to growth as supporting a relatively large policy move at this meeting, though even after today's 50 basis point action, the Committee judged that downside risks to growth would remain. Members anticipated that economic data over the upcoming intermeeting period would show significant weakness in economic activity, and some suggested that additional policy easing could well be appropriate at future meetings.'

“The target rate was lowered to 1.0% on October 29, with the effective rate trading between 22 bps and 37 bps since then. Is there a benefit to lowering the Federal funds rate? A lower Federal funds rate, as suggested in the minutes of the October 28-29 meeting, would only accomplish validating the already low effective Federal funds rate. It is possible the Fed could cut the Federal funds rate and abandon attempting to manage the effective rate such that it trades close to the target rate. It appears that the Fed may be considering the possibility of a zero federal funds eventually, if economic conditions warrant it.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , November 19, 2008.

Bloomberg: Fed to cut rates to zero on deflation risk, JPMorgan predicts

“The US Federal Reserve will probably cut interest rates to zero percent over the next two months to staunch deflation, according to JPMorgan Chase.

“The Fed will lower borrowing costs by 50 basis points at each of the next two policy meetings on December 16 and January 28, JPMorgan economist Michael Feroli wrote in a note to investors yesterday. The central bank will hold rates at zero for the rest of 2009 to prevent prices from spiraling down as companies cut jobs and banks reduce lending, stifling spending, Feroli said.

“The Fed may not be the only central bank to begin offering free money to jolt life into their recessionary economies and keep prices rising as the 15-month credit crisis deepens. The Bank of Japan cut its benchmark rate to 0.3% last month, and the European Central Bank has signaled it's ready to lower rates further after two reductions in the past six weeks.

“‘Taking the target rate to zero percent would not be costless for the Fed,' Feroli said. Public confidence may drop ‘if there is a perception that the Fed has run out of ammo'.”

Source: Jason Clenfield, Bloomberg , November 20, 2008.

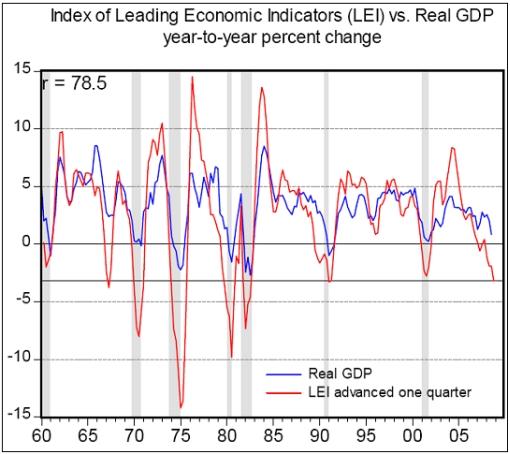

Asha Bangalore (Northern Trust): Leading index points to further weakening of economy

“The Conference Board's Index of Leading Economic Indicators (LEI) dropped 0.8% in October after a revised 0.1% increase in September. The LEI has dropped in four of the last six months. On a year-to-year basis, the LEI has dropped 3.5%, the largest monthly decline for the current cycle.

“The LEI has sent a reliable warning of weakening economic conditions for all recessions since 1960, with the exception of the 1967 dip (the economy was weak in this period but it was not a recession).”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , November 20, 2008.

Asha Bangalore (Northern Trust): Industrial production is significantly weak

“The headline industrial production index rose 1.3% in October, after a 3.7% drop in September. The September estimate now shows a larger drop than the original estimate of a 2.8% decline due to revised estimates of the impact of Hurricanes Gustav and Ike on the chemical industry. According to the Fed, excluding the special factors of hurricanes and Boeing strike, industrial production dropped 2/3 percent in both September and October.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , November 17, 2008.

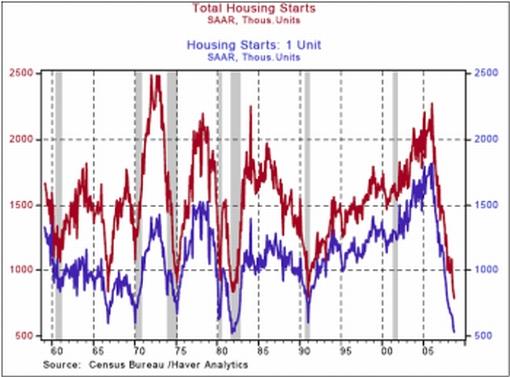

Asha Bangalore (Northern Trust): Decline in housing starts stress persistence of housing turmoil

“Total housing starts dropped 4.5% to an annual rate of 791,000 in October, reflecting a decline in starts of both multi-family and single-family units. These numbers along with the record low of the Housing Market Index of the National Association of Home Builders in November imply that the bottom of housing starts is not here yet.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , November 19, 2008.

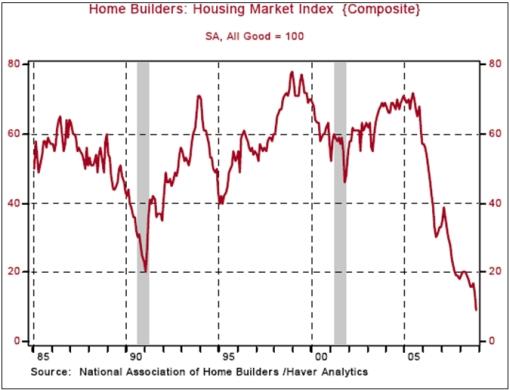

Asha Bangalore (Northern Trust): Housing market update - grim news bolsters Sheila Bair's plan to stem the crisis

“The grim housing market news continues to support opinions that the mortgage problem is the key to a resolution of the current financial market crisis. The crux of the issue is that falling home prices, foreclosures, and rising inventories need to be replaced by more stable conditions for the economy to turnaround. The National Association of Home Builders reported in the November survey that the Housing Market Index fell to 9.0 from 14.0 in October to establish a new record.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , November 18, 2008.

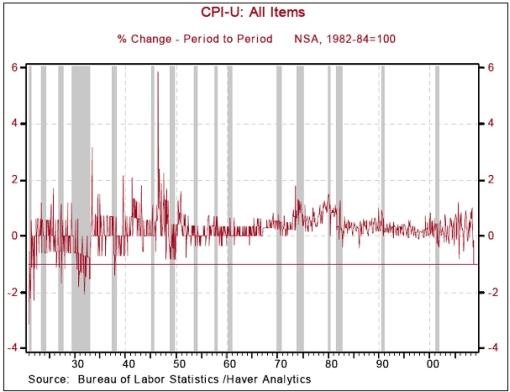

Asha Bangalore (Northern Trust): Consumer Price Index plunges

“Today the BLS reported that the Consumer Price Index (CPI) fell by 1.0% both seasonally adjusted as well as unadjusted. On an unadjusted basis, this was the largest monthly decline in the CPI since January 1938.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , November 19, 2008.

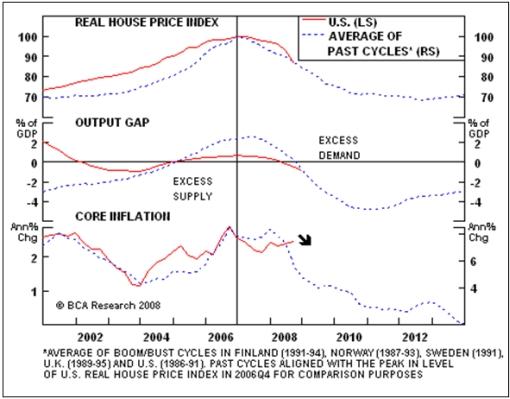

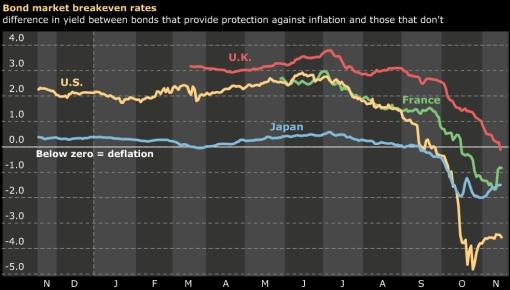

BCA Research: Heading for deflation?

“A deflation scare will grip the developed world over the next 12 to 24 months.

“Our research on past real estate bear markets and subsequent banking sector stress (throughout Europe, the US and Japan) highlights that these episodes always lead to a recession, followed by a multi-year period of sub-par growth (i.e. negative output gap). In turn, excess supply helps dramatically drive down core CPI inflation in the years that follow. Granted, it could be argued that the previous episodes occurred during a period of strong structural disinflationary trends, thereby amplifying the magnitude and duration of the decline in price pressures.

“Nonetheless, core CPI inflation is likely to drop sharply throughout the G7 over the next 12 to 24 months, to lows at least comparable to the 2003 deflation scare. In turn, it is likely that the US prints very low positive or even mildly negative headline CPI numbers, given the drag resulting from the recent plunge in food and energy prices.

“Headline inflation is less likely to turn negative in Europe given the rigidity of the price structure but a deflation scare similar to the US earlier this decade is likely. The implication is that policymakers will continue to ease aggressively and then stay on hold for an extended period, benefiting our long duration call. “While the longer-term consequences of such actions may be inflationary, government bond yields will adjust lower in the near term.”

Source: BCA Research , November 17, 2008.

Bloomberg: Bond-market yields signal deflation worldwide

“Bonds worldwide are showing that investors are betting that slumping economic growth will lead to deflation in every major economy. Britain's five-year breakeven rate went negative Tuesday for the first time since Bloomberg records began in 1996.”

Source: Bloomberg , November 19, 2008.

Financial Times: In a weird world, yields on Tips point to deflation

“Would you believe that we shall actually have significant deflation in the US next year? And the year after that? And flat consumer prices for the year following? That's happened only once in a developed country since the 1930s - when Japan recorded a negative 1.6% consumer price index for 2002.

“Yet, if you believe the yields on US Treasury inflation protected bonds, or Tips, we shall have a 2.2% fall in prices in 2009, a 2.5% decline in 2010 and only flat prices in 2011. If that turns out to be true, the real interest rate burden on even the highest-rated borrowers will be extremely hard to bear.”

Source: John Dizard, Financial Times , November 18, 2008.

John Davies (WestLB): Buy German bunds

“The 10-year German Bund yield could fall to a record-equalling 3 per cent in the months to come in response to worries about the eurozone economy, believes John Davies, bond analyst at WestLB.

“‘Given the contracting economy and mounting threat of deflation, we now expect the European Central Bank to cut rates to 1.5% by the summer [from 3.25% now], which is lower than the market expects,' he says.

“Mr Davies notes that the rapid steepening of the spread between two-year and 10-year German yields, which started in September, has slowed as the market moves to price in rates of 2% by the spring.

“But he says: ‘Given our forecast of a more aggressive ECB rate cut cycle, we fully expect the curve-steepening trend to remain safely intact.'

“While the steepening will primarily be driven by moves at the short end of the curve, long-end yields will fall as recession fears overshadow a jump in new issuance, Mr Davies says.

“‘We expect the 10-year yield to fall from 3.6% to 3.25% within the next three-to-six months, and even test the 3% record low set in September 2005. It is only the rise in supply next year that stops us projecting a sub-3% yield.'”

Source: John Davies, WestLB (via Financial Times ), November 18, 2008.

Bloomberg: China passes Japan as biggest US Treasuries holder

“China surpassed Japan in September to become the biggest foreign holder of US Treasuries, as foreign investors sought the relative safety of government debt as stocks plunged 9.1% that month.

“Total net purchases of long-term equities, notes and bonds increased a net $66.2 billion in September from $21 billion the previous month, the Treasury said today in Washington. Including short-term securities such as stock swaps, foreigners bought a net $143.4 billion, compared with net buying of $21.4 billion the month before.

“China led all foreign official investors in September by posting a net increase in US Treasuries for the sixth month in the past seven, bringing its total ownership close to $600 billion. Japan was a net seller of Treasuries for the fourth month in the past six.

“‘The details of the report paint a much more positive picture of cross-border investments than expected,' said Michael Woolfolk, a senior currency strategist at Bank of New York Mellon Corp. ‘China, along with others, is showing more demand than anticipated for US assets.'”

Source: John Brinsley and Rebecca Christie, Bloomberg , November 18, 2008.

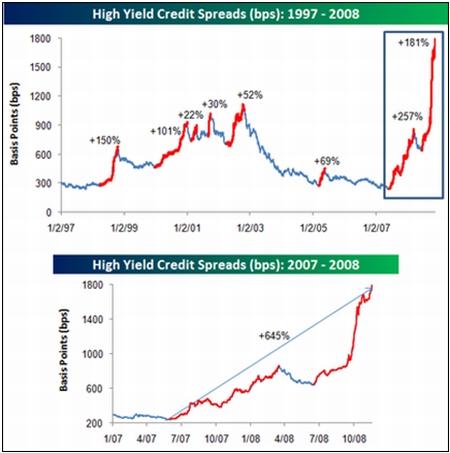

Bespoke: High yield spreads - no slowdown in sight

“If you're looking for signs of stabilization in the credit markets, the high yield market is not a good place to start. Based on data from Merrill Lynch, high yield bonds are yielding nearly 1,800 basis points more than comparable Treasuries. In the last month alone, spreads have risen by more than 200 basis points, and since bottoming in the Summer of 2007 at 241 basis points, they are up 645%. To put this in perspective, with the 10-year US Treasury now yielding 3.4%, a high-yield borrower would need to pay roughly 21.4% per year to take out a ten-year loan. With terms like these, who needs loan sharks?”

Source: Bespoke , November 19, 2008.

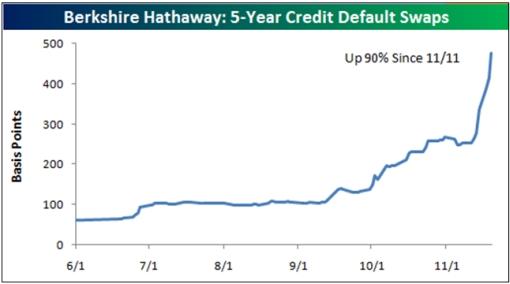

Bespoke: Financial weapons of mass destruction aimed at Omaha

“Warren Buffett is credited with coining the phrase ‘financial weapons of mass destruction' with respect to derivatives. However, after some big unrealized losses on index options that Berkshire has written in the last couple of years, it now appears as though the derivative market is taking aim at Omaha. Over the last eight days, the cost to insure debt of Berkshire Hathaway has risen to 475 basis points per year. To put this into perspective, Morgan Stanley's credit default swaps are currently trading at 456 basis points, and that is the highest of the big global banks and brokers. Berkshire Hathaway has long been considered one of the safest of the safest financial companies, but if Black October 2008 has taught us anything, it's that nothing is safe.”

Source: Bespoke , November 20, 2008.

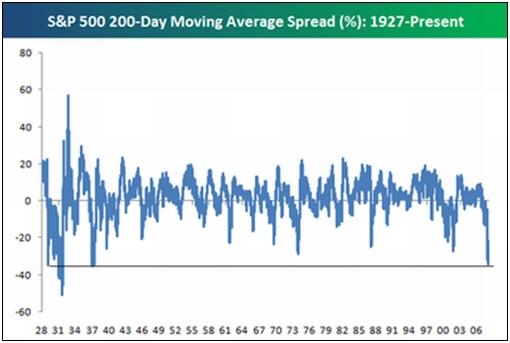

Bespoke: S&P 500 200-day moving average spread at -32%

“Multiple market pundits have recently mentioned that the S&P 500 is trading the furthest below its 200-day moving average since the Great Depression. Below we have plotted the 200-day spread indicator going back to 1927. The index is currently trading 32% below its 200-day moving average, which is indeed the most negative spread since 1937. While the spread can remain negative for quite some time, the reaction to the upside has been extreme once the market turns. In the 1930s, and even following the big declines in the 70s, 80s, and early 2000s, the spread turned violently positive in the months following the ultimate low in the 200-day spread. Unfortunately, nobody knows when that low will be.”

Source: Bespoke , November 17, 2008.

Barron's: Reversal of fortunes between stocks and bonds

“… the dividend yield on the Standard & Poor's 500 stock index touched 3.57% at 1:13 PM Eastern time [on Tuesday], exceeding the 3.54% yield on the benchmark Treasury 10-year note, according to Bloomberg News. That's something that hadn't happened since 1958.

“I was aware that there was a time when equities provided more income than bonds, but that belonged to a long-gone era. That was a time I knew of only from old movies, yellowed newspaper clippings and stacks of old Life magazines. It was when gentlemen wore suits and fedoras, not just to work but even to the ballpark; when the Dodgers played in Brooklyn; a bygone era already a half century ago.

“To contemporary market observers, it's more than nostalgia. For the S&P 500 to yield more than Treasuries suggests the market is very cheap by historical standards, says Jack Ablin, portfolio strategist for Harris Private Bank. ‘Dividend yield, like price-to-sales, is one of those persistent metrics. We can all quibble about earnings, but dividends, particularly those of the entire S&P 500, are remarkably consistent,' he adds.

“‘You can fake earnings through account hanky-panky, but you cannot fake dividends,' agrees Barry Ritholtz, chief executive of Fusion IQ. So after a 47% drop, stocks look relatively cheap for the first time in a long time, he adds.

“Scott Minerd, chief investment officer for Guggenheim Partners, calls the drop in Treasury yields below the S&P 500 dividend yield a ‘straw in the wind' that the stock market may be bottoming. Still, he thinks the market is signaling that dividend cuts are in the offing, but this recessionary trend also will push Treasury yields still lower.”

Source: Barron's , November 19, 2008.

John Authers (Financial Times): US stocks fall on deflation fears

Source: John Authers, Financial Times , November 19, 2008.

Frank Holmes (US Global Investors): An emotionally impaired market

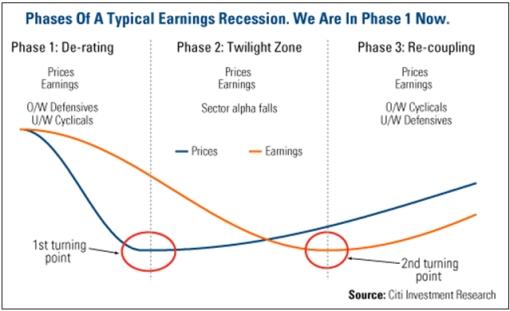

“Global equities are now trading on their lowest valuations since the early 1980s. History says we should expect stock prices to turn up before earnings do. A recovery in earnings, when it happens, has previously been a robust second leg for more significant price appreciation. The second leg will take place when the earnings recession ends and profits begin to recover. Investment research based on historical patterns by Citigroup suggests the second leg is about 12 months away. With this in mind, we're nibbling on stocks we believe are undervalued based on fundamental screens and have been hit the hardest as candidates for price appreciation.

“Weak earnings and expectations of more bad news to come have weighed heavily on stock prices. The global equity market trades on 10 times trailing earnings and over 15 times expected trough earnings. The 40-year average global price-to-earnings ratio is 17 times. Citigroup's research demonstrates that the global equity market is extremely undervalued, but valuations could continue to fall through year end.

“We believe the market and economy are now being emotionally impaired due to the cascading negative news by unbalanced media. Today [Friday] is the first day this week without negative grandstanding politicians on TV and the market was up. Stocks are so oversold and markets, as we have commented in the past, are due for a substantial rally. We believe the market is looking for certainty that President-elect Obama and his team are not going to raise taxes in this economic environment. If the new administration reverses course and denounces tax hikes for two years and proposes a budget to rebuild our infrastructure, then this week could have been the bottom for the market.”

Click here for article by Robert Buckland, Citigroup's Chief Global Equity Strategist.

Source: Frank Holmes, US Global Investors - Weekly Investor Alert , November 21, 2008.

Bespoke: Trailing 12-month P/E ratios are low

“The S&P 500 Financial, Consumer Discretionary, and Telecom sectors currently have negative P/E ratios, which makes the overall index's P/E high at 18.41. Sectors whose P/Es aren't negative have very low trailing P/Es versus historical readings. The Energy sector currently has the lowest P/E at 6.55. The second lowest is Materials at 9.14, followed closely by Industrials at 9.44. And the Technology sector, which usually has a relatively high P/E, currently has a P/E of just 12.49.”

Source: Bespoke , November 17, 2008.

Bloomberg: Mobius says he's buying China, India, South Africa

“Mark Mobius said he's ‘aggressively' buying consumer stocks, including cell-phone companies, retailers, banks and furniture makers, as faster economic growth in China, India, South Africa and Turkey offsets sagging demand from developed nations.

“‘We see a consumer boom in all of those countries,' Mobius, who oversaw more than $24 billion in emerging-market stocks on September 30 as executive chairman at Templeton Asset Management, said in a Bloomberg Television interview from Johannesburg. ‘Per-capita income is growing at a very rapid pace in these countries.'

“China announced a $586 billion stimulus plan on November 9 after its gross domestic product grew 9% in the third quarter, the slowest pace in five years. India's central bank estimates growth will slow to 7.5% this year and next, from an annual average of 8.9% in the past four years. Emerging markets will expand at an average of 5% in 2009, compared with 1% in developed countries, Mobius forecast on October 21.

“The global economic downturn may not be as long or severe as expected because of the coordinated fiscal and monetary stimulus put forth by policy makers worldwide, the 72-year-old investor said today.

“The slowdown ‘will be rather short-lived and, of course, the markets will anticipate this', Singapore-based Mobius said. ‘There will be some deceleration, but these are still fast- growing countries.'”

Source: Fabio Alves and Monica Bertran, Bloomberg , November 17, 2008.

David Powell (Bank of America): Is the dollar's recent rally coming to an end?

“David Powell, currency strategist at Bank of America, believes the dollar has lost several important sources of support.

“The global shortage of dollar liquidity - one of the primary reasons for the US currency's strength as the financial crisis escalated in September - has been sharply reduced by the extraordinary measures introduced by central banks to ease money market stress, he says.

“Furthermore, the repatriation of the dollar, which prevented its retracement as tensions in the wholesale funding markets were reduced, may no longer provide the currency with much support moving forward. Private sector flow data indicate the repatriation of foreign investments to the US is slowing sharply, Mr Powell says.

“‘A third factor behind the resilience of the dollar seems to have been the steady return offered by longer-dated US Treasuries, when compared with the sharp drop in German Bund yields. However, the fall in the euro against the dollar appears excessive even when compared to drop in the 10-year Bund-Treasury yield spread.

“‘In addition, a dollar retracement is likely to gain momentum from the pattern of seasonal weakness normally seen in December. As such, we affirm our year-end euro/dollar forecast of $1.38 and outlook for a return to $1.44 by the first quarter of 2009 before the pair resumes a more gradual sell-off.'”

Source: David Powell, Bank of America (via Financial Times ), November 19, 2008.

Financial Times: Jim Rogers - the dollar is a flawed currency

The following is an excerpt from an online interview with Jim Rogers.

“FT: It's a year since we last interviewed you. You were aggressively bearish about the dollar, but you thought there would probably be a rebound and you would take that as an opportunity to further get out of the dollar. Have you made a further exit from the dollar?

“JR: Not yet, no. And the reason I haven't is because we're in a period of forced liquidation of everything. We've only had eight or nine periods like this in the past 150 years, where everybody has to reverse their positions on everything. There is a gigantic short position in the dollar and they're all having to cover as they reverse their positions, so this rout is going to go on much further than I would have expected, to my delight, because then I'll get to sell at higher prices. I don't know whether I'll get out this month or this year even, maybe next year, but I do plan to get out of the rest of my US dollars, because this is an artificial rally caused purely by short covering.

“FT: How will you tell when that deleveraging is finally over?

“JR: I'm sure I won't get it right, but I do hope that when there's a lot of euphoria about the dollar and everybody's saying, well, see, there's no problem with the dollar … I hope I'm smart enough to recognise it and finally get out of the dollar, because it is a flawed and maybe, even, doomed currency.

“FT: Do you see the sell-offs we've seen in commodities as a drastic correction?

“JR: Well, we're in a period of forced liquidation of all assets … we're getting the business cycle effect on demand right now, certainly, but unless the world's in perpetual economic decline, commodities are the only thing going to come out of this okay.

“FT: Does this mean you're actually buying back into commodities at the moment, or is this an area you're standing clear of?

“JR: No, no. In October when I started covering my shorts in the US stock market, I started buying Chinese shares, Taiwan shares, I started buying commodities again. No, no, I've added to those positions.

“FT: What's your strategy towards emerging market stocks?

“JR: My hope is that I'm smart enough and brave enough at some point along the line to buy some of them back. But I'm not even thinking about it right now … The world's financial situation is in a mess, and there are a lot of people who have to liquidate. I mean, we must have had 30,000 MBAs flying around the world looking for emerging markets. All of that money has got to come home.

“FT: How do you think the world should go about redesigning the regulatory system, and are you worried that we're going to end up with a swing towards over-regulation?

“JR: Well, we probably will, The problem is that people like Alan Greenspan would never let the market work … For 15 years, under Greenspan, and now Bernanke, they would not let the market work. Had they let Long-Term Capital Management fail back in 1998, we wouldn't have these problems now, I assure you. Lehman Brothers would have been smashed. Goldman Sachs, Bear Stearns, would have been smashed. We wouldn't have these problems now. That only happened because every time they turned around they propped these guys up, gave them more money, and that's why we have the problem … But now, of course, they're going to blame it on other people and cause more regulations.

“FT: You're arguing we need to allow some more big institutions to fail?

“JR: One failed. Why didn't they let Fannie Mae and Freddie Mac? I mean, I was short Fannie Mae, and they should have let it fail, go to zero. AIG, they should have let it fail, they should have let all of these guys fail, and we would clean out the system … What they're doing is they're taking the assets away from the competent people, giving them to the incompetent people and saying to the incompetent: ‘Okay, now you can compete with the competent people, with their money.' I mean this is terrible economics. This is outrageous economics.”

Source: Jim Rogers, Financial Times , November 17, 2008.

Bloomberg: China should buy gold for reserves, Association says

“China, the second-biggest overseas holder of US Treasuries, should increase its bullion holding to diversify its reserves because the dollar may decline, the country's gold association said.

“‘China should have at least several thousand tons of gold in its reserves, five to six times the officially announced 600 tons,' Hou Huimin, vice chairman of the China Gold Association said from Beijing. The group represents producers, traders and retailers.

“The US budget deficit climbed to a record in October, and some investors are betting the dollar may weaken as the Treasury would need to sell more debt to finance its $700 billion financial-rescue package. Gold has tumbled 29% from its March record.

“‘There's no doubt that gold would be attractive, as US debt is likely to swell,' said Kenichiro Ikezawa, who oversees about $3 billion as a fund manager at Daiwa SB Investments in Tokyo. ‘In the long term, both the dollar and Treasuries will probably weaken. It's possible that China will buy more gold, though the country is likely to do so gradually.'”

Source: Xiao Yu and Ron Harui, Bloomberg , November 14, 2008.

Reuters: Iran switches reserves to gold

“Iran has converted financial reserves into gold to avoid future problems, an adviser to President Mahmoud Ahmadinejad said in comments published on Saturday, after the price of oil fell more than 60% from a peak in July.

“Iran, the world's fourth-largest oil producer, is under UN and US sanctions over its disputed nuclear programme and is now also facing declining revenue from its oil exports after crude prices tumbled.

“‘With the plans of the presidency … the country's money reserves were changed into gold so that we wouldn't be faced with many problems in the future,' presidential adviser Mojtaba Samareh-Hashemi was quoted as saying by business daily Poul.

“Iranian officials in July denied reports that Iranian banks were moving funds from Europe, with one report suggesting as much as $75 billion had been withdrawn and converted into gold or placed in Asian banks, because of a threat of tightening sanctions.”

Source: Zahra Hosseinian, Reuters , November 15, 2008.

The New York Post: Global run on gold coins

“There's a worldwide run on gold coins. Even as the price of the precious metal itself comes under pressure along with commodities like oil and copper, people around the world are demanding so many of the valuable coins that government mints are having difficulty filling orders.

“A spokesperson for the US Mint tells me that gold coins in this country, for the past month, ‘are being allocated because of an increased demand'.

“And the price that the government charges coin dealers has recently been increased by as much as 10% for a 10-ounce coin.

“And even when gold coins are available, dealers report that customers are paying a bigger premium than they would have just a few months ago.

“In one sense, the attraction for gold coins isn't surprising. Since ancient times, gold has been considered the safest investment to hold in times of uncertainty.

“With fears of future inflation rising and concern about the value of paper currency and government-debt increasing with each new recovery plan announced in Washington and in foreign capitals, the desire to hold gold grows.

“That part makes perfect sense. But there's another more puzzling aspect to the recent gold rush. Even as the demand for gold coins such as the Canadian Maple Leaf or the Krugerrand of South Africa has grown, the market price of the precious metal itself is off its highs.

“Bill Murphy, chairman of the Gold Anti-Trust Action Committee, says the price of spot gold is even more perplexing given the demand for coins and the fact that central banks in Europe have stopped selling gold into the open market.

“‘Gold should be moving up,' Murphy says. ‘How could there be such a dichotomy between the historic high premium for coins all over the world and the low Comex price?'

“His answer? ‘Today the public is buying gold like crazy, but the US government and the banks that hold bullion are intentionally keeping the price down.'”

Source: John Crudele, New York Post , November 18, 2008.

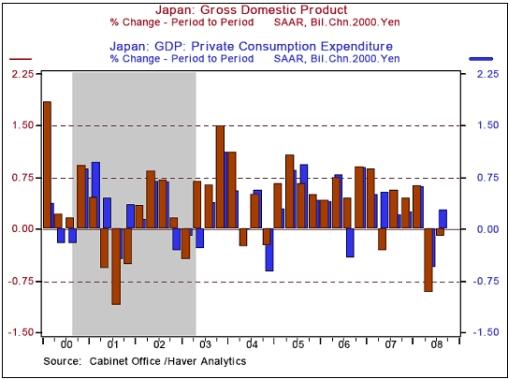

James Pressler (Northern Trust): Japan enters first recession in 7 years

“Today's indicators out of Japan confirmed what we had expected - that Japan is in recession, though the consensus believed there were enough one-offs to growth to keep the headline figure on the positive side of zero. Real GDP contracted by 0.1% from the previous quarter after a sharper fall of 0.9% in Q2 (originally -0.7%), with Q3 consumption rising by 0.3% after a fall of 0.6%. True, there were factors that perked up private consumption, but they were not enough to overcome a weak net exports figure that will only get worse in the coming quarters.”

Source: James Pressler, Northern Trust - Daily Global Commentary , November 17, 2008.

YouTube: Bloomberg Voices - Japan enters recession

Source: YouTube , November 17, 2008.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.