Is the tide turning for the Stock Market?

Stock-Markets / Global Stock Markets Nov 27, 2008 - 07:35 AM GMT I posed the following question a few days ago: “ Does the stock market rally have legs? ” We have now had four days in a row of a higher market, something we have not seen since June this year. This is also the S&P 500 Index's biggest four-day surge (+18.0%) since 1933.

I posed the following question a few days ago: “ Does the stock market rally have legs? ” We have now had four days in a row of a higher market, something we have not seen since June this year. This is also the S&P 500 Index's biggest four-day surge (+18.0%) since 1933.

A sharply weaker opening yesterday as a result of a barrage of gloomy economic reports was followed by a reversal on the news of former Fed Chairman Paul Volcker's appointment to a new White House Economic Recovery Advisory Board tasked to revive growth in the US. Involving the 81-year Volcker in this way is a smart move by President-elect Obama.

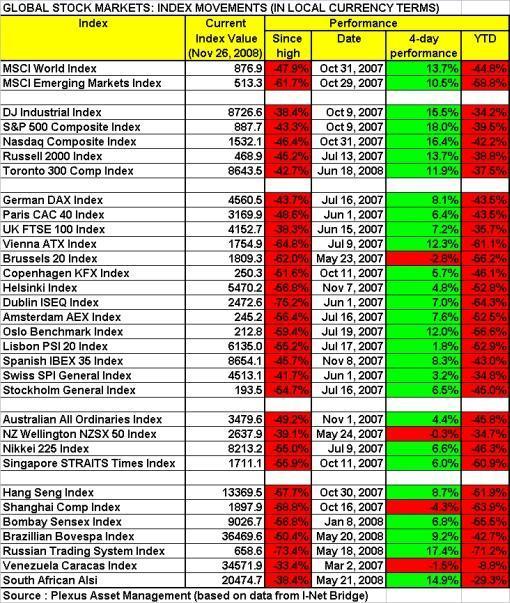

The table below shows the performances of various global stock markets over the past four trading days, as well as figures since the respective markets' highs and for the year to date (all in local currency terms).

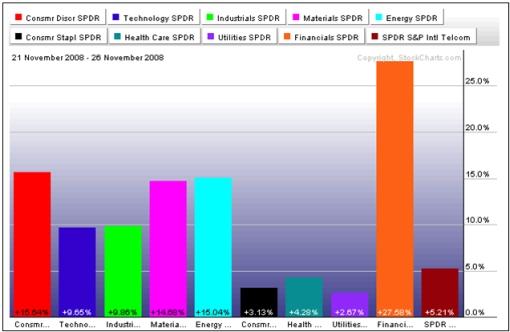

The gains of the various US stock market sectors since the November 20 lows make for interesting reading, with previous laggards such as financials, consumer discretionary, energy and materials showing the defensive sectors (health care, utilities and consumer staples) a clean pair of heels.

Interestingly, according to Bloomberg , Société Générale global equity strategist James Montier said he's never been so bullish after the financial crisis dragged down prices of stocks, corporate bonds and inflation-protected government debt.

“This is a value investor's version of heaven. From a bottom-up perspective, the equity market is offering some excellent companies at truly bargain prices for those with the fortitude to shut their eyes, or at least switch off their screens and buy.

“With all of these opportunities available I have never been more bullish! Will I be early? Almost certainly yes, but if I can find assets with attractive returns and I have a long time horizon I would be mad to turn them down.”

Barton Biggs of Traxis Partners , according to the Financial Times , said: “I have no idea when the next bull market starts, but I do think we are setting up for the mother of all bear market rallies.” He motivates this viewpoint as follows:

• “Stocks around the world are very cheap.”

• “Stock markets have been obliterated and are deeply oversold.”

• “The fabric for economic healing is developing.”

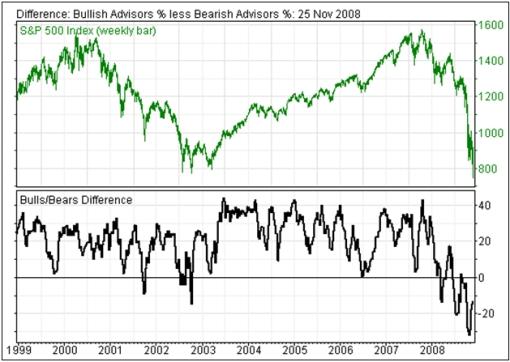

• “We must be pretty close to maximum bearishness.”

On the last bullet, Investors Intelligence points out that its sentiment indicator has improved from its historical mid-October low of -32.2% (i.e. percentage bearish advisors less percentage bullish advisors) to -15.1% - still signaling low risk to accumulate shares.

Another important development regarding sentiment is the fact that the CBOE Volatility Index (VIX) is threatening to drop below its 50-day moving average for the first time in almost three months. Given the inverse relationship between the VIX and stocks, this is good news for equity bulls.

Should the bullish seasonal tendencies hold true on this occasion, possible first targets are the November 4 highs of 9,625 for the Dow and 1,006 for the S&P 500. This will also result in both indices clearing their 50-day moving averages (see my post “ Does the stock market rally have legs? ” for a summary table of the key levels).

The question remains: have we seen an important turn to the upside? According to Richard Russell ( Dow Theory Letters ) we've had ten 90% down-days since September, followed by a 90% up-day on November 24. If the tide is in the process of turning up, we should now see a series of strong sessions. I will be keeping a close eye on market breadth in particular.

Although there is as yet little evidence that we are leaving the corpse of the bear behind (especially with Q4 earnings disasters looming in January), it would appear that the nascent rally could have more steam left.

All that remains is to say a big thank you to my readers for your support and friendship and wish you a joyous Thanksgiving!

Source: VosieSales

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.