Credit Crisis Watch- LIBOR Eases Whilst UK Spread Soars on Sovereign Debt Risks

Interest-Rates / Credit Crisis 2008 Nov 28, 2008 - 01:23 PM GMT

For the world's financial system to start functioning normally again, it is imperative that confidence in the credit markets be restored. In order to gauge the progress being made to unclog credit markets, I regularly monitor a range of financial sector spreads and other measures. By perusing these one can ascertain to what extent the various central bank liquidity facilities and capital injections are having the desired effect.

For the world's financial system to start functioning normally again, it is imperative that confidence in the credit markets be restored. In order to gauge the progress being made to unclog credit markets, I regularly monitor a range of financial sector spreads and other measures. By perusing these one can ascertain to what extent the various central bank liquidity facilities and capital injections are having the desired effect.

I am planning on updating this “Credit Crisis Watch” regularly as I believe a grip on the credit situation will be key to determining the appropriate investment strategy.

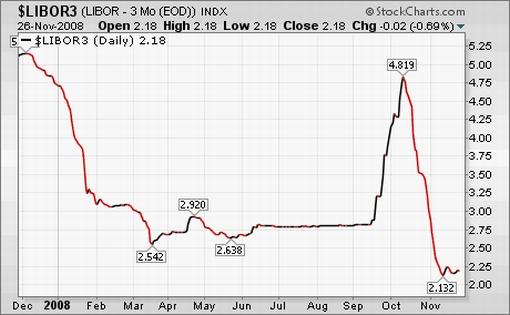

First up is the three-month dollar LIBOR rate. After having peaked on October 10 at 4.82%, the rate declined sharply to 2.13% on November 12, but the healing process has since experienced a setback with the rate edging up to 2.18%. LIBOR trades at 118 basis points above the Fed's target rate of 1.0%, compared with 43 basis points at the start of the year.

Source: StockCharts.com

Importantly, the US three-month Treasury Bills are trading at a minuscule 0.071%, indicating that liquidity is still being hoarded.

US three-month Treasury Bill rate

Source: The Wall Street Journal

The TED spread (i.e. three-month dollar LIBOR less three-month Treasury Bills) is a measure of perceived credit risk in the economy. This is because T-bills are considered risk-free while LIBOR reflects the credit risk of lending to commercial banks. An increase in the TED spread is a sign that lenders believe the risk of default on interbank loans (also known as counterparty risk) is increasing. On the other hand, when the risk of bank defaults is considered to be decreasing, the TED spread narrows.

Since the TED spread's peak of 4.65% on October 10, the measure eased to 1.75%, but has since worsened to 2.10%.

Source: Fullermoney

The difference between the LIBOR rate and the overnight index swap (OIS) rate is another measure of credit market stress.

When the LIBOR-OIS spread is increasing, it indicates that banks believe the other banks they are lending to have a higher risk of defaulting on the loans so they are charging a higher interest rate to offset this risk. The opposite applies to a narrowing LIBOR-OIS spread.

The movement in the LIBOR-OIS spread over the past few weeks is similar to the TED spread and shows that credit markets are still not functioning smoothly.

Source: Fullermoney

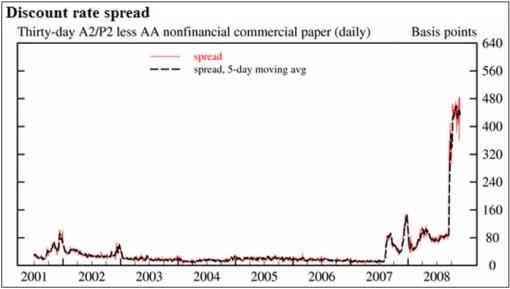

As far as commercial paper is concerned, the A2P2 spread measures the difference between A2/P2 (low quality) and AA (high quality) 30-day non-financial commercial paper. Although the spread has declined from a record high of 4.83% to 4.27%, it remains at an elevated (i.e. crisis) level.

Source: Federal Reserve Release - Commercial Paper

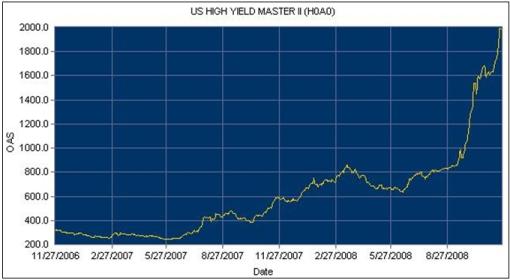

Similarly, junk bond yields continue to scale new highs as shown by the Merrill Lynch US High Yield Index.

Source: Merrill Lynch Global Index System

Another indicator worth keeping an eye on is the Barron's Confidence Index. This Index is calculated by dividing the average yield on high-grade bonds by the average yield on intermediate-grade bonds. The discrepancy between the yields is indicative of investor confidence. A declining ratio indicates that investors are demanding a higher premium in yield for increased risk, showing waning confidence in the economy.

Source: I-Net Bridge

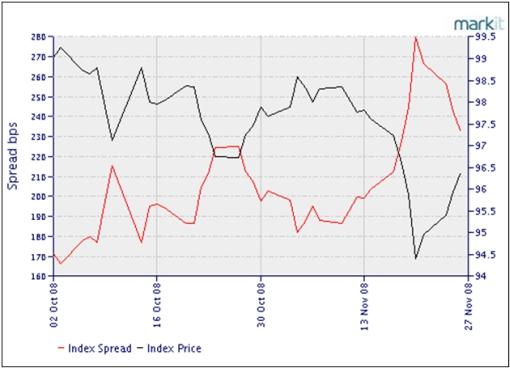

According to Markit , the cost of buying credit insurance for US and European companies eased somewhat over the past week as shown by the narrower spreads (basis points) for the following credit indices:

• CDX (North American, investment grade) Index: down from 267 to 233

• CDX (North America, high yield) Index: down from 1,546 to 1,376

• Markit iTraxx Europe Index: down from 183 to 163

• Markit iTraxx Europe Crossover Index: down from 915 to 869

• Markit iTraxx Japan Index: down from 350 to 320

• Markit iTraxx Asia ex Japan IG Index: down from 452 to 360

• Markit iTraxx Asia ex Japan HY Index: down from 1,375 to 1,218

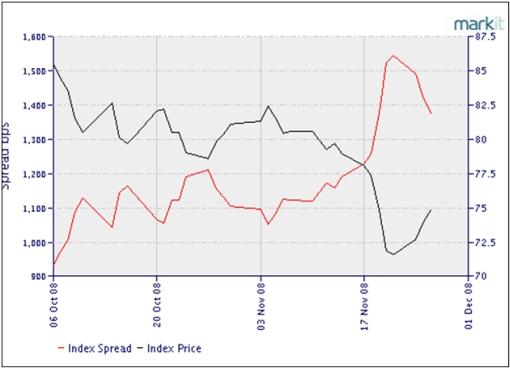

The graphs of the CDX Indices are shown below, with the red line indicating the spreads easing over the past few days.

CDX (North American, investment grade) Index

Source: Markit

CDX (North America, high yield) Index

Source: Markit

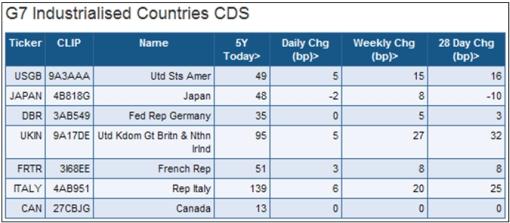

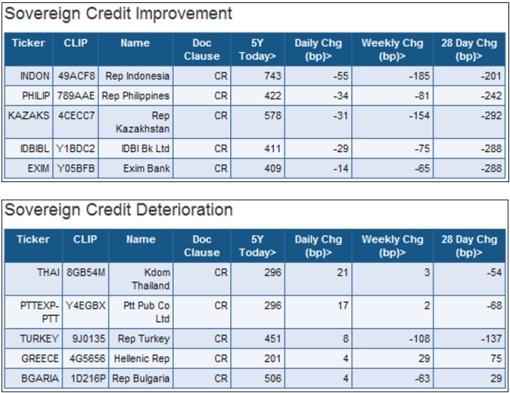

Lastly, some CDS statistics as at November 26, courtesy of Markit . These prices represent the cost per year to insure $10,000 of debt for five years. For example, Italy is in most trouble among the G7 countries with a cost of $139 per year to insure $10,000 of debt.

It is noteworthy that the US and UK CDSs are trading at record levels as unease over the level of national debt takes its toll on their sovereign credit risk.

The TED and the LIBOR-OIS spreads have eased (i.e. narrowed) since the panic levels of October 10, whereas the CDX and iTraxx indices have also shown some improvement over the past few days. However, US Treasury Bills and high-yield spreads are still at distressed levels.

In summary, although some progress has been made as a result of central banks' liquidity facilities and capital injections, the credit markets are not yet thawing.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.