Major Stock Market Test Underway

Stock-Markets / US Stock Markets Dec 02, 2008 - 06:09 AM GMTBy: Marty_Chenard

... because a formidable 6 month resistance is now being tested ...

... because a formidable 6 month resistance is now being tested ...

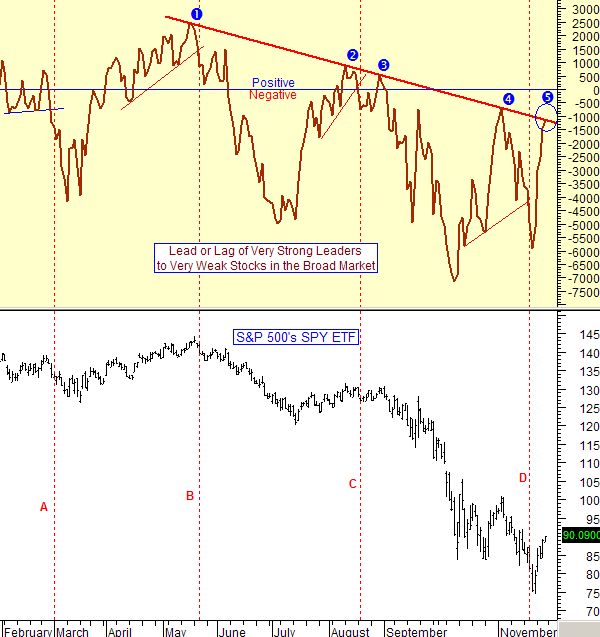

Today, we will share the chart of our "Net Daily Difference between the Very Strong to Very Weak" stocks.

Indicator Explanation : On this indicator, instead of calculating the Ratio, we calculated the difference between the Very Strong to Very Weak daily number of stocks. This shows "the change of balance fight" between how many stocks were shifting between being Very Strong in Strength, or Very Weak in Strength.

The Lead/Lag Indicator of the Very Strong stocks minus the number of Very Weak Stocks moved up close to its resistance line on November 4th. When it got close, it pulled back and moved lower once again.

At the close last Friday, the Lead/Lag Indicator touched the 6 month, down trending resistance line for the 5th time. Here is where it will have a formidable challenge. If it moves above the resistance, it should then move up and test the zero level. If it moves above the zero level, then that would put it in positive territory where market momentum could maintain its movement a while longer. (For a Bear Market upside rally, we would want to see the indicator make it above the resistance line, AND make it above the zero line to move into positive territory. That would be a positive change of balance.)

However, the big test question today is ... Will we break above the resistance or will we fail to the downside like the previous 4 times? (The Lead/Lag Indicator chart updates are posted every morning on our paid subscriber site.)

____________________________________________________________________

*** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.