Central Banks Open the Money Printing Floodgates to fight Deflation

Interest-Rates / Money Supply Dec 03, 2008 - 02:54 PM GMTBy: Gary_Dorsch

In the early 1980's, the Federal Reserve's headlines figures for the M1, M2, and M3 money supply aggregates flashed at the top of trader's radar screens, and jolted US T-bill rates by 50-basis points or bond yields by 30-points within minutes. Inflation was raging at a 10.7% annualized rate, and repeated attempts to cure it had failed. Former Fed chief Paul A. Volcker was doggedly pursuing a radical monetary policy that led to skyrocketing interest rates and two back-to-back recessions.

In the early 1980's, the Federal Reserve's headlines figures for the M1, M2, and M3 money supply aggregates flashed at the top of trader's radar screens, and jolted US T-bill rates by 50-basis points or bond yields by 30-points within minutes. Inflation was raging at a 10.7% annualized rate, and repeated attempts to cure it had failed. Former Fed chief Paul A. Volcker was doggedly pursuing a radical monetary policy that led to skyrocketing interest rates and two back-to-back recessions.

Volcker's strategy was designed to curb inflation by controlling the growth rate of the money supply, within established target ranges for M1, M2, M3, and bank credit. However, if one money supply measure grew faster than its targeted range, while another measure grew slower than its targeted range, it was difficult to predict if the Fed would lift the fed-funds rate to slow the growth rate of the rapidly growing aggregate, or instead, lower interest rates, to speed-up the lagging one.

When Volcker became Fed chief in August 1979, M1 was growing at an annualized +9% clip, compared to the Fed's target range of 1.5% to 4.5-percent. M2 was expanding at a +12% rate, compared with its target range of 5% to 8-percent. With Volcker's focus on monetary control, the federal funds rate was immediately hiked 50-basis points to 11.75%, and by April 1980, the fed-funds rate averaged 17.5-percent. Three months later, the fed funds rate tumbled to 10-percent.

But the rollercoaster ride did not end there. By November 1980, the fed funds rate was pushed back-up to 17%, destroying Jimmy Carter's re-election bid. During Ronald Reagan's first year in the White House, interest rates the fed-funds rate reached a record 20% in June 1981. A new recession began in July, one that saw the unemployment rate reach 11% by the end of 1982, the highest since the Great Depression. The devastation was particularly acute in the industrial Midwest , - where steel mills, auto plants, and coal mines were shut down.

Volcker's tough-medicine untangled “Stagflation,” the dreaded combination of stagnant economic growth and high inflation that persisted through the late 1970's and early 1980's. Inflation, which averaged 14.6% in the year from May 1979 to April 1980, had fallen to below 4-percent. During Reagan's first term, the stage was set for strong growth and the bullish stock market of the 1980's. Volcker stepped down from the Fed in August 1987, with the Dow climbing to record highs, but just two-months before the October “Black Monday” stock market crash.

Volcker's tough-medicine untangled “Stagflation,” the dreaded combination of stagnant economic growth and high inflation that persisted through the late 1970's and early 1980's. Inflation, which averaged 14.6% in the year from May 1979 to April 1980, had fallen to below 4-percent. During Reagan's first term, the stage was set for strong growth and the bullish stock market of the 1980's. Volcker stepped down from the Fed in August 1987, with the Dow climbing to record highs, but just two-months before the October “Black Monday” stock market crash.

Once again, Volcker is summoned to rescue Wall Street, tapped by President-elect Barack Obama on Nov 25 th , to lead a new advisory panel, dedicated to stabilizing the markets. Volcker will be a key figure in Obama's inner circle of economic advisors, including his Treasury chief Timothy Geithner, White House chief Economist Larry Summers, - forming the next “Plunge Protection Team,” (PPT).

While government commentators are still trying to assure the public that there will be no repeat of the 1930's Depression, the financial markets are telling a different story. So-far, every government intervention and G-20 central bank rate-cuts have failed to stem the economic meltdown. The American, Chinese, and European leadership are crafting stimulus packages of a combined $1.2-trillion, but that's only a small fraction of the $30-trillion that's been lost in global stock markets.

Whereas Volcker pursued “Monetarism,” to defeat double-digit inflation, Fed chief Benjamin Bernanke is signaling a diametrically opposite strategy, - “Quantitative Easing,” (QE) to head-off deflation in the US-economy, which if left unchecked, can generate a downward spiral of corporate earnings, production cuts, mass layoffs, and greater difficulty for companies to pay-off debts. Yields on speculative-grade US corporate junk bonds surpassed 20% in November on speculation the recession will leave a glut of companies unable to meet their debt payments.

“Our nation's economic policy must vigorously address the substantial risks to financial stability and economic growth that we face,” Bernanke declared on Dec 1 st . Bernanke said a further reduction in the federal funds rate, now pegged at 1%, is “certainly feasible,” and telegraphed the Fed's intention to use more unorthodox measures to flood the markets with ultra-cheap money.

“Our nation's economic policy must vigorously address the substantial risks to financial stability and economic growth that we face,” Bernanke declared on Dec 1 st . Bernanke said a further reduction in the federal funds rate, now pegged at 1%, is “certainly feasible,” and telegraphed the Fed's intention to use more unorthodox measures to flood the markets with ultra-cheap money.

“Although conventional interest rate policy is constrained by the fact that nominal interest rates cannot fall below zero, the second arrow in the Fed's quiver remains effective,” he said. The Fed will purchase long-term US Treasury and government-sponsored agencies notes, in order to manhandle the credit markets, and force bond yields lower. US Treasury prices rose sharply on his remarks, pushing yields to their lowest in five-decades, on expectations that a long period of ultra-low interest rates, similar to Japan 's, lies on the horizon for the United States .

“The Fed can backstop liquidity not only to financial institutions but also directly to financial markets, as we have recently done for the commercial paper market,” he said, referring to recent Fed moves to act as a market maker, or buyer of last resort, for securities that no one-else wants to buy. The Fed is widely expected to lower the fed funds rate by a half-point to 0.50% at its next scheduled meeting on December 15-16, while simultaneously engaging in “Quantitative Easing” (QE).

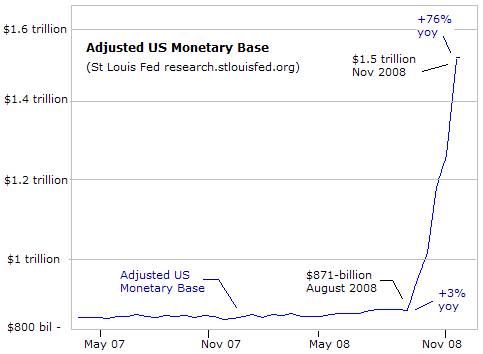

The Fed's money-printing operations are showing-up in the explosive growth of the monetary base, which includes banknotes and coins in circulation, plus commercial banks' reserves held at the Fed. The monetary base has soared by $630-billion in the past three-months, or +76% higher from a year ago. Between August 1987 and November 2005, under “Easy” Al Greenspan, the monetary base rose from $233-billion towards $782-billion, or an annualized +6.8% rate of expansion.

The Fed's portfolio of securities has expanded by $1.2-trillion over the past seven weeks, to a record $2.1-trillion. Banks are on the receiving end of the Fed's money injections, but are afraid to lend to the private sector. Instead, banks are hoarding the excess cash to fix their balance sheets, or depositing the excess funds with the Fed itself, or buying Treasury bills and notes, at the lowest yields in history.

Under a new law, the Fed is allowed to pay interest on excess bank reserves, currently offered at 1.15-percent. That's higher than the 1% fed funds target rate, and higher than the 0.01% one-month T-bill rate. The Fed's ability to pay interest on bank reserves, allows it to flood the banking system with unlimited amounts of money, without pushing the fed funds rate to zero-percent. The Fed might avoid a Zero-Interest-Rate-Policy (ZIRP), in order to prevent money market yields from turning negative, after deductions are levied for annual operating expenses.

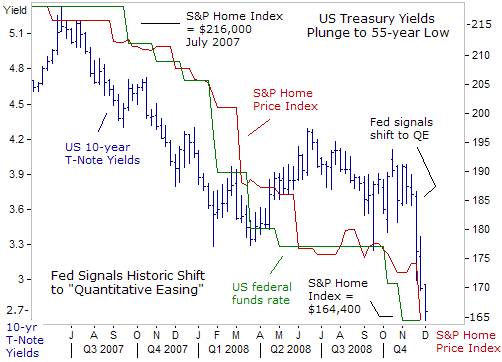

The Fed has signaled a historic shift to “Quantitative Easing,” in a desperate bid to stop the unrelenting slide in the US-housing and stock markets, which have lost a combined $12-trillion of value, over the past 13-months. A common estimate is that every dollar's change in wealth causes people to change their spending by 5-cents. If so, the hit to consumer spending could be $600-billion ($12-trillion times .05). Even this might be too optimistic, if leveraged households decide to pay down debts.

Home prices have been on a steep decline, with 20 major markets plunging a record 17.4% in September from a year earlier, according to the S&P Case-Shiller Home Price Index, after tumbling for 26 consecutive months. A total of 936,000 homes have been lost to foreclosure since the housing crisis flared-up in August 2007. Furthermore, the inventory of unsold homes has risen to 11-months, and a record 2.9-million vacant homes are up for sale.

On Nov 26 th , the Fed and the Treasury unveiled the next step into the murky world of “quantitative easing,” - a plan to purchase $200 billion of asset backed securities (ABS) secured by risky credit cards, car loans and student loans. The Fed will also purchase $500 billion in mortgage backed securities (MBS's), and another $100 billion in direct debt issued by Fannie Mae and Freddie Mac. The Fed succeeded in driving the 30-year mortgage rate a half-point lower to 5.50% last week, enabling millions of homeowners to re-finance their monthly payments.

The latest gambit - “Quantitative Easing,” is designed to force yields on two, ten, and 30-year Treasury debt to the lowest since 1955. Fed chief Ben “Helicopter” Bernanke confirmed on Dec 1 st , that the central bank will target long-term interest rates to combat the deepening recession, knocking the 10-year yield to 2.65%, and the 30-year bond yield to 3.18 percent. Just like the Bank of Japan, the Fed is expected to target the 10-year yield in a tight range next year.

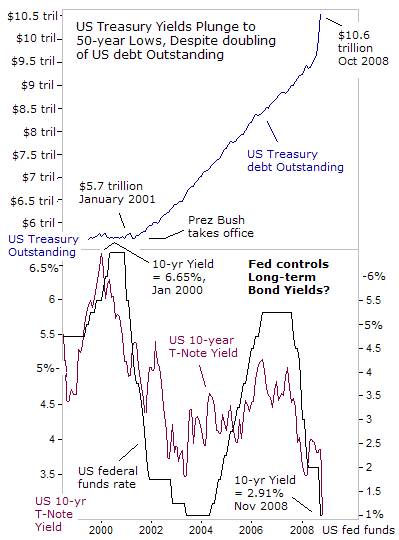

The mechanics of “QE” has turned conventional logic upside down . Treasury yields are plunging to record lows, even at a time when the supply of marketable US federal debt outstanding has soared to $10.6-trillion in October, up from $9.3-trillion in February. During the lifetime of the Bush administration, the federal debt has mushroomed by nearly $5-trillion, yet 10-year T-note yields have moved sharply lower, from around 5.50% in January 2001, to 2.70% today.

This year's fiscal budget deficit could easily top $2-trillion, due to the regular operating deficit, TARP and other bailouts, and a $500-billion stimulus package. That would far exceed the previous record deficit of $450-billion. But with the Fed printing unlimited quantities of US-dollars out of thin-air under the QE framework, so far, Washington has been able to issue massive amounts of debt with impunity.

The Fed learns from Japan's Deflation Experience

The Fed has slashed the fed funds rate 425-basis points to 1% in response, yet the housing and stock markets continue to slump. The US-economy is thought to have contracted at a -5% annual rate in the fourth quarter, highlighted by the plunge in the ISM's factory index to 36.2 in November, the lowest level since 1982. US retail sales have contracted for four straight months, and more than 10-million Americans are out of work and cannot find jobs.

The unfolding events are reminiscent of Japan 's descent from giddy economic prosperity in the late 1980's into a deflationary spiral in the 1990's, which Japan 's central bank couldn't reverse. In the last few-weeks, a growing number of Fed policymakers also have fretted about the threat of deflation, hinting the central bank should act quickly to fight deflation before it becomes entrenched.

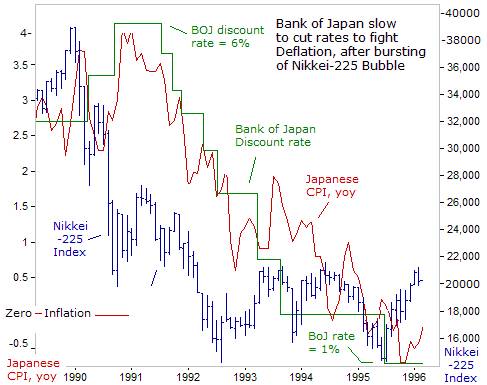

A Fed study, written by 13-economists in 2001, said central bankers can learn from Japan 's experience with deflation. In the late-1980s, Japan 's economy grew so rapidly that the Bank of Japan (BoJ) worried that inflation might overheat. The BoJ hiked its discount rate from 1989 thru May 1991, to curb the danger of inflation and pricked the Nikkei-225 bubble. Stock prices soon plummeted by 50% in 1990, and the economy and land prices began to deteriorate a year later.

A Fed study, written by 13-economists in 2001, said central bankers can learn from Japan 's experience with deflation. In the late-1980s, Japan 's economy grew so rapidly that the Bank of Japan (BoJ) worried that inflation might overheat. The BoJ hiked its discount rate from 1989 thru May 1991, to curb the danger of inflation and pricked the Nikkei-225 bubble. Stock prices soon plummeted by 50% in 1990, and the economy and land prices began to deteriorate a year later.

Belatedly, Japan 's central bank began a series of interest rate-cuts, lowering its discount rate by 500-basis points to 1% by 1995. But the Japanese economy never recovered, despite $1-trillion in fiscal stimulus programs. In hindsight, the Fed study concluded that if the Bank of Japan cut its discount rate to 1%, much sooner than early-1995, the scourge of deflation could have been avoided.

“The window of opportunity was closed in the second quarter of 1995.” By then, the Fed study says, “inflation had already fallen below zero. The BoJ also didn't recognize that deflation would be harder to control than inflation. Accordingly, the BoJ may have worried too much that lowering interest rates might engender conditions leading to the emergence of a new bubble in equity and land prices. The Japanese government cut taxes and increased government spending - but couldn't engineer an economic recovery,” the Fed study said.

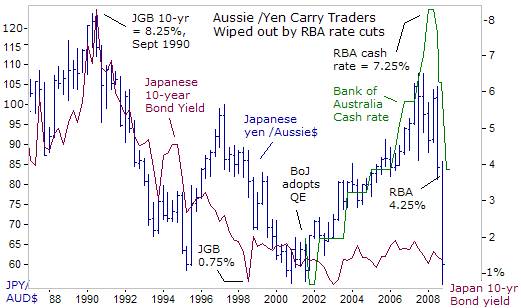

Since 2001, the Bank of Japan has locked the government's 10-year bond yield into a tight range of 1.20% to 2.00%, forcing yield starved Japanese citizens to search abroad for better returns on their savings. The BoJ's ultra-low interest rate policy spawned the infamous “yen carry” trade, its size estimated at $1.5 trillion to $6-trillion, which inflated bubbles in stock markets worldwide.

Since the BoJ adopted QE in March 2001, the mother-of-all “carry trades” has been to sell the yen and convert the proceeds into the higher yielding currencies of Australia and New Zealand . For a long-time, the “yen-carry” trade paid off, as the central banks of Australia and New Zealand hiked their interest rates over a six-year period to 7.25% and 8.25% respectively, and investments in Aussie and kiwi bonds paid significantly more than 0.50% offered for Japanese bank deposits.

Since the BoJ adopted QE in March 2001, the mother-of-all “carry trades” has been to sell the yen and convert the proceeds into the higher yielding currencies of Australia and New Zealand . For a long-time, the “yen-carry” trade paid off, as the central banks of Australia and New Zealand hiked their interest rates over a six-year period to 7.25% and 8.25% respectively, and investments in Aussie and kiwi bonds paid significantly more than 0.50% offered for Japanese bank deposits.

Japan 's legions of individual investors emerged as a global financial force to be reckoned with, directing $6.2-trillion dollars of the nation's $14 trillion in personal savings overseas. They were joined by other “ Yen carry” traders such as institutions, hedge funds, and other big-time players, leveraging more than $1.2-trillion in global financial markets. Over a seven-year period beginning in late 2001, the Aussie dollar rose by two-thirds to above 100-yen, its highest level in 17-years.

But with Australia 's economy now facing its first recession in 17-years, and plummeting global demand for commodities drying-up a five-year boom of export earnings, the Aussie's bull-run versus the yen quickly unraveled in just five-months . Hammering the nails into the coffin of the Aussie /yen “carry trade,” Australia 's central bank slashed its overnight cash-rate target by 100-basis points on Dec 2 nd , to a three-year low of 4.25%, from a high of 7.25% in September.

Japan 's ultra-low interest rates encouraged local investors to plunge into foreign markets, with volatile currency risk, and American fixed-income investors could soon face the same dilemma, under Bernanke's QE. Ironically, the Bank of Japan now refuses to go back to a Zero-Interest-Rate-Policy, and for the second month in a row, left its overnight target rate unchanged at 0.30%. Meanwhile, the mother of all bubbles - the Tokyo bond market, has refused to burst for 10-years.

Bank of England in Panic Mode,

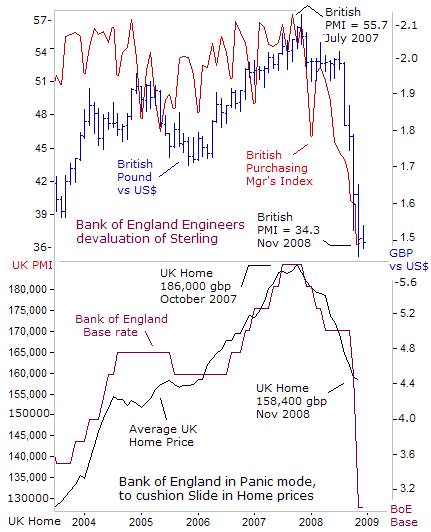

In April 2008, the BoE's leading dove, David Branchflower, warned that UK house prices could tumble by as much as a third in the next two years and called for swift rate cuts to stave off a crash. Blanchflower warned, “In my view, a correction of approximately one-third in house prices does not seem implausible in the UK over a period of two to three years if house price-to-earnings ratios are to be restored to more sustainable levels,” he said.

“Cutting interest rates now may help to prevent such a dramatic fall. Monetary policy, in my view, still remains restrictive, and we need to take action to loosen policy sooner rather than later. The slower rates fall, the further they will eventually have to go down, in order to boost the economy,” Branchflower added. Since then, the typical UK home price has fallen to £158,400, or 15% below the 2007 peak.

An Oct 24 th report issued by S&P indicated that 335,000 households in Britain now find themselves in negative equity, meaning that the value of their homes has fallen below their mortgage. This was an increase of 250,000 in only four months, and by 2010, S&P predicts that 2-million UK-households could be mired in negative equity, with home prices tumbling a further 10% in 2009. Housing sales were 53% lower in September, compared with the same month in 2007.

An Oct 24 th report issued by S&P indicated that 335,000 households in Britain now find themselves in negative equity, meaning that the value of their homes has fallen below their mortgage. This was an increase of 250,000 in only four months, and by 2010, S&P predicts that 2-million UK-households could be mired in negative equity, with home prices tumbling a further 10% in 2009. Housing sales were 53% lower in September, compared with the same month in 2007.

On Nov 29th , the British government handed a check for £20-billion to the Royal Bank of Scotland, (RBS) and will also buy about £17-billion of stock in Lloyds TSB and Halifax Bank of Scotland, that would leave t hree of the country's biggest lenders are under quasi-state control. The British government now controls nearly 3-trillion pounds in bank assets, and almost half the mortgage market, which would suffer further losses as economic conditions continue to deteriorate. Already, the UK is holding a paper loss of £2.3-billion in shares of RBS.

Job losses in the UK soared by 164,000 in the third quarter, the biggest surge in 17-years. Now at 1.79-million, or 5.7% of the workforce, unemployment is widely predicted to reach two-million by December, possibly rising to three-million by December 2010. To cushion the blow, the BoE opened the floodgates on Nov 6 th , unleashing a stunning 150-basis point rate cut to 3%, the lowest level in more than half a century, to rescue the badly shaken housing market.

The BoE rate cuts triggered a massive 25% devaluation of the British pound vs the US $, and a 45% slide against the Japanese yen, to UK multinational earnings, and increase the competitiveness of exporters. However, factory activity in the UK plunged -15% in November, putting the BoE under heavy political pressure to slash interest rates by a half-point or more on Dec 4 th . Manufacturing accounts for 14% of the British economy, and is suffering its longest streak of contraction since 1980 .

On Nov 12 th , BoE chief King gave a stark warning of the difficulties that lie ahead for the UK economy and said, “We are prepared when the world changes to make big changes to the bank rate in response. Consumer spending faltered in the third quarter under the weight of tighter credit and the squeeze on household budgets,” Asked if interest rates could fall all the way to zero, Mr King said the BoE would set rates at “whatever level is necessary.”

In London, the two-year British yield tumbled 24 basis points to 1.78%, as traders bet the BoE would slash its base lending rate by a full-point to 2% on Dec 4 th , and as low as 1% next year. Central bank interest rates have never fallen below 2% since the BoE was created in 1694. Yields on 10-year gilts slid 17-basis points to 3.48%, their lowest level since records began 30-years ago.

Most fascinating, long-term gilt yields are plunging to record lows, even as the supply of British budget deficit is mounting to record highs. The UK Exchequer will auction £146.4 billion of gilts this fiscal year, compared with £80 billion originally projected in the March Budget. The UK national debt is expected to zoom past £1trillion by 2012, equal to 57% of gross domestic product.

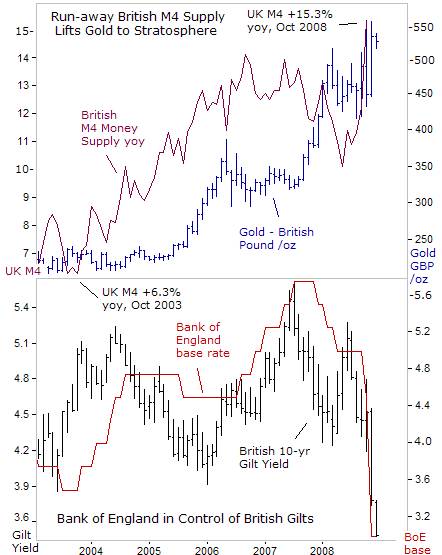

Yet the BoE is in the driver's seat for now, with near total control over both short and long-term British interest rates. UK banks are hoarding the high powered money that the BoE is pumping into the credit markets, or channeling the cash into safe haven gilts, amid fears of deflation and corporate defaults. In this environment, the M4 money supply was skyrocketing at +15.3% rate of expansion in October. “I care not what puppet is placed upon the throne of England to rule the Empire on which the sun never sets. The man that controls Britain 's money supply controls the British Empire ,” observed Baron Nathan Rothschild.

While the BoE is busy monetizing whatever amount of debt the Exchequer needs to sell, British investors in gold are the biggest winners, with the yellow metal soaring to 550-pounds /oz, up 130% from four-years ago . The explosive surge of the UK's M4 money supply, and the sharp devaluation of the British ounce against all major currencies, reminds us, “If you have to choose between trusting the natural stability of gold, and the honesty and intelligence of members of the government, with due respect for these gentlemen, I advise you, as long as the capitalist system lasts, to vote for Gold,” - George Bernard Shaw, 1928.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2008 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.