U.S. Economy Disintegrating as Government Supports Zombie Banks

Economics / Credit Crisis 2008 Dec 04, 2008 - 05:07 PM GMTBy: Jim_Willie_CB

The USGovt and financial system is growing deep commitments to support dead entities. Their business models have failed. They are bankrupt. Although with faulty business model, often l aced with fraud, they have been fully adopted by the USGovt and US Federal Reserve. They are considered too big to fail. Or one should say, they are too connected to the power structure, or they are too intertwined with explosive financial devices, or one from their own tribe is running the Dept of Treasury. Capitalism embraces the Darwinian principles bound by survival of the fittest. The United States bears absolutely no resemblance to such principles anymore, at least at the upper corporate echelons.

The USGovt and financial system is growing deep commitments to support dead entities. Their business models have failed. They are bankrupt. Although with faulty business model, often l aced with fraud, they have been fully adopted by the USGovt and US Federal Reserve. They are considered too big to fail. Or one should say, they are too connected to the power structure, or they are too intertwined with explosive financial devices, or one from their own tribe is running the Dept of Treasury. Capitalism embraces the Darwinian principles bound by survival of the fittest. The United States bears absolutely no resemblance to such principles anymore, at least at the upper corporate echelons.

The system is giving colossal support to zombie banks and soon zombie corporations. The Wall Street banks continue to receive money without any restrictions whatsoever, even grants after meetings held before dawn, but Detroit car makers must produce a plan for reform. Under what conditions did Citigroup receive untold billion$? Did they make concessions, or just pull a string? Hidden motives abound, even for the Citigroup last minute bailout.

The climax of this charade in ass-backward policy will be the nationalization of the mortgage system . It is a fully neglected problem, soon to need powerful aid in the nation's largest program in its history. Its prelude was the adoption of the Fannie Mae & Freddie Mac couple, despite its well-known fraud, perhaps directly due to the desire to cover its fraud. Foreigners like China demanded the USGovt backstop of the fat failed duo, which gave the fraud kings political cover. The many foreign funds would have continued to dump the F&F label bonds en masse without the official takeover. Instead, they have shifted from US Agency Mortgage Bonds to USTreasury Bonds.

The US financial structure deeply invests in failure, and is fully committed to the ruling elite, to the exclusion of the mainstream public. Ever since Clinton appointed Robert Rubin of Goldman Sachs to the post of Secy Treasury in 1992, the US Economy and US financial structure has suffered mortally wounds. That decade of prosperity was stolen from Fort Knox, a major piece to the Strong Dollar Policy having been the gold carry trade enacted by Rubin. These insiders borrowed gold at a lease rate pushed down by Rubin, and bought USTreasury Bonds. Since borrowing costs were the biggest component to business profitability, economic growth ensued. Time revealed the gaping wounds, however. Their actions over eight years resulted in a stock boom and bust, a clear and loud signal at the end of their reign, of a failure soon evident in a wrecked national financial foundation.

In the last year, clearly the new business model is governed by reaction to failure that the Strong Dollar Policy produced. The manufacturing base left town for Asia, starting in 2001. Again, thanks to Clinton for pushing the Chinese Most Favored Nation status. In the first few years since its passage, $23 billion in US corporate investment was put in place inside China. At its peak, Wal-Mart owned 160 manufacturing plants, in direct opposition to founder Sam Walton's ‘Made in America' slogan. The corporate titans sidestepped higher US labor costs and strict US labor unions by leaving the country in a grand movement.

The moron US economists hailed the move as a ‘Low Cost Solution' in typical wrong-footed fashion. They somehow overlooked that much less employment in the United States would have consequences rooted in debt growth and foreign debt dependence. By year 2006, fully 60% of Chinese trade surplus was derived from US corporate subsidiaries located in China, exporting products to the West. Here we are, stuck in the present, as the great US consumer economy has virtually collapsed. The stewards of the US money wellspring have decided to backstop or acquire numerous failures. The preservation of jobs and the system itself is their stated motive. Instead, they have guaranteed the failure and collapse of the system, all in time. Viable enterprise is being denied capital, which has been re-directed to failed enterprise. This fact has escaped the US economists, clearly the worst in the world.

GREAT JOKE, SAD TO BE SO TRUE

Lawrence Livermore Laboratories has discovered the heaviest element yet known to science. The new element, Governmentium (symbol=Gv), has one neutron , 25 assistant neutrons, 88 deputy neutrons, and 198 assistant deputy neutrons, giving it an atomic mass of 312. These 312 particles are held together by forces called morons , which are surrounded by vast quantities of lepton-like particles called peons . Since Governmentium has no electrons, it is inert. However, it can be detected, because it impedes every reaction with which it comes into contact. A tiny amount of Governmentium can cause a reaction that would normally take less than a second, to take from 4 days to 4 years to complete. Governmentium has a normal half-life of 2 to 6 years. It does not decay, but instead undergoes a reorganization in which a portion of the assistant neutrons and deputy neutrons exchange places. In fact, Governmentium's mass will actually increase over time, since each reorganization will cause more morons to become neutrons, forming isodopes . This characteristic of moron promotion leads some scientists to believe that Governmentium is formed whenever morons reach a critical concentration. This hypothetical quantity is referred to as critical morass . When catalyzed with money, Governmentium becomes Administratium (symbol=Ad), an element that radiates just as much energy as Governmentium, since it has half as many peons but twice as many morons.

The above is not my original creation, the rest is my addendum. If the above does not make you laugh as much as cry inside, you aint human. The missing portion of the substance known as corruptium , which leads to radiated energy into channels almost entirely into the power source, once damaged heavily by exposure to light, but now covered by czar tissue .

GUARD FROM CURRENCY COMPETITION

The US Economy is in the early stages of disintegration, not yet recognized as such. The US Fed is not helping the system, but rather draining the system, in order to fund Wall Street bailouts, to redeem its fraud, and to ward off foreigners in a global dollar swap policy. The competitive currency devaluations are in full swing. The competing currency war is best seen from the standpoint of official interest rate by nations. Yesterday, desperate rate cuts were ordered atop previous desperate rate cuts done on November 6. The Euro Central Bank cut this time by 75 basis points to 2.5% (last time by 50 bpts). The Bank of England cut this time by 100 basis points to 2.0% (last time by 150 bpts).

Even the central bank of Sweden cut by 175 basis points. The rate cuts one month ago were a parade, a cavalcade of discredited bankers, who have increasingly lost confidence of the public. The confusion on monetary policy is aided by observation of the money supply figures, which are growing rapidly. The irony in my mind is that the monumental money supply growth has not entered the mainstream economy, but does not result in economic response, zero traction. The reason is that the US Fed has directed funds only to New York banks, thus feeding a black hole. The central bankers are not asleep at the wheel as much as operating a machine with a built-in breakdown mechanism after a few decades. Their time is up. The Gosbank board is worth another view.

Even the central bank of Sweden cut by 175 basis points. The rate cuts one month ago were a parade, a cavalcade of discredited bankers, who have increasingly lost confidence of the public. The confusion on monetary policy is aided by observation of the money supply figures, which are growing rapidly. The irony in my mind is that the monumental money supply growth has not entered the mainstream economy, but does not result in economic response, zero traction. The reason is that the US Fed has directed funds only to New York banks, thus feeding a black hole. The central bankers are not asleep at the wheel as much as operating a machine with a built-in breakdown mechanism after a few decades. Their time is up. The Gosbank board is worth another view.

NEW LIGHT ON MOTIVE TO EXTORT & DIVERT

Mr Mortgage is astute in analyzing banks and balance sheets. He explains a prima facie motive for the Czar Paulson confiscation of $125 billion, in the scrapping of the TARProgram first tranche. See the article entitled “America's Mark-to-Model Banking System (revisited)” (CLICK HERE ). He points out that everybody is focused on Level-3 assets, which are the obscure asset backed bonds veiled in price model chicanery, loaded with leverage, but worthless beyond argument. The subprime loans are laced within this level of asset, given cover by false AAA-ratings and obscured by bond packaging, often structured with leverage. What has not received with much publicity is that the Level-2 assets might result in similar volume losses to banks, but not yet realized. They are loaded down by Alt-A loan portfolios.

To be assigned an Alt-A loan, a borrower must have inconsistent records of income, typical of the self-employed, or have a blotch in the credit history, like with a judgment against, or have incomplete records required by bankers from their many unique situations. The Level-2 assets are soon to explode onto the scene, with losses that in all likelihood will eclipse the subprimes losses. Could it be that Czar Paulson might have changed course on TARP fund usage when he realized that the US banking system is due for the next painful round of crippling losses? He might know the US banks are zombies, surely not revived by a cover by a tarp.

Details are in the article, with analysis to be included in the December Hat Trick Letter report due out in mid-December. Let it be clear that the Level-2 assets held by banks are much larger in magnitude than the subprime loan portfolios, like 8x to 10x larger. Wachovia is in possession of $160 billion in Level-2 assets on their books, most likely dominated by Pay Option adjustable rate mortgages. A mere 7.5% writedown in Level-2 assets on bank balance sheets would equal the total writedowns by banks worldwide to date!!! Some argue without basis that the Alt-A mortgages have a significantly lower default rate. NOT TRUE! As of October 2008, serious delinquencies for Alt-A pools that include Option ARMs averaged 20.3% for the 2006 vintage loans and 17.5% for the 2007 vintage, up from 16.9% and 12.2% six months ago, all according to Moodys.

These delinquency rates are equivalent to subprimes, and indicate equally high defaults. Thus the volume of bank losses should be expected to be much bigger.

Paulson must be aware of these facts and figures. Instead of throwing Congressional funds into a black hole, he enabled a selected diversion of funds to the member banks of the Federal Reserve Bank system, an elite group of less than a dozen banks. For instance, Wells Fargo is a major mortgage provider, yet was not doled out any confiscated funds. In doing so, he enabled executive bonuses to be given whose size is on par with those of last year, despite performance by executives that resulted in the death of the Wall Street business. My forecast is for three waves to hit US banks, of equal or INCREASING magnitude, from three delineated risk levels. First was subprime, done. Next is Alt-A, in progress. The last wave will be from conventional primes, sprinkled with car loans and credit card losses.

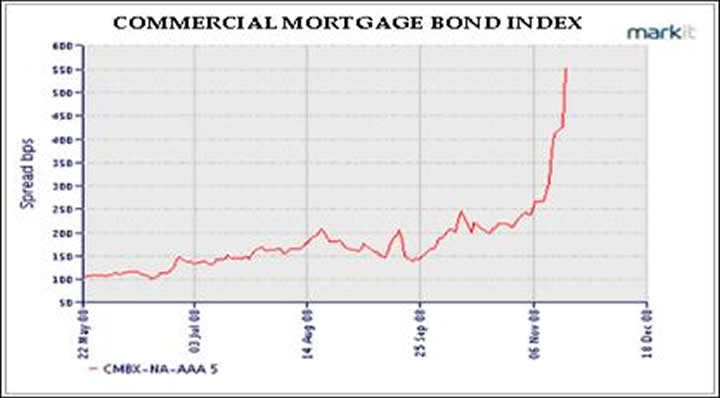

The last wave of significant bank losses will also include the commercial mortgages, whose bond spreads reacted very badly to the Paulson confiscation and diversion for elite benefit. The total volume of commercial mortgages is not very large by comparison. However, the blight will be unmistakable, as office buildings might go empty, and projects left incomplete. Notice the CMBX index rose over 300 basis points since late October alone.

The commercial mortgage backed bond index tells the tale of betrayal well. The news media does not. The justification offered by Czar Paulson was that purchase of bank stocks offered a 12x leverage to the big banks, enough to facilitate loans. Except that privately, the banks were ordered not to lend to the public, but rather to save funds for bank acquisitions like National City. Only in America can a group be responsible for wreckage of the banking system, get away with rampant fraud with export, yet its executive icon be put in charge of the rescues, relief efforts, and dispensation of money. The system is broken. Those in charge of the solution are actually making the situation worse.

STRANGE SIGNALS

Numerous onerous signals can be detected. One must ignore the public statements of improvement. In past articles, the point has been made that the US Federal Reserve has engaged in truly massive Cash Management Bill sales , to the tune of several hundred billion$, with $145 billion more between October 2 and 15 alone. THESE ACTIONS DRAIN THE MAINSTREAM PRIVATE SECTOR OF BANK FUNDS, which is precisely the opposite of what Chairman Bernanke claims. He is not flooding the system with liquidity, but rather draining the system in order to subsidize the insolvent Wall Street banks and broken major financial firms. Rob Kirby in private conversations calls it suffocating a man in his living room by placing a bag over his head, when the room is being injected by huge oxygen tanks. Mine is to describe it as filling a vast swimming pool, by diverting water from the neighborhood homes and businesses, then declaring the pool for aristocratic usage only, except for certain peon individuals who are permitted to swim in the shallow section wearing a giant hefty bag for a swim suit. In neither example, is the person gaining benefit.

The USTreasury Bond credit default swap used to trade at a cost of only 1 or 2 basis points. That means the cost was 0.01% or 0.02%, translated to be $1000 or $2000 per $10 million of USTBonds. Nowadays, the CDSwap cost has risen to almost 50 basis points, far higher than government debt for Germany, England, and France. Investors are taking out protection for the unthinkable, a USTreasury default. The risk premiums for such protection have nearly doubled from levels seen two months ago after the collapse of Lehman Brothers. Contrast the USTBond insurance cost with some of the member states. CDS data on some states: Michigan at 192 basis points, California at 165 bpts, Nevada at 164 bpts, New Jersey at 150 bpts, Ohio at 104 bpts. Foreign nation Slovakia has sovereign bond insurance cost at 150 bpts, by comparison.

Many dismiss the threat of a USTreasury default, but they do so in blind faith. They ignore confirmation signals, such as the in the 30-year USTreasury swap spread . It has been negative for a few weeks. Some call this development inconceivable, illogical, impossible. Yet it is the reality. The swap contract exchanges a floating rate for a fixed rate, and pays a price to do so. Imagine paying a small fixed amount to render an adjustable ARM mortgage loan with a fixed rate, a similar concept. Some experienced analysts have interpreted this as meaning that investors are somehow reckoning that they are more likely to be redeemed on their USTBond investments by a private counter-party than by the government itself! One can call this event the ‘proverbial canary in the coalmine' as a threat to the current system. Last week, arguments were put forth that the central bank franchise concept is in danger of demise. Evidence in the signals supports the view. Currency wars are heating up, even as investors are anxious about fiat currencies in general, and their offered debt securities. The Iceland situation rocked the system, to be sure.

Former Harvard University endowment fund investment manager, now PIMCO co-executive, Mohammed El-Erian frequently offers an opinion. He believes US bank officials are making big errors by attacking problems one item at a time, as opposed to treating the problems in an aggregate fashion, from a systemic approach. He makes a key point: A flight to liquidity is occurring, not a flight to quality or a flight to safety, as a global phenomenon takes place toward vast liquidations. He is a system wonk, never forget. He also claims the bank system is again functioning because of the TARP equity purchases at a premium, and placement of funds directly into capital structure. He must not have noticed that over 85% of the TARP funds in the initial tranche went to executive bonuses to select Fed Reserve banks.

The laws of Supply & Demand have not gone away. Yet we have grand disparities to pressure price structures. A) The supply of USTreasury Bonds is huge, yet yields are low and price is high. That is ass backwards. B) The creation of truly vast sums of USDollars is huge, needed to pay for the bond swaps, bailouts, stimulus packages, and nationalizations. Yet the USDollar index rises, due to liquidations and payouts. That is ass backwards. C) The demand for physical gold and silver is huge, motivated by crisis, yet their prices are determined by corrupt paper pricing systems. That is ass backwards. Soon, all three stresses on price structures will be addressed. A strange day occurred on Monday. Gold was down hard, the euro currency was down a little, but the pound sterling was down 500 bpts. Some attributed it to lousy economic news in England. Not completely so! Another factor might be at work. A clearer perception of a struggling UK Economy would not take down the gold price. My sources tell of possible shipments of gold from England to the US-based COMEX, in order to satisfy gold demands for delivery. It is hard to verify. Time will tell.

REACTION TO DISINTEGRATION

If you do not believe the claim of economic disintegration, you have not been paying attention to the many USEconomic signals. The housing prices continue down in an accelerated speed. The Case Shiller September decline for 20 cities was 17.4%, still rising monthly. The home foreclosures continue to grow at a monstrous pace, with no letup. The various regional Fed reports such as the Empire State, the Philly Fed, the Richmond Fed, along with the ISM manufacturing and ISM service indexes are not indicating recession. They are indicating collapse, falling far lower than even keeled 50 levels. My preference is to label it as DISINTEGRATION.

When the credit lines are interrupted, when the USFed is acting as the main bank to fund non-lending hamstrung banks, those credit lines are not just broken, but favored toward the insiders, the system is dysfunctional. When short-term credit is hampered, distribution channels are interrupted for necessities that keep an economy running. Letters of credit for shippers are routinely refused when US banks are involved. Consumers finally have fallen down, the indefatigable US consumer, the engine of the world economy. Give me a break! They never were the engine of global growth. They were the lopsided lamb which spent household equity, burning the furniture figuratively, to fund Asian industrial expansion, not to mention the Asian foreign reserve funds. A bonfire to burn home equity is far from an engine, the only thing in common being combustion.

The Asian sovereign wealth funds grew in lockstep with the insanity of manifested US consumer mentality. In the same manner, the Persian Gulf sovereign wealth funds (and private sheik accounts) grew from oil revenues. Never have consumer sentiment measures been so low. To heck with claims of economic depression risk. The palpable risk is for disintegration. The USFed, with its drainage of private sector bank capital to fund Wall Street bond swaps, almost guarantees the slide into disintegration. AS THE SYSTEM DEGRADES FURTHER IN ITS STRUCTURAL INTEGRITY, A PANICKY RESPONSE IS ALMOST ASSURED TO PRODUCE INFLATION FAST. Gold & silver will respond.

RELUCTANT NATIONALIZATION OF MORTGAGES

The national situation will continue to degrade. With New York bankers hogging the trough, the rest of the herd with lesser pedigree is starving. Only after objections to the TARP confiscation and theft has the USFed installed new programs to address Asset Backed Commercial Paper and other pools such as for car loans and credit cards. They must realize that they are strangling the entire USEconomy. In time a panic climate will set in. A turning point is coming for reflation. Slowly, the banking officials and legislators will realize that the ultimate source of the problem for the USEconomy is falling home prices, foreclosures, and the straightjacket that homeowners find themselves with negative home equity. To date they only talk about deeply impaired mortgage bonds, with short-sightedness. Just Thursday, the hapless Secy of Inflation Bernanke admitted that 15% to 20% of US homeowners are underwater on home loans, living with negative home equity. THIS IS THE ULTIMATE PROBLEM BEHIND THE INSOLVENT BANKS.

Bankers will not lend when borrowers are insolvent. Bankers will not lend when their own balance sheets decline each quarter due to falling home prices, the effect being to push their mortgage bonds down further in value. The great majority of homeowners facing foreclosure who accept federal help in mortgage repayment plans actually pass through a revolving door. They face foreclosure only a few months later. WHY? Because the late payments are put onto the loan balance, the fees are sometimes waved, the interest rate is reduced in many cases, BUT THE LOAN BALANCE REMAINS ABOVE THE HOME VALUE. The unsuccessful USGovt HOPE NOW program calls for VOLUNTARY banker reduction in the loan balance. To date, the great majority of troubled home loans are NOT reduced. Thus the revolving door. A big jump has been seen in recent home loan refinances, with lower mortgage rate. This is good news, but fails to address the ultimate problem of insolvent households. The priority must be the achievement of bank solvency and actual home loan balance reductions with federal reimbursement.

THE NEXT MAJOR STEP IS MONTHS AWAY, BUT IT WILL FEATURE NATIONALIZATION OF MORTGAGES, REDUCTION IN LOAN BALANCES, WHOSE COSTS ARE COVERED BY THE US CONGRESS. More pain is needed to reach a consensus on such a huge new program. The nationalization of mortgages will ultimately cost at least $2 trillion.

After blowing $8.5 trillion so far in US Federal Reserve programs, Federal Deposit Insurance Corp programs, Treasury Dept programs, and Federal Housing Administration programs, none of which address the ultimate problem of insolvent homeowners, the stage is set for a radical solution, the final solution to the problem. See the SFGate table of details on this colossal sum of money, which to date roughly doubles the entire USGovt federal debt up to 2008 (CLICK HERE ). With nationalization and meaningful loan balance reductions to a few million mortgage loans, a bid can only then be finally placed under home prices. Mortgage bond losses will be stemmed. Bank ruin will be halted. Of course, the solution is radical. But so is the problem. The people lack a solid representation in the USCongress anymore.

THE MORTGAGE NATIONALIZATION WILL FINALLY PERMIT REFLATION, SURE TO RESULT IN HYPER-INFLATION. THE GOLD PRICE WILL REACT IN A CLEAR AND UNMISTABLE MANNER. Now that most foreign central banks have moved to extremely accommodative official interest rates, the USDollar is less at risk from relative monetary competition. They are by now fully aware of the risk to their own banking systems and economies. The global move to reflation, if not hyper-inflation, is soon to be triggered. The maneuver in October to install a globally available USDollar Swap Facility was a deft insurance policy planted by the USFed to assure that foreign banking systems are laced with USTBonds. They can less easily abandon the USDollar as the global reserve currency. The entire, at least Western, world will be joining in the process.

GOLD IN EURO TERMS

The last several months have put too much focus on the US perspective. The gold price has consolidated in euro terms. The real fireworks for gold lie ahead. The COMEX gold & silver markets are certain to endure major assaults. Their phony low price invites heavy demand, if not destruction much like an outstretched rubber band. The swallow of the bitter hyper-inflation pill will assure the rise in gold price. The engines are revving still at 10 thousand RPMs, as gold watchers await the price inflation skidmarks on the economic tires. They are coming. Patience has been sorely tested. With the shift of power away from the US and toward Europe in the Western world, the price of gold should be viewed more often in euro terms. It has not fallen badly, but instead has consolidated. The bullish divergence is clear. A U-shaped reversal pattern requires a move above 650 euros to ignite a rally. Before long, gold will run up in all currencies.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

“Your analysis is of outstanding quality, the best I have read. In particular, as a person on the spot, I can confirm the accuracy of your bleak assessment of our prospects in the UK .” (JanB in England )

“I just subscribed to your services and must say that your insights are so eye-opening that it is like having a window to the future. I never thought that they would in so much detail encompassing the entire world. With all that is going on, I still wonder how you are so in touch with it all.” (ChrisB in Australia )

“The latest Hat Trick letter is great work. I am still reading and absorbing, but this is just great analytical work. Truly inspired. I would say you produce a very sophisticated, detailed product that is the best of the bunch. Truly. You help keep me very focused on current events and help me keep my eyes on the distant horizon.” (RichardB in Texas )

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-*****-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces' approach into an awesome intellectual tool.” - (RobertN in Texas )

“Your reports scare the hell out of me every month, probably more so over time, since so many of your predictions have turned out to be very accurate. I am afraid you might be right that by the end of 2008, we are in a pretty severe situation, with civil unrest and severe financial stress on Main Street .” - (GeorgeC in Minnesota )

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.