Stock Markets at Critical Crossroads- Yorba TV Show

Stock-Markets / US Stock Markets Dec 09, 2008 - 12:46 PM GMT

Today all the markets are at a crossroads. Either we continue going up or the market sells off in what may be the largest decline yet. So, let’s get busy and explain the choices the market must make.

Today all the markets are at a crossroads. Either we continue going up or the market sells off in what may be the largest decline yet. So, let’s get busy and explain the choices the market must make.

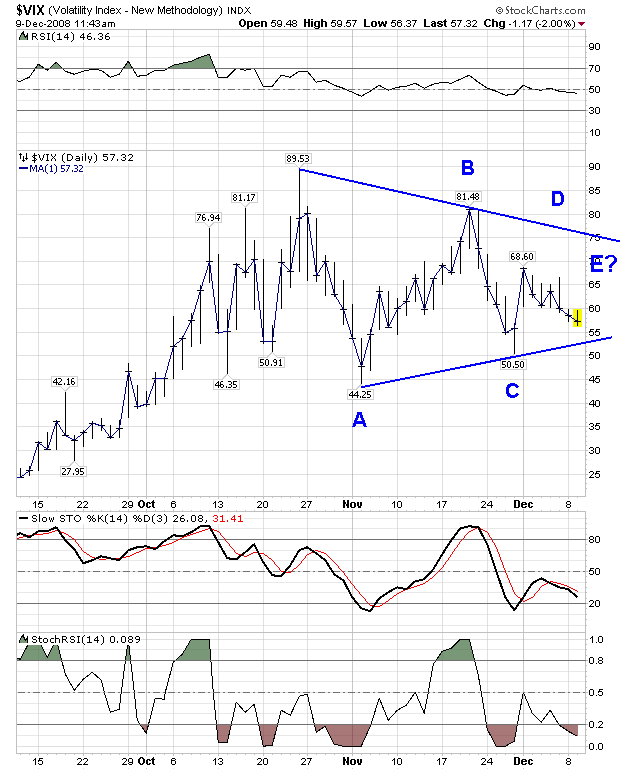

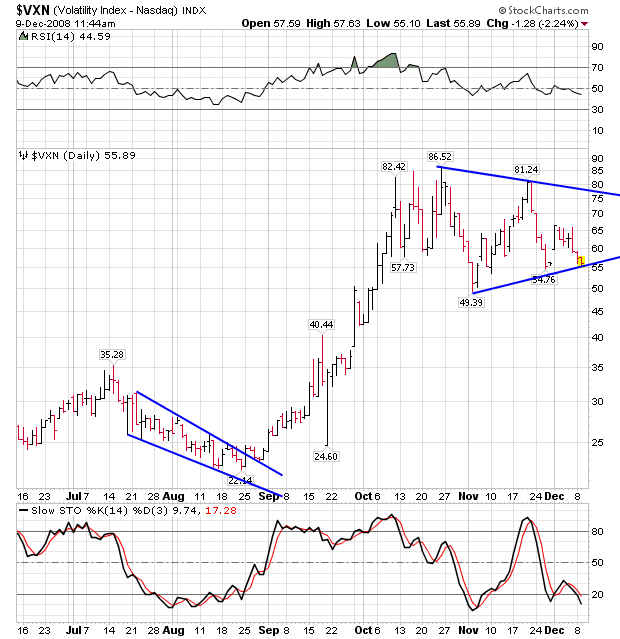

Let’s take a look at an old formation that keeps coming up. It’s the expanding triangle that I had introduced in October. The indexes have kept to their pattern in the triangle, so I must report what I see.

As of this morning, the expanding formation is at a crossroads. Since the election, the indexes have gone down to the lower half of the triangle and stayed there. Yesterday, all of the indices rallied up to what I call the 50% line and stopped. This morning they are testing that line in the sand to see if the direction of the market is bullish or bearish.

Let’s look at the DJIA chart. After closing above the halfway line at 8850-8900, it sold off this morning and has retreated below these supports/resistances since.

The NDX has finished its rally this morning to 1250, which is the halfway point of the expanding triangle. It has been in retreat since.

The SPX rallied up to its 50% line yesterday and has been in retreat since then.

I know a lot of you are looking at the very same charts and seeing an inverted head and shoulders pattern which would suggest that the DJIA might go to 10250, the NDX might go to 1481 and the SPX might go to 1050. May I suggest that those are only

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Tuesday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.