Stock Market Rally Was Running on Empty- “The 12 Bailouts of Xmas”

Stock-Markets / Financial Markets Dec 10, 2008 - 07:45 AM GMTBy: PaddyPowerTrader

Stocks retreated yesterday as the euphoria about Obama's package gave way to a more somber reflection on more layoff announcements (Sony, Citibank, Rio Tinto, Skf and Molex) and poor earnings outlooks (Nokia, Texas Instruments, Broadcom, Danahe and Samsung). Bellwether stock FedEx fell 16%, hardly an omen of a 2009 economic pickup.

Stocks retreated yesterday as the euphoria about Obama's package gave way to a more somber reflection on more layoff announcements (Sony, Citibank, Rio Tinto, Skf and Molex) and poor earnings outlooks (Nokia, Texas Instruments, Broadcom, Danahe and Samsung). Bellwether stock FedEx fell 16%, hardly an omen of a 2009 economic pickup.

The market is now braced for a horror show retail sales number on Friday. This should debunk the myth of better than expected sales on Black Friday. Sales may have been up by volume but if you are being forced to sell goods below cost you aren't going to make any profits.

Today's Market Moving Stories

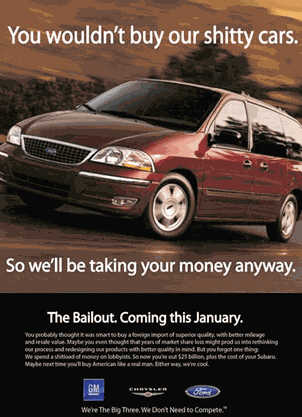

- Lawmakers have put the pedal on the metal and broad agreement has been reached in the long running auto bailout saga. This has caused Asian bourses to rally overnight.

- The latest installment in the farcical story of the black hole that is AIG(reed) is that they have managed to chalk up another $10bn in losses . It must be time for another trip to that luxury spa. They have some neck with news that managers are getting retention payouts topping $4 million ! Where is the oversight? Who is minding the purse strings on behalf of Joe the Plumber? Maybe one of the key challenges for the future will be to prevent monstrosities like AIG from becoming “too big to fail” as the alleged economies of scale are dwarfed by the staggering costs of bailout nation.

- German wholesale prices fell the most in 40 years. These are the kinds of numbers one gets during a depression, NOT a recession. Are you watching J.C. Trichet, who seemed yesterday to be hinting of a ill advised pause to recent rate cuts in January?

- The World Bank is even gloomier than the IMF regarding global growth (or the lack of it) in 2009 with a projection of an anemic 0.9%. They go on to predict a contraction in world trade next year. This would be the first such decline in 20 years. No wonder export dependent countries are thinking currency manipulation. But history shows that unilateral intervention is rarely successful.

- In Japan policymakers seem to be getting increasingly fretful about the strength of the Yen with Bank of Japan governor Shirakawa saying the economy was slowing rapidly and that authorities were watching FX moves very carefully. Machinery orders dropped 4.4% and the BoJ's corporate goods price index saw a dramatic 1.9% fall. The theme of possible competitive interventions to weaken currencies is spilling over into China where the State Council's Development Research center economist Zhang Xiaoji said that the CNY should be more flexible.

- Note the yield on short dated US Treasury bills traded at negative rates yesterday! Last time this happened was 1929. This is as pure an example as you could get of safe haven buying and banks refusal to lend.

- Troubled German bank Hypo Real Estate (who bit off more than they could digest with buying Depfa) has tapped the Federal government bailout slush fund for another €10bn. While there is another €20bn left in the kitty, given their AIG-style cash burn, this may not last long!

- The Irish government is still playing hardball, saying that there will be no extension of the debt guarantee at this stage. At least until the banks have sorted out their capital position and undertaken substantial restructuring. Ironically, probably the only way the banks can sort out their capital position right now is via government assistance. As for restructuring, we are hearing of pressure on management teams from the Irish press, but the restructuring arguably has to go wider and deeper. It could mean the end of the stand-alone status of possibly two banks in Ireland. Whatever happens, it's almost impossible to see a resolution on this subject before year-end.

And Finally… The Second Of My Picks For Best Bailout Videos Of 2008… “The 12 Bailouts of Xmas”

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2008 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.