Quantitative Interest Rate Easing American Style: Free Money

Interest-Rates / US Interest Rates Dec 17, 2008 - 09:53 AM GMTBy: Mike_Shedlock

The Treasury rally continued in spectacular fashion in conjunction with the ZIRP Arrival: Fed Targets Interest Rates 0 to 1/4 Percent .

The Treasury rally continued in spectacular fashion in conjunction with the ZIRP Arrival: Fed Targets Interest Rates 0 to 1/4 Percent .

From the FOMC Press Release .

The focus of the Committee's policy going forward will be to support the functioning of financial markets and stimulate the economy through open market operations and other measures that sustain the size of the Federal Reserve's balance sheet at a high level.

As previously announced, over the next few quarters the Federal Reserve will purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand its purchases of agency debt and mortgage-backed securities as conditions warrant. The Committee is also evaluating the potential benefits of purchasing longer-term Treasury securities.

Free Money

The Fed is looking at the "benefits" of purchasing longer-term Treasury securities. The benefit is to banks who are front running the trade. Banks can now borrow from the Fed at the discount rate of .5% and invest somewhere out on the yield curve at a higher rate.

And as long as the Fed is not going to contract credit, banks can hold to maturity and pocket "free money". The odds of Bernanke contracting credit any time soon are essentially zero.

Bernanke hopes ZIRP will spur lending. But why lend in the middle of a recession with credit spreads blowing sky high and consumers walking away from mortgages, when you can borrow from the Fed at .5% and have guaranteed free money?

There is infinite demand for free money. But note that only banks can get it. Citigroup is not going to get a margin call from the Fed no matter how many treasuries it buys. You or I would get one in a flash if the rates went against us.

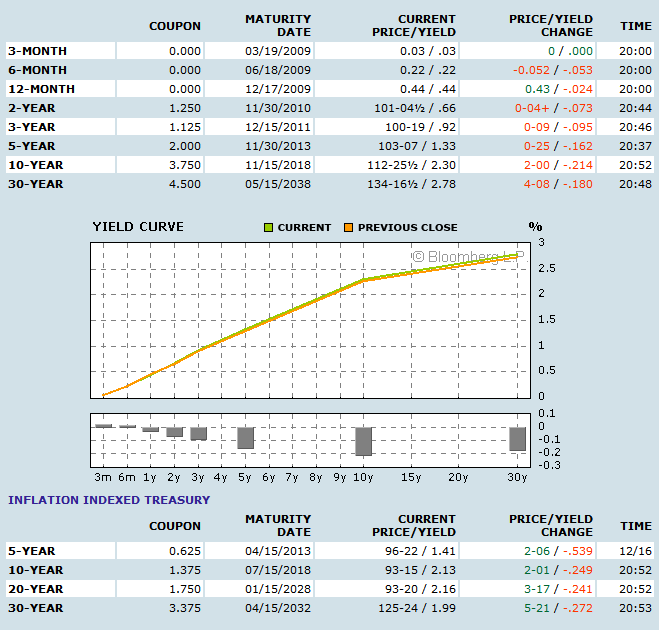

Treasury Yields

Chart courtesy of Bloomberg .

Shorts stepping in front of banks rushing to get free money have been trampled once again. 10 year yields are now approaching a 1 handle. Remember the cries of "bond bubble" at 5%? Don't say you weren't warned.

Yes, this is artificial demand. And no, this is not going to help the economy. But standing in front of a freight train does not make a lot of sense. And although the treasury trade will at some point blow sky high, that point will probably not happen until shorts give up trying.

Remember that the Fed cannot change the direction of a trend, the Fed can only juice it. The trend is for lower yields as deflation sets in. The Fed has only reinforced that trend.

Quantitative Easing American Style

Quantitative easing American style has arrived as noted in Bernanke Charts New Fed Course With Zero Rate, Asset Purchases .

The Federal Reserve opened a new era in U.S. monetary history, cutting interest rates to as low as zero and pledging to buy unlimited quantities of securities, after conventional policies failed to arrest what may be the worst recession since World War II.

The new strategy is likely to involve unusually close cooperation with the Treasury of President-elect Barack Obama, which is still formulating its economic-rescue plans. The aim is to kick-start borrowing and spending to propel the economy toward a recovery by the middle of next year.

“It's going to take a combination of fiscal and monetary stimulus to get the job done,” said former Fed Governor Lyle Gramley, now senior economic adviser at Stanford Group Co. in Washington. The central bank has signaled it will “make sure that the fiscal stimulus package, which is going to be a big one, is fully supported” and “in effect financed by the Fed.”

“We are running out of the traditional ammunition that is used in a recession,” Obama said at a news conference yesterday. While the Fed is going to have “more tools available to it, it is critical that the other branches of government step up,” he said.

“The only meaningful limitation right now is their capacity to be creative,” said David Resler, chief economist at Nomura Securities International Inc., New York. “The Fed is telling us there is just about nothing off the table.”

“The availability of Fed credit might deter private credit,” said Vincent Reinhart, resident scholar at the American Enterprise Institute in Washington and former director of the Division of Monetary Affairs at the Fed Board. “The lender of last resort becomes the lender of only resort.”

“Quantitative easing American style is what they're giving us,” said Allen Sinai, chief global economist at Decision Economics Inc., New York. “The Japanese style was to buy government maturities. The U.S. style is directly buying agency securities, buying mortgage-backed securities and lending money right into the private sector.”

The key ideas above are:

"The availability of Fed credit might deter private credit."

"The lender of last resort becomes the lender of only resort."

Change the word "might" to "will" in the first sentence and you have the essential idea. Bernanke wants to drive long term rates lower, but there is no incentive for banks to lend at lower rates.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.