Fed Targeting Long-term Interest Rates to Force Mortgage Rates Lower

Interest-Rates / US Interest Rates Dec 20, 2008 - 09:31 AM GMTBy: John_Mauldin

I Meant to Do That

I Meant to Do That- The Lights of Myanmar

- Some Good News for Borrowers

- Madoff May Give Us a Sell-Off

The Fed has taken interest rates to zero. They have clearly started a program of quantitative easing. What exactly does that mean? Are we all now Japanese? Is the Fed pushing on a string, as Japan has done for almost two decades? The quick answer is no, but the quick answer doesn't tell us much. We may not be in for a two-decades-long Japanese malaise, but we will experience a whole new set of circumstances. In what will hopefully be a shorter holiday version of the e-letter, I will tackle these questions and more.

The Lights of Myanmar

Most of us are familiar with the devastating hurricane that hit Myanmar (Burma) this last year, and the difficulty in getting aid to those who were suffering. My friends and colleagues at Knightsbridge were able to get in and help where others couldn't.

Knightsbridge International is a small group of volunteers who go to places that are definitely not safe but where the need for help is critical. Like the knights of old, who ran hospitals and relief efforts, these modern-day knights go to where the need is greatest. They took food and medicine to northern Afghanistan before the troops went in (very dangerous!). They went to rebel-held territory in Sri Lanka after the tsunami, when no one else could get medicine and other aid in. Whether it's driving in to rescue nuns in Rwanda (fascinating story!) or taking solar power to clinics in Myanmar, or water purification units and medicine to Darfur, they go where other groups fear to tread. They have no political or religious agendas, just the drive to get aid to where it can do the most good.

Last year an award-wining documentary was made about three of the Knightsbridge men, Ed Artis, Dr. Jim Laws, and Walt Ratterman. It was shown on PBS and viewed all over the world. These men are the real deal, heroes who like to do good deeds but get an adrenaline rush at the same time. Some of the things they do I cannot write about, as it would put them and others in serious danger. They are a little bit crazy, but then you'd have to be to accomplish everything they do.

Last year you generously supported missions to both Darfur and Myanmar, where a team led by Walt Ratterman (a leading expert on solar power) put into place solar power systems that help power clinics. Walt once showed me a photo of a doctor in Myanmar who had to do an amputation on a child (as a result of a land mine) in the dark, holding a flashlight in his teeth. You can bet that doctor was very happy about getting solar power.

For the past few years your generosity has helped provide solar power for health clinics for refugees in Thailand, as well as in villages in Myanmar. Walt wrote me about the project he recently finished:

"The project we just completed provided solar power for a medical and training facility in the Karen State that is operated by the Free Burma Rangers (www.freeburmarangers.org) The project started with a 4-day journey on foot to get into the area. Equipment for the solar systems had to be carried in by over 100 people prior to our arrival. After we all got in place, and completed the training for the solar installers, we installed twelve 2-panel solar systems. These systems provided electricity for the central communications center, the medical training center, the human rights training center, and other miscellaneous buildings. Once the work was done, we had to take the same 4-day hike back out of the area."

This is not an easy hike. It is through very dense, mountainous jungles, over rivers, and through deep valleys. The Free Burma Rangers have trained over 110 multi-ethnic relief teams, and there are 43 full-time teams active in the Karen, Karenni, Shan, Arakan, and Lahu areas of Burma. Seven more teams have been formed recently in the Chin area on the Indian Border. The teams have conducted over 350 humanitarian missions of one to two months into the war zones of Burma. On average, between 1,000 and 2,000 patients are treated per mission. You can see more about this last project at www.sunepi.org/SunEPI/Burma_files/PP_FBR.pdf

Partially due to your generosity, there are literally thousands of people (many of them young children) who are alive today. This year Walt wants to complete another clinic on the Thai border and then one on the India border with Myanmar. It will take approximately $75,000 to do both.

We are grateful for any donations to this year's project. Donations can be made at the website, www.sunepi.org or by directly going to our Funding Burma page, www.sunepi.org/SunEPI/Funding_Burma.html. Checks can be made out to SunEnergy Power International and sent to 11 Laurel Lane South, Washougal, WA 98671.

As I said, these guys are the real deal. They are helping people who the world has mostly forgotten yet who work hard day in and day out to keep their families alive. I know we are in a recession, but when you compare what is happening here to the devastation in Myanmar, our plight does not seem so bad. Please give generously.

By the way, Walt is in Palestine right now, installing more solar power for clinics. I can't mention where some of the other teams are, but a little extra prayer wouldn't hurt. (Did I mention that none of these guys take any money, and pay their own way? And if you too are a little crazy and are in decent shape and you want to join in some of the projects, drop them a line.)

I Meant to Do That

In my house, when someone stumbles or does something odd, they quickly say, "I meant to do that." It's a running joke, and we all have fun with it. This week the Fed did something rather interesting. Quoting from the release after their two-day meeting:

"The Federal Open Market Committee decided today to establish a target range for the federal funds rate of 0 to 1/4 percent."

Normally they have a specific rate and not a range. But for the last few weeks the market has pushed the Fed's fund rate close to zero, making the Fed look like they were behind the curve at the then-official rate of 1%.

Now the Fed, with a range rather than a specific rate, will be able to say, "I meant to do that." They can keep the Fed funds rate from rising over 0.25%. And if it stays near zero? Well, now they can say it is within the target.

And with Fed funds at an effective zero, it is having the effect of bringing down other rates as well. I wrote in 1998, and have repeatedly made the point over the past five years, that deflation will be the primary force that must be dealt with, rather than inflation, before we are done with the current credit cycle. Over the last year, when CPI (Consumer Price Index) inflation was high and rising, I kept insisting that the problem would be deflation in 2009. (That brought more than a few letters telling me I was wrong.) Because of my view about deflation, I have long held that, ultimately, interest rates on the US 30-year bond would fall below 3%. That was rather bold in 1998, or even last year.

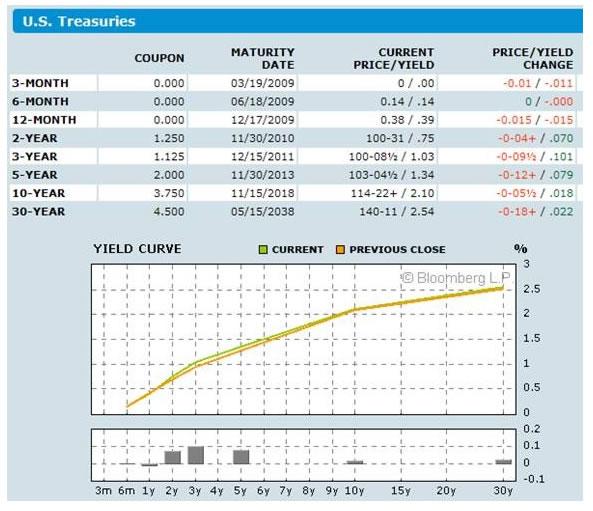

Now, that prediction seems rather tame. We went right through 3% this week, and as I write we are at an astounding 2.54% on the 30-year and 2.1% on the 10-year!

Note that the 3-month is at zero. Indeed, to get even 1% you have to go all the way out to a 3-year maturity. This is going to make it very hard on money market funds to offer any type of yield. Indeed, several large firms have closed their Treasury money market funds, as it costs more to operate the fund than the interest paid on the bills, notes, and bonds.

And this is precisely what the Fed wants to see. Investors are going to have to start looking to other avenues to get yield. If you can't get a return on your money market, why not put it in a bank certificate of deposit? You can get a federally insured CD for one year at over 3% at many institutions, and 4% if you want to tie your money up for three years. Making the competition - money market funds – less profitable is one way to recapitalize banks.

The Federal Reserve, as noted last week, has significantly increased the monetary base, but the money supply has not risen in concert. I failed to explain why last week. It is because banks have not taken those reserves and lent them out. Until that happens, the Fed is not really "printing money," they are just making it available. At some point, let's hope the banks decide to use it.

This week's FOMC statement was rather remarkable, in that it was very clear. Normally, and especially under Greenspan, you had to take each sentence apart to try and divine the meaning of the release and what that meant for the future. And the statements are typically short. Not this one. Let's look at three paragraphs from it (emphasis mine).

"Since the Committee's last meeting, labor market conditions have deteriorated, and the available data indicate that consumer spending, business investment, and industrial production have declined. Financial markets remain quite strained and credit conditions tight. Overall, the outlook for economic activity has weakened further.

"Meanwhile, inflationary pressures have diminished appreciably. In light of the declines in the prices of energy and other commodities and the weaker prospects for economic activity, the Committee expects inflation to moderate further in coming quarters.

"The Federal Reserve will employ all available tools to promote the resumption of sustainable economic growth and to preserve price stability. In particular, the Committee anticipates that weak economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time."

The Fed expects inflation to fall well into next year. They have noted their concern. They have also said they will hold the Fed funds rate at these low levels for a long period of time. This is to encourage longer-term lending at low rates.

How serious are they? Richard Fisher is the President of the Federal Reserve Bank in Dallas (just down the road from my new office). Over the past few years, he has been the most outspoken "hawk" on inflation of all the Fed governors and presidents. He spoke yesterday at the Dallas chapter of the World Affairs Council. Let me quote a paragraph:

"Price pressures now are in the other direction...[and] we have to do everything we can to lift the economy up and prevent deflation from taking [hold].... We are well aware that at some point, God willing, we'll have to tighten and we'll have to act; and I'm here to tell you that my voice will be very loud at that juncture, but right now that's not the issue."

That is a rather remarkable statement for Fisher. I don't ever recall him talking about preventing deflation. The FOMC meeting this week (where he is currently a voting member) must have been a real eye-opener for him.

The Fed has already committed to buying mortgages and consumer loan securities. In Ben Bernanke's famous "helicopter speech" in November of 2002, he stated that one of the ways the Fed could fight deflation would be to "move out the yield curve" and set target rates for longer-dated securities, like 2- or 3-year US notes. In the FOMC release, the Fed noted that they might indeed use that tool. That is one of the reasons interest rates are falling, as the market must sense that the Fed is prepared to do just that. This meeting simply put the market "on notice" that at some future meeting it is quite possible for them to set a target rate on longer-dated securities.

Some Good News for Borrowers

Remember that ARMs (Adjustable Rate Mortgage) reset problem I was writing about late last year? This includes all the alphabet of ARM mortgages, interest-rate-only mortgages, pay-option ARMs, etc. Resetting the rates has been a problem up until now, as the rates which are the usual base for the resetting have been high, forcing mortgagees to pay a much higher monthly mortgage when the rates reset. However, given the current environment, that may no longer be a problem in the near future.

The large majority of ARMs are linked to either 1-year LIBOR or 1-year Treasuries. We saw above that 1-year Treasuries are 0.39%, and 1-year LIBOR is 2.09. Both were at 4.5% in 2006. Those getting ready to reset in the near future are actually going to catch a break and see their payments go lower!

Fellow analyst Mish Shedlock writes that he has an interest-only mortgage tied to 1-month LIBOR, and his annual rate is going to drop to 1.75%.

You can bet that between the Fed and the incoming administration they are going to pull out all the stops to get 30-year fixed-rate mortgages to drop along with the 10-year US bond, with which mortgages normally move in tandem. The spread is now as wide as I can remember, at well over 3%. Not all that long ago it was 1%. It is quite possible that we will see mortgage rates below 5% and approaching 4% in the next year, at least for conforming mortgages. Since I have two kids that have bought homes this year, I hope they will be able to get refinancing at lower rates with whatever new program the administration introduces.

Madoff May Give Us a Sell-Off

Much of the selling pressure that has come in the stock and credit markets has been rightly attributed to forced selling by hedge funds in an effort to meet redemptions for January 1. I wrote a few weeks ago that this could be the kicker for a powerful rally in the first quarter. Most of those redemptions will show up in the last two weeks of January, with the rest by the middle of February. Institutions, which are the bulk of redemptions, are going to have to put that money to work. Do you put it into bonds at 2%? That is not going to get you to the target returns that you need for the future if you are a pension or insurance company.

Much of that money is going to go back into either the stock market or into other hedge funds. This could be the fuel for a real rally. However, that was before Madoff. I have no hard evidence, but I know a lot of funds of funds had exposure to Madoff. Those funds are likely to see further redemption requests and face the need to further liquidate underlying hedge fund positions. Also, a lot of people who did have investments with Madoff are now going to need to get their liquidity somewhere else.

This all has the potential to put more selling pressure into the market. Enough to overcome the tsunami of money that is coming back into the market? I don't know, but I think it could put a damper on the rally I was predicting. The actual redemptions for most funds of funds will be next April 1, as only a few offer monthly liquidity, but the selling will have to be in the months before. This will need to be closely watched in March.

Conversations with John Mauldin

Yesterday, some of you got a special email from me talking about a new subscription service that we will be offering beginning next month, called "Conversations with John Mauldin." One of my "secrets" is that I have a very powerful rolodex (or, for the younger crowd, my contacts list). Each month, I will call up one of my special contacts in the investment and economic world and hold a conversation with them about the important topics of the day - how we should be investing, what opportunities and pitfalls are out there in the world, etc. Some will be names you recognize, and others you should. You will get to listen in, download to your computer, or read a transcript, whichever you prefer.

Right now, we are offering a subscription for $99, half off the regular $199 price. This is only available for the Holiday season. You can click here and subscribe, if you haven't already. Insert code JM33 for this special offer.

And for those of you who experienced errors signing up, please email eu@2000wave.com and we will let you know whether your subscription and credit card went through.

If you like my regular e-letter (and it will still come to you each week), then you are really going to like this new service. This letter will not change at all. This new service is to let you look over my shoulder as I talk things over with colleagues who are in the know. I hope you join in and get to hear the January conversation, where we will discuss the forecast for 2009. You won't want to miss it.

New Orleans, La Jolla, and Merry Christmas

It is time to hit the send button, as I am off to New Orleans, where I'll spend the next four days with Tiffani, working on our new book, Eavesdropping on Millionaires. I really am looking forward to getting out of the office and focusing on the project. It's a lot of fun to interview millionaires and get their stories. There are just so many ways to achieve wealth, and so many interesting paths and personal insights that we have come across.

Tiffani and I will be in La Jolla in mid-January to have our annual planning meeting with my partners at Altegris Investments. I always look forward to meeting with Jon Sundt and his team, and feel they do an excellent job for our mutual clients. After that, I have a few trips planned in the US, but no trips lined up yet outside the country. That means I will have to get my travel "kicks" by reading International Living. It is an inexpensive way to learn about traveling and living outside your home country. For me, it is cheap fantasy about that beach home in Paradise. You can get your own subscription at http://web-purchases.com/ILV2008/WILVJC04/

The move into the new offices has been rather hectic, to say the least. Getting used to a new phone system, trying to unpack boxes, traveling to Phoenix (where it was rainy and cold), getting Trey ready for a new school, and more than the usual number of distractions has all made life more interesting. But then I have so many blessings that complaining about the small hassles seems out of line this season.

I am not sure if I will write another letter between now and January 9, when I will do my annual forecast issue. Let me take the time to wish you, gentle reader, a heartfelt Merry Christmas and the best ever New Year. While the economy may be a tad bumpy, the important things like family, friends, and health are where our real wealth is. Enjoy this season and all that it means.

Your still having to pack analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.