Stock Market Crash 2008 Gives Birth to Baby Bull 2009

Stock-Markets / Stocks Bull Market Jan 04, 2009 - 07:25 PM GMTBy: Clif_Droke

The old man of 2008 has yielded his place to the baby New Year and with it a changing of the guard. Not only has 2009 brought a fresh new start with a clean slate, but also a new series of Kress cycles.

The old man of 2008 has yielded his place to the baby New Year and with it a changing of the guard. Not only has 2009 brought a fresh new start with a clean slate, but also a new series of Kress cycles.

The previous year was dominated by every conceivable nightmare in the financial realm. From housing market woes to bank collapses, from soaring fuel costs to collapsing equity prices -- in 2008 we saw the extremities of price inflation give way to deflationary collapse, all within the space of a few short months. Truly the financial market turmoil of the past year was head-spinning.

The seismic volatility of 2008 was a testament to the power of the Kress cycles, for in 2008 the Kress cycles were in the worst possible configuration. The 6-year cycle was bottoming while the 12-year cycle was peaking. This produced much of the volatility and cross-currents of the past year, particularly between the months of June and November.

With the advent of the New Year, the financial market has the benefit of a positive Kress cycle configuration behind it. Instead of serving as detrimental cross currents, the cycles will be as beneficial tail winds to the stock market in the coming months. The Kress 6-year cycle is now on the rise and exerting increasing strength with each passing week. Instead of a depressing influence as was the case in 2008, the 6-year cycle will have an uplifting effect in the months ahead. Providing additional strength will be the 10-year cycle, which is peaking later this summer.

With the 6-year cycle bottom and the recently bottomed composite interim cycle behind us, another thing investors can look forward to in 2009 is diminished volatility. One of the prime contributors to the hyper volatility of 2008 was the dual between the bottoming 6-year cycle and the peaking 12-year cycle. Now that this event has passed we can already see market volatility is on the wane. The Volatility Index (VIX) recently broke under its 60-day moving average and is also below the psychological 50.00 level, a proverbial “line in the sand” delineating the control of the stock market between the buyers and sellers. With the VIX now under 50.00, the sellers have lost the advantage they formerly held.

Another welcome change in 2009 is the return of the market’s “Wall of Worry.” During the second half of 2008 the market fed off the near continuous stream of bad news. Since the Kress cycles were down hard in 2008, bad news generated a depressing effect on stock prices. Now that the Kress cycles are turning up it means that from here on the contrarian principle will work once again. This means that bad news is good news for the bull market. And good news is also good news. The market’s “Slope of Hope” which reigned supreme in the bear market will now be replaced by the “Wall of Worry” now that a new cyclical bull market is underway.

The contrarian principle worked exceptionally well in 2003-2007. It even worked fairly well during the first half of 2008 before the final “hard down” phase of the 6-year cycle and when some of the interim cycles were still peaking. Yet from June through November, if you were a died-in-the-wool contrarian you would have lost money by betting against the bearish crowd. Why is this? Because in the final phase of a bear market when the cycles are synchronized on the downside, and internal momentum is declining to boot, then bad news tends to feed on itself. Instead of the market reversing on a manifestation of negative sentiment and bad news headlines, it falls all the more. This is why it’s important to adjust our investment posture to stay in line with the cycles.

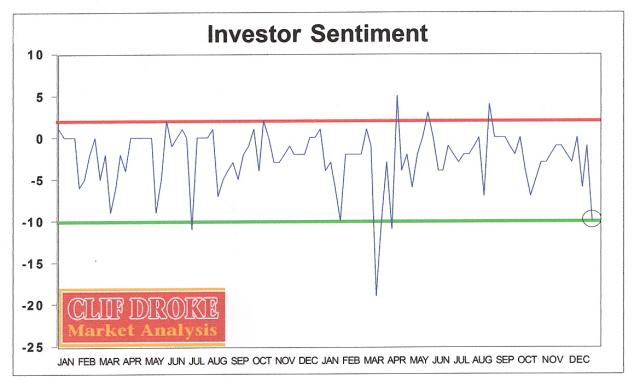

Our in-house investor sentiment gauge is updated weekly. Notice in the following graph that each time in the last two years the indicator fell to -10 or below marked a good time to buy stocks. The times this happened were: July 3, 2007; Jan. 23, 2008, Mar. 12-18, 2008, April 2, 2008, Dec. 31, 2008.

Speaking of sentiment, in the business section of my local newspaper something caught my attention the other day. It was in a financial advice question and answer by Bruce Williams, who writes the nationally syndicated “Smart Money” column. The questioner asked him, “What can we do to prepare for the impending depression? Should we take money out of savings? Pay off credit cards? Start a garden?”

Never mind Mr. Williams’ answer. The question is what really matters for purposes of this discussion. Now keep in mind that this column is read by hundreds of thousands across the country and in some of the biggest metropolitan newspapers as well as smaller ones. This question is reflective of the public’s mindset right now.

If this question had been published in a financial advice column anytime before 2008 we could automatically assume it was being asked by a “permanent pessimist” type of investor. There is no way your average mainstream investor (who tends to be eternally optimistic) would have asked this sort of question before the 2008 financial crisis, or at least, such a question would never have been be publicized in mainstream newspapers before this year. This gives us a very good idea of just how gloomy the average American is feeling right now. They are depressed, despondent, forlorn, forsaken, and just about every other negative description you’d care to throw in. The bottom line is that depression is now being treated by the mainstream as inevitable instead of merely a remote possibility as it had been before this year.

Even the books shelves of mainstream books stores are swelling with titles evoking the “coming depression” and “financial collapse” being predicted for 2009. Quite a few financial heavy hitters, including some who were noted for being super bullish in former years, have come out with books predicting depression in the past few months. The depression trade has come full circle from being a small cottage industry dominated by a handful of permanent pessimists, to a major business where even well-known mainstream financial pundits have jumped on the bandwagon.

This is earth-shattering in its implication and speaks volumes about the current investor sentiment out there. Viewed from a contrarian’s perspective, and with the Kress cycles firmly to our backs, the odds say the pessimism of the majority will be disappointed in the coming months. Or, as Joe Granville reminds us, “The obvious is obviously wrong.” This statement especially holds true when the cyclical winds are blowing against the grain of conventional wisdom, as they are now.

Every market signal is telling us that the U.S. will probably avoid depression in 2009. Calls for financial Armageddon will have to be postponed for another time. If investors want to make money in the financial marketplace of the opening months of 2009 they will have to discard their bearish hangover mentality from 2008, for it won’t serve them well from here. Maintaining a bearish posture heading into 2009 is like wearing a fur coat on the Fourth of July: it just isn’t suitable to the climate of the times.

The mini cyclical bull market now underway has the potential to last until summer, when the 10-year cycle is scheduled to peak. While it may not be a spectacular bull market it should nonetheless offer a much needed respite from the previous year’s pain.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.