U.S. Unemployment Soars to 7.2%; Jobs Contract 12th Straight Month

Economics / Recession 2008 - 2010 Jan 09, 2009 - 12:06 PM GMTBy: Mike_Shedlock

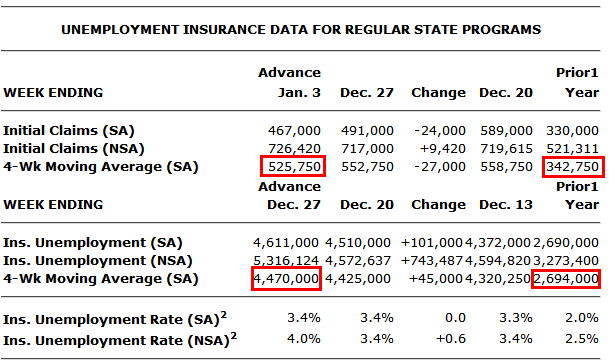

Before taking a look at the monthly jobs data, let's take a look at Initial Unemployment Insurance Claims from The US Department of Labor.

Before taking a look at the monthly jobs data, let's take a look at Initial Unemployment Insurance Claims from The US Department of Labor.

For a look at how well states are handling the massive rise in claims, please see Unemployment Claims Crash Multiple State Websites .

Jobs Decline 12th Consecutive Month

This morning, the Bureau of Labor Statistics (BLS) released the December Employment Report .

In December 2007 I predicted a jobs disaster every month this year. That prediction is now 12 for 12. Here is a synopsis of the BLS report.

Nonfarm payroll employment declined sharply in December, and the unemployment rate rose from 6.8 to 7.2 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Payroll employment fell by 524,000 over the month and by 1.9 million over the last 4 months of 2008. In

December, job losses were large and widespread across most major industry sectors.

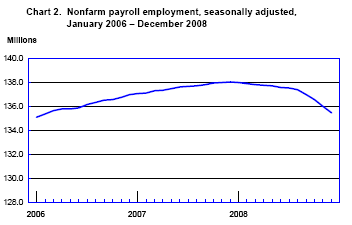

Nonfarm Payroll employment has shrunk to mid-2006 levels.

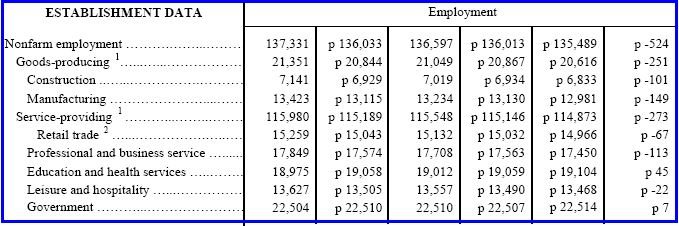

Establishment Data

Highlights

- 524,00 jobs were lost in total

- 101,000 construction jobs were lost

- 149,000 manufacturing jobs were lost

- 273,000 service providing jobs were lost

- 91,000 retail trade jobs were lost

- 67,000 professional and business services jobs were lost

- 45,000 education and health services jobs were added

- 22,000 leisure and hospitality jobs were lost

- 7,000 government jobs were added

Note: some of the above categories overlap as shown in the preceding chart, so do not attempt to total them up.

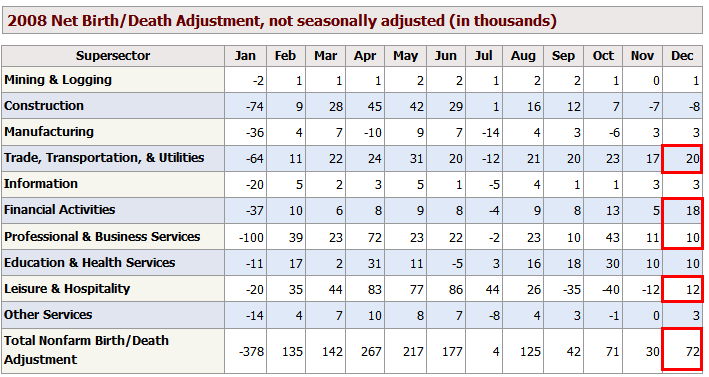

Birth/Death Model In Outer Space

Once again was an extremely weak jobs report. And once again the Birth/Death Model assumptions are absurd. The birth/death adjustments have been in deep outer space every month this year except for January and July.

The Birth Death numbers are once again in deep outer space.

A quick check on the Mortgage Lender Implode-O-Meter shows that 314 Major US lending operations have imploded. This number appears to be topping.

However, even if fewer lenders are going under, there is still decreasing activity in the sector and many small 1-5 person shops are throwing in the towel. Those small 1-5 person businesses are not properly accounted for in the Birth-Death Model. At this point in the cycle birth death numbers should be massively contracting. Month after month, with the exception of January the BLS is assuming more jobs were created by new businesses than lost by businesses closing shop. This is patently absurd.

BLS Black Box

For those unfamiliar with the birth/death model, monthly jobs adjustments are made by the BLS based on economic assumptions about the birth and death of businesses (not individuals). Those assumptions are made according to estimates of where the BLS thinks we are in the economic cycle.

The BLS has admitted however, that their model will be wrong at economic turning points. And there is no doubt we are long past an economic turning point.

Here is the pertinent snip from the BLS on Birth/Death Methodology.

- The net birth/death model component figures are unique to each month and exhibit a seasonal pattern that can result in negative adjustments in some months. These models do not attempt to correct for any other potential error sources in the CES estimates such as sampling error or design limitations.

- Note that the net birth/death figures are not seasonally adjusted, and are applied to not seasonally adjusted monthly employment links to determine the final estimate.

- The most significant potential drawback to this or any model-based approach is that time series modeling assumes a predictable continuation of historical patterns and relationships and therefore is likely to have some difficulty producing reliable estimates at economic turning points or during periods when there are sudden changes in trend.

The important point in this mess is that both the job data and employment data are much worse than appears at first glance (and the first glance looked horrid).

Household Data

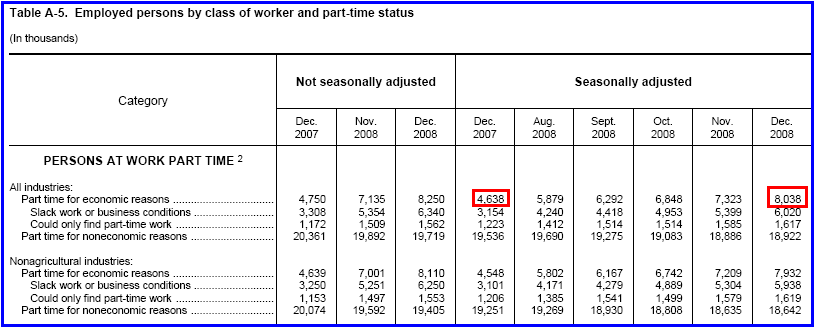

In December, the number of persons who worked part time for economic reasons (sometimes referred to as involuntary part-time workers) continued to increase, reaching 8.0 million. The number of such workers rose by 3.4 million over the past 12 months. This category includes persons who would like to work full time but were working part time because their hours had been cut back or because they were unable to find full-time jobs.

Persons Not in the Labor Force

About 1.9 million persons (not seasonally adjusted) were marginally attached to the labor force in December, 564,000 more than 12 months earlier. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months. They were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey. Among the marginally attached, there were 642,000 discouraged workers in December, up by 279,000 from a year earlier.

Discouraged workers are persons not currently looking for work specifically because they believe no jobs are available for them. The other 1.3 million persons marginally attached to the labor force in December had not searched for work in the 4 weeks preceding the survey for reasons such as school attendance or family responsibilities.

Table A-5 Part Time Status

The chart shows 8 million people are working part time but want a full time job. A year ago the number was 4.6 million.

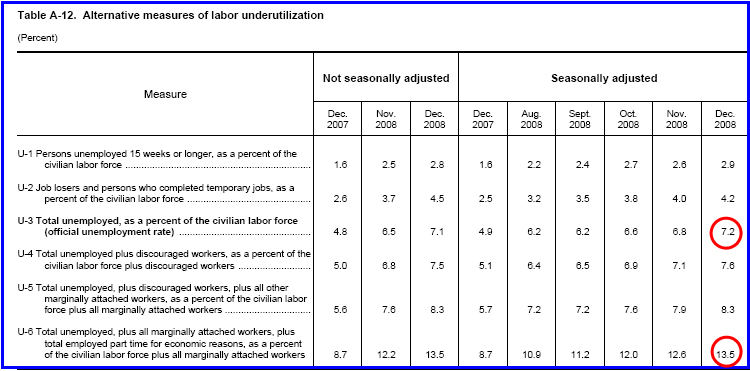

Table A-12

Table A-12 is where one can find a better approximation of what the unemployment rate really is. Let's take a look

Depression Statistics

The official unemployment rate is 7.2%. However, if you start counting all the people that want a job but gave up, all the people with part-time jobs that want a full-time job, all the people who dropped off the unemployment rolls because their unemployment benefits ran out, etc., you get a closer picture of what the unemployment rate is. That number is in the last row labeled U-6.

It reflects how unemployment feels to the average Joe on the street. U-6 is 13.5%. Note that it was 8.7% a year ago. Both U-6 and U-3 (the so called "official" unemployment number) are poised to rise further.

There is no official definition of depression. Here is mine. When the U-6 unemployment rate rises above 12.5 in conjunction with a stock market that is down close to 50%, and a negative CPI, it's an economic depression. We are in one.

Looking ahead, I expect the service sector to continue to weaken. Mall vacancy rates are rising and a huge contraction in commercial real estate is finally started. There is no driver for jobs and states in forced cutback mode are making matters far worse. Expect to see the official unemployment rate hit 9% in 2009.

Given that unemployment is a lagging indicator, it is likely to continue rising in 2010.

Small Businesses Have Largest Decline In Seven Years

The ADP Small Business report found that small businesses lost 281,000 jobs and medium businesses lost 321,000 jobs in December. See Massive Jobs Contraction In Small and Medium Sized Businesses for details.

There is no driver for jobs, nor will the misguided $700+ billion bailout plan of Paulson provide any. Hope now rests with Obama but it is a misguided hope as explained in As Pink Slips Mount, So Do Concerns .

Bear in mind that government cannot really "create" any jobs per se. It can raise taxes and shift private sector jobs creation to government jobs creation (typically a malinvestment), and it can bring production and consumption forward for those jobs that are genuinely needed (filling potholes), but once the potholes are filled, one has to ask the question, "What will we do for an encore?"

The Fed is desperately trying to get you to borrow. I am suggesting you cut all unnecessary spending cold turkey. We cannot spend ourselves to prosperity. It is simply impossible. Job losses are going to mount, few jobs are safe and the best thing to do is to be mentally prepared to be working fewer hours.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.