Stock Markets Could Rise a Wall of Terror!

Stock-Markets / Investing 2009 Jan 15, 2009 - 02:33 PM GMTBy: Oxbury_Research

Just How Much Money is Out There? - There's no end to the talk of how much cash is sitting on the sidelines just raring to be put to good investment use. We hear of mutual funds net cash positions at all time highs; we hear of investors turning to – of all things – bank accounts and CDs to park their cash (say it isn't so!); we hear of foreign investors loading up on treasuries as a safe haven bet; and we wonder just how much money really is out there.

Just How Much Money is Out There? - There's no end to the talk of how much cash is sitting on the sidelines just raring to be put to good investment use. We hear of mutual funds net cash positions at all time highs; we hear of investors turning to – of all things – bank accounts and CDs to park their cash (say it isn't so!); we hear of foreign investors loading up on treasuries as a safe haven bet; and we wonder just how much money really is out there.

The answer?

A pretty penny.

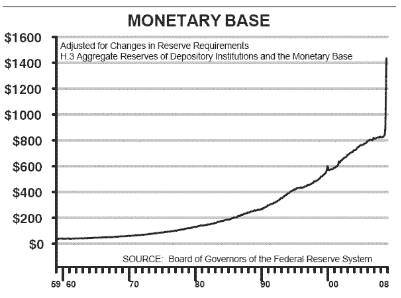

But let's begin with a look at a chart that should startle, or alarm you, depending upon how sensitive you are to issues of taxation, inflation and personal liberty. What you see below is the Federal Reserve's “ Monetary Base ” charted for the last fifty years. The “ Monetary Base ” is the essential American money supply – dollars in their most liquid form.

This is not a sleight of hand. And I am not Harry Houdini. Nor am I “The Amazing Kreskin.” This chart accurately depicts a brazenly sudden and incomprehensible increase of 75% in the number of dollars floating about the U.S. economy. What took the Federal Reserve 23 years to accomplish until 2008 was literally replicated overnight. For every $100 that was in circulation, another $75 was added. And know it well: the consequences will be lasting.

Now be sure, too, that much of this money will never find its way into the hands of Joe consumer; significant quantities will be pasted against losses registered by bankers and other free-spirited financial types who never seem to learn from their mistakes. But a good bit of it still will end up in the hands of retailers and, dare we say, back in our friendly neighborhood mutual fund.

The truth is that such action is unprecedented – we have no calculus to measure what the consequences of so drastic a move will be. Will it be absorbed serenely by a contracting economy and bring about some sort of economic equilibrium? Will it lead to immediate, massive inflation and all the shock and dislocation that should attend that phenomenon? No one knows. For someone to say he does is to admit to a lie. The consequences of this action occupy the realm of pure fantasy. And when we get there (if we get there), we will all surely be shocked by what the results are.

That said, here are some figures to ponder:

- Pension funds manage approximately $29 trillion in assets.

- Insurance funds manage approximately $19 trillion in assets.

- Mutual funds manage approximately $28 trillion in assets.

- According to the latest data from the Investment Company Institute , cash invested in Money Market mutual funds recently overtook that invested in stock mutual funds: $3.83 trillion – an amount equivalent to nearly half the S&P 500's total current market cap.

- This is the highest such reading (Money Market Funds/S&P 500) in 25 years.

If pension and Insurance funds are holding similar percentages of cash, and the average consumer/investor decides that things are going better for him than the headlines say – and he can get his hands on his share of that lip-smacking “ Monetary Base, ” there's no telling how high this overly depressed market could fly.

All that's needed is a wall of worry.

And “depressed” is the key word here. Recent comments from two leading economists are helping to paint a picture of global economic dread that's crucial for the markets to catch a bid and continue to rise over time.

The first is no less than the International Monetary Fund's chief economist, Olivier Blanchard, who this week stated that unless radical steps are undertaken – and fast – “there will be major crises in a number of emerging economies.” Moreover, he and his research team were caught off guard by the “striking … drop in consumer confidence and business confidence in all the countries of the world,” the true cause, he believes, behind the current seizure in economic activity.

So, too, opines the Governor of the Bank of Spain, Miguel Angel Fernandez Ordonez, who feels that confidence will either make or break any future attempt at economic recovery. Says this man with too many names:

“The lack of confidence is total. The inter-bank (lending) market is not functioning and this is generating vicious cycles: consumers are not consuming, businessmen are not taking on workers, investors are not investing and the banks are not lending. There is an almost total paralysis from which no-one is escaping.”

According to him, the world faces “'total' financial meltdown” unless confidence returns.

And that's just what we like to hear. Economists, as a group, are not high on our list of those offering meaningful opinions. But the newspapers sure like them. And this kind of negativity is precisely what feeds a bull market.

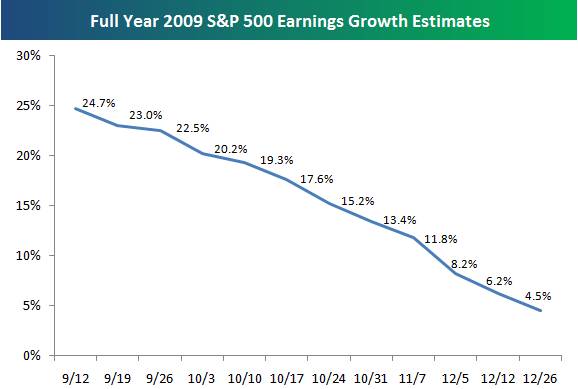

Even Wall Street analysts have become doomsayers. A quick look at historical earnings growth estimates for the S&P 500 show a steadily increasing pessimism. Only three short months ago they were predicting overall earnings growth of nearly 25%. Now? 4.5%.

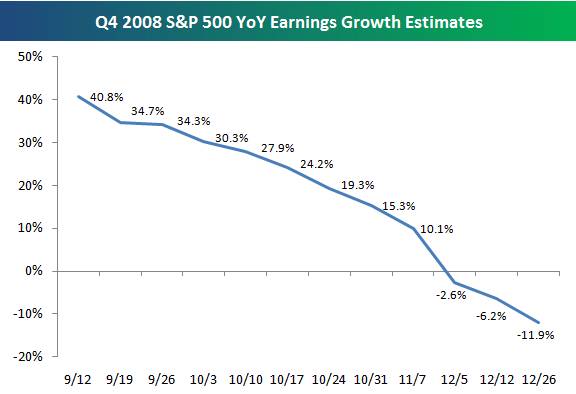

So, too, with year over year earnings estimates for the current quarter: everyone thought banks would bounce back and drive 4 th quarter earnings higher by 40% over last year's numbers. But that changed in a hurry:

Now they're expecting a YOY decrease in earnings of nearly 12%.

Love it.

One more thing: when bond investors are paying the United States Government to hold on to their hard earned money (as the short end of the yield curve indicates) you have a uniquely frazzled investment community on your hands. This is no ordinary lack of confidence, friend. This is out and out terror. And it makes for great market moves.

So, while there are those who are quick to make comparisons to the Great Depression (outright silly), and those who condemn those same comparisons, we find ourselves nestled comfortably between. Let the wailing continue. It keeps the buying coming at a more measured pace.

Dive in!

Matt McAbby

Analyst, Oxbury Research

After graduating from Harvard University in 1989, Matt worked as a Financial Advisor at Wood Gundy Private Client Investments (now CIBC World Markets). After several successful years, he moved over to the analysis side of the business and has written extensively for some of corporate Canada's largest financial institutions.

Oxbury Research originally formed as an underground investment club, Oxbury Publishing is comprised of a wide variety of Wall Street professionals - from equity analysts to futures floor traders – all independent thinkers and all capital market veterans.

© 2009 Copyright Oxbury Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Oxbury Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.