Consumer Spending, Last Bastion of U.S. Economy In Full Retreat

Economics / Recession 2008 - 2010 Jan 19, 2009 - 12:00 PM GMTBy: Oxbury_Research

In previous economic slowdowns, it was always consumer spending that kept the American economy afloat. Millions of Americans continued shopping at malls, buying cars, ordering gadgets through the mail and TV and otherwise putting their wallets and purses on the line. It was always the brave American consumer rushing unto the breach to beat off the demons of economic gloom and uncertainty.

In previous economic slowdowns, it was always consumer spending that kept the American economy afloat. Millions of Americans continued shopping at malls, buying cars, ordering gadgets through the mail and TV and otherwise putting their wallets and purses on the line. It was always the brave American consumer rushing unto the breach to beat off the demons of economic gloom and uncertainty.

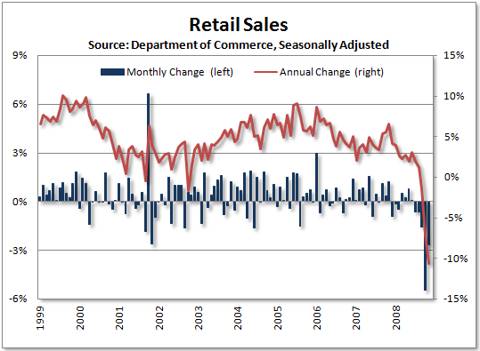

But not this time, it seems. Retail sales have now declined for the sixth straight month .

The U.S. Census Bureau announced that advance estimates of U.S. retail and food services sales for December (adjusted for seasonal variation and holiday and trading-day differences but not for price changes) were $343.2 billion. That's a 2.7% drop (±0.5%) from November and a 9.8% collapse (±0.7%) from December 2007. The 2.7% December drop was more than twice as much as the experts expected.

What's more, retail sales fell 0.1% for all of 2008 as compared to 2007 which is the first decrease in the Commerce Department's records (although like-for-like data only go back to 1992).

And so last month's drop was a bit more than "just average" for this downturn. Look here...

This drop is in spite of the global collapse in commodities dropping imported goods prices of goods for a fifth month.

There are also signs that businesses themselves are also cutting spending. Inventories at all businesses in November dropped 0.7% (again, more than economists estimated) for the third straight time in combination with a 1.7% decline in retailer stockpiles.

A full 11 of the 13 major categories fell, with the worst being the 16% implosion (partially offset by dropping fuel costs) in gas station revenues.

There's some hope, however: beauty and health stores bucked the trend and saw December spending increases. So at least the nation's women will continue looking beautiful even as we grimace at our reduced ability to buy them flowers and fancy dinners. Perhaps they'll be happy with some e-cards and home-cooked meals?

Obama's Rescue Plan Keeps Getting Bigger and Bigger

President-Elect Barack Obama is proposing a two-year recovery plan that aims to save four million jobs via a $850 billion package that features $300 billion in tax cuts for individuals and businesses as well as infrastructure spending.

This is a tad larger than the earlier package of about $775 billion, but these days even a hundred billion or so seems like small money, right?

Supposedly this package will prevent a deeper and more prolonged recession, but we're not so sure. After all, the government and its friends apparently never saw this problem coming or pretended not to . Why should we suddenly believe they have all the right answers?

While tax cuts are certainly a good idea (we support the idea of impoverished citizens keeping more of their hard earned cash in their pockets and out of the hands of foolish government mandarins) government spending is rarely a great idea in practice.

Given that government is probably the most wasteful institution on the planet, shouldn't businesses which have to watch their bottom line be the best judge of when and where to spend their capital?

That won't stop Washington , though. In the rush to be seen as “doing something” (even if it's exactly the wrong thing), they're determined to intervene for the sake of intervening. Politicians like to appear useful (especially when they aren't) and the public rarely knows the difference between good policy and bad policy until it's too late.

In that light, the falling GDP figure and the growing unemployment number in the middle of this chart look very ominous, indeed. (Table from FinancialForecasts.com)

The Dow Rests on a Precipice

Rather predictably, stocks disliked the retail report and descended in ungainly fashion today and now sit at important support. If the Dow's 8200 level fails this time, it's unlikely to bounce back as quickly as it did in late November.

That's because the traditional Santa Claus rally isn't on the horizon and there's apparently nothing but bad news to come for the foreseeable future.

You might do well by anticipating that 8200 will hold and prove to be "just the right time to buy" … but we don't think there's truly enough "blood on the streets" yet.

That will arrive at some point in the future when all the hope has been sucked out of even the most optimistic bulls. A good sign that a bottom isn't in is the apparent willingness of most investors to be looking for one.

Why shouldn't they? That's because this is not the bear market of a typical recession, given the economic statistics which are coming out. We suspect this bear market will turn out to a be a once-in-a-lifetime event by the time it's all over.

And therefore, it makes a lot more sense to conserve your investment dollars for better opportunities in the future. After all, if this does turn out to be a highly-unlikely bottom, you can always catch the next wave of the resurgent bull a few months from now.

Some of the first pioneers got their hands on the first homesteads, true. But most of the others got the first arrows in their backs too.

Bailing Into Bare Treasure-y Chests

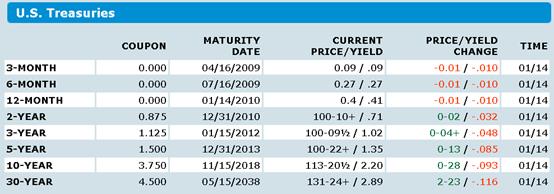

So where has the money been going? Treasury coupon securities, apparently.

The New York Fed has reported that “the financial sector maintains that the industry is still far from hitting bottom.” Lehman Brothers' failure continues to wreak havoc on banking balance sheets while Citigroup stands on the precipice of being split up.

So there's more to come, and Treasury securities remain the continued safe harbor. They certainly don't offer much, but apparently the promise of a government that's blowing up the money supply is good enough for some. (Table from Bloomberg.com).

And so the yield across the full spectrum of Treasuries has dropped today. Who would ever have guessed that lending your money for 30 years would return only 2.89%?

The TARP and Obama's revised stimulus plan (as well as this year's project trillion dollar deficit) don't augur well for the dollar.

But it seems that investors in these paltry yields are betting that other governments will be even more profligate and that the dollar will somehow maintain its power in relation to its paper competitors. Are they right? We'll find out soon enough …

Good investing,

Nick Thomas

Analyst, Oxbury Research

Nick Thomas is a seasoned veteran of technical analysis and has mastered all intra-day trading in stocks, options, futures and forex. He prefers to scout investments as one asset class of many and shapes his investment strategies accordingly. He writes extensively about offshore banking and offshore tax havens and is active in the career development field of independent investment research.

Oxbury Research originally formed as an underground investment club, Oxbury Publishing is comprised of a wide variety of Wall Street professionals - from equity analysts to futures floor traders – all independent thinkers and all capital market veterans.

© 2009 Copyright Oxbury Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Oxbury Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.