Corporate Earnings to Drive This Weeks Stock Market Trend

Stock-Markets / Corporate Earnings Jan 26, 2009 - 07:32 AM GMTBy: PaddyPowerTrader

Equity markets remain wary and soft with earnings (or the lack of them) remaining the focus. This week, 137 companies from the S&P 500 are reporting earnings results , including 12 Dow Jones components. American Express (expected EPS $0.22), Caterpillar ($1.31), Texas Instruments ($0.12) and McDonalds ($0.83) are due today. With earnings per share (EPS) expectations this low, it hammers home the point that the pain has spread beyond the banking system and that we have entered a synchronized slowdown globally. So just another manic Monday in prospect then.

Equity markets remain wary and soft with earnings (or the lack of them) remaining the focus. This week, 137 companies from the S&P 500 are reporting earnings results , including 12 Dow Jones components. American Express (expected EPS $0.22), Caterpillar ($1.31), Texas Instruments ($0.12) and McDonalds ($0.83) are due today. With earnings per share (EPS) expectations this low, it hammers home the point that the pain has spread beyond the banking system and that we have entered a synchronized slowdown globally. So just another manic Monday in prospect then.

Today's Market Moving Stories

- Weekend talk is that the U.S. stimulus package will be larger than originally planned. Speaking on ABC's “This Week,” current Speaker of the US House of Representatives Nancy Pelosi resisted the notion that the government would nationalise some banks, but when asked whether more funds would be needed above those already approved for the TARP , she said that “some increased investment” in return for equity might be necessary. “Change has to happen in terms of what is done, what the transparency of it is, what the accountability of it is,” Pelosi said. “Only then would we be able to pass any additional funding.”

- ECB's Yves Mersch makes interesting comments on Quantitative Easing in the FT. Says it will be complicated and raises question of whose government bonds you buy. Why don't they just step into the mire of the CDS market and underwrite the PIIGS (Portugal, Italy, Ireland, Greece and Spain), earning some premium and causing the spreads at which these cash strapped sovereigns can fund over Germany to narrow dramatically?

- More woe in the UK housing market as real estate consultancy firm Hometrack said that British prices fell a further 1% this month, down 9.4% year on year. This was the 16th consecutive monthly decline.

- Unconventional methods are being tried in Finland. An advertising campaign featuring a piggy bank with vampire fangs urges Finns to continue spending despite fears of a recession and daily news of lay-offs and job cuts.

- Dr Doom is nothing if not consistent in predicting more pain for global equities in 2009 .

- Jerome Kerviel, the €5bn rogue trader, got “ orgasmic pleasure ” from playing the market. I do hope it's as good for you as it was for him.

In case you have been living on another planet or not reading this blog, here's a nice summary of the errors and hiccups that got us into this present mess. Barron's has a very readable piece about the consequences and aftermath of the financial crisis. The Guardian chimes in the blame game by naming names .

Barclay's Open Letter To Shareholders

Barclay's Chairman and CEO Marcus Agius and John Varley said in a letter to shareholders that the bank has around £36bn of committed equity capital and reserves and is not seeking any further capital subscription. The bank will bring the release of its final results forward to February 9 in an effort to reassure shareholders. Total write-downs in 2008 will be £8bn. The bank reiterated an earlier announcement that it will report a pre-tax profit “well ahead” of the £5.3bn consensus forecast and that its Tier 1 capital ratio stands at around 9.5%. The bank also said it has made a good start to 2009, in particular at its investment banking arm following the integration of businesses acquired from Lehman Brothers. The stock is up over 37% so far this morning as this should take all the nationalisation talk off the table.

Equities

- Philips Electronics has posted a €1.5bn loss for Q4 2008 mainly due to its ill fated acquisition of Lumileds. It is also to cut 6k jobs and halt its share buyback programme.

- The Pfizer / Wyeth deal appears to be close .

- Seems there's more trouble brewing for Starbucks with another 1k jobs to be cut.

- Troubled Swiss bank UBS faces more pressure in the U.S. as the case against its tax avoidance scam for clients widens but this hasn't stopped them giving themselves a little bonus !

- UK building materials supplier Wolseley reported Monday a further downturn in business. Its stock is getting hammered this morning.

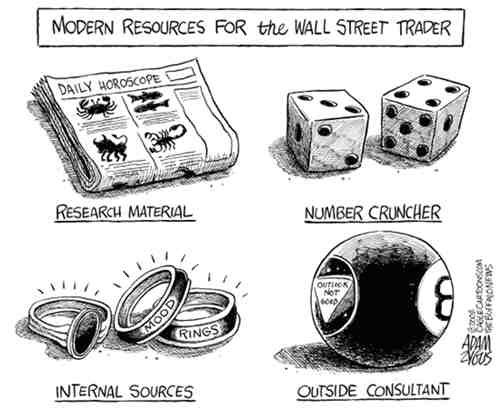

And Finally… Good To See Some Things Never Change

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.