Financial Markets at Cross Roads On Stimulus Plan

Stock-Markets / Financial Markets Jan 26, 2009 - 03:02 PM GMTBy: Chris_Ciovacco

Proposed Economic Stimulus Plan May Not Stimulate Much

Proposed Economic Stimulus Plan May Not Stimulate Much

The new administration is proposing an $825 billion "stimulus" plan. Most of the package is geared toward helping existing or expanded programs such as unemployment assistance, law enforcement, food stamps, etc. Much of this spending will "save" existing jobs or keep existing programs already in place. This may help prevent things from getting worse, but it will offer little in the way of providing new stimulation for the economy. Another large portion of the stimulus plan is in the form of tax cuts. While depreciation incentives may spur some new business spending, credits to individuals may offer little incentive to spend given the state of their balance sheets and concerns about employment. After all the hype about infrastructure spending, only about 25% of the package is geared toward this area.

Tug of War Between Liquidity and Economic Weakness

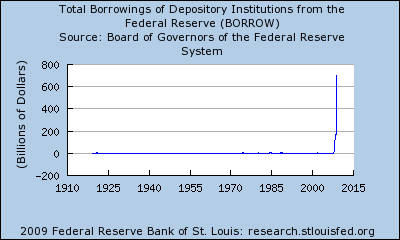

The chart below was created on the website of the Federal Reserve Bank of St. Louis. It shows the eye-popping expansion of the money supply as financial institutions have swapped securities and other "assets" for cash via borrowing from the Federal Reserve. Borrowing prior to this crisis is barely visible on the graph. Recent borrowing is an extreme example of the term "spike" on a graph. Despite the never before seen tapping of the Fed, financial assets show little evidence of reflation taking place.

U.S. Stocks: Downtrend Remains In Place

If you compare the long S&P 500 ETF (SPY) to the short S&P 500 ETF (SH), it is clear the short side of the market is in better shape. There is little in the way of fundamentals, except hope of government bailouts, to expect any change to these trends.

Recent weakness in the S&P 500 Index leaves open the possibility that we will revisit the November 2008 lows around 740 (intraday). If those lows do not hold, a move back toward 600 becomes quite possible. On Friday (1/23/09) the S&P 500 closed at 832. A drop back to 740 is a loss of 11%. A move back to 600 would be a drop of 28%. These figures along with the current downtrend highlight the importance of principal protection and hedging strategies. SH, the short S&P 500 ETF, can be used to protect long positions or to play the short side of the market.

Gold & Gold Stocks: Moves Impressive, But Still Face Same Hurdles

Friday's big moves in gold (GLD) and gold mining stocks (GDX) have some calling a new uptrend. While recent moves have been impressive some hurdles remain.

Gold stocks (GDX) look a little stronger than gold, but any entry in the market should be modest in size. If $38.88 can be exceeded, our confidence would increase and possibly our exposure.

Run In Treasuries Is Long In The Tooth

Investments with the highest probability of success are those with positive fundamentals and positive technicals. Conversely, the least attractive investments have poor fundamentals and poor technicals. With the U.S. government issuing new bonds at an alarming rate, a continued deterioration in the technicals could signal the end of the Treasury bubble.

TBT offers a way to possibly profit from the negative forces aligning against U.S. Treasury bonds.

Strength In Bonds Shows Little Fear of Price Inflation

The government's policies are attempting to stem the tide of falling asset prices. They hope to reinflate economic activity along with asset prices. The charts here show:

- A weak stock market (see SPY above), and

- An improvement in many fixed income investments (below: LQD, AGG, BMT, PHK, and AWF).

Weak stocks and stronger bonds tell us the government's reflation efforts are thus far not working. If concerns about deflation remain more prevalent than concerns about inflation, fixed income assets may offer us an apportunity. With money markets, CDs, and Treasuries paying next to nothing, we may be able to find improved yields in the following:

- LQD – Investment Grade Corporate Bonds

- AGG – Investment Grade Bonds – Diversified

- BMT – Insured Municipal Bonds

- PHK – High Yield Bonds

- AWF – Emerging Market Government Bonds

With the economy in a weakened and fragile state, we need to tread carefully in these markets. Some key levels which may improve the odds of success are shown in the charts below. Erring on the side of not taking positions is still prudent. The markets remain in a "prove it to me" mode where we would like to see the markets move through key levels before putting capital at risk.

U.S. Dollar Remains Firm

From a technical perspective, the dollar continues to look strong. Its strength supports the continuation of concerns about deflation, rather than inflation. With a rapid expansion of the money supply along with large increases in government liabilities, future dollar weakness is almost a certainty.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2009 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.