Gold and Silver Lifeboats for Sinking Titanic U.S. Economy

Economics / Gold & Silver 2009 Jan 28, 2009 - 04:04 AM GMTBy: Darryl_R_Schoon

A lifetime is not long. It is long enough, however, to lead one to believe that life is far different than it really is.

A lifetime is not long. It is long enough, however, to lead one to believe that life is far different than it really is.

My uncle, Bobby Schoon, grew up during the Great Depression. Born in the 1920s, the 1930s were to be far different than the previous decade. My uncle came of age when the US led the world into an economic abyss where human desperation and misery were to become commonplace, an abyss that is now about to be revisited.

For most born after the 1960s, the Great Depression was an event that had happened to a previous generation. They have no idea how an economic collapse could affect them; that no matter how much they had saved, that their savings could instantly disappear and that no matter how willing they were to work, that no work could be found.

The same conditions that led to the Great Depression in the 1930s have led us to today; and the one safeguard that was put in place in 1933 to prevent another depression, the Glass-Steagall Act, was repealed in 1999; and, with the guard rail now removed, we are again headed over another cliff into another economic abyss.

HOW FAR IS DOWN

I saw my uncle last week. Now, in his late 80s, his mind is still sharp and his observations always of interest. Our conversation moved to the current state of affairs and my belief that another Great Depression was underway.

My uncle then said: The difference between the Depression and today is now how much people owe. Instead of owing $15 they owe $15,000; and, because they owe so much more, this time the fall is going to be greater.

And, so it is.

THEN AND NOW

The collapse of the 1920s stock market bubble in 1929 signaled the beginning of the Great Depression. The actual descent was to take four years as the depth of the depression did not begin until 1933. The same might be true today, or it might not.

This time, the beginning of the current deflationary collapse was marked not by a stock market collapse. This time, the event that signaled the current crisis was when global credit markets suddenly and unexpectedly contracted in August 2007.

The contraction of global credit markets is a far more serious event than even a stock market collapse. This is because in capitalist credit-based economies, the flow of credit is absolutely essential to all commercial activity.

In today's fiat credit-based economies, credit markets are the heart of the artificial system created by bankers. From credit markets flow the credit needed to support commerce and entrepreneurial activity now addicted to the bankers' credit. Today, credit markets are barely functioning and remain frozen.

The contraction of global credit markets was then in a very real sense, a heart attack, a heart attack from which the markets have not yet recovered; and, as with humans, the longer the recovery takes, the greater the damage and the greater the possibility of death, in this case, parcus ne x, economic death.

What central bankers have been doing is credit-based CPR in an attempt to revive an increasingly moribund patient. To date, irrespective of the trillions of dollars committed and spent, their efforts have been futile. This is because even before the current heart attack, the health of the patient had been deteriorating for years.

IN THE ECONOMIC EMERGENCY ROOM

In March 2000, the stock market collapse popped a speculative bubble larger than any previous bubble. The dot.com bubble, fed by central bank credit, had taken on a life of its own in the late 1990s and by so doing threatened to take the life of the very system that had created it, the fiat credit-based system of capital (credit) markets called capitalism.

The central bankers knew the danger the system was in. They were well aware of the severe deflationary collapse of Japanese markets in 1990 and their previously smug feeling that they had relegated systemic collapse onto the scrap heap of history along with gold and the gold standard had become increasingly less certain.

The events of the next decade, the 2000s, were to demonstrate how wrong the central bankers had been and how impotent they were in battling forces they themselves had set in motion with their artificial system of credit stimulation and “control” of markets, a “control” that was to prove increasingly illusory as the decade progressed.

The strategy of central bankers was lifted from Ben Bernanke's playbook, a strategy that was based on the theory that systemic deflationary collapse could be averted by the quick availability of unlimited credit to capital markets.

BERNANKE'S THEORY

Bernanke's theory was just that, a theory whose sole positive attribute was that it had not been tried during the Great Depression. The fact that it hadn't been tried, however, did not mean it would work.

That fact that nothing had worked during the Great Depression, however, left Bernanke's theory the only response central bankers had in an otherwise empty tool kit; and when the dot.com bubble collapsed, Bernanke's theory was trotted out to be tried in the marketplace.

The central bankers led by Alan Greenspan knowing of the danger the patient was in decided on a highly unusual response based on Bernanke's theory, to wit , although the economy was suffering from the after effects of an enormous overdose of credit; in accordance with Bernanke's theory, they decided to give the economy a dose of even more credit.

At first, the central bankers' strategy worked, but only temporarily. Because of the low US 1 % interest rates, flows of cheap central bank credit flooded the markets and reversed the downward trend of the stock markets but they also set in motion something far more dangerous.

The low 1 % central bank rates created another bubble, a bubble more dangerous than the 2000 dot.com bubble. The bankers' cheap credit created the 2002-2006 US real estate bubble; and the collapse of that bubble was to result in the severe credit contraction of August 2007 and the return of the patient to the central bank emergency room just five years after his previous visit.

This time, the patient was in far worse shape than in 2000/2001. This time, heavily sedated, breathing only in short gasps, the economy has been kept alive only by constant and artificial infusions of even more credit in the attempt to keep systems functioning until a solution can be found.

However, the central bankers have no more solutions. Bernanke's theory didn't work, proving to be no solution to the systemic deflationary collapse brought on by years of credit abuse administered by previous doctors, primarily Dr. Alan Greenspan.

FROM THE HOSPITAL TO HOSPICE TO THE GRAVE

After the central bank emergency room, hospice is next. The current frantic attempts of central banks and governments to reverse what they set in motion is analogous to the application of pain medication given in the hopes of calming those whose lives they have destroyed.

Governments have extended bankers the public purse in the hopes the bankers will be able to rescue them from the coming anger of those whose lives, savings and livelihoods they were elected to protect but instead plundered by taxation and inflating the money supply.

Capitalism, a credit-based economy based on debt-based money issued by central banks is now claiming its victims, the bankers and governments who benefited from the system, and producers and savers who were used by bankers and government as bankers pursued private profit and politicians pursued public power.

Politicians with notably few exceptions, e.g. America 's Ron Paul, have been willing co-conspirators with the bankers who plundered the savings and productivity of society for personal gain.

By indebting society beyond its ability to ever repay, government and bankers have destroyed the base of their own profit and own power. The credit contraction of 2007 is in the process of destroying the banks that created the crisis and has already virtually destroyed the Republican Party who abetted them.

Next the Democrats will suffer as they did little to prevent what is now in motion and now bear the burden of reversing the damage of what previous generations of bankers and politicians have done.

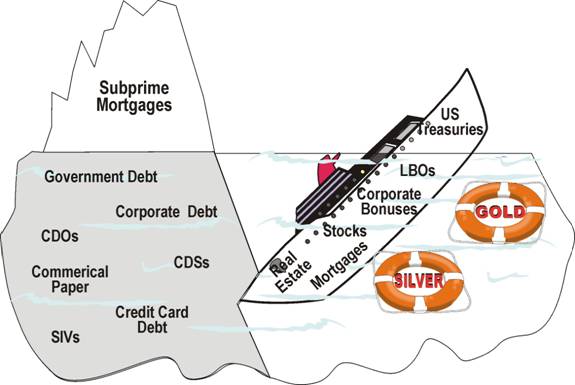

THE ECONOMY THE TITANIC & THE LIFE RAFTS OF GOLD AND SILVER

What has happened to America, the destruction of what was recently the most powerful economy in the world could not have happened without the complicity of politicians of both parties who aided the bankers in their parasitic plundering of America's wealth, productivity and future.

The Republicans were the primary tool—and natural home—of the bankers but the bankers could not have achieved their enormous power and influence over America's domestic and foreign policy without the complicity of Democrats along the way.

It was Democrat Woodrow Wilson, who signed into law the Federal Reserve Act in 1913 that gave private bankers control over US currency, control that was to indebt our nation, businesses and people into perpetual indebtedness.

It was Democrat Franklin Delano Roosevelt who outlawed the possession of gold in 1933 by US citizens thereby trapping Americans into the paper assets of bankers just as the bankers wished, putting beyond Americans' reach the gold that would have otherwise protected them from the banker's debasement of the US dollar.

And it was Democrat Bill Clinton who signed the repeal of the Glass-Steagall Act in 1999, thereby repealing the safeguards set up in 1933 to prevent another Great Depression and allowed investment banks, insurance companies and commercial banks to co-mingle America 's savings in what was to be soon the greatest destruction of wealth on a scale never before seen.

AND, NOW, ANOTHER DEMOCRAT IS IN THE WHITE HOUSE

We now have a another Democrat in the White House who has the dubious honor of inheriting a nation in tatters, its reputation and economy virtually destroyed by its previous occupant who allowed the nation to sink to previously unimaginable lows in both fiscal irresponsibility and illegal acts.

I guess that's to be expected when a fraternity boy moves into the same house his father once lived in and brought in friends such as Dick Cheney and Donald Rumsfeld who sent the nation into a war based on lies and then had legal hacks such as Alberto Gonzales and John Woo justify torture if done in the name of freedom.

Illegal voting machines aided by the US Supreme Court and a Democratic Party that rolled over as easily as a drunken sorority girl at a frat party allowed Paulson and Wall Street bankers and Washington DC power brokers free reign at the White House from 2000 to 2008, more than enough time to apply the coup d ' état to a once great nation.

What happened between 2000 and 2008 in the White House is so much more egregious than the few blow jobs that Clinton got from Monica Lewinsky (all that money spent and we still never got an exact accounting) and yet the crimes of Bush and Cheney et. al. will probably never be investigated nor will justice ever be served on those who so callously used their power to serve it to others.

The pursuit of Bill Clinton over a blow job and the non-pursuit of George W. Bush and Dick Cheney for their callous disregard of the truth and the US Constitution is an indictment of America itself.

What America chooses to prosecute and what America chooses to deny is a direct indictment of America and the “values” it so loudly proclaims to others. In the future, America should be more careful as the world is not as swayed by the distorted reflection America sees in its own media.

PRESIDENT BARACK OBAMA

I don't know President Barack Obama nor did I know any of America 's previous presidents but I do know that I don't envy the man or the task he has in front of him. It is never easy to lie to a nation (although politicians do a far better job than most) but Americans have never seemed to really want the truth which is perhaps one reason it has rarely been disclosed to them.

The America of today grew up on bankers' easy credit. The America of tomorrow will be buried by it. I don't know if President Obama knows this but I do know the men he has appointed to counsel him in economic affairs know it and don't care.

Paul Volker, the hero of another age, salvaged the bankers' paper money game for another generation but he did so at the expense of what could have saved the nation. Volker later said he regretted not having earlier managed the price of gold and if his actions in saving the parasitic system of bankers are to be lauded, then so be it.

But perhaps the least of all the men Obama has surrounded himself to counsel him on the economy is Lawrence Summers, Obama's Chief Economic Advisor. Summers is the former Chief Economist at the World Bank who at the time suggested that polluting industries should be moved to 3 rd world countries where the human toll would be less costly, and was also later fired as President of Harvard University for his statement that women were intellectually inferior to men.

But Summers' greatest transgression against true economic freedom guaranteed by gold and its protection against government power is his 1988 paper he co-authored with Robert Barsky, Gibson's Paradox And The Gold Standard wherein Summers argued that manipulating the price of gold would have a favorable impact on interest rates and the price of paper assets.

Summer's paper served as the basis for further US government manipulation of the gold market and does not speak well for future US policy in that regards. Newly appointed US Treasury Secretary Timothy Geithner also comes with as much baggage as Volker and Summers in respect to his relationships with the investment bankers who have raped and pillaged our nation.

Timothy Geithner was the man who last fall stood shoulder to shoulder next to Henry Paulson as Paulson looted America' treasury for the benefit of his Wall Street friends and cronies and insured that he would never be called to task for what he would do.

Geithner is described in Wikipedia as having Lawrence Summers for his mentor but other sources call him a “Rubin protégé”, neither man a positive role model. It should be remembered that Robert Rubin, former Goldman Sachs partner and US Treasury Secretary, lobbied for the deregulation of financial instruments such as derivatives, an effort that later helped to destroy our financial system.

Rubin was also instrumental in the repeal of Glass-Steagall, the Act passed to prevent another depression and he played an important role in the $4 billion payout from the US Treasury to Goldman Sachs indemnifying Goldman Sachs bondholders from any losses on their Mexican bonds in 1995.

Geithner, as a Rubin “protégé”, obviously comes highly recommended and well connected to the same core of investment bankers who have done yeoman's work in destroying America 's economy while at the same time lining their own deep pockets.

It is my belief that President Obama should fear both the enormity of the task in front of him and the counsel of those he has surrounded himself; and, while I wish him the best I cannot help but suspect the wisdom he will receive from men like Lawrence Summers, Paul Volker, and Timothy Geithner will do little to serve the national interest.

Three out of three, the odds aren't good and we should not take false refuge in what the US government may or may not do—or even can do in these perilous times. The guard rail designed to protect us from another depression was removed in 1999 and we are now sliding rapidly out of control towards the precipice ahead.

THE GREAT DEPRESSION

Although my parent's generation grew up in hardship during the Great Depression, the family as a whole did remarkably well considering the circumstances. Most graduated from college no small feat during those difficult times and all raised families and achieved more than a measure of personal success.

It would do us well to remember the achievements of those before us as we again move into more difficult times, times that will test our inner strength as well as our character. The life of ease afforded us by easy credit is a thing of the past. What will replace it we do not yet know. It will be, however, far different than what we have known.

THE PRICE OF GOLD AND SILVER

The price of gold and silver has now made significant moves towards its previous highs, gold pushing above $900 and silver above $12 but there remains much volatility between now and their ultimate ascent, an ascent guaranteed by the accelerating debasement of fiat paper currencies as governments attempt to shock their moribund economies into life with unlimited amounts of fiat money and credit.

Whether gold and silver's recent moves are a portent of more shortly to come or if they will be met again with renewed resistance from central banks remains to be seen. Either way, rest assured that the battle between the paper boys of Wall Street, the power brokers of Washington DC and the free market is still in progress.

Wall Street may be but a badly damaged shadow of its recent past but its co-conspirators in manipulating the markets, the central bankers and their enablers in government are still committed to maintaining their fiefdoms no matter how high the cost—as long as those costs are born by the taxpayers.

Someday, in the future however, a future that is closer today than it was yesterday, gold and silver will triumph despite the best efforts of central bankers and government manipulators to prevent it

For central bankers and those in government are up against the market itself and no matter how much paper they have at their disposal, their supplies of gold are limited. Each ounce bought takes another ounce out of the arsenal governments use to suppress gold's price, an arsenal comprised of our central banks.

Buy gold. After all, it was yours and still for only a short while, it is being subsidized by your government as it continues its fight against your interests and a free market unfettered by bankers' credit.

Have faith and buy gold and silver until better days arrive.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.