Fiat Currency Seigniorage ("The Inflation Tax")

Economics / Money Supply Jan 29, 2009 - 09:14 AM GMTBy: Mike_Hewitt

Before becoming Governor of the Federal Reserve, Ben Bernanke co-authored several text books familiar to college students studying economics. In one of these text books, Macroeconomics , the question of whether government budget deficits can lead to ongoing increases in the money supply is both asked and answered.

Before becoming Governor of the Federal Reserve, Ben Bernanke co-authored several text books familiar to college students studying economics. In one of these text books, Macroeconomics , the question of whether government budget deficits can lead to ongoing increases in the money supply is both asked and answered.

And the answer is yes .

|

"The link is the printing of money to finance government spending when the government cannot (or does not want to) finance all of its spending by taxes or borrowing from the public. In the extreme case, imagine a government that wants to spend $10 billion (say, on submarines) but has no ability to tax or borrow from the public. One option is for this government to print $10 billion worth of currency and use this currency to pay for the submarines. The revenue that a government raises by printing money is called seigniorage." |

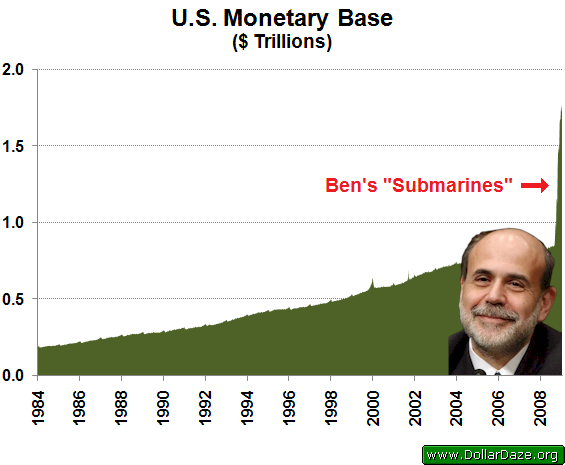

It appears that over the last few months, Mr. Bernanke has been putting these concepts into practice.

The following graph takes weekly data released from the Federal Reserve Bank of St. Louis for the adjusted monetary base of the United States. The monetary base consists of all currency in circulation (known as M0) plus reserve balances with the Federal Reserve banks. These reserve balances (also known as "vault cash") do not directly enter the general money supply. Instead, they comprise the reserve requirement of the banks under the fractional reserve banking system .

Seigniorage is the revenue derived from the face value of a currency net production costs. Thus if it costs four cents to produce a crisp new dollar bill, then the net revenue is 96 cents. Larger denominated bills are even more profitable!

Tapping this source of revenue isn't without consequence. Expansion of the money supply reduces the value of those notes already in circulation. Initially, this cost may be well hidden, especially when the country is enjoying a strengthening economy. But as the currency diminishes in value, larger and larger amounts are needed to support government expenditures.

The present-day hyperinflation of Zimbabwe is the latest example of a currency in the end stages of excessive seigniorage.

By Mike Hewitt

http://www.dollardaze.org

Mike Hewitt is the editor of www.DollarDaze.org , a website pertaining to commentary on the instability of the global fiat monetary system and investment strategies on mining companies.

Disclaimer: The opinions expressed above are not intended to be taken as investment advice. It is to be taken as opinion only and I encourage you to complete your own due diligence when making an investment decision.

Mike Hewitt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.