Gold Outlook: Currency Debasement Risks Inflation Spiraling Out of Control

Economics / HyperInflation Jan 30, 2009 - 06:42 AM GMTBy: Mark_OByrne

Gold rose by just over 1% yesterday to over $900/oz as renewed risk aversion saw stock and bond markets come under pressure.

Gold rose by just over 1% yesterday to over $900/oz as renewed risk aversion saw stock and bond markets come under pressure.

Gold subsequently traded sideways in Asia prior to another strong rally at 0800 GMT when gold surged from $901/oz to $926/oz in the hour. It has since given up some of those gains but remains above $920/oz. Demand remains very high internationally for etf's, gold certificates and bullion coins and bars.

There is a gradual realisation that zero percent interest rates, quantitive easing, trillion dollar bailouts and printing money to buy government bonds is leading to currency debasement. This monetary debasement risks an inflationary spiral and this, counter party risk and the sharp deterioration in the global economy is seeing continuing safe haven demand for gold.

Printing money and the digital creation of trillions of pounds, euros, yen, dollars and other paper currencies will unfortunately likely prove nothing but a very short term panacea (as it has done throughout history) and risks creating an international currency crisis as investors and savers lose faith in their national currencies. The irresponsible practices of many on Wall Street and in the City of London is being payed for by the taxpayers of the world - rich, middle class and poor. As the humunguous liabilities in the international financial system are transferred onto government balance sheets we are likely to see government downgrades, defaults and government bonds being sold off with a correspnding rise in yields and long term interest rates.

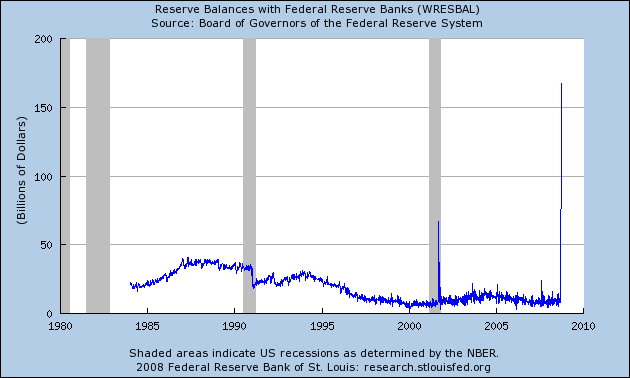

Reserve Balances with Federal Reserve Banks (weekly, not seasonally adjusted, in billions of dollars). Source: FRED.

http://research.stlouisfed.org/fred2/series/BORROW

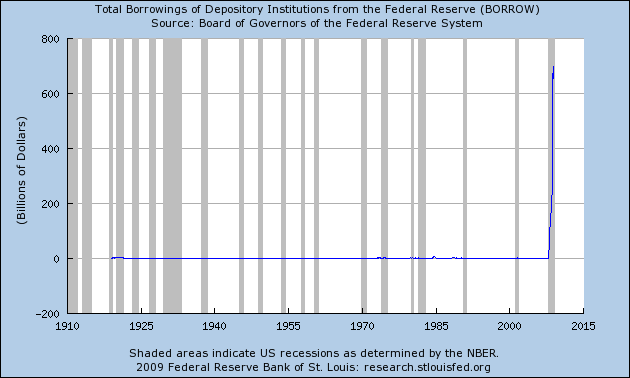

The Federal Reserve's balance sheet is deteriorating massively (as seen in the 'Total Borrowings of Depository Institutions from the Federal Reserve' Chart directly above). The Federal Reserves has lent more than $1 trillion in recent months after the central bank provided $416 billion in term loans to banks and purchased $350 billion of commercial paper issued by U.S. corporations.

To put this into context, from 1919 to 2008 crisis borrowing from the Federal Reserve never exceeded $8 billion (World War I Banking Crisis: $2.8 billion; 1929 Crash: $1 billion; Cold War and Vietnam War 1972: $3.3 billion; Savings and Loan Crisis 1986/87: $8 billion; 1999 Y2K Precautionary Borrowing: $3.5 billion).

As bad as this is the US national debt which is now surging and expected to increase by some $2 trillion in the next year or two alone.

This crisis is on a scale of nothing we have ever seen before and no amount of bailouts and stimulus packages will rectify this terrible financial mess. This is why some fear serious double digit inflation and possibly even hyperinflation in the coming years. Especially if "Helicopter Ben" and other central bankers continue to debase our currencies.

Credit is due to the European and particularly the German central bankers who are more aware of these risks and are rightly being far more cautious - wary as they are of debasing the Euro.

Gold remains less than half of it's adjusted for inflation value in 1980. It will not remain so for long as the inflation adjusted high of $2,400/oz is likely to be reached sooner than many expect.

America's creditors (in particular China) are becoming extremely worried about their dollar denominated assets and when they diversify only a very small amount of their dollar assets into gold than gold will likely surge by more than it did in the 1970's when it rose some 25 fold - from $35/oz to $850/oz.

Should a similar price move occur again today, gold would have to rise from a low of $250/oz in 1999, 25 fold to $6,250/oz. Given the magnitude of the current crisis, this is far from unlikely.

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold and Silver Investments Limited No. 1 Cornhill London, EC3V 3ND United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.