Plantinum The Forgotten Metal!

Commodities / Platinum Apr 26, 2007 - 09:17 AM GMTLarry Edelson writes :Gold is within a mere 7% of a new 26-year high, exploding higher by $38 in just the last seven weeks.

The culprit is the growing recognition that the U.S. dollar is weak at the knees and heading down the tubes. That in turn is causing inflation to rev higher … and other natural resources to climb virtually non-stop.

I have absolutely no doubt that you will soon see record new highs in gold, above $875 an ounce. Oil too will soon soar to record new highs. Trading at about $65 a barrel, black gold is a mere $12 or so away from a record high. Naturally, gas prices are soaring too.

All the markets I follow closely are doing precisely what I've expected — they're soaring. And so are the many recommendations I've issued in my Real Wealth Report .

But today, I want to talk about one natural resource that almost no one is covering. A forgotten metal that is well on its way to new all-time record highs …

Platinum: A Scarce Metal That's in Hot Demand!

Platinum is among the world's rarest metals. New mine production totals about five million troy ounces a year. Compare that to gold, where mines produce approximately 82 million ounces a year, or silver, which is produced at an annual rate of approximately 547 million ounces.

Most platinum comes from South Africa, which accounts for approximately 76% of supply. Russia accounts for another 14%, and North America contributes about 6%. The rest of the world makes up the other 4%.

That's new mine supply. In terms of total platinum reserves in the ground, it's estimated that there are only about 3.5 billion ounces left. Plus, more than 50% of the platinum produced is destroyed in industrial applications.

Meanwhile, readily-available, above-ground platinum reserves have been practically wiped out! That's because demand for platinum has been soaring. Back in 1975, demand was about 2.6 billion ounces a year. Today, it's virtually tripled to seven billion ounces. In the last 10 years, demand has exceeded mine supply by nearly 8.3 million ounces.

Stricter Emissions Laws, and Emerging Economies Creating Huge Demand for More Platinum

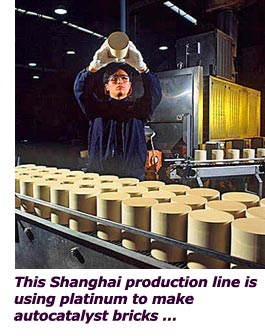

About half of all platinum goes to the automobile industry for use in catalytic converters, which reduce the toxicity of emissions from engines.

Never mind that the U.S. auto industry is suffering from miserably slow sales … or that energy prices are rising around the world. The fact is that motorbikes and autos are now becoming affordable for hundreds of millions of people.

Look at China! The country's auto production and sales soared in the first quarter of this year. According to the China Association of Automobile Manufacturers, 2.19 million vehicles were produced in the first quarter, up 22.6% from the same period last year. Auto sales rose 22.2% to 2.12 million vehicles.

In March, China's auto manufacturers put nearly 854,000 new cars on the street. And for all of 2006, China put out 7.22 million autos! As you'd expect, the country needed 58% more platinum for catalytic converters in 2006 than it did in 2005.

By 2010, China will overtake Japan as Asia's largest carmaker, producing an estimated 11 million vehicles per year. What do you think will happen to the price of platinum by then?

And don't forget, China is just one of the emerging giants:

- South Korea and Thailand are each producing more than a million vehicles per year.

- India is putting out about a million vehicles a month , pushing up demand for platinum even more.

- In Brazil, vehicle production jumped 7.4% in the month of March vs. the same month a year ago.

This natural built-in and growing demand for platinum — in the face of severely limited supplies — is a major reason why platinum prices are exploding higher. And in my opinion, the price of platinum could double over the next couple of years from a current $1,300-an-ounce level to $2,500 an ounce, if not higher.

New clean air legislation in the U.S. and in many of the world's fastest-growing economies will keep sending demand for platinum through the roof. The global warming issue, and attempts by authorities around the world to cut down on pollution, will have a major effect on the way cars are produced.

The new, more stringent Tier II environmental regulations involve a greater number of countries than ever before. Countries that a decade ago had little or no environmental regulation will soon have restrictions on auto and motorbike emissions.

Moreover, much of the rest of the world, unlike North America, uses diesel fuel, which relies very heavily on platinum for emission control instead of palladium, an alternative to platinum.

In short, I see no end in sight for rising platinum prices. Except for a brief speed bump or two, I think prices are headed much, much higher.

New Ways to Play Platinum Are Just Around the Corner

There are a few platinum stocks, but I reserve those for active subscribers to my Real Wealth Report .

Unfortunately, right now there is no mutual fund that I am aware of that concentrates enough on the platinum metals or companies to make them pure plays on the metal.

But soon enough, there will be a relatively easy way to get in on the platinum market. That's because two new exchange-traded funds concentrating on platinum will soon be launched by ETF Securities and Zurich Cantonal Bank. The actual start of trading is not yet known, but rest assured, I will keep you posted.

In the meantime, consider two of my favorite metals funds, the Tocqueville Gold Fund (TGLDX) and the U.S. Global Investors Gold Shares Fund (USERX). Both are doing extremely well, rising 11% and 7%, respectively, in the past six weeks.

Everything I have been warning you about is coming to pass. The dollar is ill … inflation is soaring … and natural resource prices are climbing skyward. If you're a Real Wealth Report subscriber, hold all recommended positions!

Best wishes for your health and wealth,

By Larry Edelson

P.S. If you don't yet receive Real Wealth Report , what are you waiting for?

Click here to join now!

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.